- Bitcoin was stable above $60K, but struggled to break the $70K resistance level.

- An analyst highlighted unrealized profits and whale activity as indicators of a potential buying opportunity.

Bitcoin [BTC] continues to show resilience by holding above the $60,000 mark, although it has yet to make significant progress toward breaking the $70,000 resistance.

After briefly rising to $64,000, the cryptocurrency faced a correction, falling to $62,340, down by 1.8% over the last 24 hours.

Despite the price fluctuation, many analysts remained optimistic about Bitcoin’s current standing, highlighting potential buying opportunities amid the ongoing consolidation.

Bitcoin: Buying opportunity ahead?

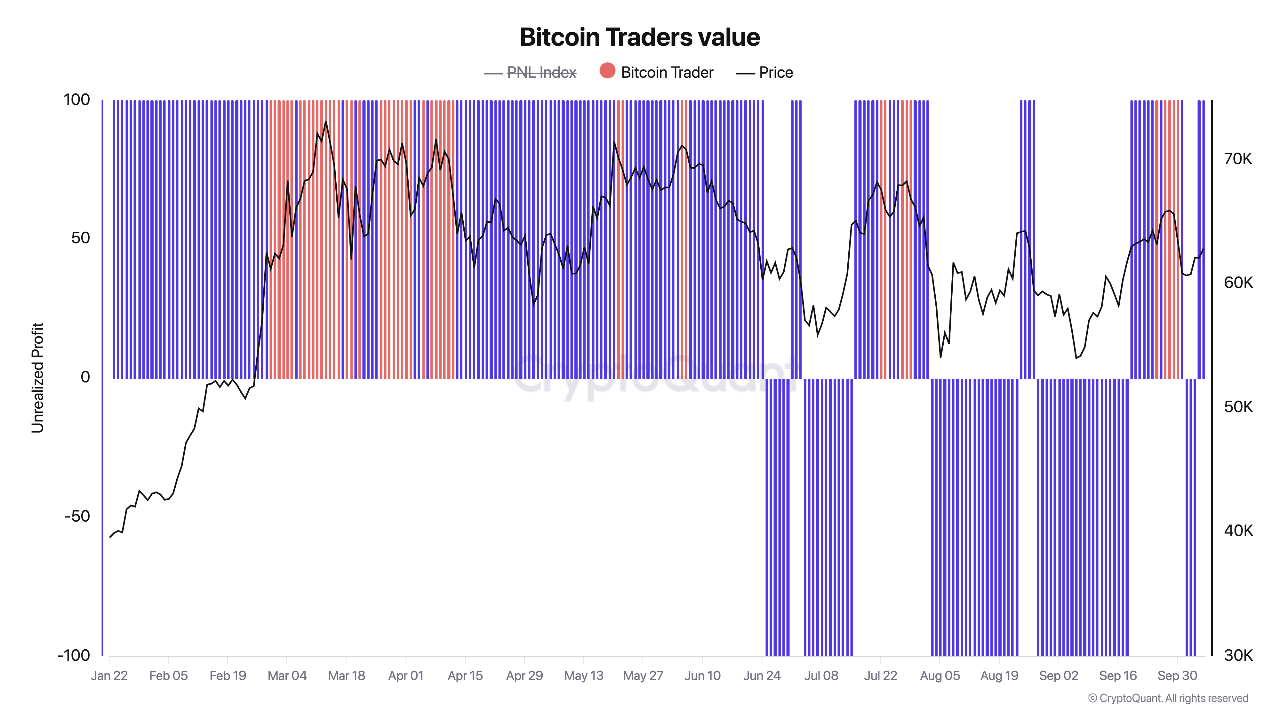

CryptoQuant analyst “Darkfost” has provided insights into Bitcoin’s current market position, emphasizing the Non-Realized Profit metric.

The analyst explained that high levels of unrealized profits often signal potential selling pressure, as traders may be tempted to take profits when they are sitting on significant gains.

