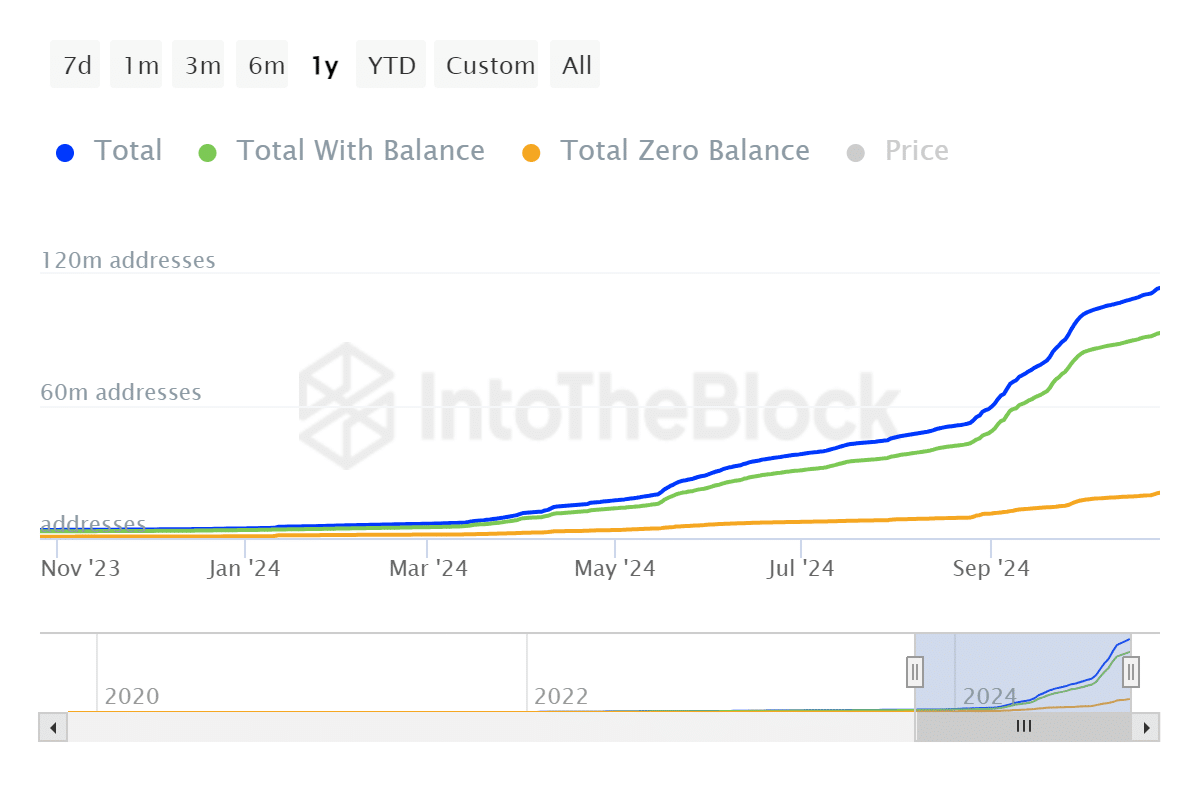

- TON addresses have been growing fast and were on track to overtake Ethereum soon.

