- Cumulative activity of whales and Smart DEX showed that the buying activity has increased.

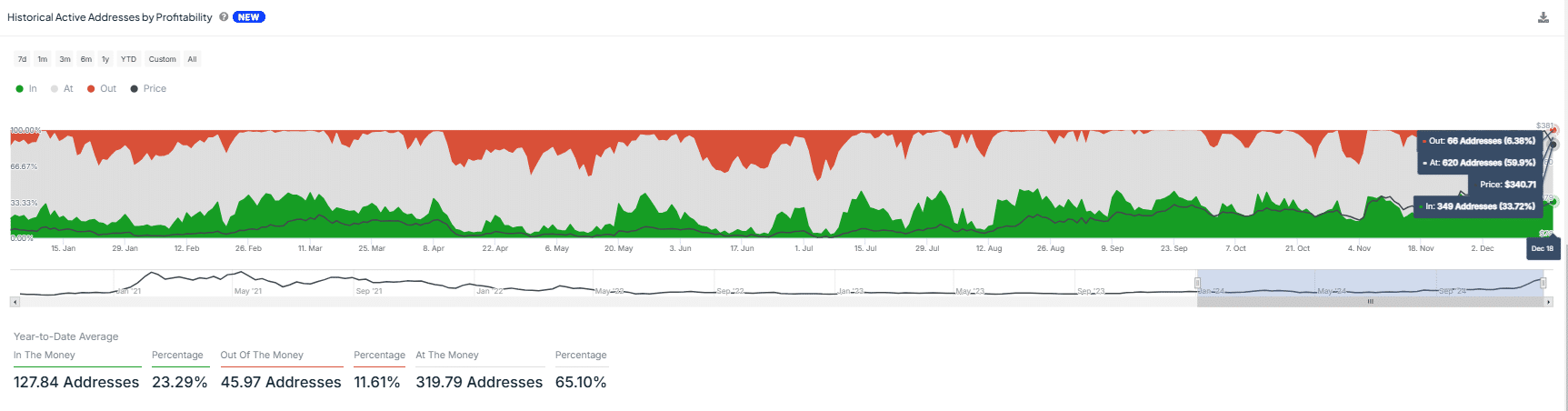

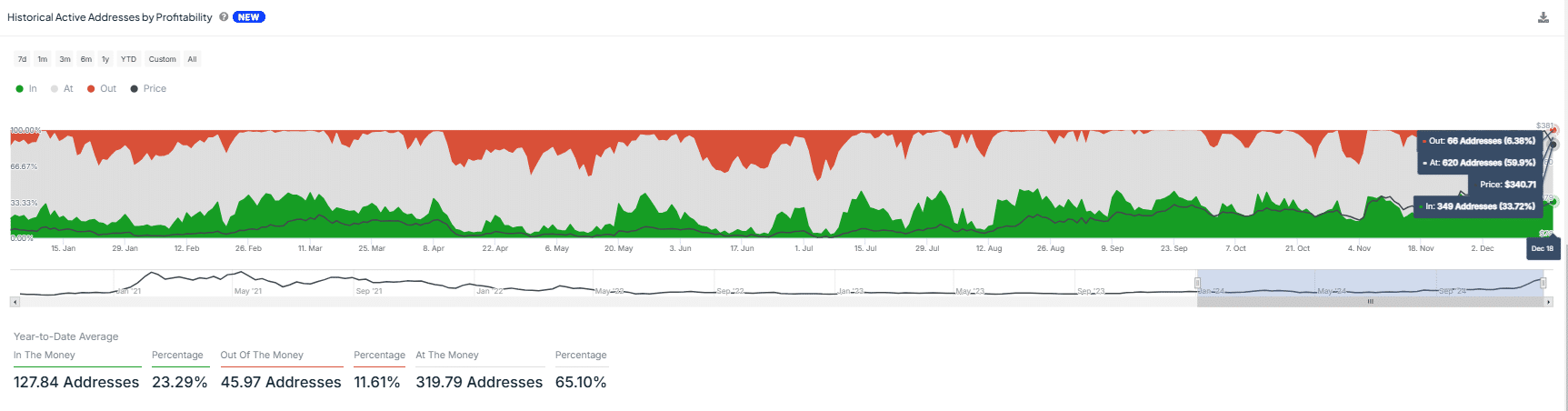

- Historical active addresses by profitability show most traders are profitable.