Conversely, negative Non-Realized Profits indicate that traders are holding positions at or below their entry prices, which can signify the market nearing a bottom and present an ideal buying opportunity.

Darkfost pointed out that Bitcoin’s current negative Non-Realized Profit zone indicates that many traders are holding positions with little to no profit, suggesting a market bottom may be forming.

The analyst noted,

“Currently, we are in the negative zone most of the time, which could indicate potential opportunities.”

Source: CryptoQuant

Additionally, Darkfost highlighted that unrealized profits have reached unprecedented levels, unlike previous market cycles, suggesting that the ongoing cycle could bring unique risks and opportunities for investors.

Backing up the data

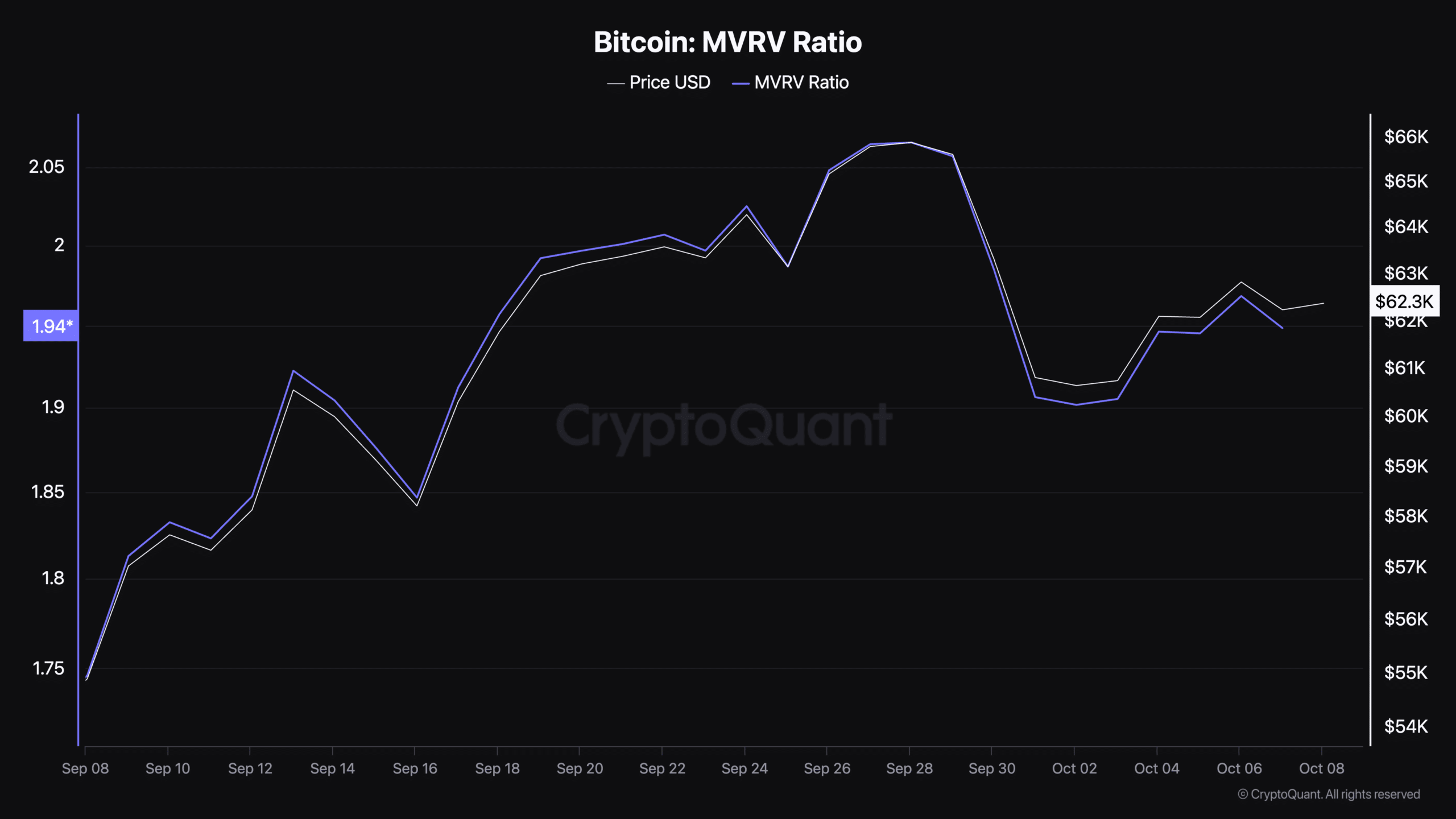

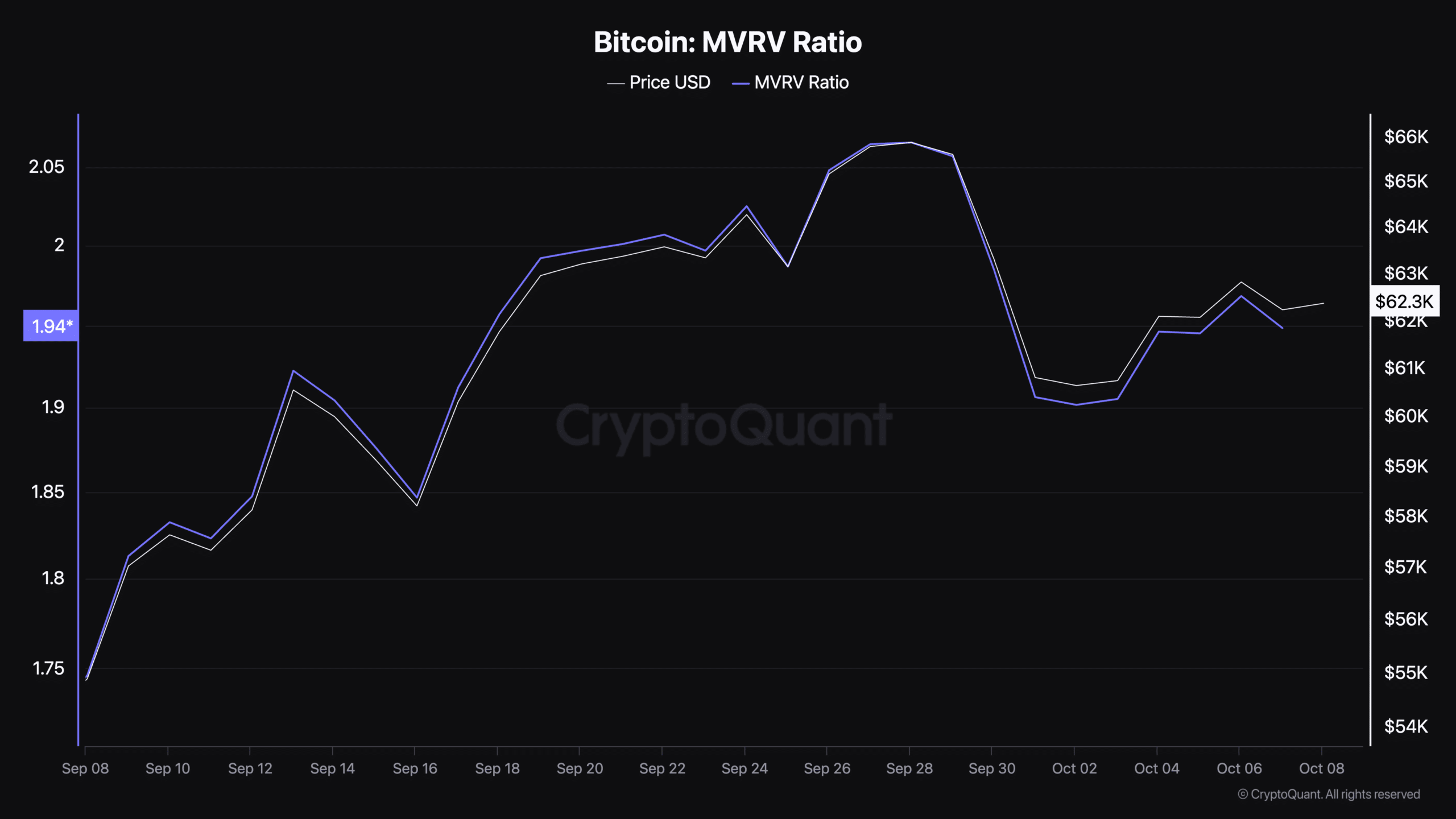

To further assess Bitcoin’s market stance, it’s worth considering other key indicators, such as the Market Value to Realized Value (MVRV) ratio.

