- Token breached a descending channel and at press time, was testing a major support level that could serve as a price catalyst

- More sellers in the derivative market will affect MKR’s rally

Compared to the rest of the market, MKR has struggled to gain significantly on the monthly charts with just 25% in gains. In fact, its market price has seen notable fluctuations lately, with a 24-hour decline of 0.25% too. However, at the time of writing, market sentiment suggested a potential rebound from its prevailing levels.

According to AMBCrypto’s analysis, large investors now appear to be driving MKR’s recent decline. A bounce remains likely if the critical support level holds, potentially paving the way for further upside.

Can MKR reach $3,970 in the coming sessions?

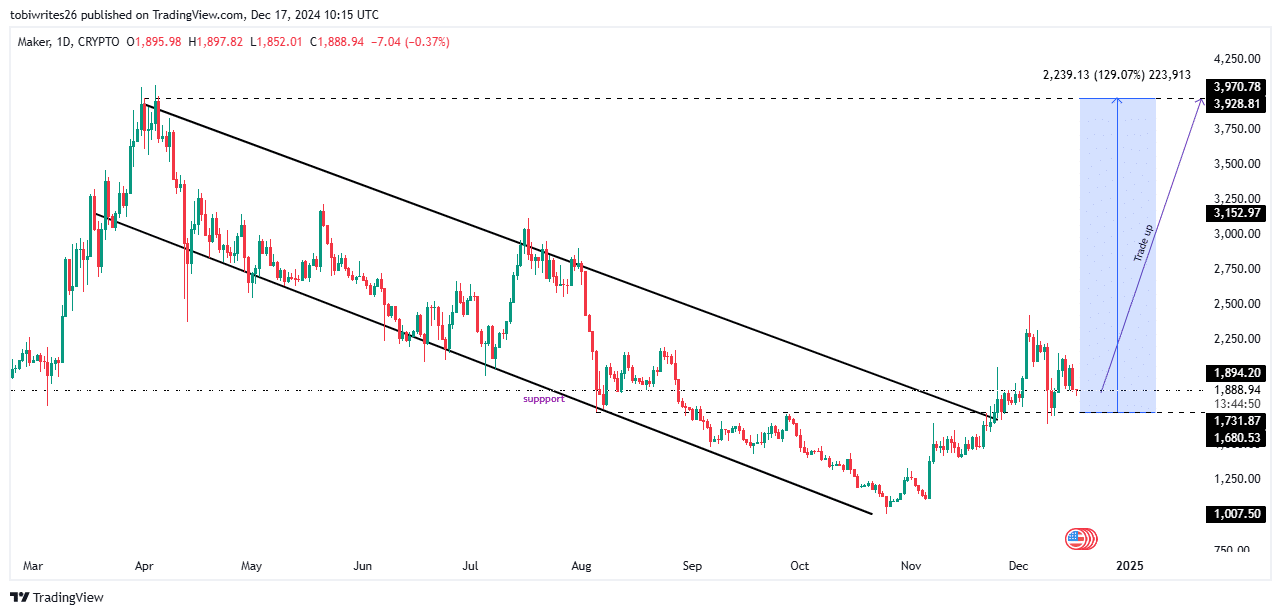

MKR recently broke out of an descending channel, a pattern it had been oscillating within since March. Despite this breakout, however, the token has struggled to gain upward momentum and remains below its anticipated levels.

At press time, MKR was trading at a key support zone around $1,854.09, with the range extending down to $1,656.55. This zone has historically acted as strong support, and if it holds, MKR could rally towards $3,970.

Source: Trading View

For this move to materialize, MKR must remain within the defined range and maintain buying interest at these levels.

Hence, AMBCrypto examined trader activity to assess whether the support zone is likely to hold, focusing on bid placement for MKR.

Large buy order placed for MKR at key support level

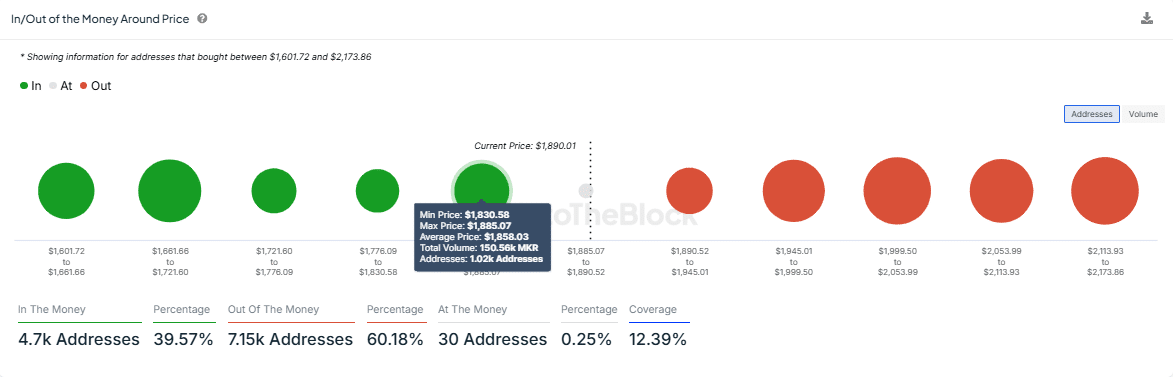

According to insights from IntoTheBlock, a significant buy order has emerged for MKR at a key support level identified using the In/Out of Money Around Price (IOMAP) metric. Here, the IOMAP is a tool that highlights critical support and resistance levels, helping traders anticipate potential price movements.

The data revealed a strong support zone at $1,858.03, closely aligning with the technical chart’s support line. At this level, 1,020 addresses have collectively placed buy orders amounting to 150,560 MKR – A sign of concentrated buying interest.

This buy activity suggested the $1,858 support zone as a potential catalyst for MKR’s upward movement. If this level holds, it could allow for a price rebound.

Source: IntoTheBlock

Simultaneously, signs of a bullish divergence seem to be emerging too. For instance, large transaction counts have dropped significantly, falling from 124 to just 27. This reduction caused the large transaction volume to decline to 9,270 MKR during the same period, coinciding with a recent price slip.

A steep drop in large transaction volume often signals weakening selling pressure. As MKR approaches this support zone, fading selling strength increases the likelihood of a rally towards higher levels, likely $3,970.

Derivative market issues warning

The derivative market indicated growing bearish sentiment, as more traders have been betting on MKR’s decline rather than a rally, based on the long-to-short ratio.

At the time of writing, the long-to-short ratio stood at approximately 0.75 – A significant drop below the neutral threshold of 1. A ratio this low points to a notable hike in short positions being opened on MKR.

If this trend persists, it could reduce the likelihood of a price rebound from its press time support range. A reversal would require a shift in sentiment, with more derivative traders placing long bets on MKR.