- The high Bitcoin spot ETF netflows showcased the bullish belief.

- The weekly price action of BTC remained firmly bullish.

Bitcoin [BTC] saw its spot ETF approved in the U.S. on the 10th of January 2024.

The U.S. Securities and Exchanges Commission approved the trading of the first 11 Bitcoin spot ETFs, marking a key milestone in Bitcoin’s history.

Source: Coinglass

The cryptocurrency, originally envisioned to be a decentralized, trustless, peer-to-peer network, has changed vastly over the past decade and a half.

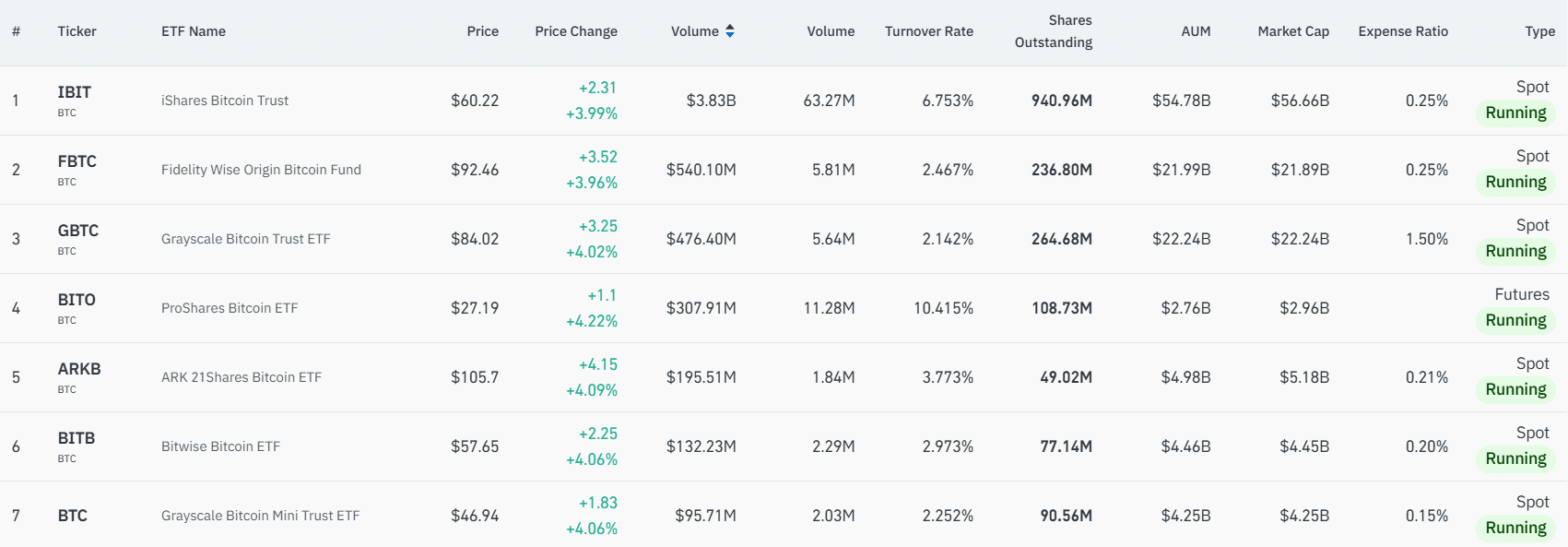

The largest BTC spot ETF, IBIT, has a market cap of $56.66 billion (price x shares outstanding).

Source: Farside Investors

The spot ETF netflow table showed that BlackRock’s iShares Bitcoin Trust saw consistent inflows over the past two weeks of trading. Overall, these inflows showed that sentiment was strongly positive.

Bitcoin ETF investors are a large profit

Source: Yahoo Finance

Since it is the largest spot ETF, we can take the price chart of IBIT. The data above showed that the trading began on the 11th of January and reached a high of $30 on that day.

If an investor had bought $1000 worth of shares on that, how much profit would they have seen by now?

Without accounting for trading commissions, taxes, or maintenance fees, shares bought on the high of the 11th of January would have appreciated by 100.7%, and be worth $2,007.

If they were bought at $22.02, the low on the 23rd of January, the investor would be up 173.46% before costs. The $1000 would now have been $2,734.6.

Weekly chart hints at $152k

Source: BTC/USDT on TradingView

The Fibonacci retracement levels showed that more gains were likely. On the weekly chart, the market structure was strongly bullish. Nearly a month’s worth of consolidation was seen under the $100k mark.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Over the past week, BTC has climbed higher, and appeared to flip the $103.8k level to support. A weekly session close above this mark would be a strongly bullish sign.

The next bullish targets were at $122.4k, $133.9k, and $152.5k. Bitcoin investors, whether in the spot ETFs or the coin itself, would be likely be even more overjoyed in the coming months.