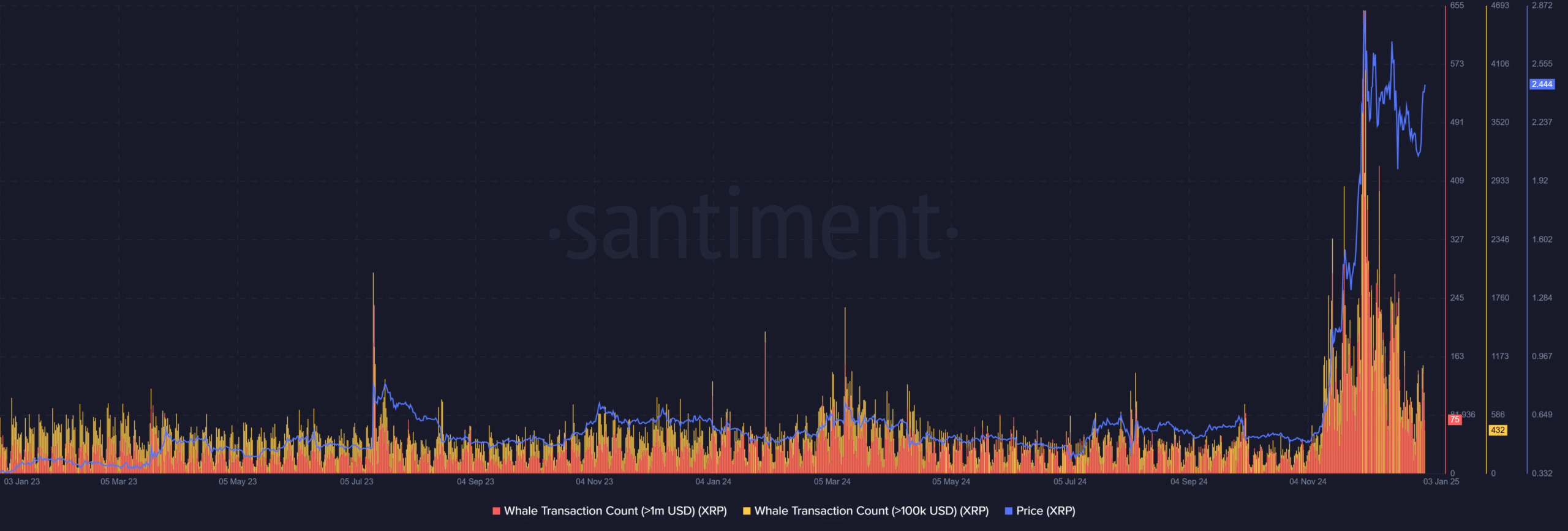

Historical context – Do whale purchases lead to sustainable gains?

When analyzing XRP’s historical data, it can be seen that spikes in whale activity – such as transactions exceeding $100K and $1M – often correlated with price surges.

For instance – Significant whale buying in mid-2023 preceded a notable rally, but these gains were short-lived, retracing within weeks. Conversely, the whale-driven rally in late 2023 showcased a more sustained uptrend, with the price stabilizing at higher levels post-spike.

