- POPCAT had a bearish structure on the daily chart.

- Its bearish social media engagement stemmed from a relative weakness during a bullish market phase.

Popcat [POPCAT] noted a 79.7% rally from the lows of November to the high at $2.08. Market participants expected a minor retracement before the next move higher, but POPCAT has retraced almost all of these gains.

Bitcoin [BTC] saw an 8.83% drop from the 22nd to the 26th of November, which further contributed to Popcat’s losses.

However, while Bitcoin jumped higher to challenge the $98k local resistance zone again, Popcat bulls were unable to breach $1.4.

Technical analysis highlights POPCAT weakness

Source: POPCAT/USDT on TradingView

On the daily timeframe, POPCAT had a firmly bearish structure.

The series of lows the token formed in mid-November around $1.65 was not defended, and the Fibonacci retracement levels were ceded to the bears as well.

At press time, the 78.6% retracement level at $1.35 served as a resistance zone on the lower timeframes.

The RSI showed bearish momentum was dominant. The OBV saw a noticeable drop in the past ten days, showing selling pressure and weakened buyers.

Of the top eight memecoins by market capitalization, POPCAT is the only one that has a negative return over the past 30 days. Dogecoin [DOGE] has the highest, and dogwifhat [WIF] the lowest.

DOGE has rallied 152% since the daily open of the 30th of October, while WIF has gained 24.87%.

By comparison, POPCAT has shed 23.28%. This was not a good look for the cat-themed Solana [SOL] token, and signified a lack of strength while the rest of the market performed bullishly.

