- AIOZ breaks key resistance at $1.08, consolidating near $1.20 with bullish momentum.

- Rising active addresses and derivatives data signal strong investor confidence in AIOZ.

The AIOZ Network [AIOZ] token has shown impressive resilience and strength, maintaining an upward trend despite fluctuating market conditions and increasing competition. At press time, AIOZ was trading at $1.09, reflecting a 1.38% increase over the past 24 hours.

This bullish price action aligns with growing investor interest, as seen in increased trading volume and derivatives activity. With a rise in both network engagement and investor confidence, all eyes are on AIOZ’s next move as it consolidates near key resistance levels.

Price analysis: Key levels to watch and future price outlook

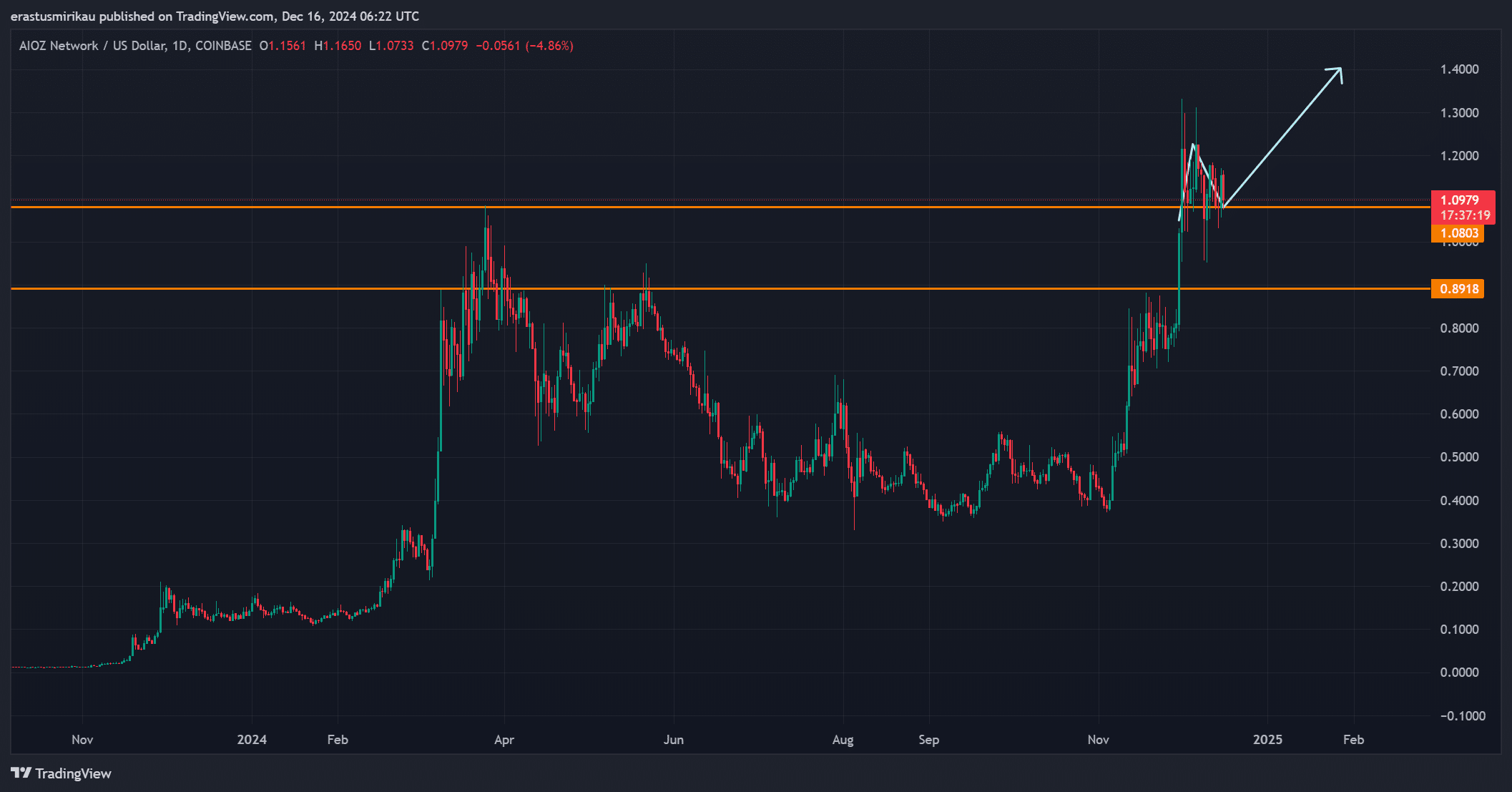

AIOZ has demonstrated impressive price movement, breaking above the critical resistance level at $1.08. This breakout allowed the price to surge toward $1.20, where it now consolidates.