The MVRV ratio compares the current market value of Bitcoin to its realized value (the price at which all coins were last traded).

When this ratio is high, it can indicate overvaluation and potential market corrections, while a low ratio suggests undervaluation and buying opportunities.

As of today, Bitcoin’s MVRV ratio has increased from 1.74 last month to 1.94, indicating that the market is nearing a more balanced level, but still has room for growth.

A rising MVRV ratio suggests that Bitcoin is gaining value relative to its historical performance, which may signal positive sentiment in the market.

Source: CryptoQuant

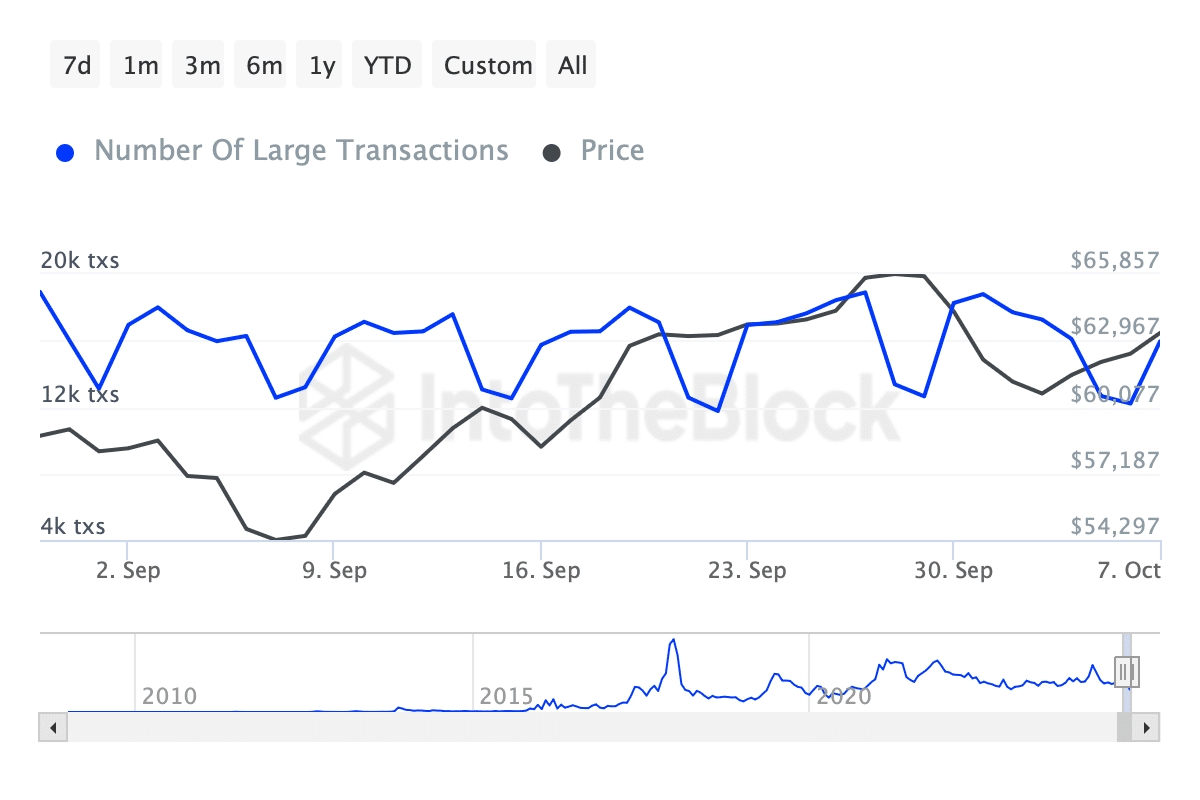

While price action and profitability metrics provide valuable insights, Bitcoin’s whale activity is another key factor worth monitoring.