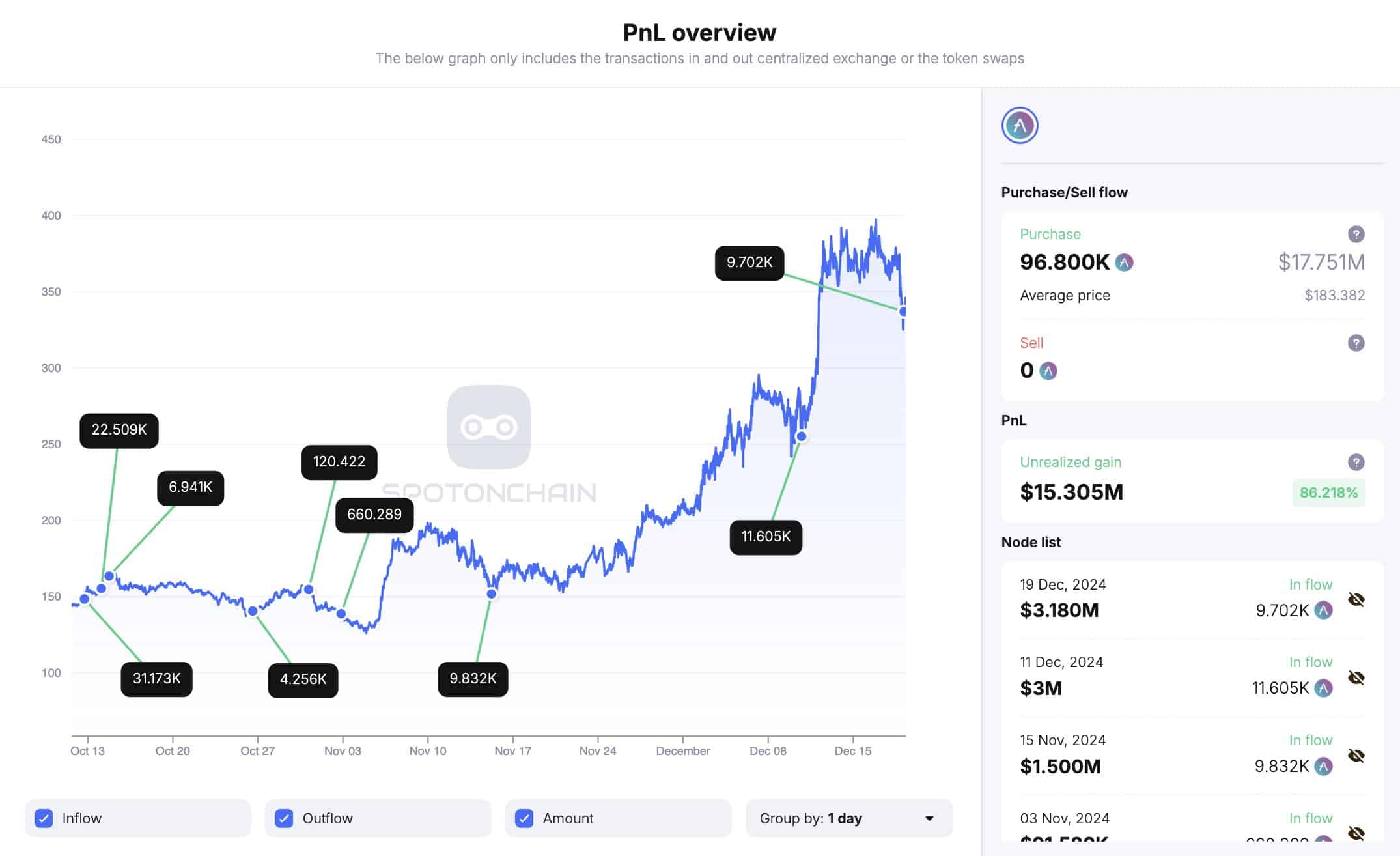

Aave [AAVE] continues to be a leading DeFi asset for whales. Notably, one whale has been aggressively dollar-cost averaging, accumulating 96,800 AAVE and spending $17.8 million at an average price of $183.4.