However, maintaining above $1.20 will be crucial for AIOZ to target its next major resistance at $1.40. A failure to hold this level could result in a pullback, with $1.08 and $0.89 acting as strong support zones.

Additionally, the steady rise in trading volume highlights growing market participation, suggesting that buyers are still in control. If AIOZ manages to close above $1.20 with significant volume, it will likely confirm the continuation of its bullish trend, driving prices even higher.

Source: TradingView

AIOZ technical indicators: MACD and STOCH RSI

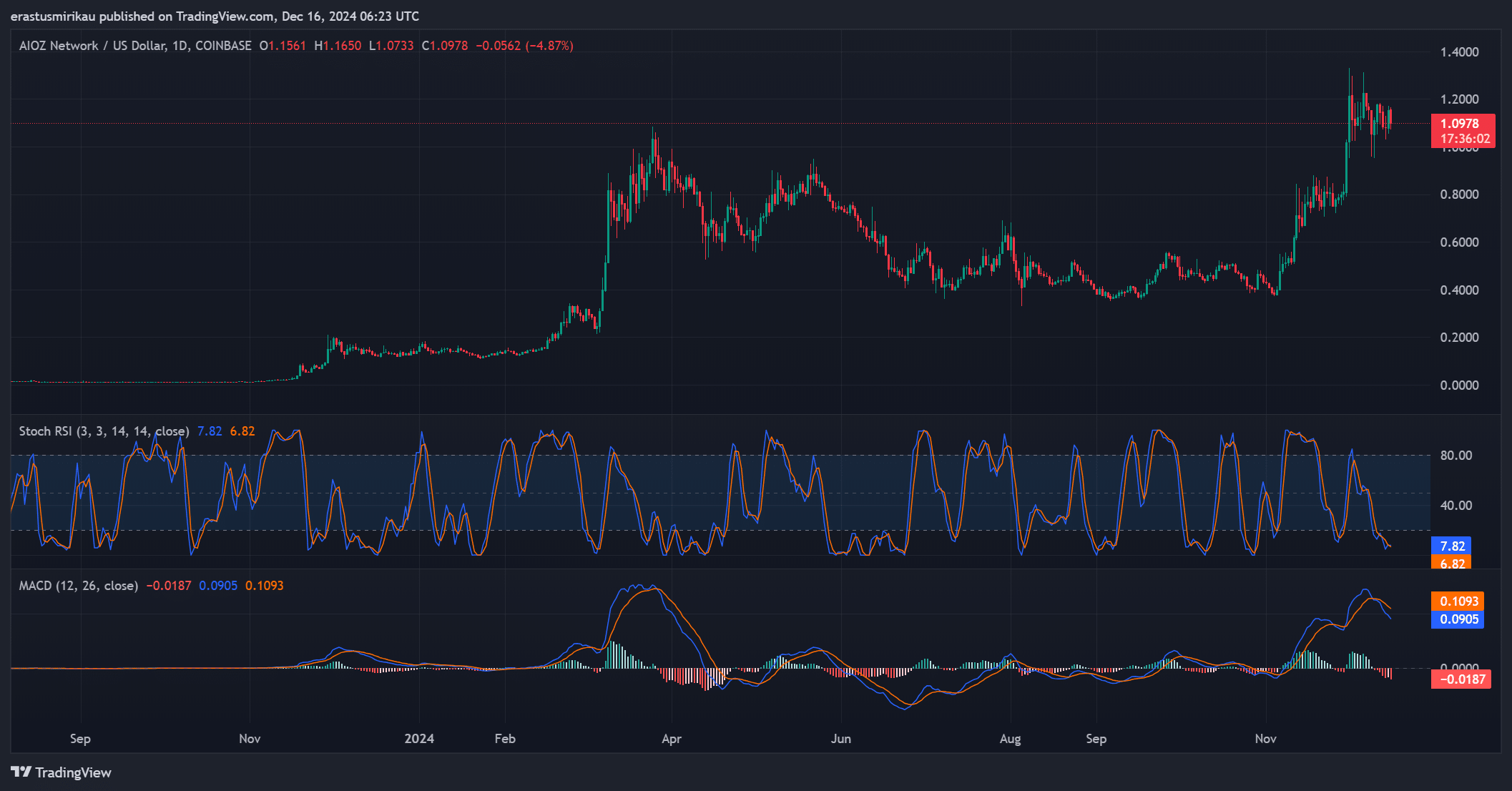

The technical indicators are also providing a positive outlook for AIOZ. The MACD remains above the signal line, signaling sustained upward momentum.