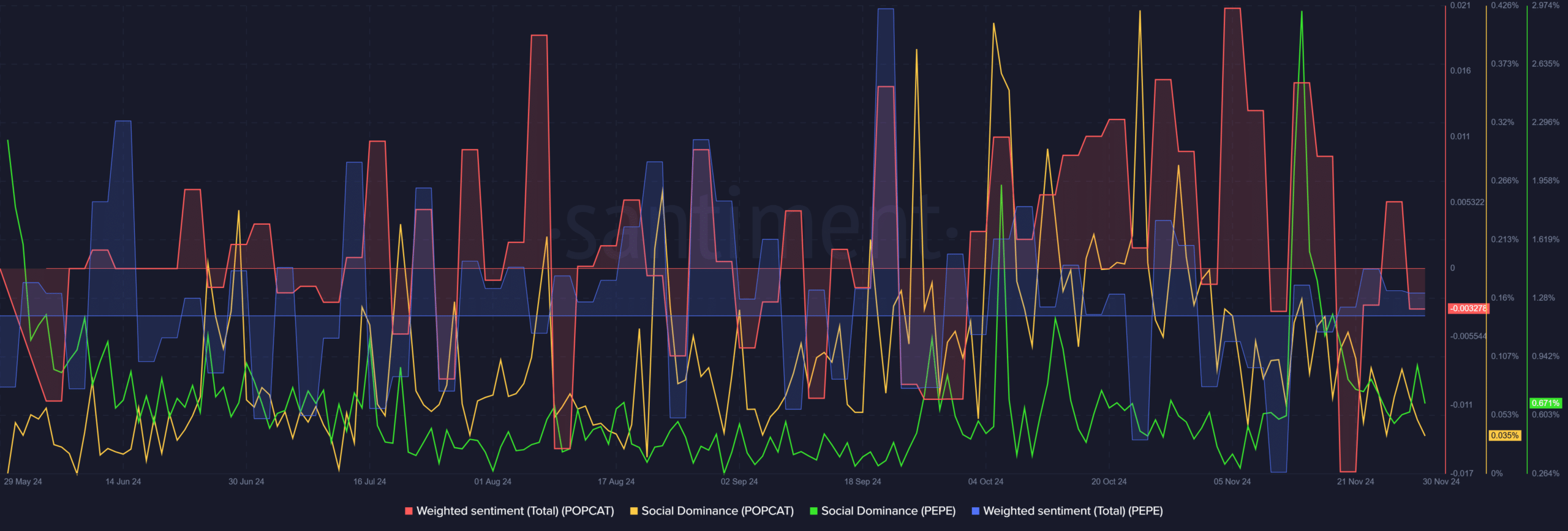

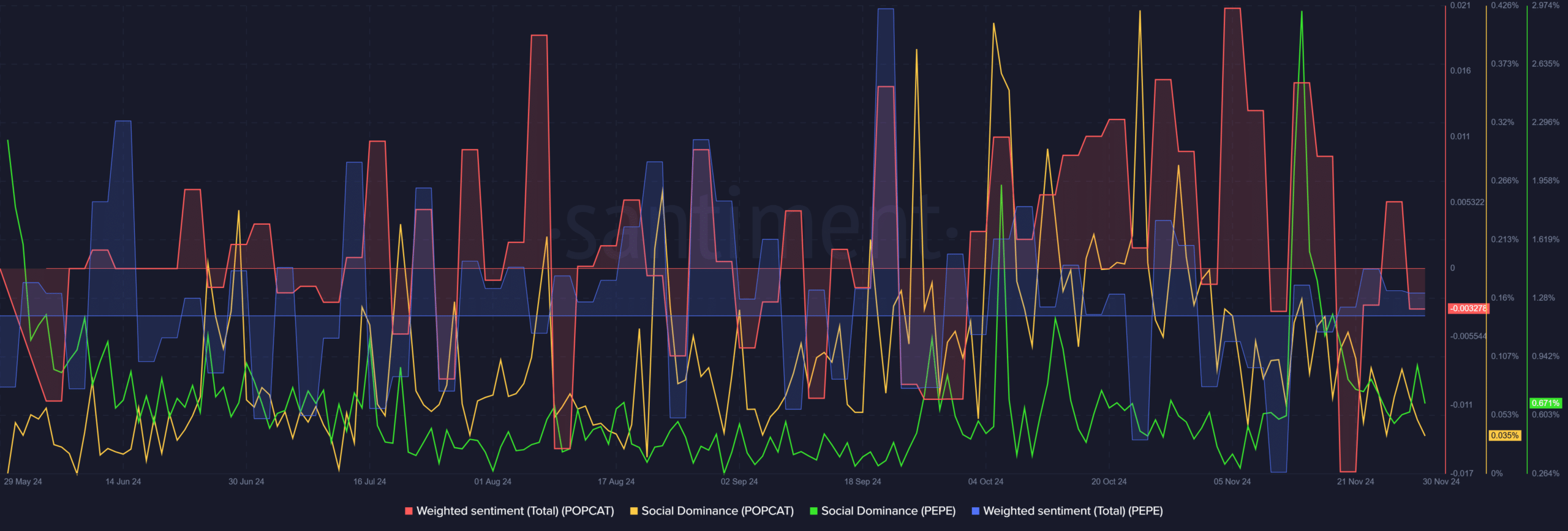

Sentiment turns negative after a brief respite

Source: Santiment

A comparison of the sentiment metrics of POPCAT and PEPE showed that PEPE holders were slightly more bullish.

PEPE has gained 112% in the past 30 days, and the recent price drop made only a dent to the meme’s bullish trend.

The social dominance of PEPE was 20x higher on the 29th of November, and the weighted sentiment was more hopeful too.

Popcat’s engagement turned bullish a few days ago but reverted bearishly quite quickly as the price continued to fall.