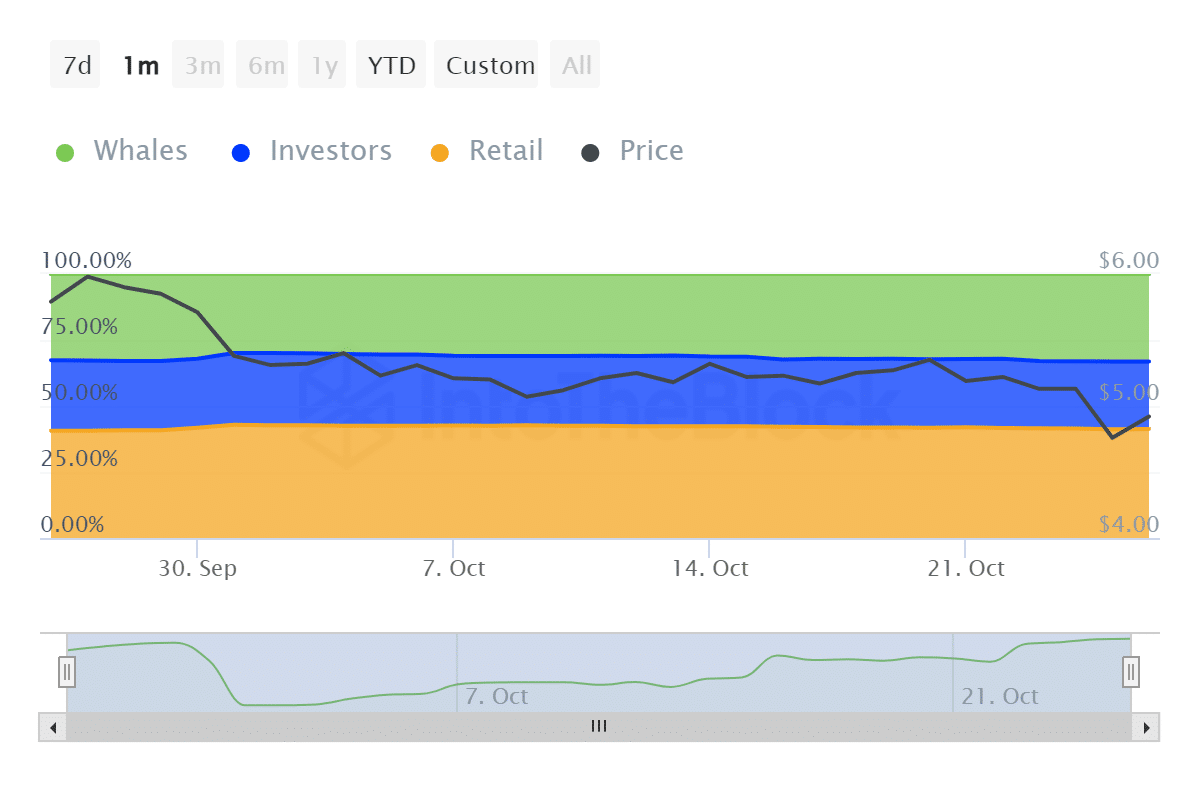

- Toncoin whales and institutional holders have been contributing to sell pressure.

Which coin between Ethereum [ETH] and Toncoin [TON] has more potential? Both are considered attractive to investors, but a recent CryptoQuant analysis suggests that TON will likely surpass ETH in terms of holder count.

The bold claim by Maartunn was based in the average rate of growth that TON kept up over the last few months. According to the analysis, TON averaged 500,000 new followers every day for the last four weeks.

The network is set to overtake Ethereum towards the tail end of December if it maintains this pace.

Maartunn’s analysis, however, noted that ETH holders may also increase and it is also possible that the growth in TON holders may slow down.

How do TON addresses compare with ETH addresses?

The total number of TON addresses as of the 26th of October amounted to 113.71 million addresses. 93.18 million of them had balances while the remaining 20.54 million addresses had zero balance.

For context, TON had 3.63 million total addresses exactly 12 months ago, hence total addresses gained by 3,032%.

Source: IntoTheBlock

In contrast, Ethereum had 309.32 million addresses in total as of the 26th of October. A significant improvement from 270.35 million total addresses exactly 12 months ago.

A 14.42% year over year growth. This means TON addresses grew 210 times faster than Ethereum addresses.

As far as ownership stats were concerned, historical concentration data revealed that demand for Toncoin was on the decline in the last 30 days. Whale balances dropped from 32.63% on the 26th of September to 33.19% at press time.

Source: IntoTheBlock

Investor balances dropped from 26.73% of the supply to 25.51% during the last 4 weeks. Finally, the TON supply held by the retail class grew from 40.65% to 41.31% during the same period.

This confirmed that whales and investors have been trimming their balances while retail has been accumulating.