However, the histogram bars show slight weakening, suggesting that the token may enter a brief consolidation phase before its next move.

Meanwhile, the stochastic RSI sits at 7.82 and 6.82, placing AIOZ firmly in the oversold zone. This signals a potential rebound, as buyers are likely to step in soon. Therefore, the combination of these indicators points to a strong possibility of continued upward movement in the short term.

Source: TradingView

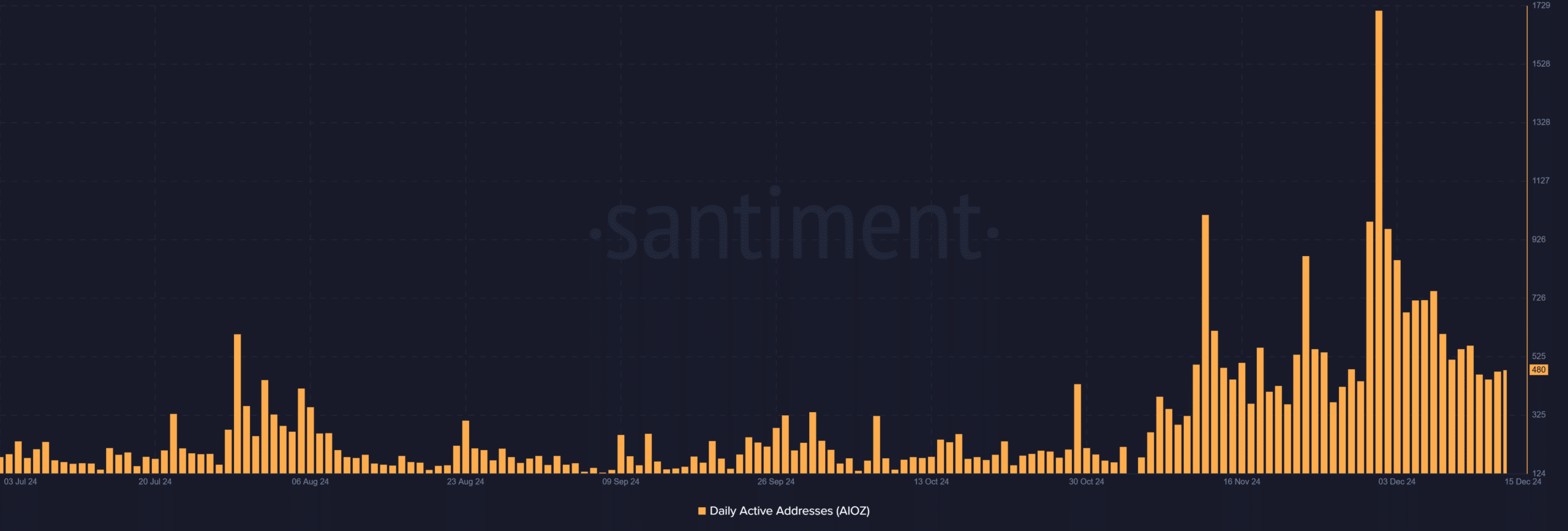

Daily active addresses: Increasing network activity

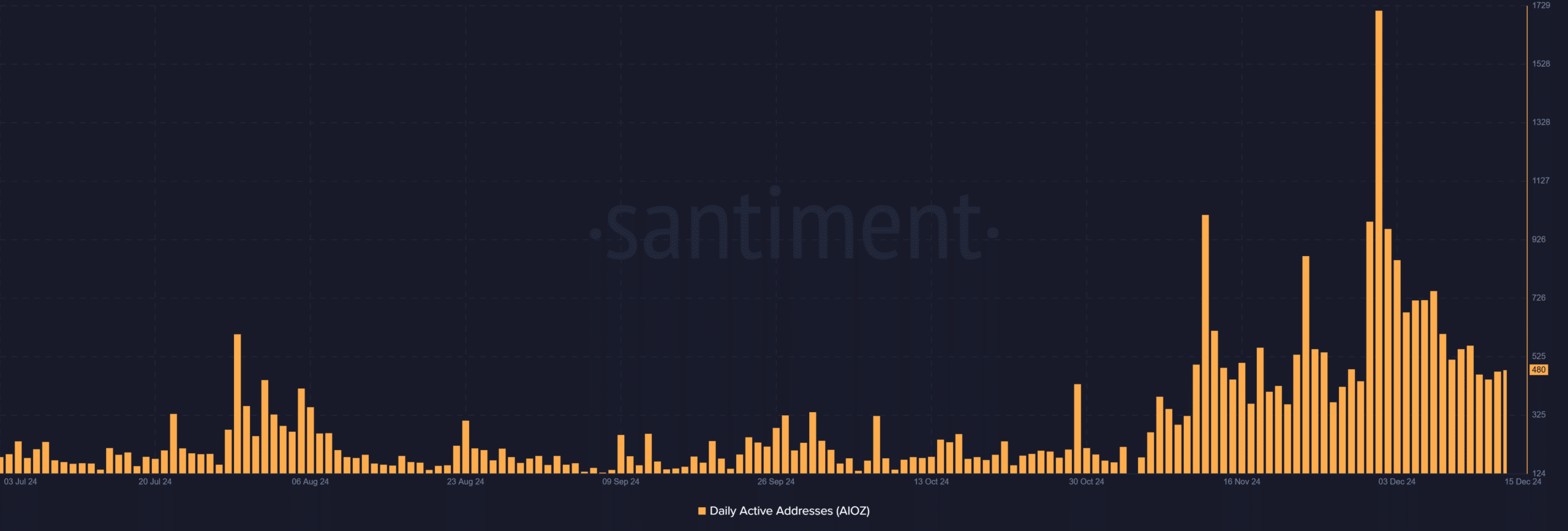

On-chain activity continues to show strength, further supporting the price rally. Daily active addresses increased to 480, up slightly from 475 the previous day.

This consistent rise in network usage reflects growing engagement within the AIOZ ecosystem, an important factor for long-term adoption.

Source: Santiment

AIOZ MVRVratio: Are profits sustainable?

The MVRV ratio climbed to 139.10%, rising from 122.57% the previous day. This increase highlights that investors are holding substantial unrealized profits.

