- A whale recently transferred over $1 billion worth of BTC to Coinbase, a move that highlights heightened institutional demand for the asset

- Bitcoin could see a slight retracement before resuming its upward trajectory in the coming days

Bitcoin has surpassed the $100,000 psychological threshold for the fifth time, recording gains of 3.39% in the last 24 hours. This follows a week of accumulation by buyers, totaling a 7.93% hike on the weekly charts.

The cryptocurrency’s price may soon climb further as rising institutional demand and whale activity appear to align with each other.

Massive whale movement matches U.S institutional demand

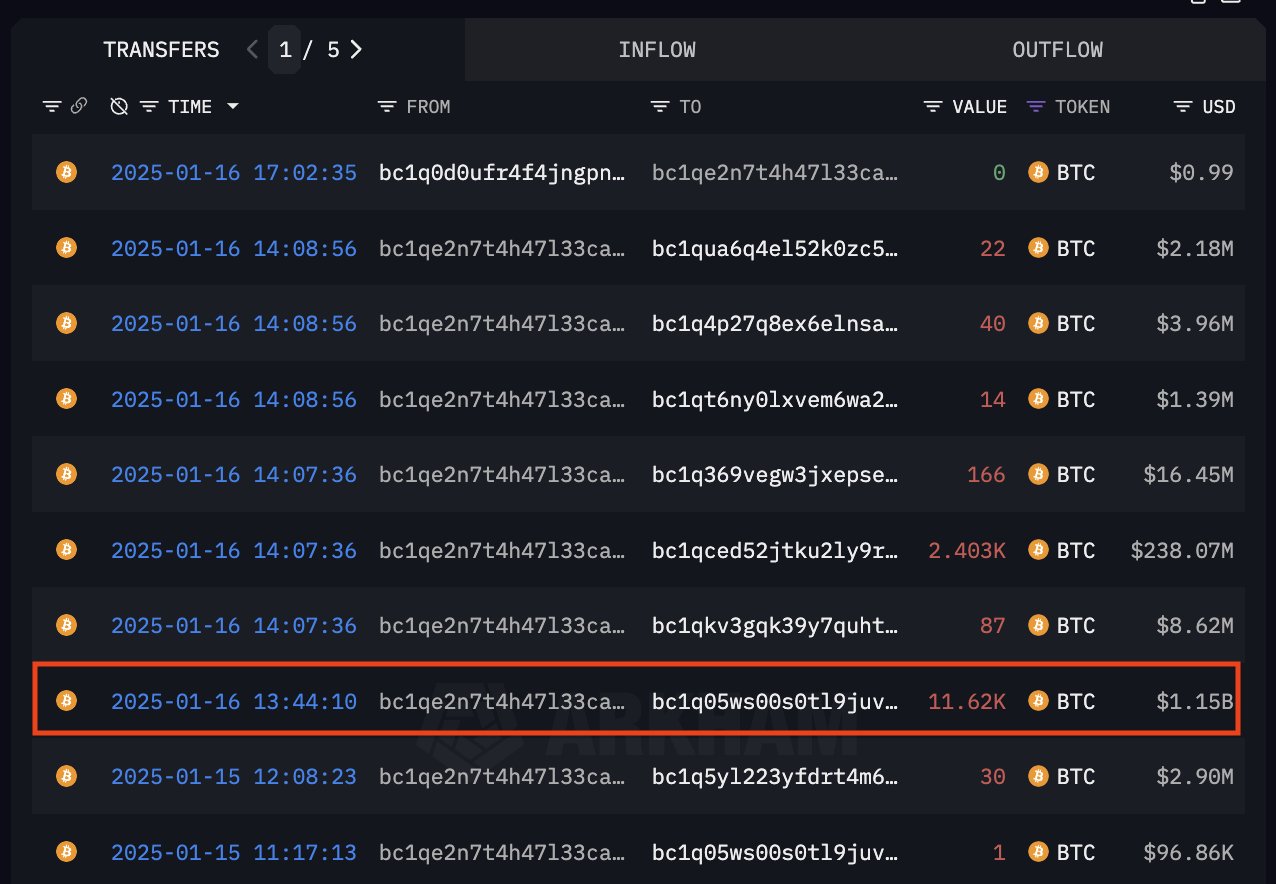

A significant surge in whale activity—addresses holding major amounts of an asset—has been seen in the last 24 hours. Notably, a whale holding approximately $2.7 billion worth of BTC moved around $1.05 billion into Coinbase Prime.

Source: X

This whale accumulated most of its BTC between 9-11 September, 2024, when the price ranged between $54,000 and $56,000. This was just months before the cryptocurrency surpassed the $100,000-threshold.

In most scenarios, large asset transfers from private wallets to exchanges are considered bearish, as they often indicate plans to sell. However, in this instance, the movement likely underlines strong demand for BTC, as evidenced by its recent price trajectory.

