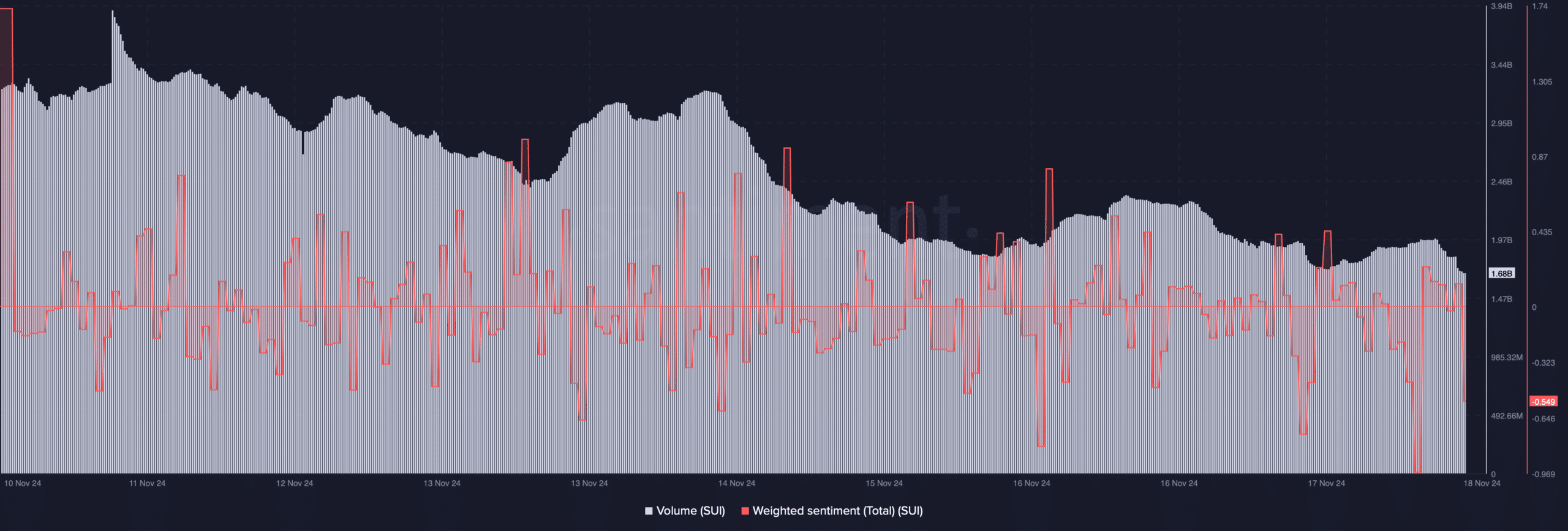

- While the token’s price increased, its trading volume dropped last week.

- Market indicators and metrics suggested that selling pressure was rising.

Sui [SUI] bulls heavily dominated last week with double digit growth. But the token’s comfortable rise might be halted in the coming days as a key indicator flashed a sell signal. Will this put an end to SUI’s bull rally, or will this just be a slight pullback?

SUI’s latest sell signal

The token earned investors profit last week by pushing its value by more than 19%. The bullish momentum did slow down, but SUI still managed to paint its daily chart green.

AMBCrypto reported that while the token’s price increased, it also witnessed a massive spike in its open interest. This acted as a foundation for the bull rally.

However, the trend might change soon. Santiment’s data revealed that while the token’s price surged, its trading volume dropped, indicating an up-coming trend reversal. Additionally, SUI’s weighted sentiment also plummeted – a sign of rising bearish sentiment.

Source: Santiment

Meanwhile, Ali, a popular crypto analyst, posted a tweet pointing out a notable development. As per the tweet, the token’s TD sequential flashed a sell signal. Whenever that happens, it suggests a price correction.

The indicator is considered to be quite accurate. To put into perspective, the same indicator flashed a buy signal, after which SUI rallied by over 112%. Therefore, investors must remain cautious, as a price correction might be around the corner.

Is selling pressure rising?

Selling pressure did increase on the 17th of November as the sell volume had a value of over 70. For starters, a value closer to 100 indicates that selling pressure was high.

A rise in selling pressure often acts as a catalyst for a price correction.