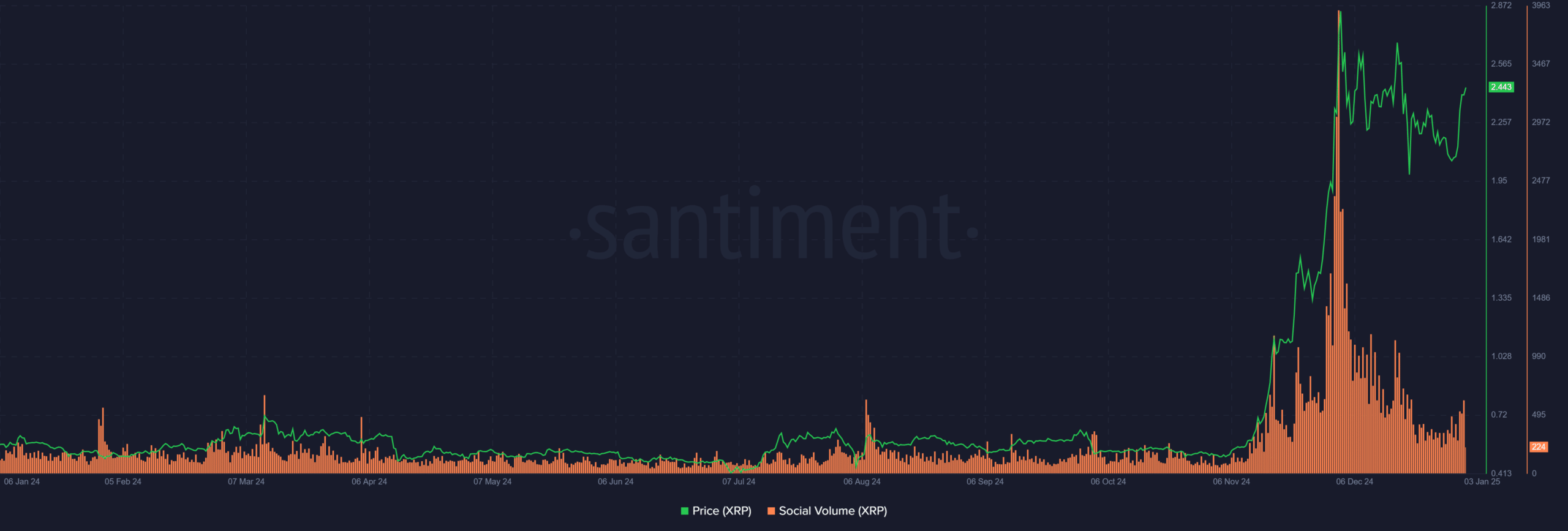

Source: Santiment

This underlines a recurring theme – While whale activity often sparks short-term euphoria, long-term price resilience depends on broader market conditions, retail participation, and fundamental catalysts.

The ongoing whale-driven surge must therefore be viewed with caution – Historical precedence suggests a potential for volatility, rather than a guaranteed bull run continuation.

