- AVAX has seen its active addresses rise by 34.46% recently.

- The key support at $19.48 could initiate a reversal.

Avalanche [AVAX] has recently had an upturn in on-chain activity, which might indicate renewed investment interest in the altcoin.

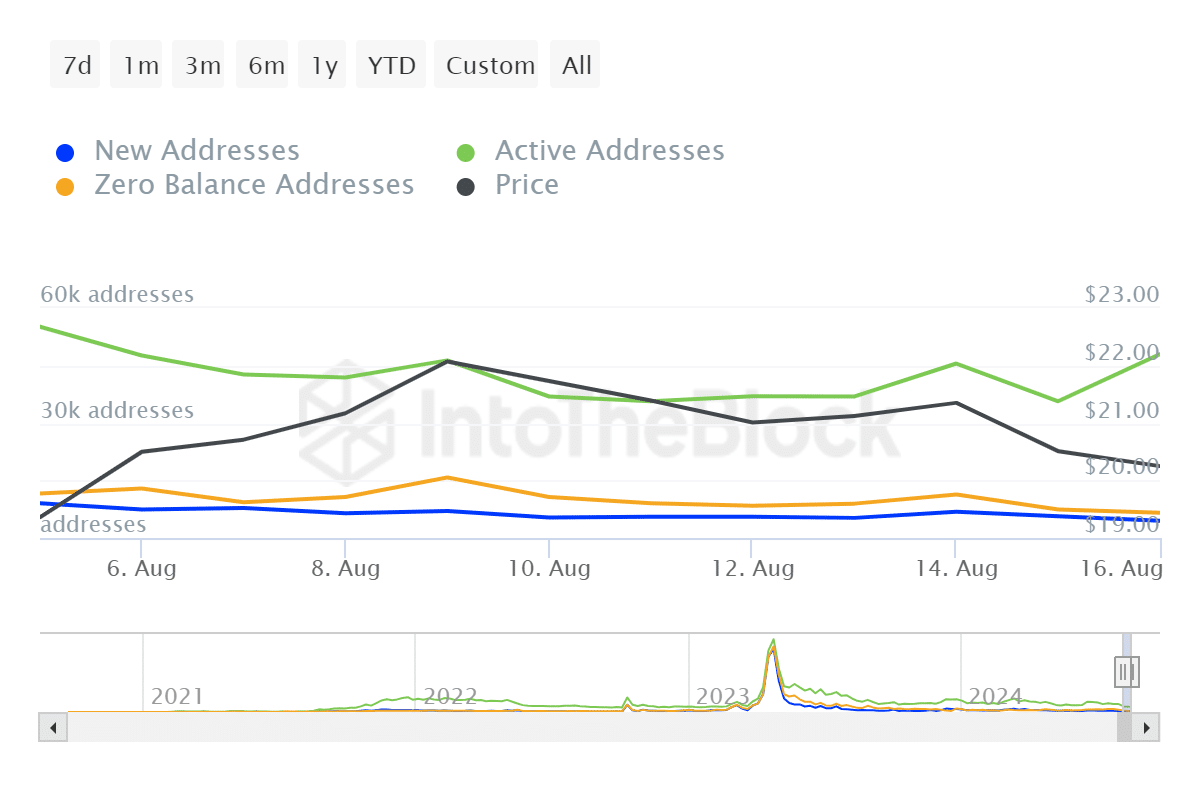

AMBCrypto’s look at Coinglass’ data indicated a 34.46% surge in active AVAX addresses, indicating that more investors had started using the Avalanche network.

