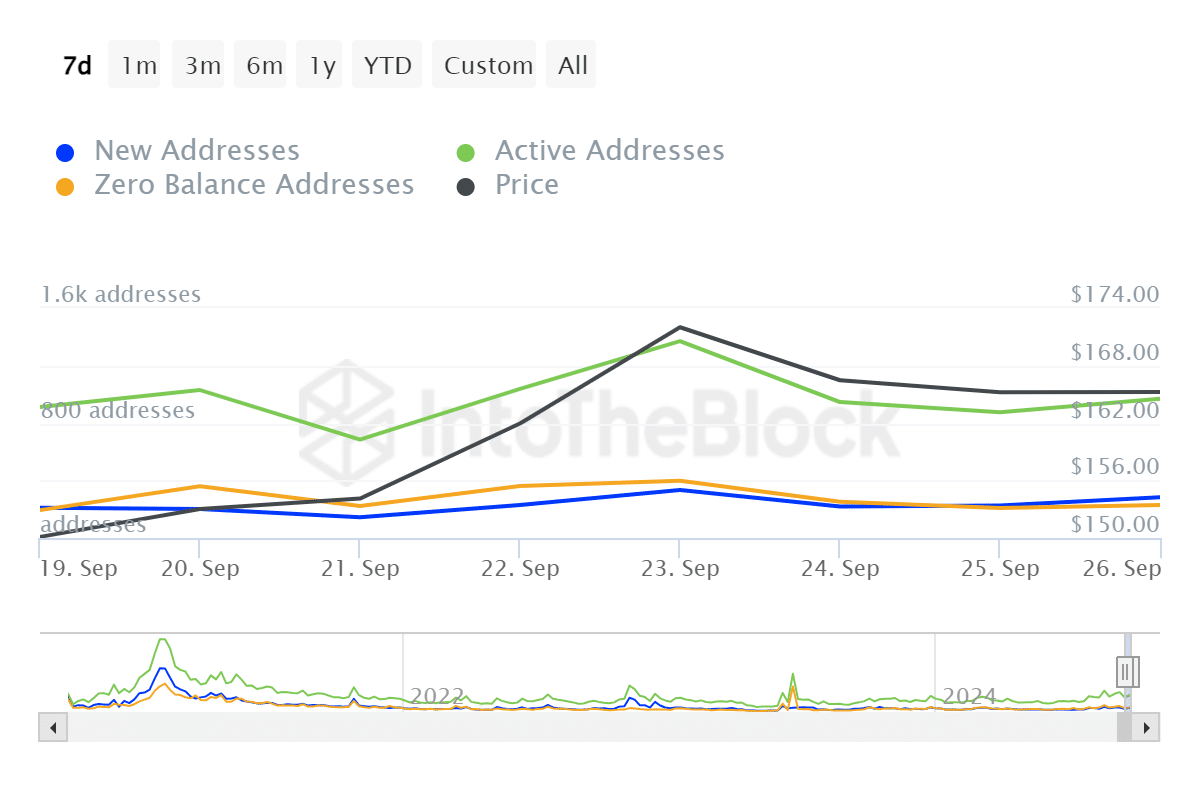

- AAVE’s active addresses surged by 34% in the last 24 hours, signaling greater user engagement