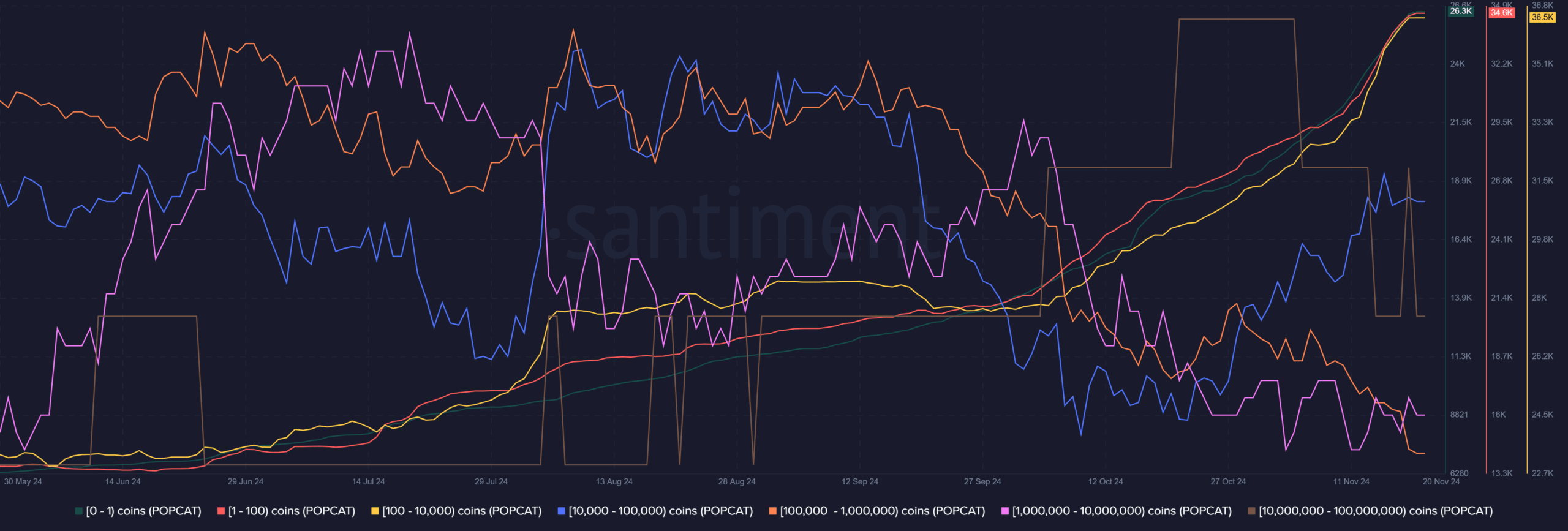

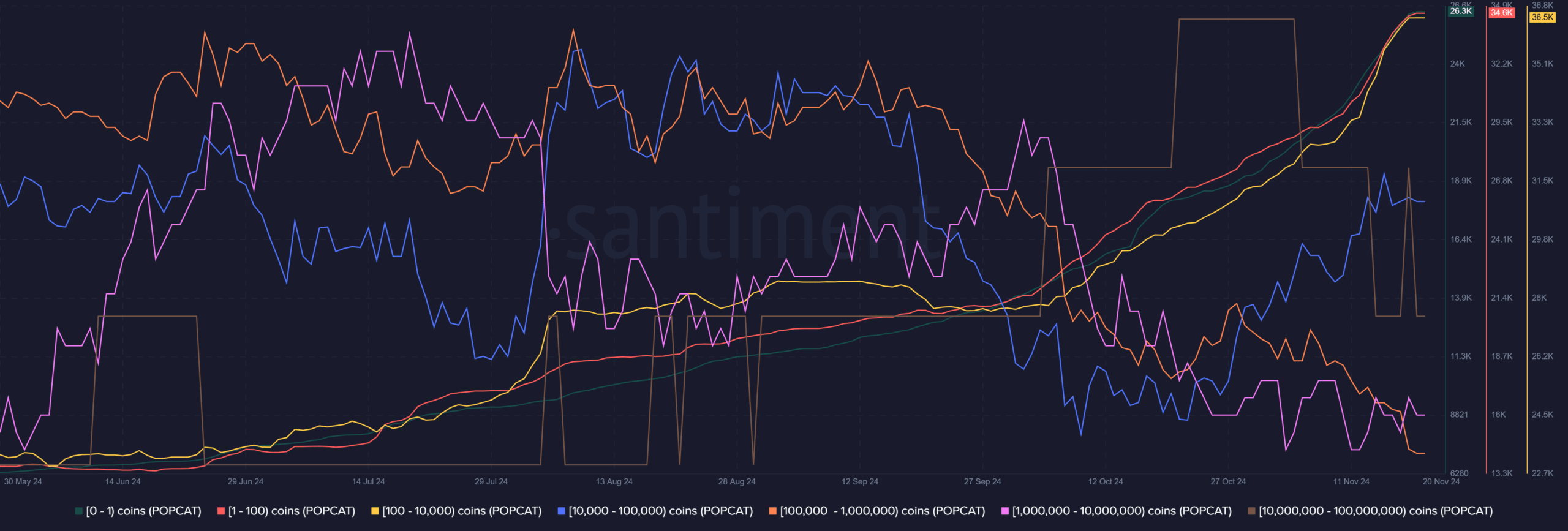

Source: Santiment

An examination of the Popcat whale addresses showed that addresses with 100k+ POPCAT have slowly declined in number since late September.

Realistic or not, here’s POPCAT’s market cap in BTC’s terms

The 10M+ cohort saw an increase in recent weeks, as did the 10k-100k holding cohort.

Meanwhile, the smaller shrimp, fish, and shark section of holders with under 10k POPCAT have been accumulating since July. Overall, the whale distribution over the past 4–6 weeks was a concern.