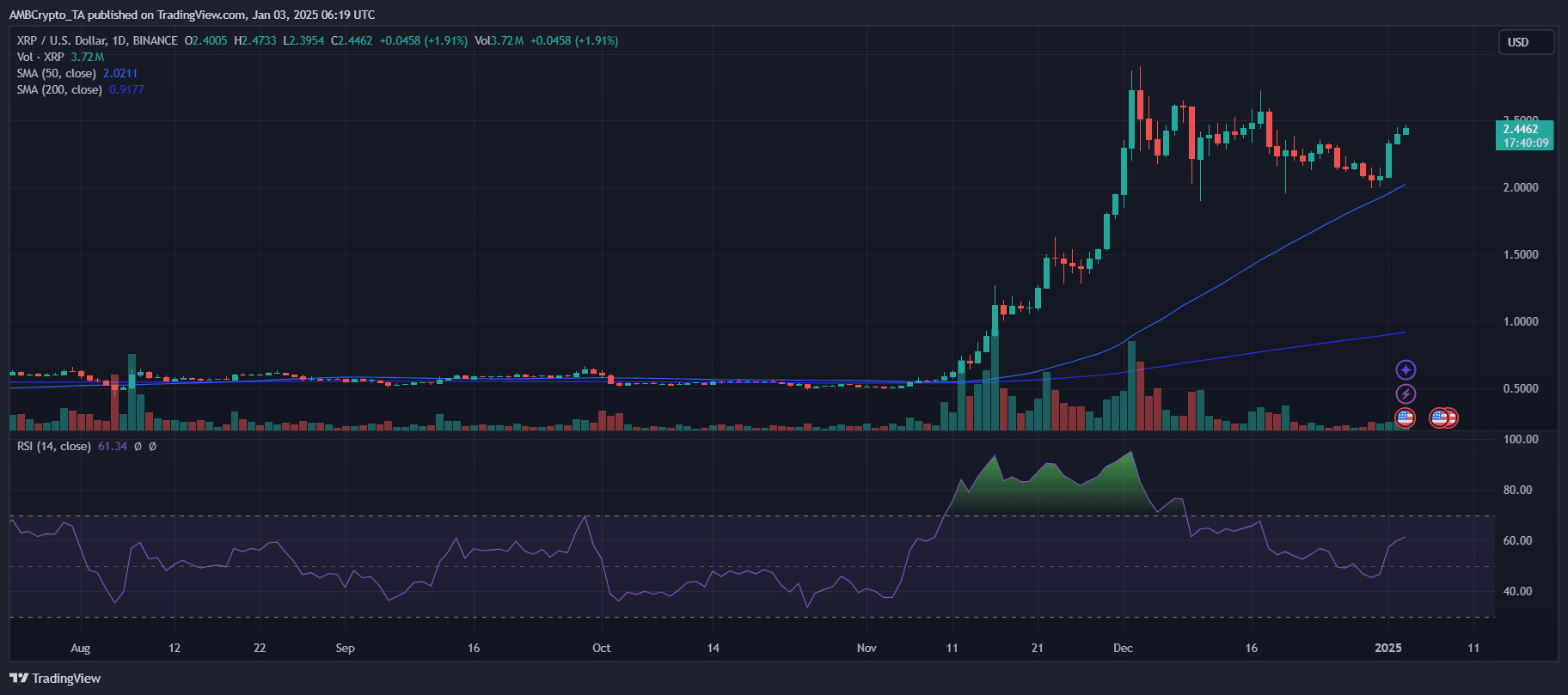

XRP – Gauging breakout potential

XRP’s price action revealed a robust uptrend, with the daily chart highlighting strong support above the 50-day SMA – A level that has consistently acted as a launchpad for bullish moves.

The 200-day SMA seemed to be distant too, highlighting long-term bullish sentiment on the charts.

Source: TradingView

The RSI alluded to bullish momentum without being overextended, leaving room for further upside before overbought conditions emerge. Trading volume has also ticked higher during price rallies, confirming genuine interest rather than speculative spikes.

A close above $2.50—a key psychological and horizontal resistance – could solidify a breakout, potentially targeting $3.00. However, failure to breach this level may invite consolidation. At the time of writing, the technical setup seemed to lean bullish, with sustained volume and RSI divergence being critical for continuation.