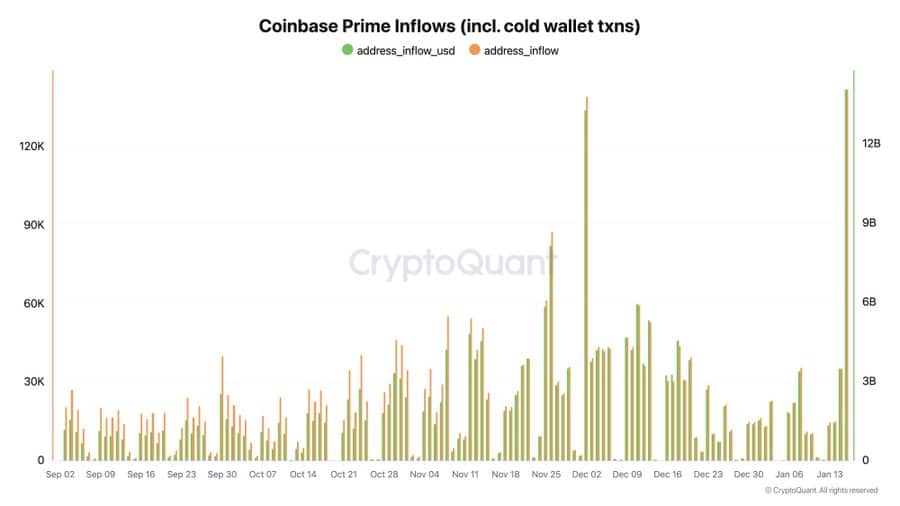

In fact, according to CryptoQuant, when significant inflows occur into Coinbase Prime Brokerage, it often signals heightened demand for the asset among institutional investors.

Crypto-analyst Ki Young Ju commented,

“The preferred Bitcoin purchase channel for U.S. institutions suggests multiple over-the-counter (OTC) trades are currently in progress.”

OTC trades involve private transactions between buyers and sellers, bypassing public exchanges to avoid slippage or significant market impact.

Source: CryptoQuant

As seen in the chart above, inflows into Coinbase Prime have increased notably over the past week, hitting levels last seen in December 2024—Just before BTC rallied to its all-time high of $108,135 on 17 December. If this trend continues, Bitcoin could touch a new all-time high in the coming weeks.

While market sentiment remains bullish, a short-term pullback is possible before BTC resumes its upward trajectory.

Local top, slight drop

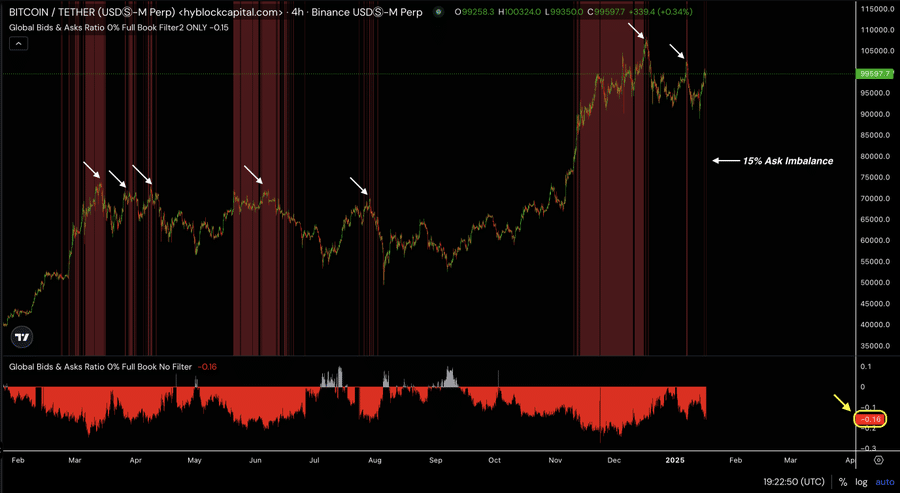

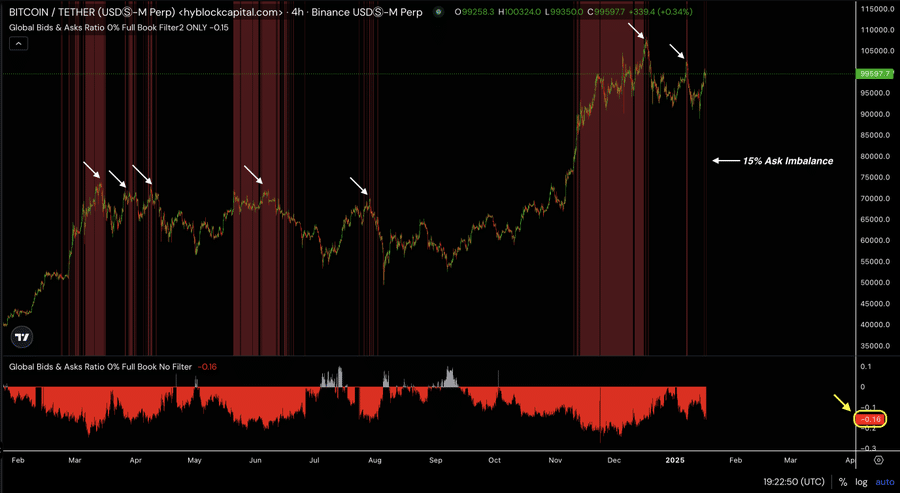

According to Hyblock Capital, there is a 15% ask imbalance on BTC. This implies the asset has likely reached a local top, with an increase in sell orders too.

Source: HyblockCapital

Historically, this pattern has occurred seven times, as reflected in the chart. In each instance, Bitcoin saw a slight retracement to the lower end before resuming an upward move.

If history repeats itself, BTC may see a minor pullback before continuing its upward trajectory and potentially hitting a new all-time high.