- Celestia has broken out of its descending channel, targeting $6.9 as the next resistance.

- Rising social dominance and increased open interest signal growing market confidence in TIA.

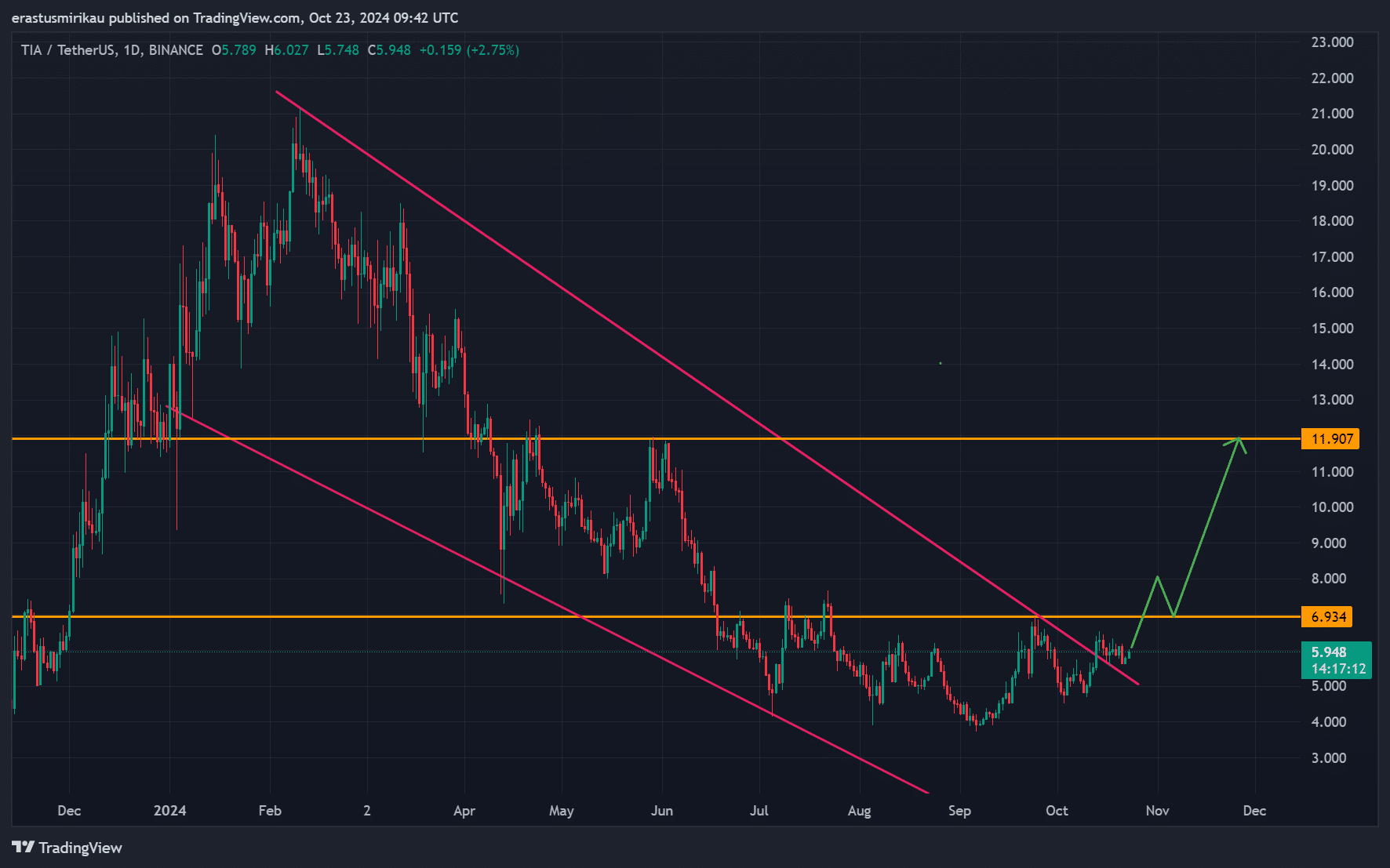

Celestia [TIA] has gained notable traction after successfully breaking out of its descending channel, positioning itself for a potential bullish run.

Trading at $5.97 at press time with a 4.39% gain, analysts are eyeing whether TIA can sustain this momentum.

However, the token now faces a critical test: Can it push past the next major resistance level of $6.9 and trigger a larger rally?

TIA descending channel breakout

The breakout from the descending channel, which has been forming for several months, has sparked optimism in the market.

