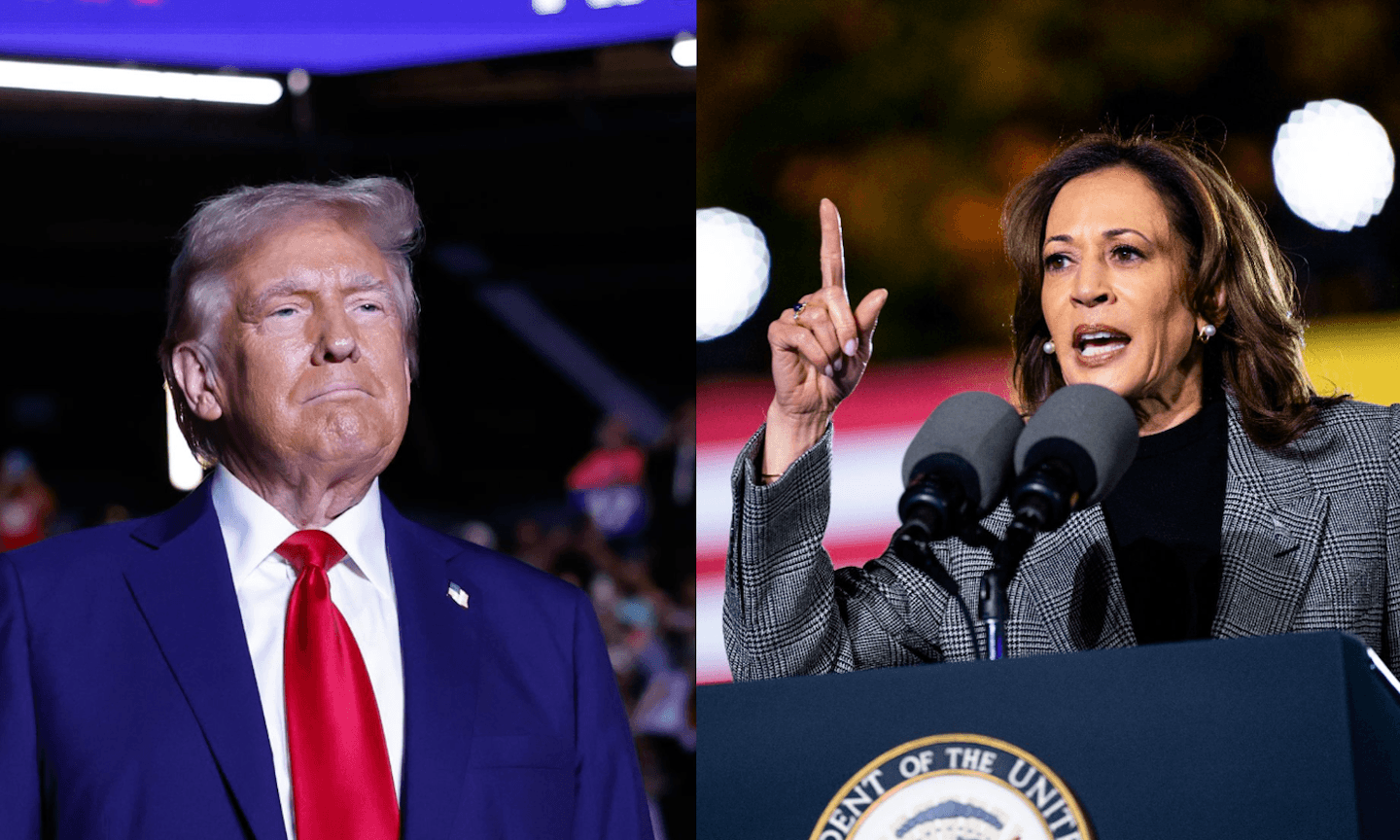

Consider this your election cheat sheet to find out what Vice President Kamala Harris and former President Donald Trump are promising to do as they vie for the nation’s highest office. Here’s where the candidates stand on top economic and personal finance issues.

Both presidential candidates want to lower prices and slow inflation, but whether a president can directly do so is less certain. Inflation, as measured by the consumer price index, has already slowed to 2.4%, well off its pandemic-fueled peak.