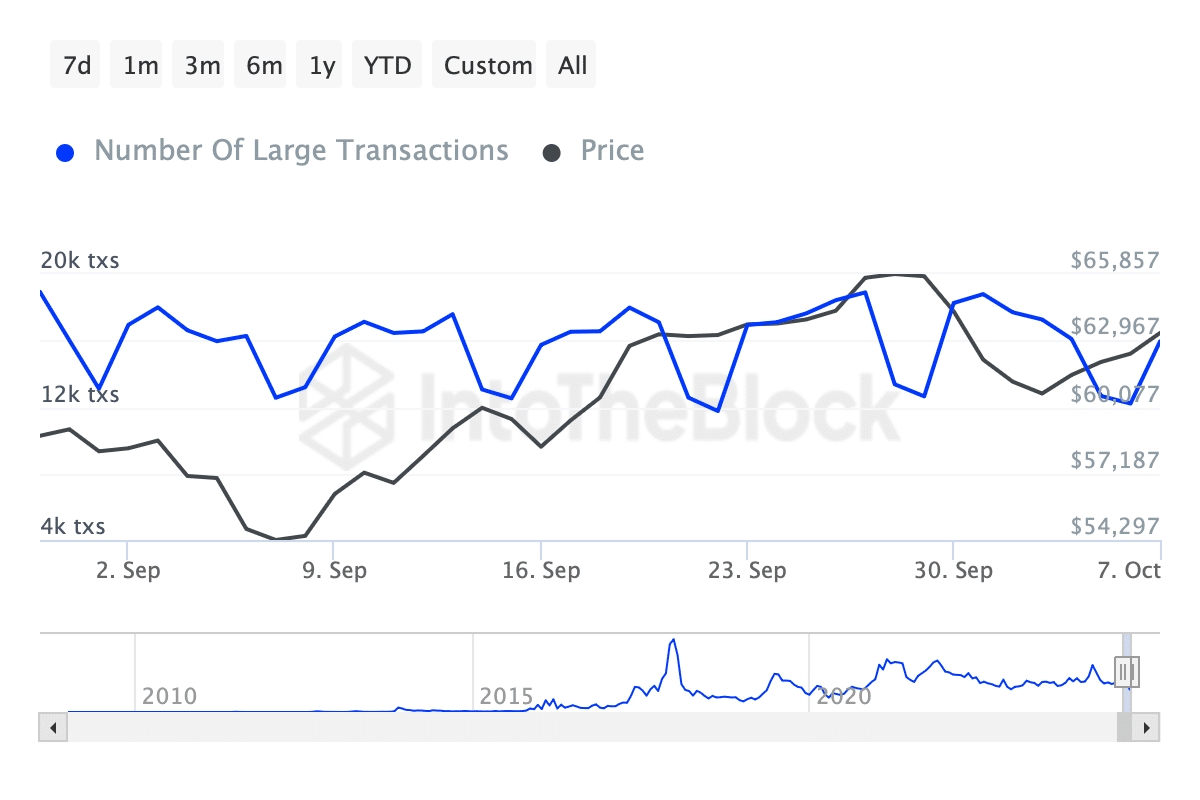

Data from IntoTheBlock revealed that transactions exceeding $100,000 have risen significantly in recent days.

The number of such large transactions has increased from below 13,000 to more than 15,000, indicating growing interest from institutional investors and high-net-worth individuals.

Source: IntoTheBlock

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This increase in whale transactions typically suggested that large investors were accumulating Bitcoin, which could further support the price and indicate confidence in the king coin’s future growth.

The involvement of whales often precedes significant market moves, as their trades can heavily influence the overall supply and demand dynamics.