- Large investors have opted to hold their tokens rather than sell ahead of the token unlock event

- Retail traders have been accumulating APE, pushing its price higher.

Over the past month, ApeCoin [APE] has surged by 62.18%, with bullish momentum still driving gains. In fact, its most recent daily hike of 10.71% highlighted the possibility of further movement on the price charts.

Such a sustained rally defies typical market behavior. Especially since token unlock events are usually associated with bearish market sentiment.

APE token unlock defies bearish expectations

A token unlock refers to the scheduled release of additional tokens by a blockchain foundation, typically done periodically. These events are meant to increase the token’s supply in the market. This often leads to price declines in the days or hours before and after the unlock.

However, APE is bucking this trend, with its price currently on the rise.

The upcoming unlock, set for 17 November, will release 15.38 million APE tokens valued at $17.58 million. This release will represent 1.54% of the total locked supply.

This is why AMBCrypto looked into the reasons behind APE’s atypical bullish performance ahead of the unlock.

Whales pause selling as retailers drive APE’s momentum

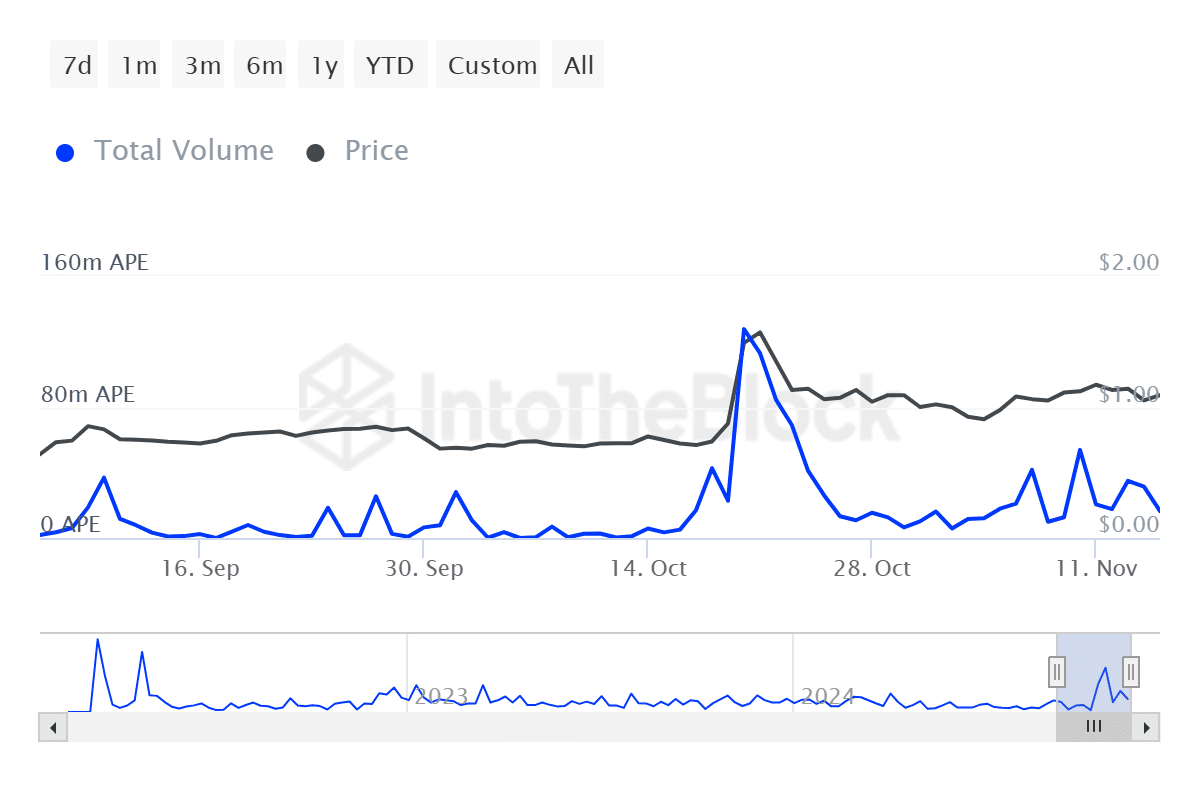

Whales appear to have reduced their selling activity for APE. This was evidenced by the significant drop in large transaction volumes, which fell from 34.9 million to 16.37 million on 13 November, as per IntoTheBlock.

This decline in whale activity coincided with a price hike, typically signaling confidence among larger holders. With whales stepping back, retail traders have become the primary drivers of the token’s recent momentum.

Source: IntoTheBlock

Further analysis underlined the role of a small, but active group of retail participants. Daily Active Addresses (DAA), a metric that tracks unique wallet activity, stood at just 1,280 at press time. This suggested that this cohort has played a key role in influencing APE’s latest uptick.

