- INJ is testing key resistance at $21.26, with a sharp 340% surge in volume signaling strong buying interest.

- Open interest is up 9.43%, indicating bullish sentiment, but failure to break resistance could trigger a pullback.

Injective [INJ] is at a critical resistance point near $21.26, with eyes on a potential breakout that could propel it above $24. At press time, the token was trading at $21.83, having risen 6.54% in the past 24 hours.

This increase, accompanied by a dramatic surge in volume, suggests that bullish momentum could be building. Can injective maintain this momentum and push through resistance?

INJ chart analysis: Can bulls push through resistance?

The chart clearly shows Injective approaching key downtrend resistance. Price has hovered around the $21.26 level but has struggled to break higher.

However, with the Relative Strength Index (RSI) at 58.16, there’s still room for a further move upward before hitting overbought conditions.

Additionally, resistance levels sit at $22.94 and $24.01, which are crucial zones for bulls to clear.

Consequently, a failure to break this trend could result in a retracement. Support lies near $20.42, with further downside possible toward $19.32 if sellers gain control.

Source: TradingView

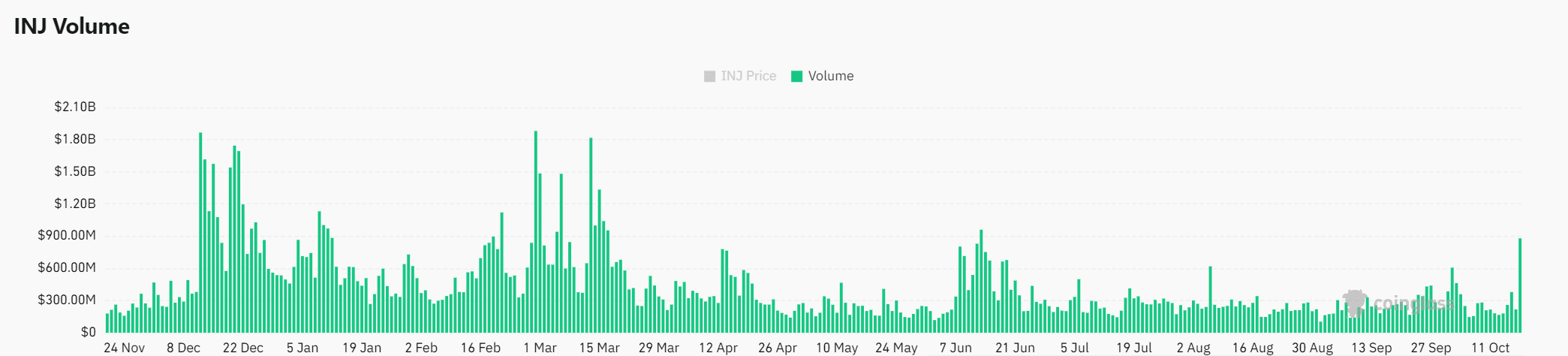

Volume surge: A precursor to a breakout?

One of the most promising signs for Injective is its 340.88% volume surge, totaling $917.65 million in trading over the last 24 hours.

Typically, when volume spikes occur at resistance levels, they signal increased buying interest. This surge indicates that bulls are stepping in, possibly in anticipation of a breakout.

However, if volume begins to taper off without the price moving past resistance, it could suggest exhaustion. Consequently, traders should keep an eye on volume trends over the next few hours to confirm whether this surge will lead to further gains or a potential pullback.

