- FLOKI has plunged by nearly 17% after a team wallet deposited $2M to Binance.

- FLOKI’s Open Interest has reached a multi-month high, but negative Funding Rates suggested further bearish pressure.

The cryptocurrency market remained down today, with all top-ten coins by market capitalization, apart from Tron [TRX], were trading in the red.

The losses were minimized across the board, apart from Floki [FLOKI], which iwas down nearly 17% in the last 24 hours until press time.

FLOKI was trading at a weekly low of $0.000127 at the time of writing. The dip comes amid concerns about selling activity by a wallet linked to the Floki Inu team.

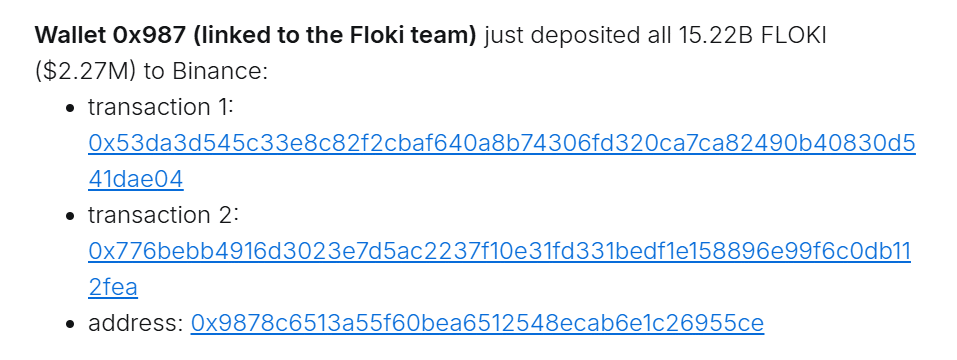

Per SpotOnChain, the wallet was reactivated after more than two years of dormancy. It deposited $2.27M worth of FLOKI tokens to Binance right before the meme coin plunged.

Source: SpotOnChain

The wallet had received these tokens in early 2022 from the Floki deployer. At the time, the stash was worth $468,000.

The wallet’s activity has now stirred concerns among FLOKI holders about a looming sell-off.

FLOKI bears seize control

Bears are currently in control of FLOKI’s price action. The Relative Strength Index (RSI) has dropped to 22 after intense selling pressure, and the meme coin is now in the oversold territory.

The dropping RSI suggested that FLOKI was becoming undervalued. This could present a buying opportunity, and the price could consolidate if FLOKI bounces after testing the crucial support at $0.000126.

Source: TradingView

The Bollinger bands have widened, with the price dropping to the lower band. This suggested a spike in volatility, increased uncertainty, and market stress.

While the oversold conditions and Bollinger bands could suggest an exhaustion of the downtrend, traders should await confirmation.

The RSI must form higher lows above 30 and crossover above the signal line. If this happens, and the price rises to the middle band (20-day Simple Moving Average), FLOKI could make a positive correction.