Trump:

-

Place tariffs on imports. Trump wants to place a 10% to 20% tariff on all foreign imports; up to 60% tariff on imports from China; and 100% to 200% imports on automobiles produced in Mexico. He says his tariffs would support U.S. manufacturing and raise revenue. But experts from all over the political spectrum say that his tariff plan is more likely to increase prices in the U.S.

-

Lower gas prices. Trump has pledged to increase oil and gas production on federal lands. The president’s ability to lower gas prices is limited as the price at the pump is more directly influenced by global market forces.

-

Weaken the power of the Federal Reserve. Trump says he wants to bring the Federal Reserve under the power of the president; experts say it could weaken the central bank’s credibility in making interest rate decisions.

-

Cap credit card interest rates at around 10%. The average credit card interest rate is 21.51%, according to Federal Reserve data from May 2024. It would require Congress to enact and would likely face legal pushback.

Nerd out on investing news

A NerdWallet account is the smartest way to see the latest financial news and what it means for your wallet.

Harris:

-

Ban price gouging. Harris wants to create rules that would prevent corporate grocers from raising prices arbitrarily. The ban would require approval by Congress. Critics say her plan is mainly an election promise rather than a sound economic policy.

-

Lower prescription drug costs. Harris plans to extend to all Americans a $35 cap on insulin and $2,000 cap on out-of-pocket expenses for seniors. She also wants to make it quicker and easier for Medicare and other federal programs to negotiate prescription drug prices. Experts say her plans could be effective in bringing down costs, but will face pushback from Big Pharma lobbyists.

-

Increase the minimum wage. Harris says she would push to raise the federal minimum wage to at least $15 per hour, up from the current minimum wage of $7.25. The federal minimum wage hasn’t been touched since 2009 and raising it would require approval in Congress.

The campaign proposals that would most directly impact consumers are tax cuts and credits.

Trump:

-

Extend tax cuts in his 2017 Tax Cuts and Jobs Act that are expiring at the end of next year. The TCJA includes estate tax cuts and individual income tax cuts.

-

Replace personal income taxes with tariffs. His new plan would place a 10% across-the-board tariff on foreign imports with much more for China. More on that above.

-

Lower the corporate tax rate by one percentage point. Trump wants to cut the corporate tax rate from 21% to 20%.

-

Implement R&D tax credits for businesses. The tax credits would allow businesses to write off 100% of expenses in its first year, including machinery and equipment. It’s a reversal of his 2017 tax cuts that phased out write-offs for R&D expenses in a business’ first year.

Harris:

-

Increase taxes for the wealthy. Harris wants to raise the net investment income tax up to 5% on those with incomes above $400,000. She also wants to increase the highest tax rate on long-term capital gains to 28% on taxable income above $1 million.

-

Increase taxes for corporations.

-

Expand Child Tax Credit: Harris wants to increase the credit to $6,000 for children under the age of 1; $3,600 for children ages 2-5; and $3,000 for older children.

-

Permanently extend the expanded premium tax credits for those who purchase health insurance through the health insurance marketplace.

-

Increase tax incentives for small businesses. An increase in federal tax incentives from $5,000 to $50,000. The deduction would be available to new businesses until they turn a profit. The incentive feeds into her goal of creating 25 million new small businesses in the next four years.

No tax on tips: The candidates’ aims are vastly different, but there’s one proposal they both support: exempting workers from paying taxes on their tips. But experts say it’s just bad policy that doesn’t get to the fundamental needs of tipped workers.

When it comes to health care, the candidates have been light on the details, although both candidates promise to protect Medicare. Here’s where they differ.

Trump:

-

Revisit the Affordable Care Act. Trump tried to repeal and replace the Affordable Care Act in his first term, but was unsuccessful. During the presidential debate on Sept. 10, he was asked if he would try again. In response, Trump said he had only “concepts” of a new plan.

-

Push for vitro fertilization (IVF) coverage. Trump has said the government or insurance companies should cover IVF, though many in the GOP oppose the idea.

-

Leave abortion laws up to the states. He says he would veto any federal ban on abortion.

Harris:

-

Expand Medicare coverage to include long-term care including at-home care for seniors and those with disabilities. She also promises to provide vision and hearing benefits for seniors under Medicare.

-

Work with states to eliminate medical debt.

-

Lower prescription drug costs. See above.