Celestia now confronts key resistance at $6.9, which, if cleared, could lead to an extended rally. A further breakout could target $11.9 as the next major price level.

However, failing to hold above $6.9 might see TIA fall back to its earlier consolidation zone. Therefore, the coming days will be crucial as traders closely monitor these levels.

Source: TradingView

TIA technical analysis: RSI and MACD

Turning to technical indicators, the relative strength index (RSI) sits at 55.19, reflecting a balanced but slightly bullish market.

However, it still remains below the overbought threshold, indicating that Celestia has room to move higher without hitting exhaustion.

Additionally, the MACD indicator is on the verge of a bullish crossover, which could further propel Celestia upward. Both indicators suggest that the token has potential to extend its gains if current trends continue.

Source: TradingView

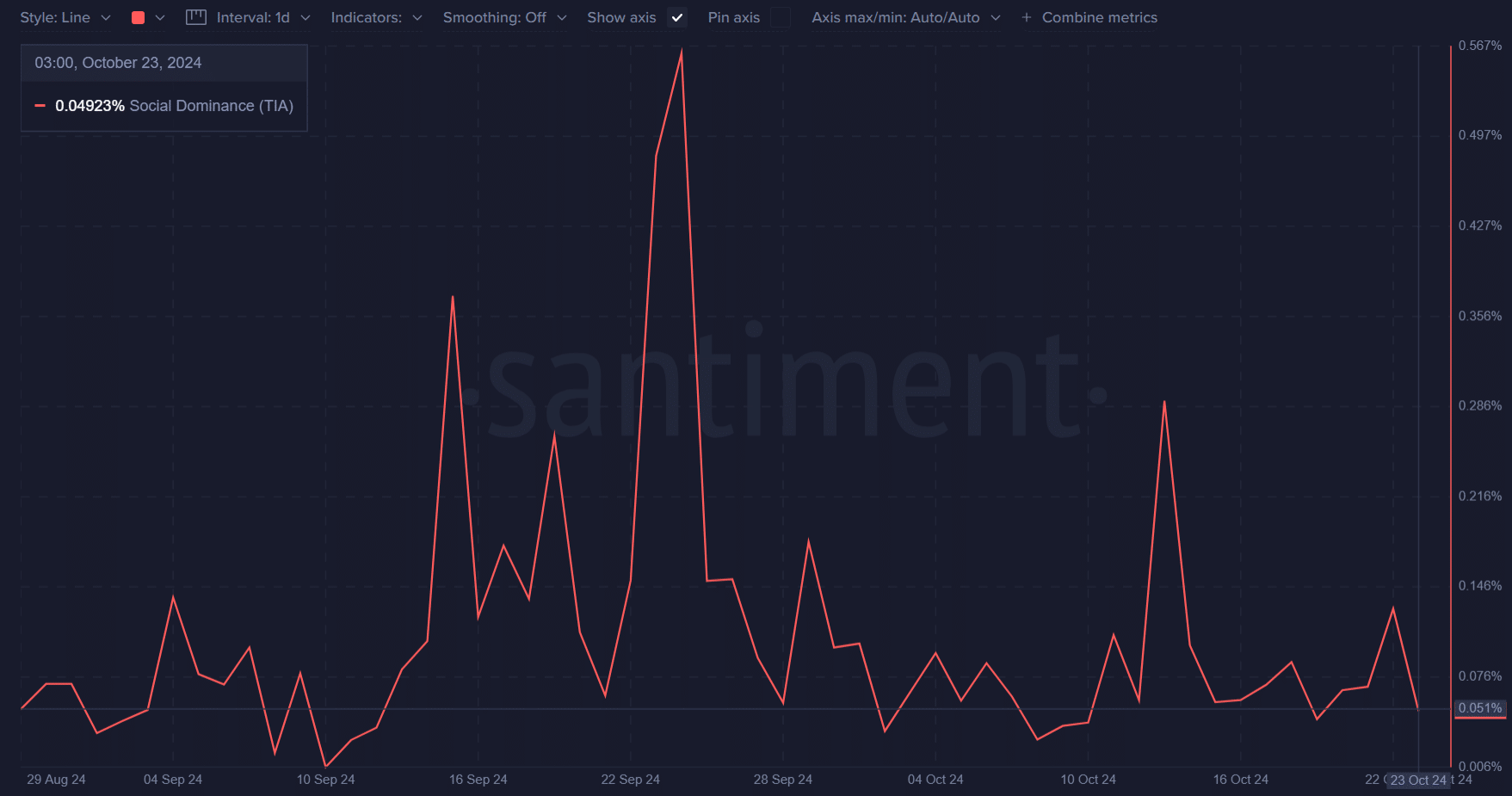

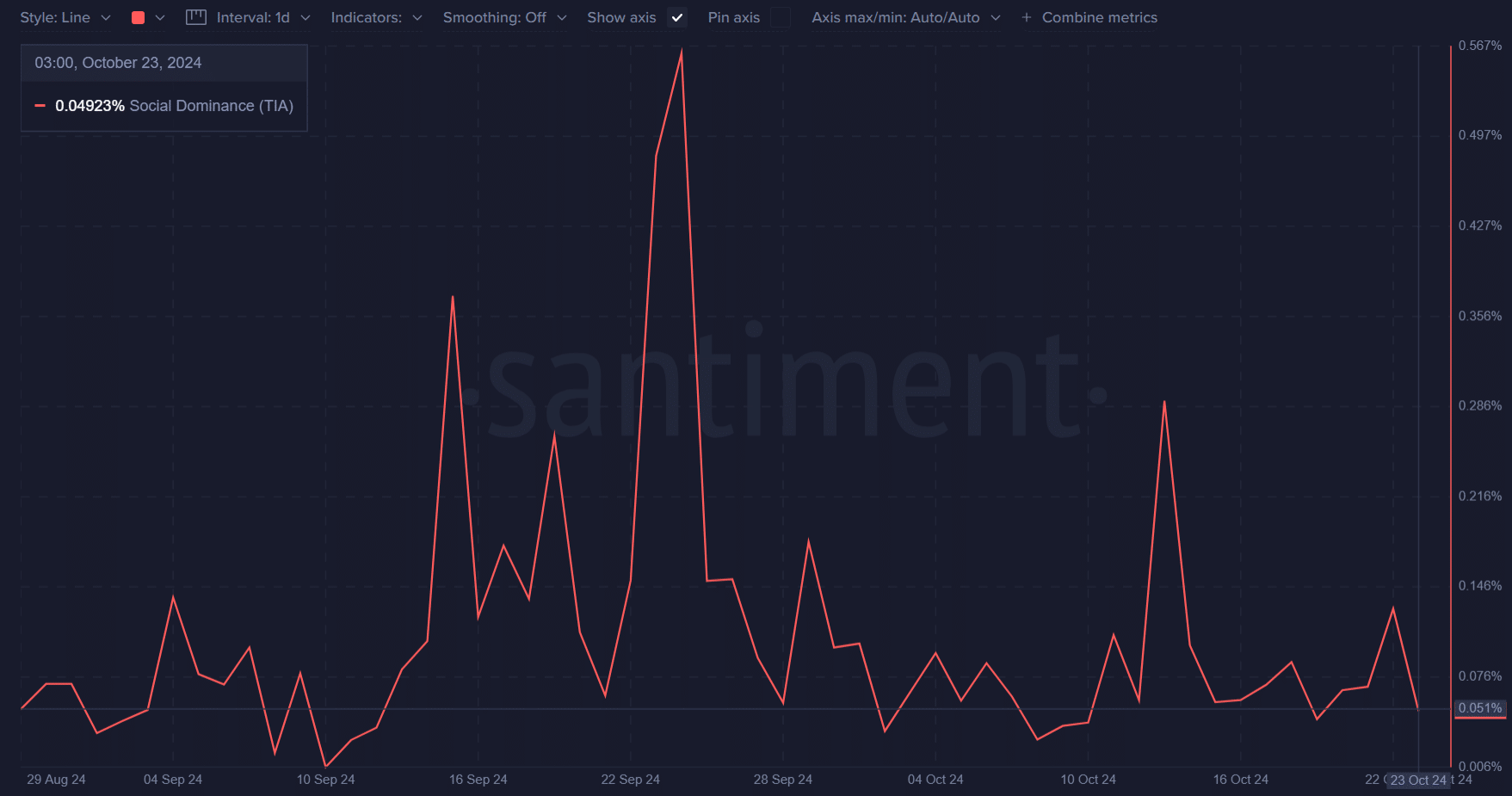

Social dominance and market sentiment

In the world of cryptocurrency, social sentiment can significantly impact price movement. Recently, TIA’s social dominance reached 0.049%, showing that it’s slowly gaining traction among retail investors.

Although this number is relatively modest, an increase in social activity often coincides with a surge in retail interest, which could consequently support further price appreciation.