Key insights

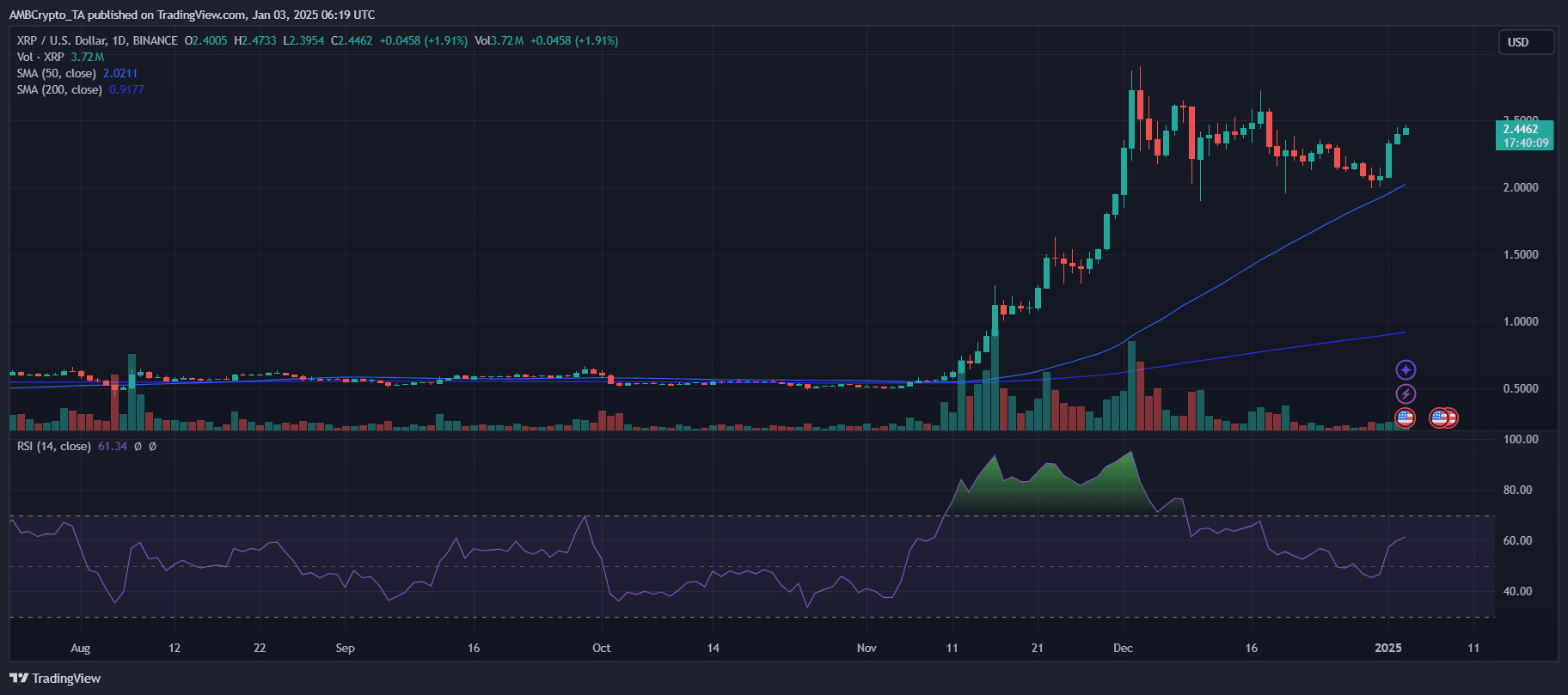

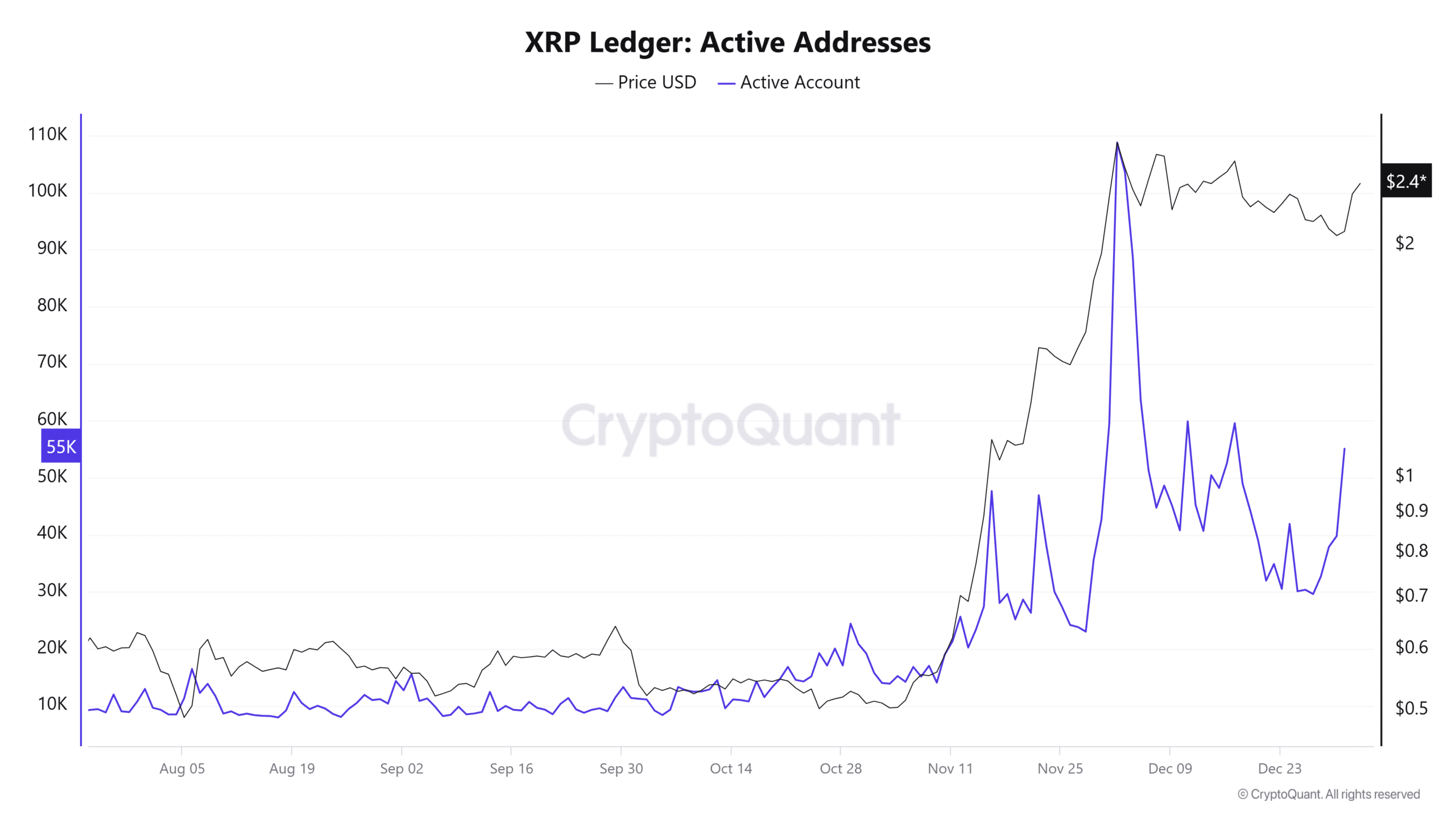

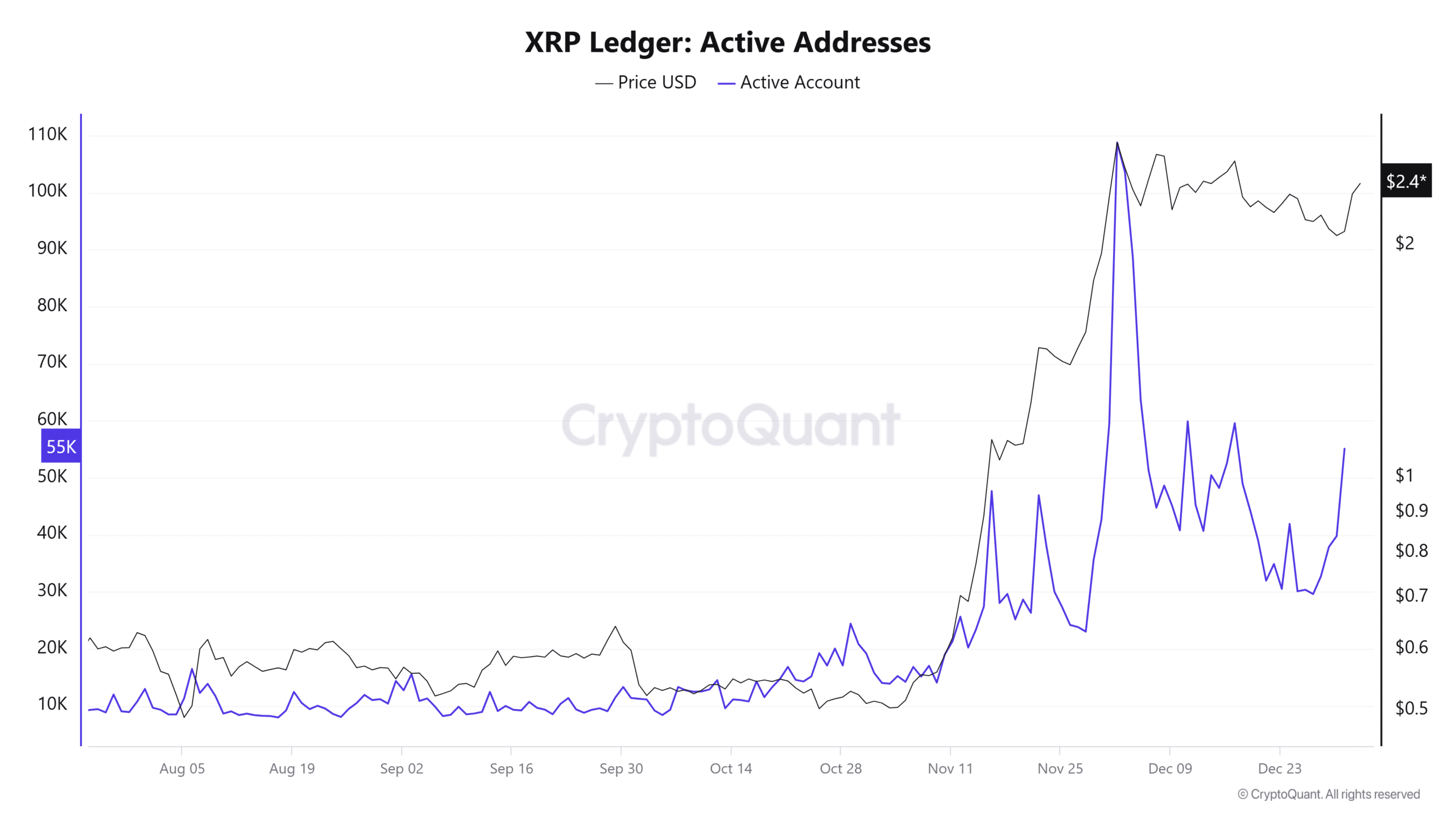

Source: Cryptoquant

The active addresses chart underlined a significant uptick in user engagement, peaking alongside the price surges. This suggested heightened retail and institutional interest, often a precursor to volatility.