-

Restore federal protections for abortion access under Roe v. Wade. Harris also promises to ensure there will never be a federal ban on abortion.

Harris wants to increase housing and make it more affordable while Trump has emphasized market-driven solutions. There are two areas that both candidates agree:

-

Open up federal lands for new housing developments. Neither has specified which lands that would include, but experts say much of the federally held land would not be ideal for creating new housing. There is precedence for using federal land to build housing; most available land is in the West.

-

Cut red tape. Reducing regulatory burden has bipartisan support, but most housing reform would need to be done at the local level to have an impact.

Harris:

-

Build 3 million new homes over four years. Experts say her proposals would likely spur additional new housing creation, but building 3 million new homes in that short of a period of time is unlikely.

-

Add tax incentives for home builders. Harris proposed a new Neighborhood Homes Tax Credit to create 400,000 new owner-occupied homes in lower income communities and a tax break for builders that construct affordable starter homes.

-

Create a $40 billion innovation fund to incentivize stakeholders — state and local governments, as well as private developers and homebuilders — to find new strategies to expand the housing supply.

-

Introduce $25,000 in down payment assistance for first-time home buyers. It would be even greater for first-generation home buyers, but has not elaborated how much. It’s unclear how it would be implemented and experts say that without a bigger housing stock, her plan won’t work.

-

Lower rent and prevent price-fixing among corporate landlords. Experts are skeptical that her plans would lower rent. However, if a significant stock of new housing is created, it could alleviate some price pressures on the rental market.

Trump:

Beyond deregulation and opening up federal lands for home building, Trump’s plans have been sparse when it comes to housing. However, experts say that his plans to deport millions of unauthorized immigrants could drive up housing prices since the construction industry is reliant on immigrant labor.

As president, Harris would likely champion student loan relief and free community college. Trump would likely restrict or dismantle loan forgiveness and promote access to non-traditional degrees.

Trump:

-

Curb debt cancellation. Trump would likely not support broad student loan cancellation or strengthening other forgiveness plans that the Biden-Harris administration has championed. Trump has also said that access to existing loan forgiveness should be restricted, including the Public Service Loan Forgiveness (PSLF) program.

-

Dissolve SAVE. Trump is likely to strike down SAVE, an income-driven repayment program that is currently caught up in legal challenges.

-

Support vocational training. Trump’s platform says it would support creating “drastically more affordable alternatives to a traditional four-year college degree.”

Harris:

-

Support “Plan B” student loan forgiveness. Harris would likely support Biden’s “Plan B” that would reduce or eliminate accrued interest for 23 million borrowers who owe more than they originally borrowed. The plan is currently wrapped up in state legal battles.

-

Support SAVE and other income-driven repayment plans. Harris would likely support the SAVE repayment plan through legal battles. She would also support the continuation of other income-driven repayment plans, including PSLF, as well as the borrower defense to repayment program that protects borrowers who are defrauded or misled by their colleges.

-

Champion free community college and trade school education. She also says she wants to subsidize tuition at Minority Serving Institutions, including Historically Black Colleges and Universities (HBCUs).

-

Expand the Pell Grant. She plans to expand grants to 7 million students and double the maximum award by 2029. Pell Grants are given to undergraduates from low-income backgrounds and are currently up to $7,395 per year.

Trump’s plan to deport unauthorized immigrants, en masse, would have unintended, but significant economic consequences including:

-

Increasing costs economy-wide. Reduced labor supply that would increase costs for businesses and, ultimately, be passed down to the consumer. It would especially impact the hospitality and service industries that rely on immigrant workers.

-

Driving up food prices. Immigrants make up a large portion of the agricultural workforce. Without that labor, the food supply in the U.S. could tighten, which would drive up prices.

-

Slowing housing construction since immigrants play a huge part in the creation of housing in the U.S. This could further worsen the nation’s affordable housing shortage.

Listen: Smart Money’s 2024 Presidential Election Series

Hosts Sean Pyles and Anna Helhoski discuss the grand economic promises made by presidential candidates and the intricate realities of presidential influence on the economy to help you understand the real effects on your daily finances.

Photo of former President Donald Trump by Anna Moneymaker/Getty Images News via Getty Images.

Photo of Vice President Kamala Harris by Brandon Bell/Getty Images News via Getty Images.