However, such levels also raise the possibility of short-term profit-taking, which could lead to minor corrections.

Source: Santiment

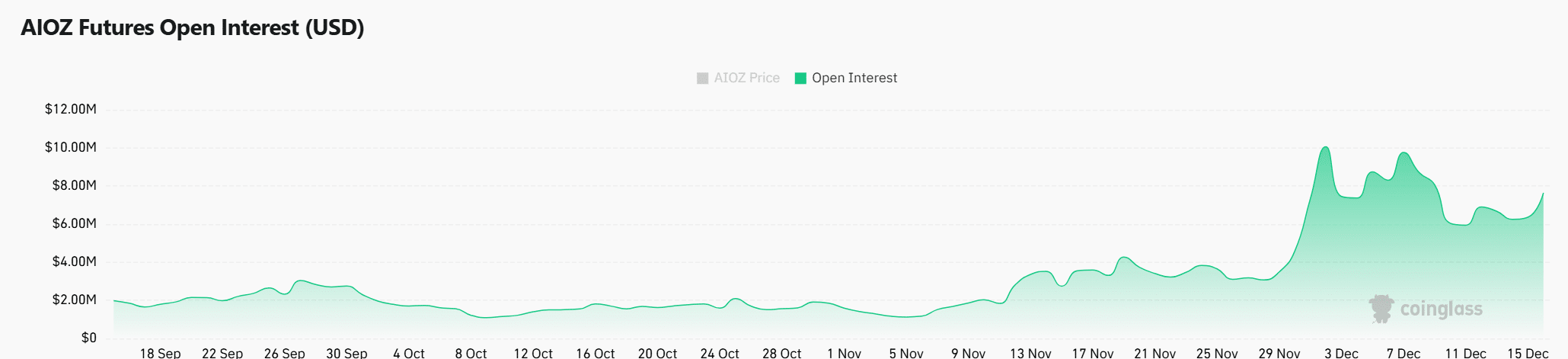

Derivatives data analysis: Rising trader confidence

The derivatives market also reflects growing optimism around the token. Open interest surged by 13.30% to $7.41M, while trading volume saw an impressive increase of 46.62%. These metrics highlight a notable uptick in market participation from both retail and institutional traders.

Therefore, the increasing derivatives activity suggests traders anticipate further upside for AIOZ.

Source: Coinglass

AIOZ price prediction 2025

AIOZ has strong momentum supported by bullish technical indicators, increasing network activity, and rising derivatives confidence. If the token successfully breaks and holds above $1.20, it is likely to rally toward $1.40 in the near term.

Looking ahead to 2025, sustained demand, steady on-chain growth, and investor optimism position AIOZ for further upward gains, potentially reaching new highs.