Source: Hyblock Capital

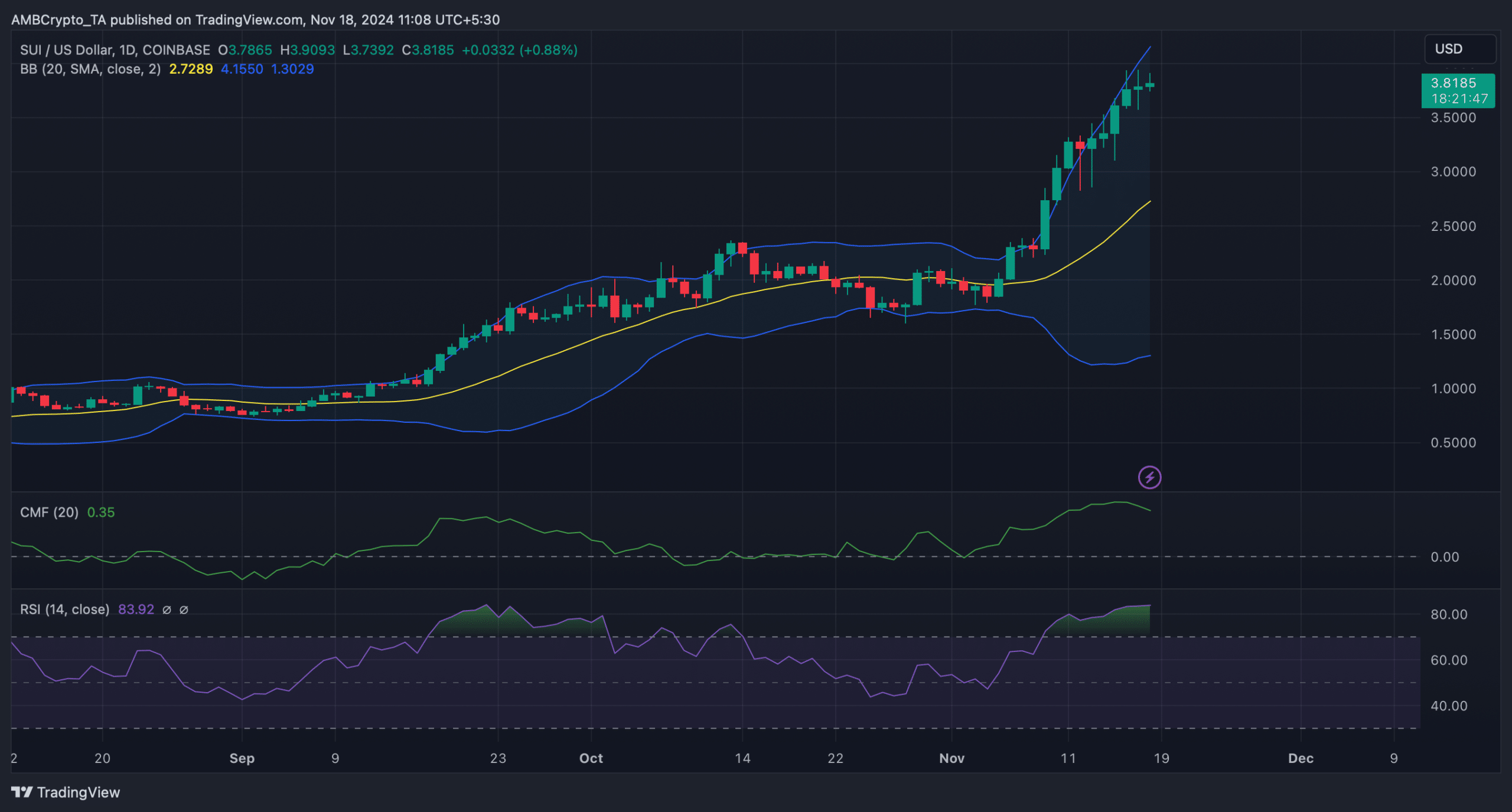

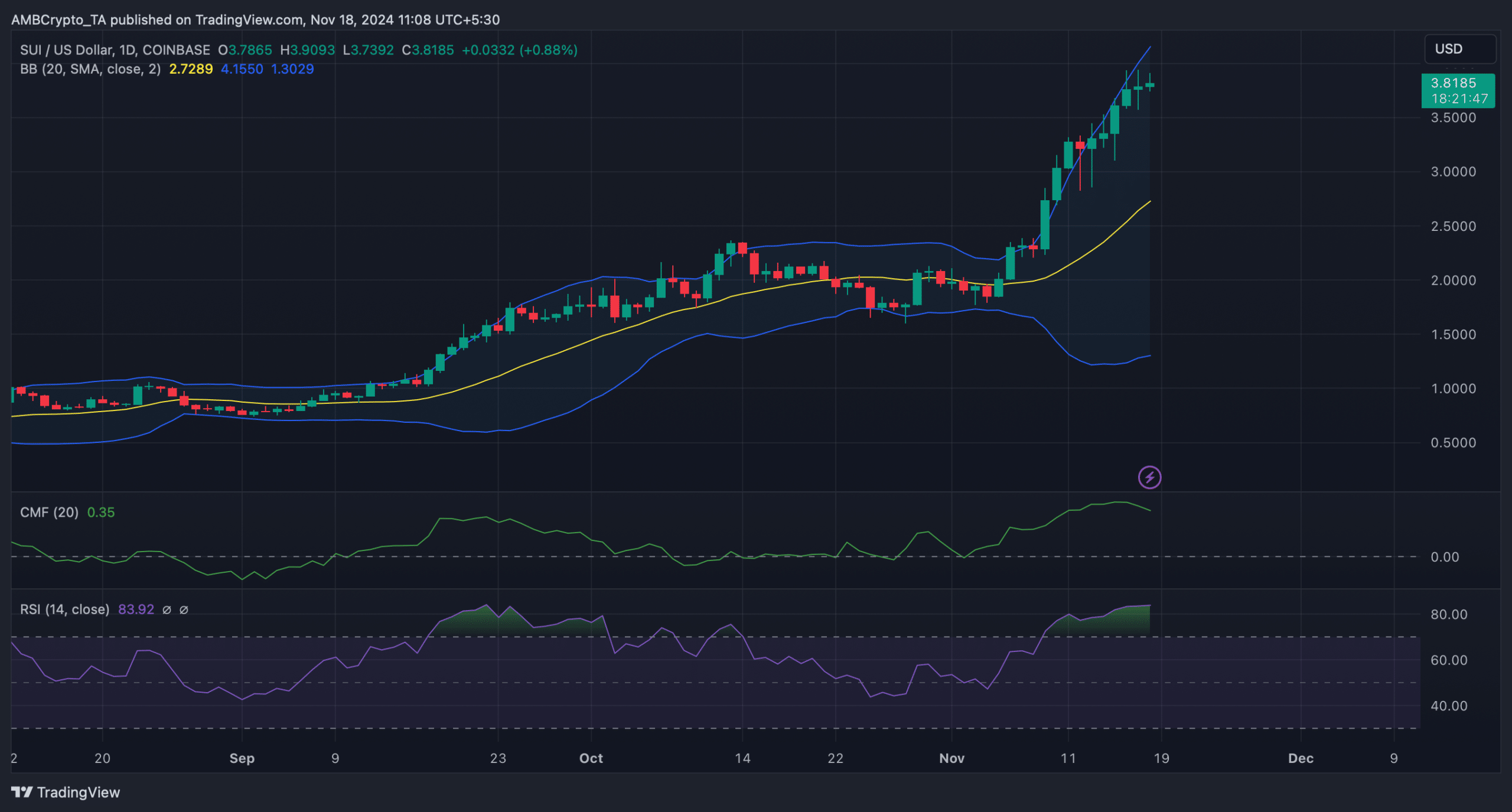

Apart from this, a few other technical indicators also highlighted the fact that selling pressure was high. For instance, the Chaikin Money Flow (CMF) registered a downtick. A drop in the indicator suggests a bearish trend, or that money is flowing out of a security.

On top of that, SUI’s Relative Strength Index (RSI) had a value of 84, meaning that it was in the overbought zone. This might instill panic in the market and motivate investors to sell their holdings, pushing the token’s price down.

Realistic or not, here’s SUI’s market cap in BTC’s terms

The token’s price had also touched the upper limit of the Bollinger Bands, which results in price corrections.

In the event of a price drop, SUI might find support near its 20-day Simple Moving Average (SMA), where it will get an opportunity to rebound.

Source: TradingView