The recent inflow of 9,702 AAVE, purchased with $3.18 million in GHO and WBTC, highlighted the whale’s continued investment even as prices dipped.

Holding an unrealized gain of $15.31 million, reflecting an 86.2% increase in value, the whale’s position indicated significant market confidence.

Source: SpotOnChain

This strategic accumulation could suggest anticipation of a forthcoming price surge, or a stabilization at current levels, depending on market dynamics.

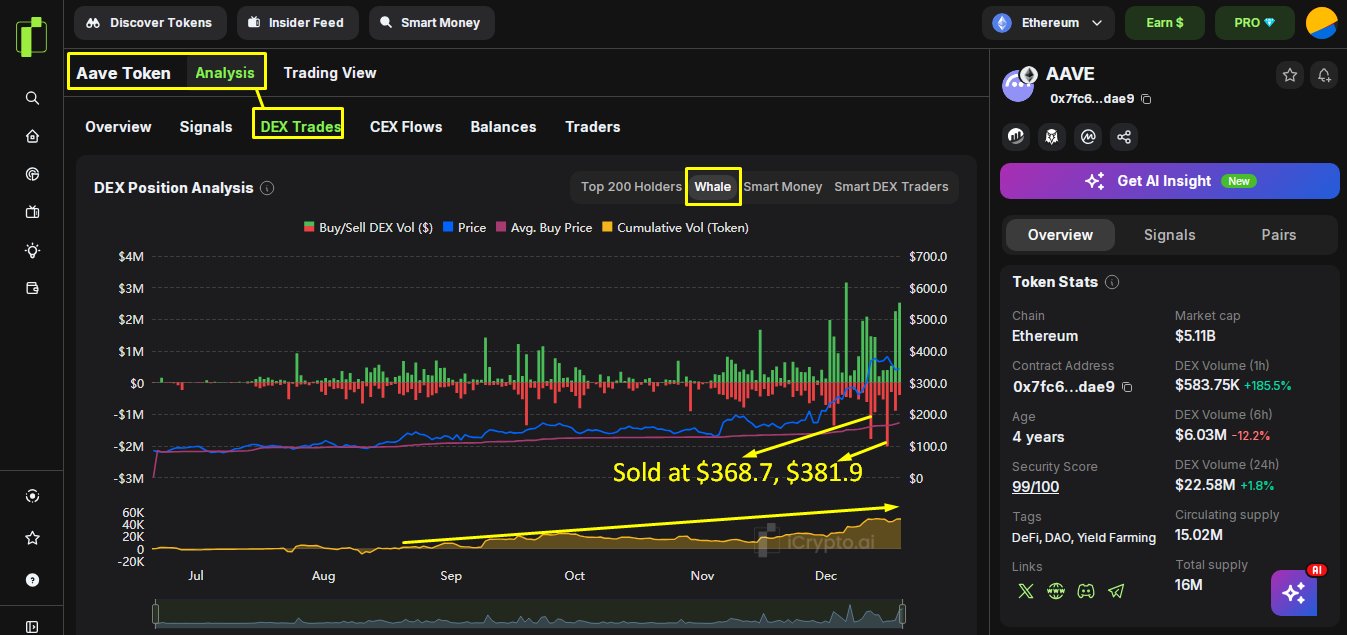

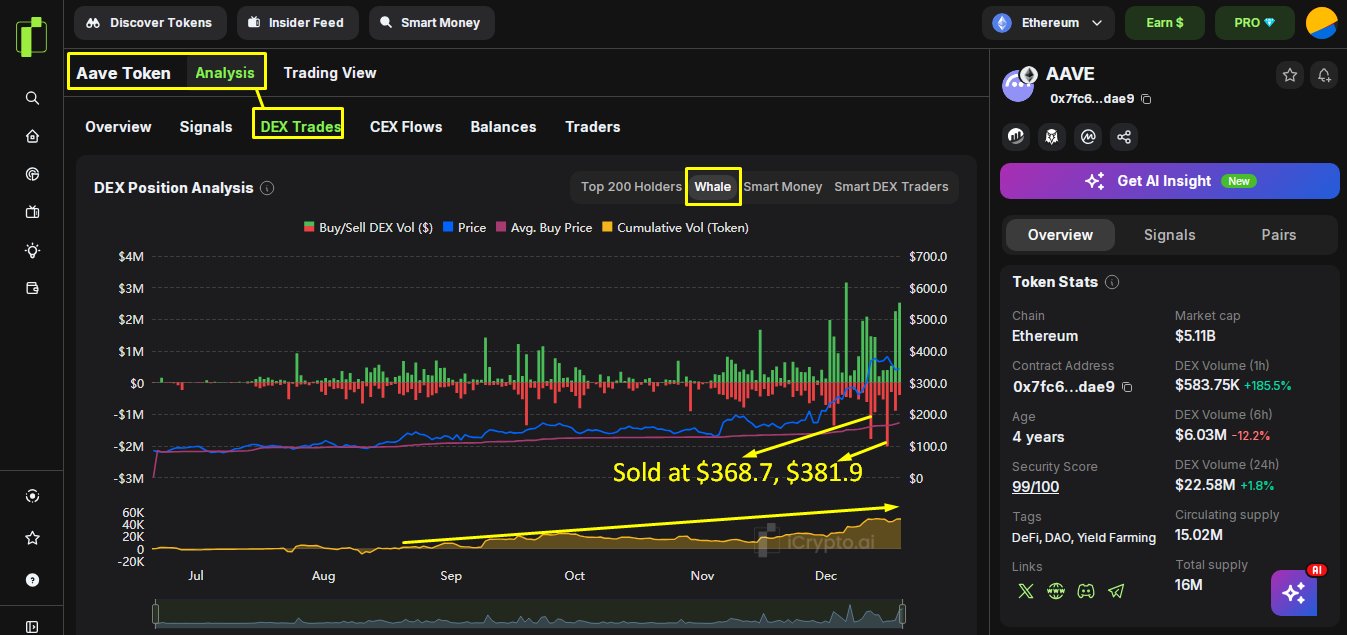

Smart DEX traders and whales are buying the dip

A cumulative analysis showed a significant re-entry of whales and Smart DEX traders. After selling at $368 and $381, whales re-entered the market, buying over $3.2 million in AAVE in a single day.

Notably, one whale, ‘0xe823’, secured $118,000 in profits, achieving returns between three to four times the investment.

Another trader, ‘0xfcc5’, re-invested $1.4 million, with returns between 3.2 to 3.3 times, now controlling a substantial 963,000 AAVE worth $331.60 million.

Source: iCryptoAI/X

Similarly, Smart DEX traders like ‘0xb040’ re-entered by purchasing $679,000 worth of AAVE after realizing profits at 3.8 times the initial investment.

This pattern suggested that both were strategically capitalizing on the recent price dip, indicating collective anticipation of a potential price recovery, suggesting confidence in AAVE’s future gains.