Source: Coinglass

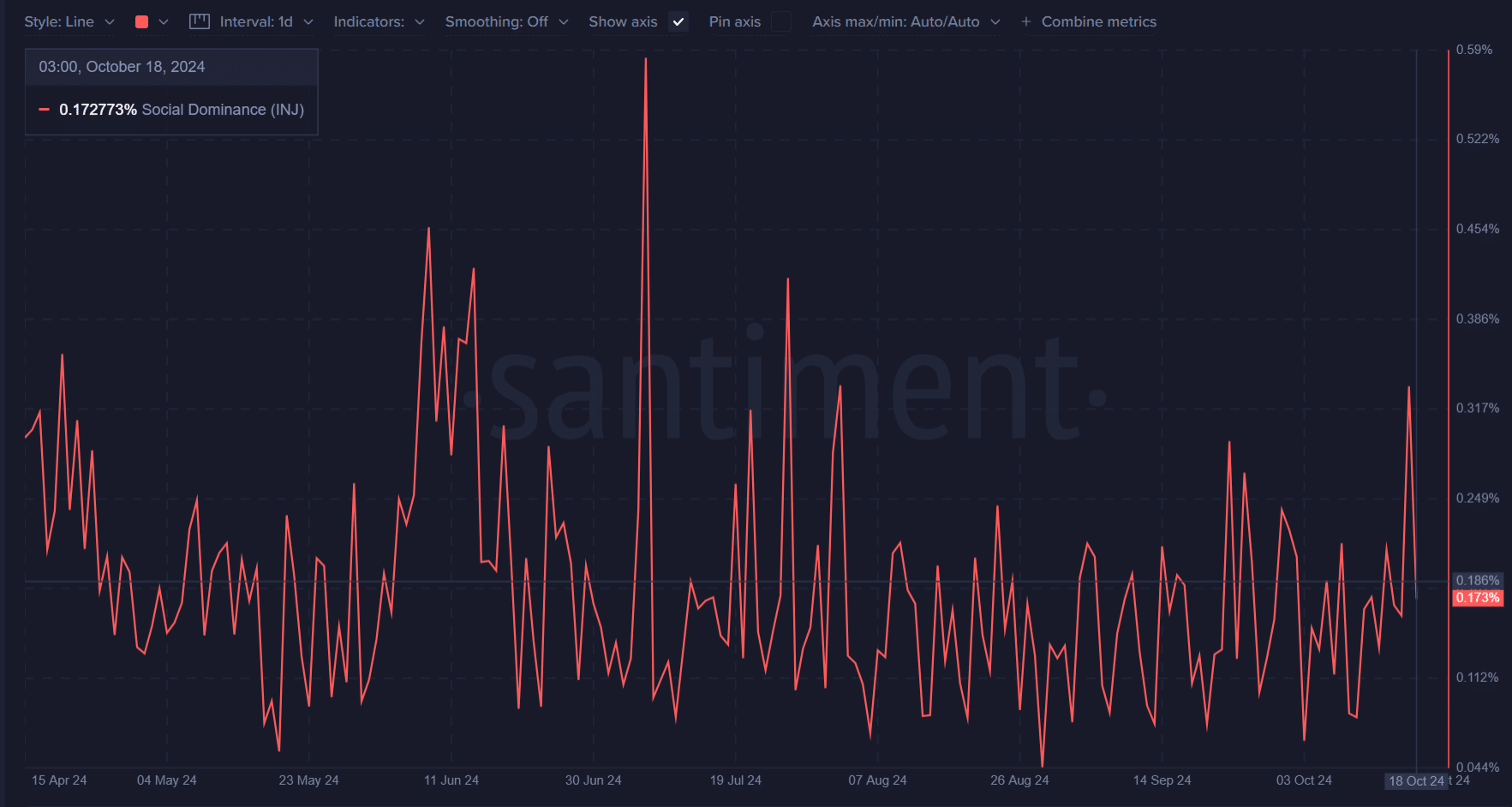

INJ social dominance: Will community interest sustain momentum?

Social dominance is another factor to consider. At 0.1727%, INJ’s social engagement remains active, though not at peak levels. This metric, which tracks community attention, often correlates with price movements.

However, to sustain upward momentum, community interest needs to stay elevated.

Source: Santiment

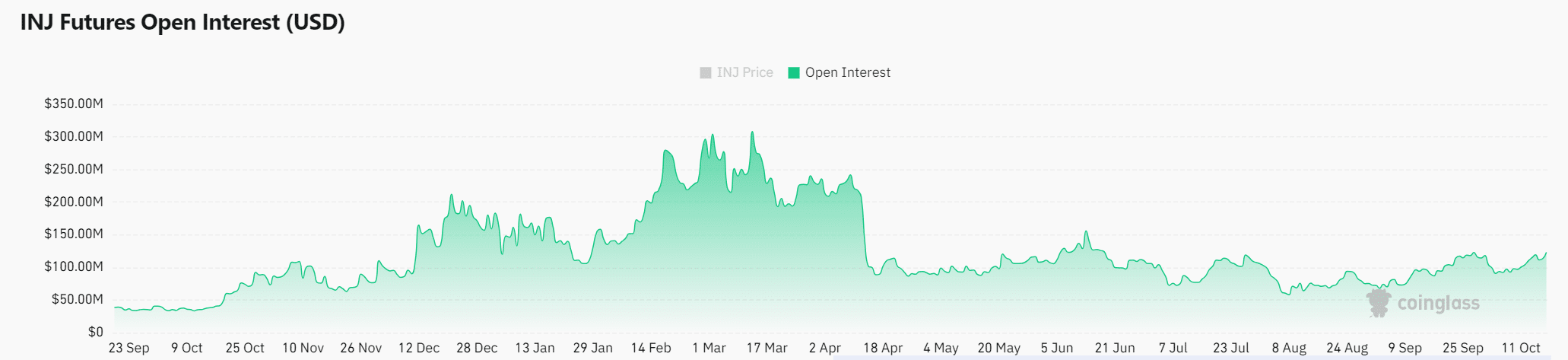

Open interest analysis: What are traders betting on?

Open interest, which reflects the total number of contracts in the market, is up by 9.43%, indicating that traders are increasing their positions. With open interest rising alongside price, it suggests that the market remains bullish.

However, if open interest grows while the price stagnates, it could indicate overleveraging, which might lead to a sharp price drop if traders begin to exit positions.

Source: Coinglass

Read Injective’s [INJ] Price Prediction 2024–2025

Conclusively, the combination of surging volume, bullish open interest, and active community engagement points to a potential breakout above $24.

However, failure to clear this resistance could result in a pullback toward lower support levels.