Open Interest hits multi-month high

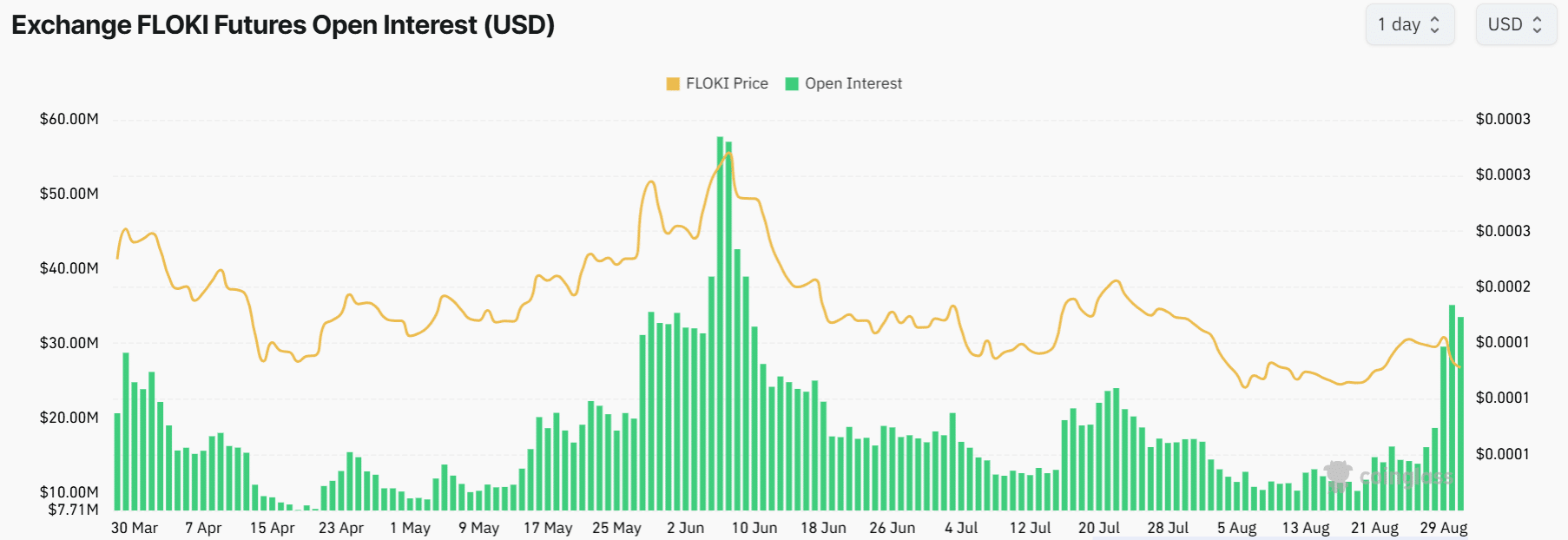

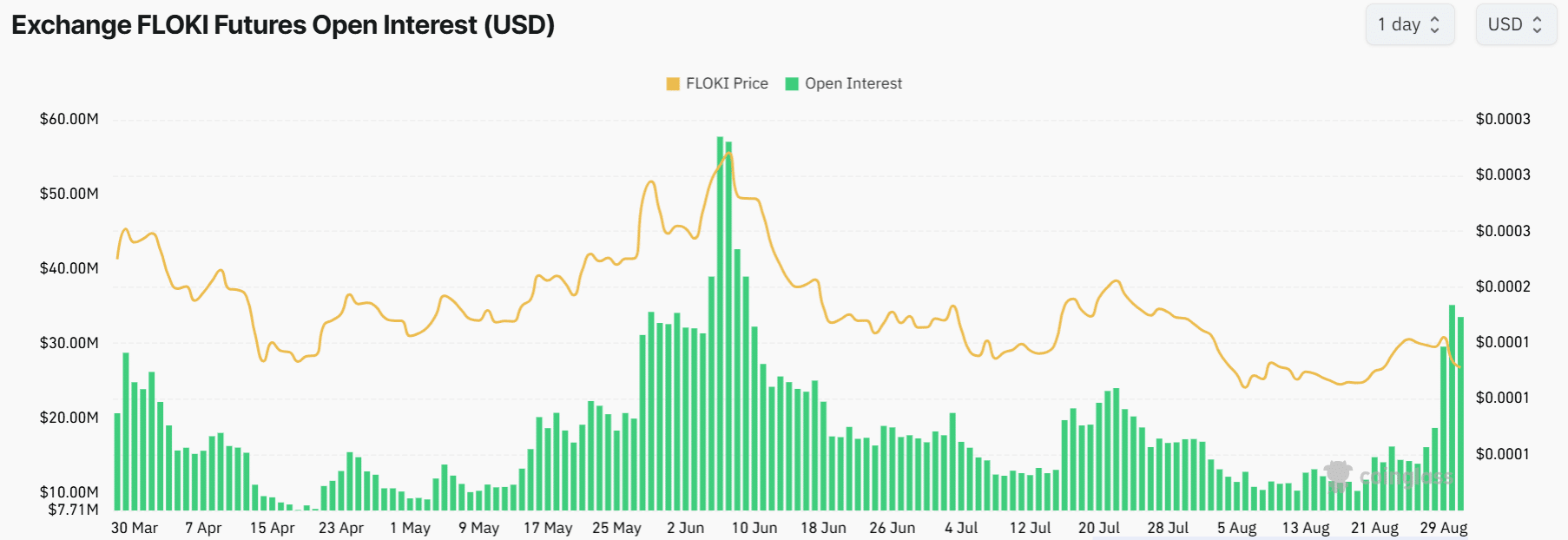

According to Coinglass, FLOKI’s Open Interest (OI) has soared to $33 million, its highest level since June. This metric has been surging gradually since the 26th of August.

Source: Coinglass

While this is usually a bullish signal, it might not be the case with FLOKI. A surge in OI alongside a sharp drop in price suggested that traders were betting on further price declines.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

Moreover, Funding Rates have made a sharp decline in the negative region, indicating a surge in short positions.

The recent price drop also saw over $408,000 in FLOKI liquidations in the last 24 hours. A majority of the liquidated traders were those with long positions.