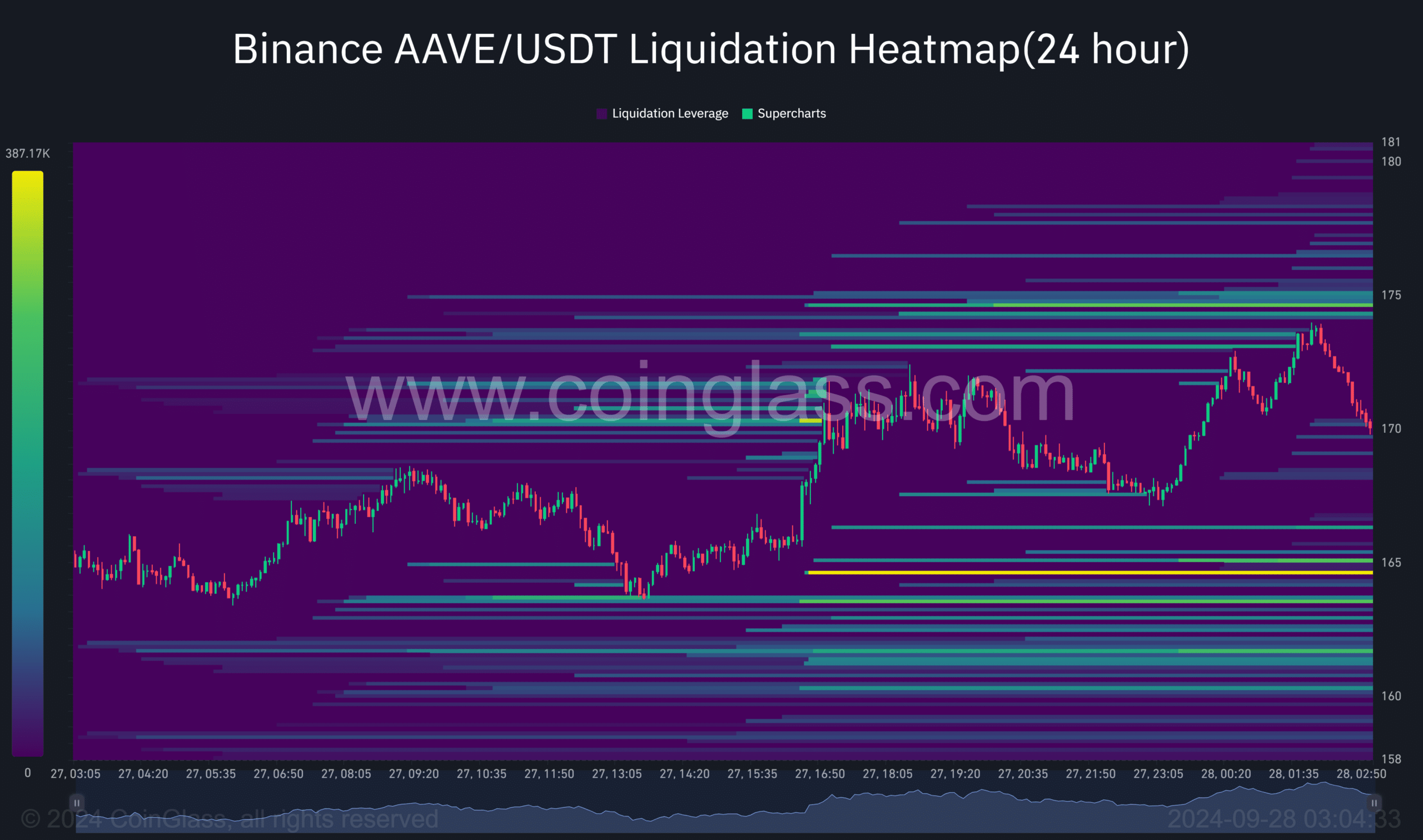

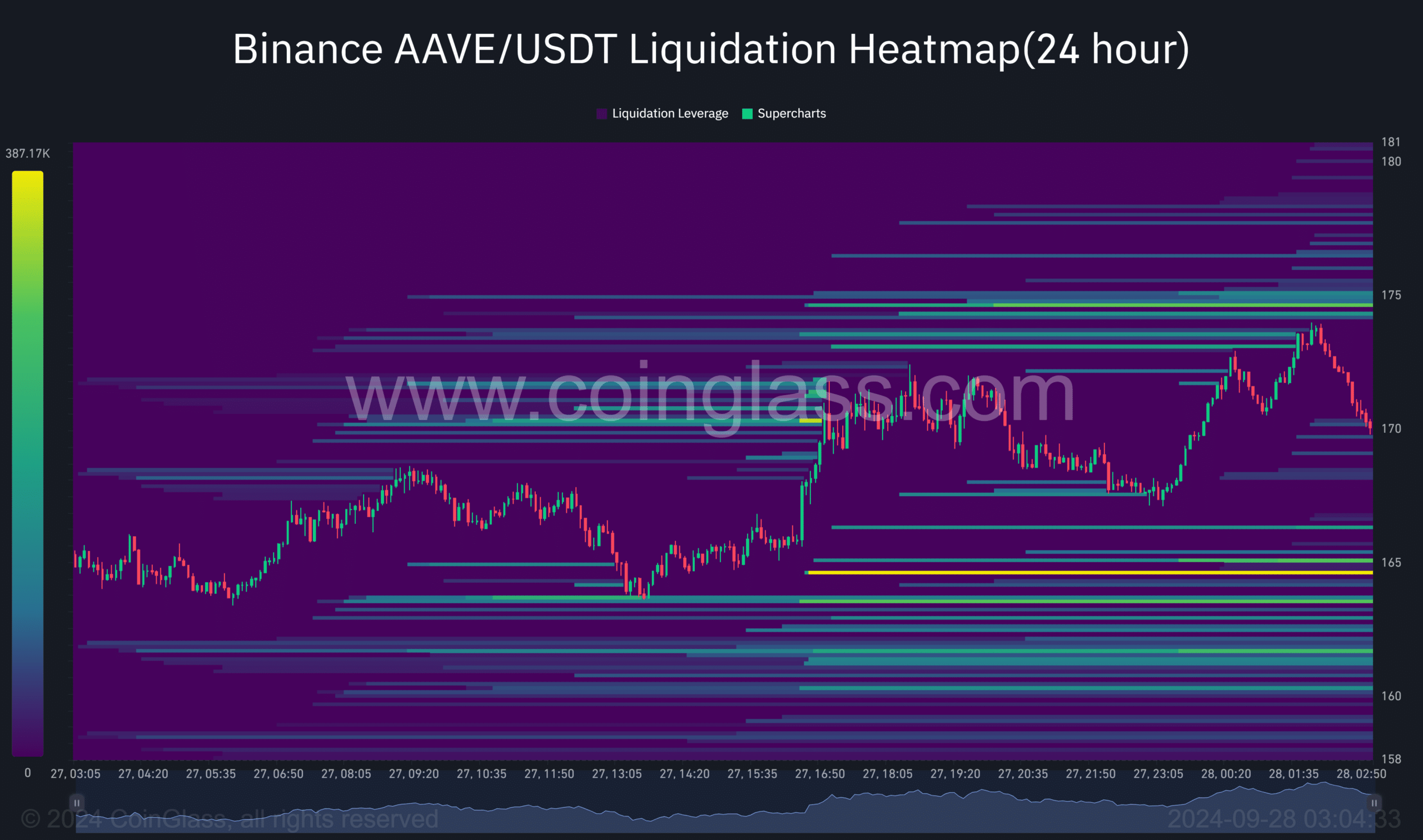

- Market sentiment surged with liquidity – A sign of bullish bias as most liquidations were on the short side

AAVE has been gaining strong momentum lately, with bullish trends taking centre stage in the market. Now expected to be among Grayscale’s top-performing assets for Q4 of 2024, this token’s performance can be affirmed by a hike in on-chain activities and positive market sentiments.

With its retracement slowing down, AAVE has very strong potential for a further rally on the charts.

Active addresses see 34% surge

In the last 24 hours alone, AAVE’s trading activity has risen significantly.The number of active addresses has hiked by 34%, according to AMBCrypto’s analysis of IntoTheBlock’s data.

This increase is an indication of growing market activity, which could propel the coin price higher on the charts.

A higher network activity usually points to greater adoption and rising market confidence. This is a positive sentiment for the market’s long-term outlook.

Source: IntoTheBlock

Liquidation data reveals strong bullish sentiment

According to Coinglass, the liquidation heatmap has been biased to the upside for the last 24 hours. Most of the liquidations seemed to be happening on the short side. This can be interpreted as a sign that buying pressure is simply overpowering any sell-off that might happen with the token.

With the market bias playing in favor of the bulls, the ongoing AAVE rally may still last in the short term.