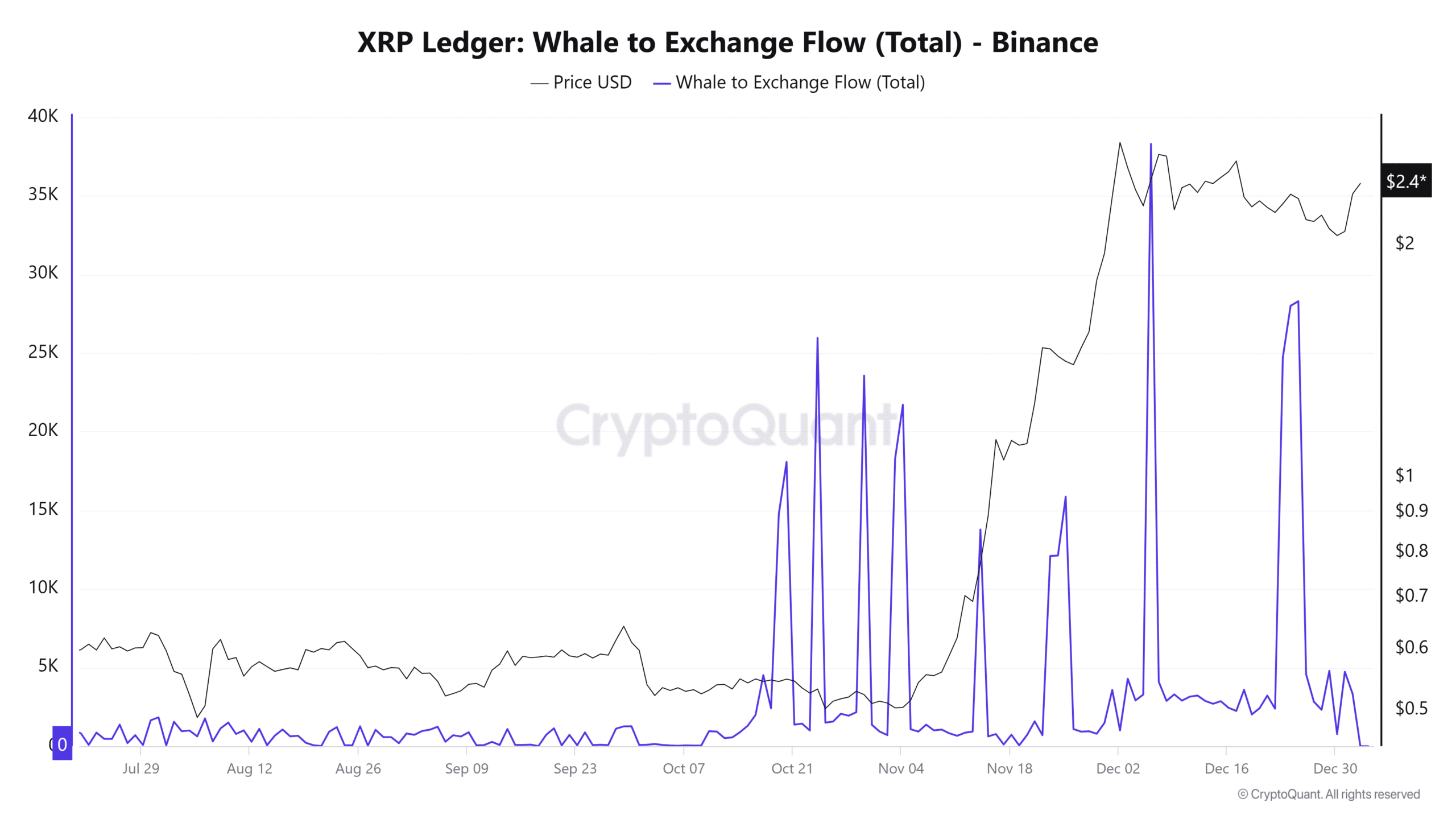

Meanwhile, the whale to exchange flow chart revealed a hike transfers to exchanges during price rallies – Indicative of potential profit-taking or market repositioning by large holders.

Source: Cryptoquant

This behavior can be interpreted as a sign of caution, as high inflows to exchanges can exert selling pressure.

While a hike in active addresses hinted at broader participation, sustained upward momentum depends on reduced whale-driven sell-offs and consistent retail support to absorb liquidity.

Riding the high or caution ahead?

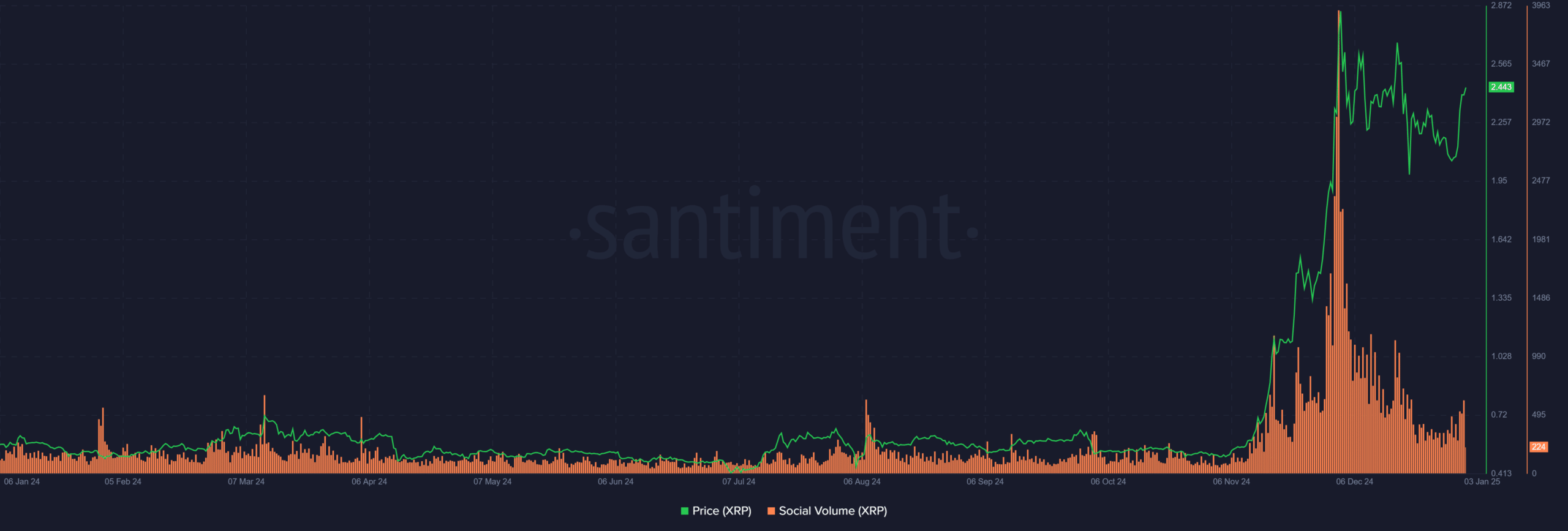

Finally, the Crypto Fear and Greed Index at 74 indicated strong bullish sentiment, nearing the “greed” territory. Coupled with a surge in XRP’s social volume, the market seemed abuzz with heightened interest.

Historically, such elevated sentiment has often coincided with price tops, as euphoria takes hold.

Source: Santiment

While positive sentiment is fueling the ongoing rally, investors must tread carefully as sharp corrections often follow when greed dominates.

Sustainable growth will depend on whether this excitement translates into increased adoption and consistent buying pressure, or whether it fizzles out as speculative fervor fades.