Now, the sustainability of these gains remains uncertain. However, AMBCrypto’s evaluation of additional on-chain metrics seemed to indicate that APE’s bullish trend may hold.

APE’s bullish momentum is likely to persist

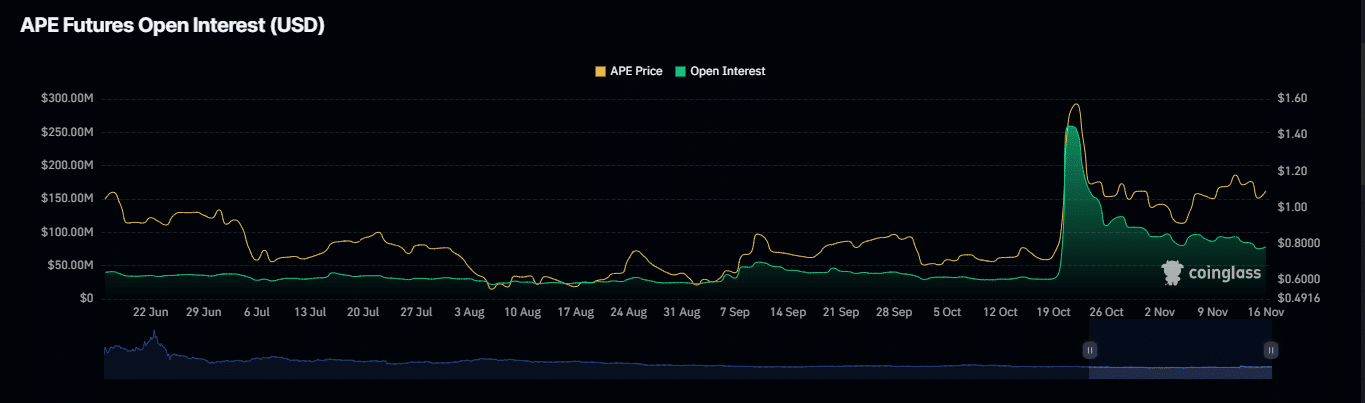

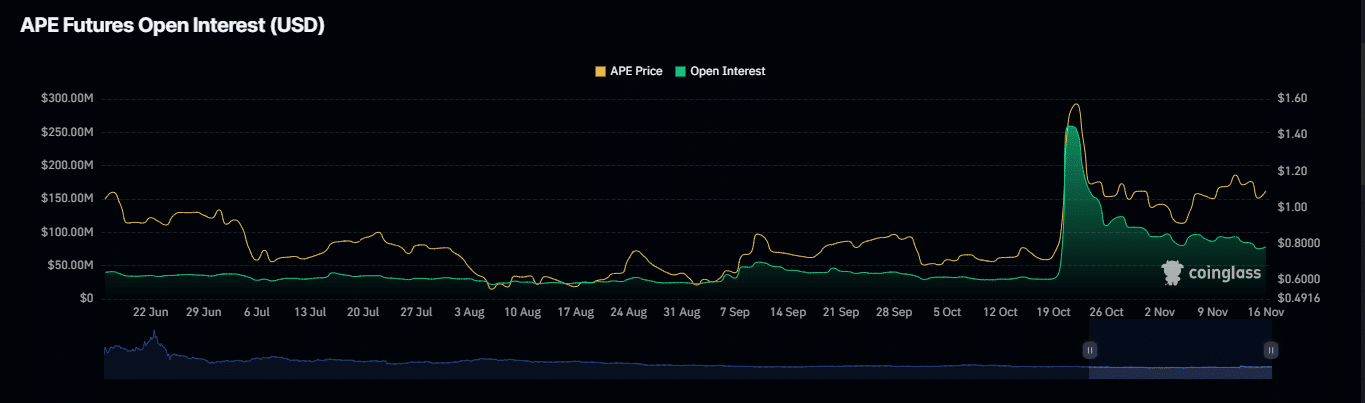

Here, it’s worth pointing out that on-chain metrics from Coinglass alluded to a long-term bullish outlook for APE too.

Open Interest, which tracks the total unsettled Futures contracts on APE, rose by 24.40%. This suggested that long traders have been actively increasing their positions – A sign of growing confidence in the market’s upward trajectory.

Source: Coinglass

The Funding Rate has also remained positive, climbing to 0.0297%. This meant that long traders have been paying fees to short traders – A key indicator of bullish sentiment.

Read ApeCoin’s [APE] Price Prediction 2024–2025

Finally, Exchange Netflows were negative on both the daily and weekly timeframes, with $2.94 million and $8.80 million worth of APE tokens leaving exchanges, respectively. This can be interpreted to allude to a fall in selling pressure and higher demand.

If these metrics maintain their bullish position, APE’s rally is likely to extend beyond the upcoming token unlock.