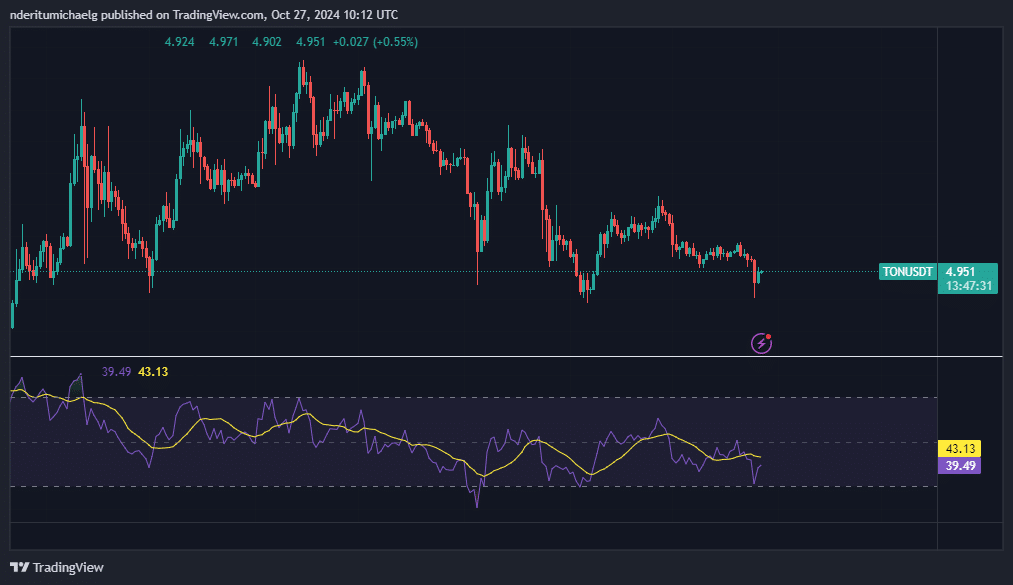

Toncoin price action recap

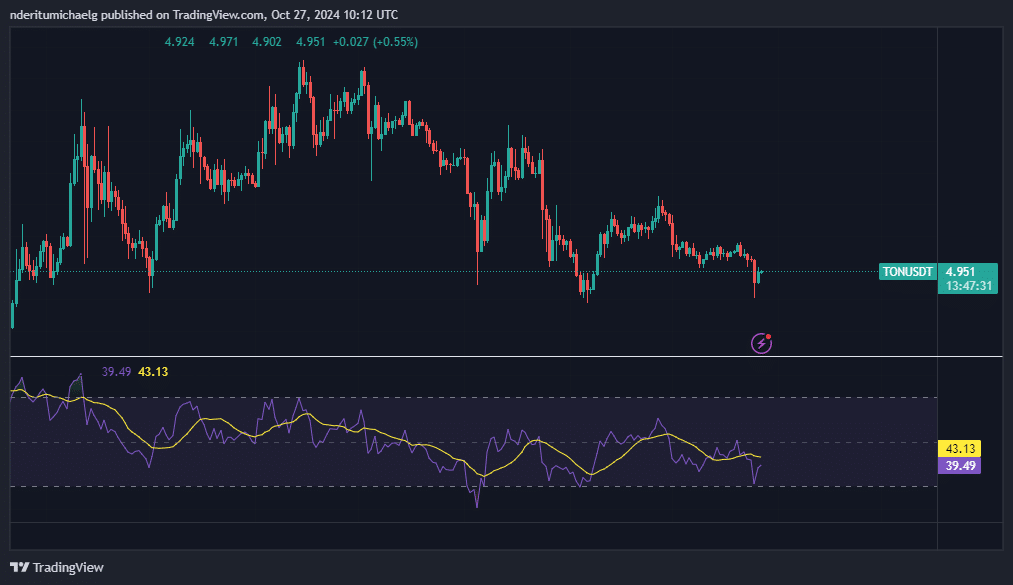

While most of the top coins have been building on September’s bullish momentum, Toncoin price action slid lower for a retest of September lows. It fell as low as $4.51 on 25th October, which was equivalent to a 16% dip from its weekly high.

Source: TradingView

Read Toncoin’s [TON] Price Prediction 2024–2025

TON’s latest crash attracted a demand resurgence, pushing the price up to a $4.95 at the time of writing.

However, it also underscored the fact that the cryptocurrency was undervalued and this could attract buyers looking to get in at discounted prices.