Source: Coinglass

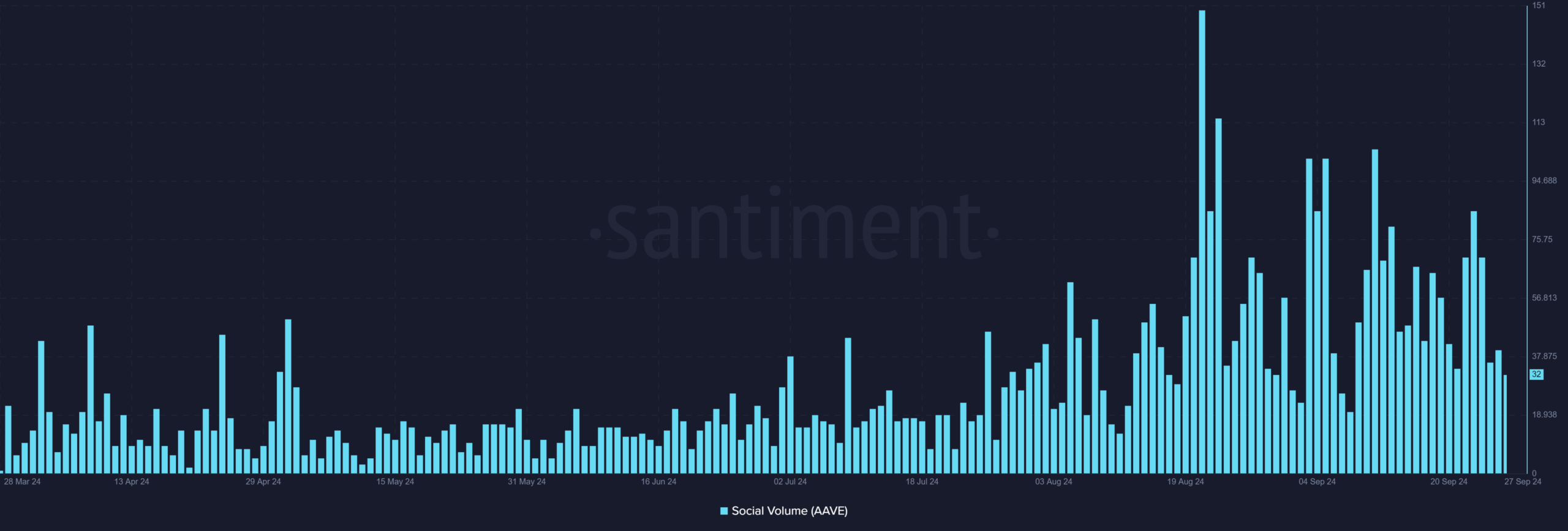

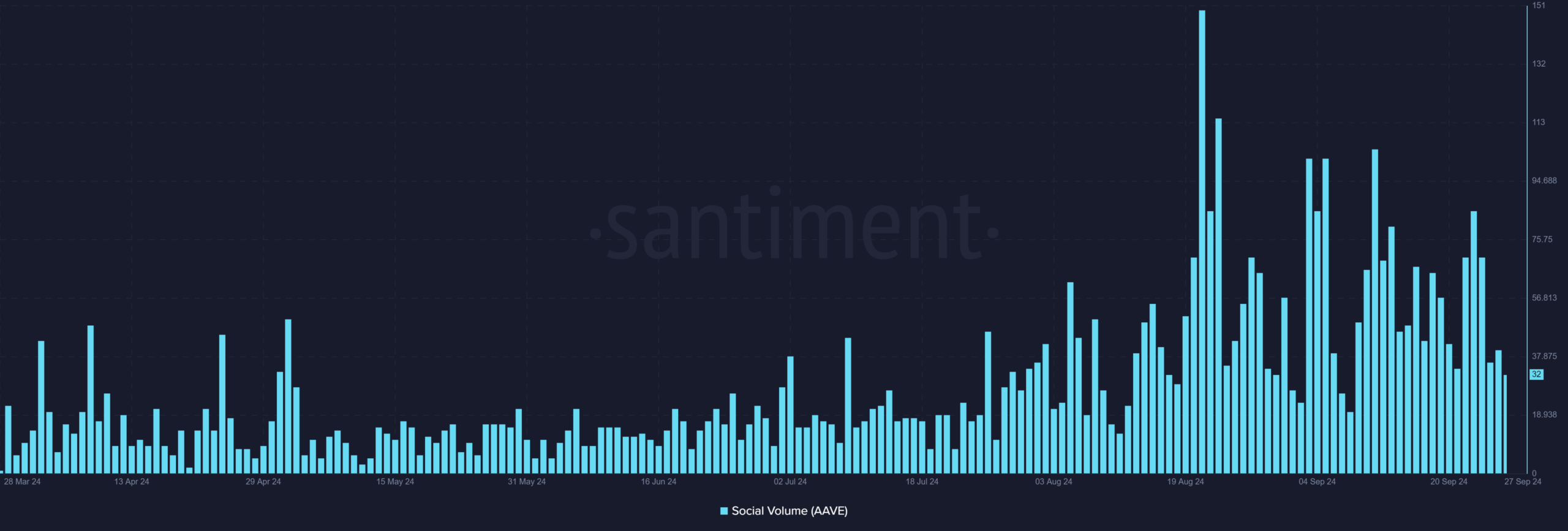

Social media buzz propels AAVE further

Adding to the aforementioned positive sentiments, AAVE’s social media mentions have also surged.

In facts, social mentions of AAVE surged from March to September 2024, indicating greater investors interest.

Given that social media sentiment often flows with price action, this might well lead to significant appreciation in the asset’s value.

Source: Santiment

AAVE’s bullish future looks bright

Sustained active address surges, bullish liquidation data, and rising social mentions, all pointed to a long-term rally that may be just beginning.

With market sentiment remaining positive, and Grayscale ranking AAVE among its top performers, investors have plenty of reasons to stay optimistic.