Therefore, TIA’s growing visibility could enhance its bullish momentum if more traders start discussing and investing in the token.

Source: Santiment

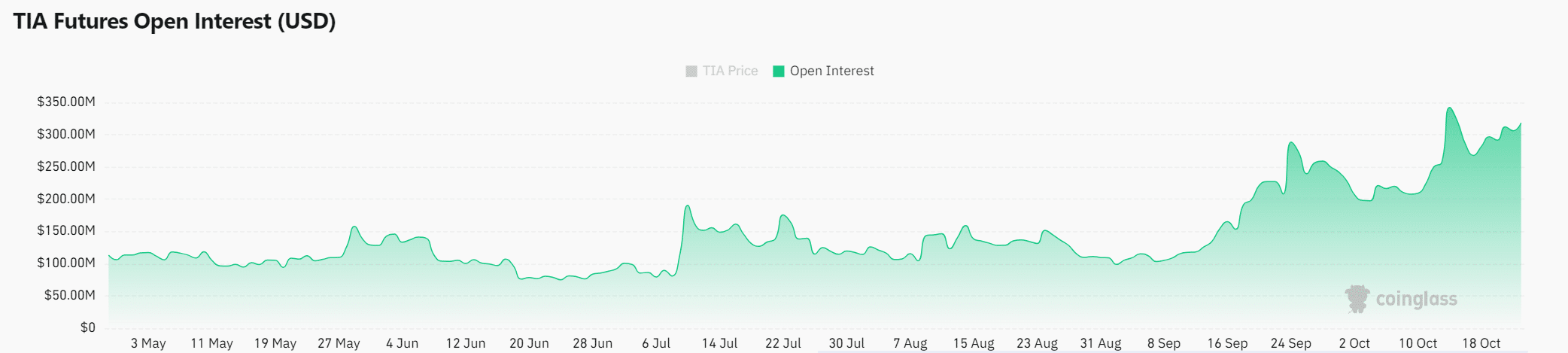

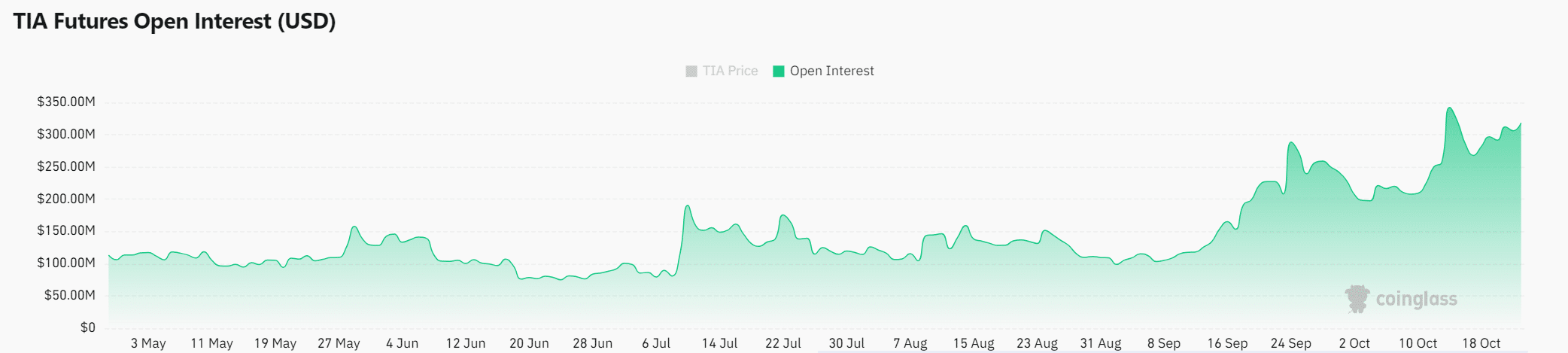

Open interest and market confidence

Open Interest for TIA futures currently stands at $317.32 million, marking a 0.66% increase. This rise suggests that traders are gaining confidence in the token’s short-term performance.

A higher Open Interest usually reflects increased trader participation and could bolster market momentum. This uptick in futures interest adds another layer of optimism around TIA’s breakout.

Source: Coinglass

Is your portfolio green? Check out the TIA Profit Calculator

Conclusively, Celestia’s technical setup and rising market interest indicate that it is well-positioned for further gains.

However, breaking through the $6.9 resistance is essential for the token to sustain its bullish momentum. Should TIA successfully clear this hurdle, it could target higher levels like $11.9.