AAVE’s prediction and profitability of addresses

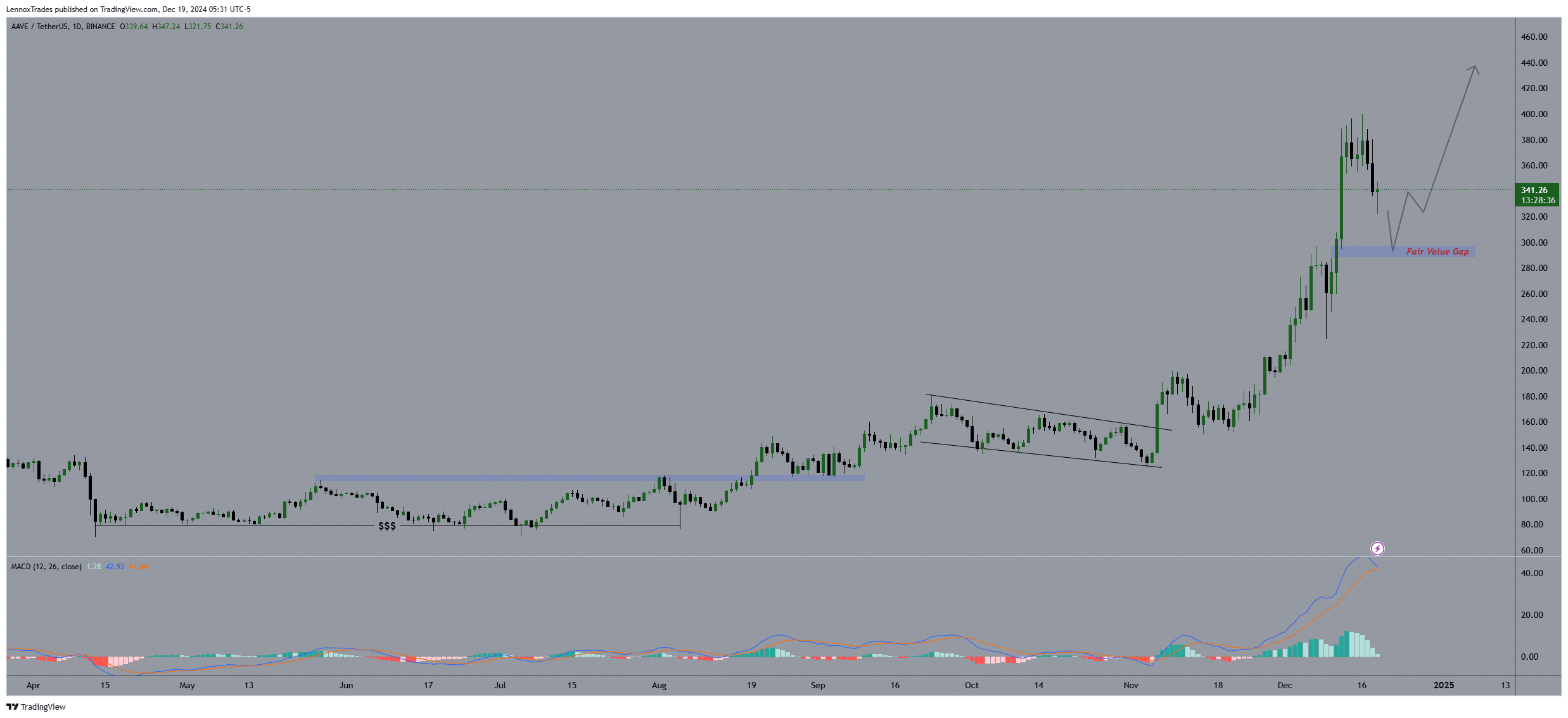

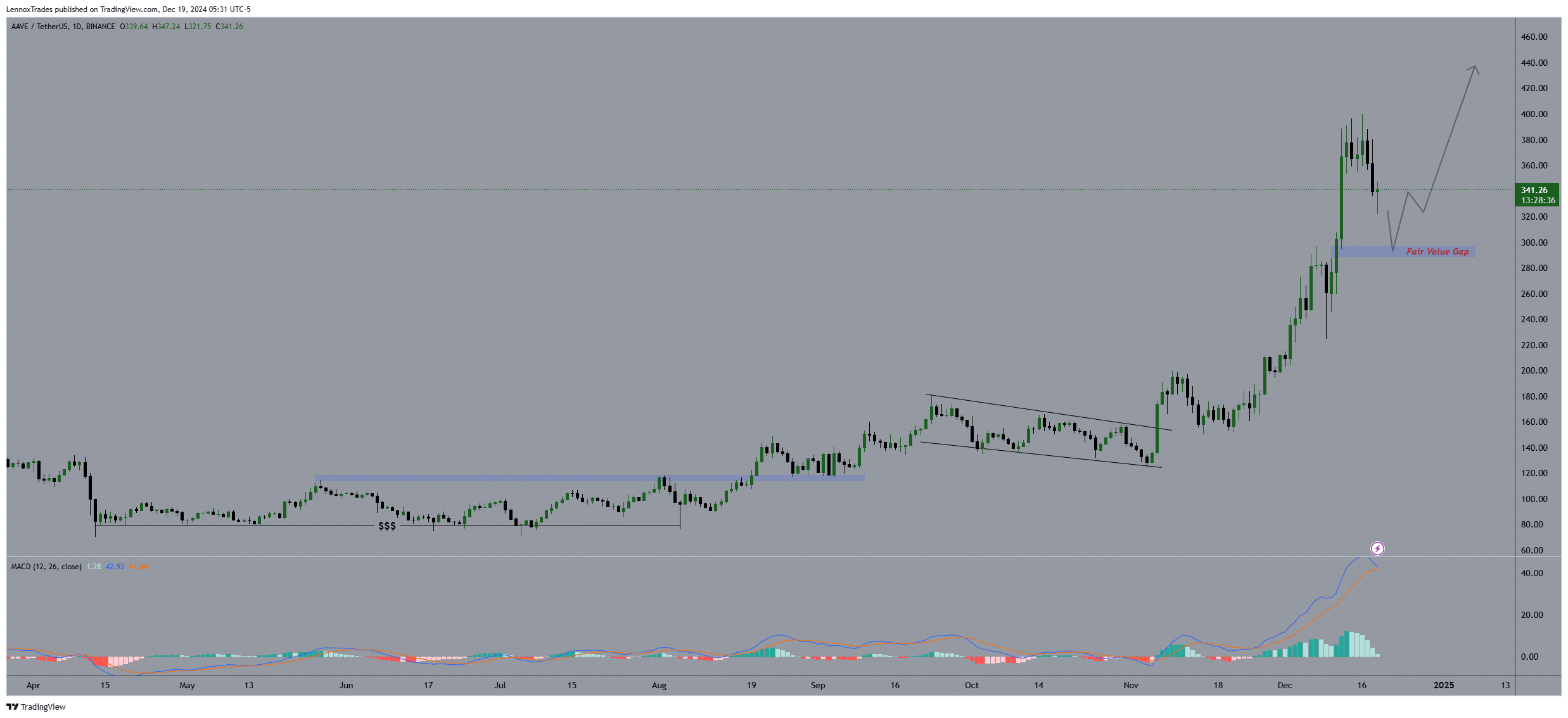

The current AAVE price indicates that Smart DEX traders and whales buying the recent dip could lead to a recovery. AAVE is trading just above the significant Fair Value Gap (FVG) at $300. This gap acted as a structure break point before the price surged, creating a strong support zone.

If AAVE successfully maintains its momentum and stays above this level, it could experience a massive uptrend. Such a move could confirm a bullish sentiment, potentially leading to higher highs.

Source: TradingView

The increasing buying volumes confirm confidence in the coin’s prospects, hinting it could achieve new peaks soon.

Moreover, the MACD showed a bullish crossover, supporting the potential for a continued uptrend. If AAVE can sustain above the FVG, the path toward $500 in 2025 appears increasingly plausible.

WLD’s Year-to-Date Average profitability shows 23.29% of addresses are ‘in the money,’ compared to 11.61% ‘out of the money.’ This indicates a higher probability of sustained investor confidence.

Source: IntoTheBlock

Recently, there was an increase of 10% in profitable addresses to 33.72%. This suggested a strong support zone around the current price level of $340.71.

Read Aave’s [AAVE] Price Prediction 2024-25

If this trend persists, WLD’s price could potentially stabilize or increase past $500 in 2025, driven by positive holder sentiment and reduced selling pressure.