Source: IntoTheJacket

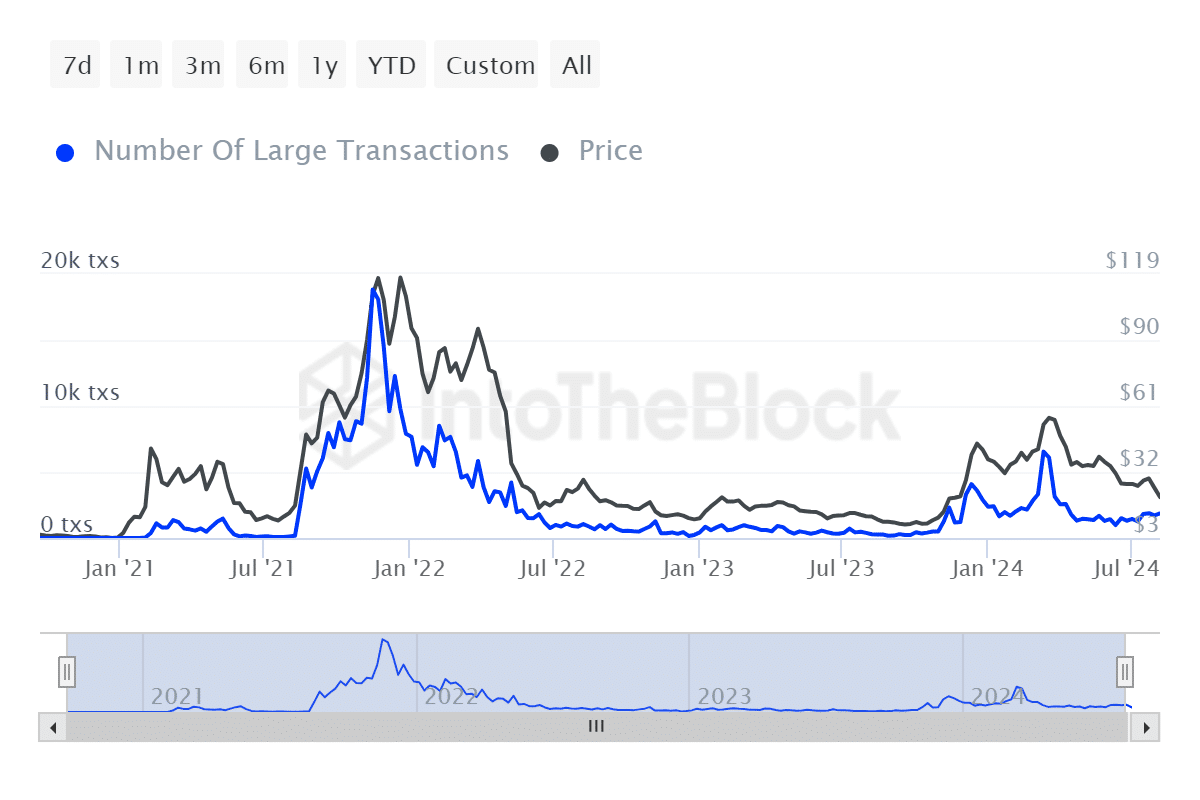

AVAX large transactions on the rise

The aforementioned increase in active addresses was also accompanied by a 9.45% growth in large transactions. This often signifies whales or institutional investors’ heightened presence in the market.

As both retail and whales continue to rise, it indicates that a wide range of AVAX holders are participating.

Source: IntoTheBlock

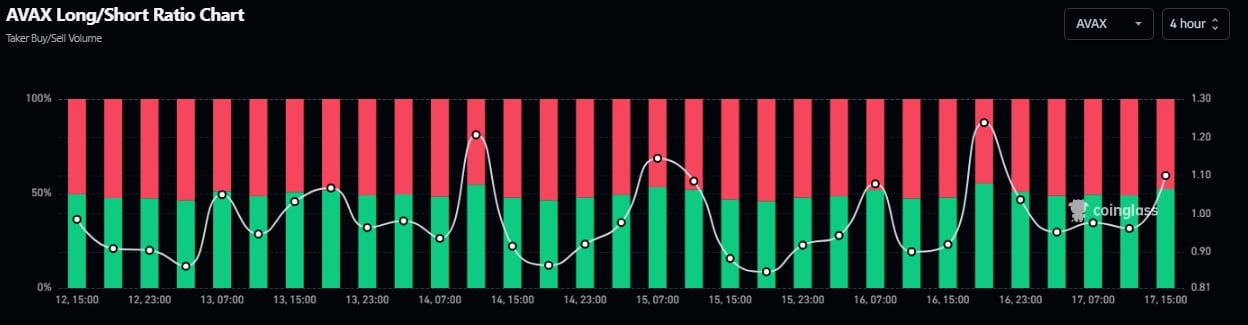

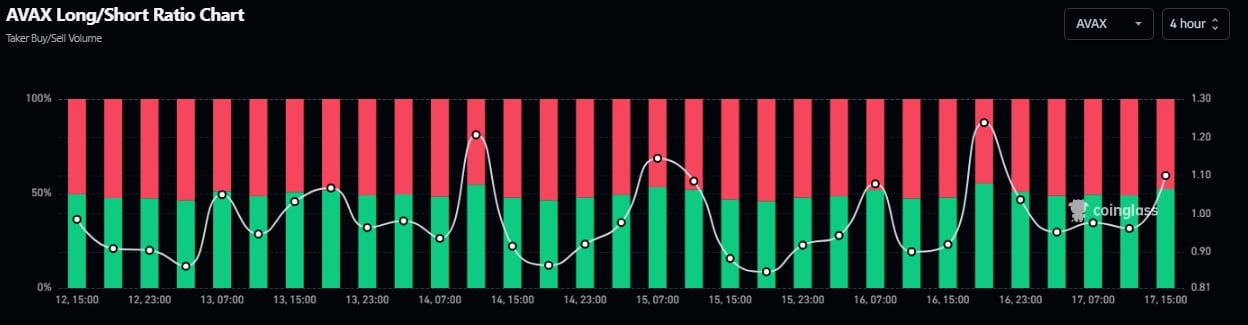

The AVAX Long/Short Ratio indicated a balanced market, with positions ranging around 50%. This balance, coupled with recent increases in on-chain activity, indicates a market at a decision point.

This point of indecisiveness could potentially set the stage for volatility if a clear trend emerges.

Source: Coinglass

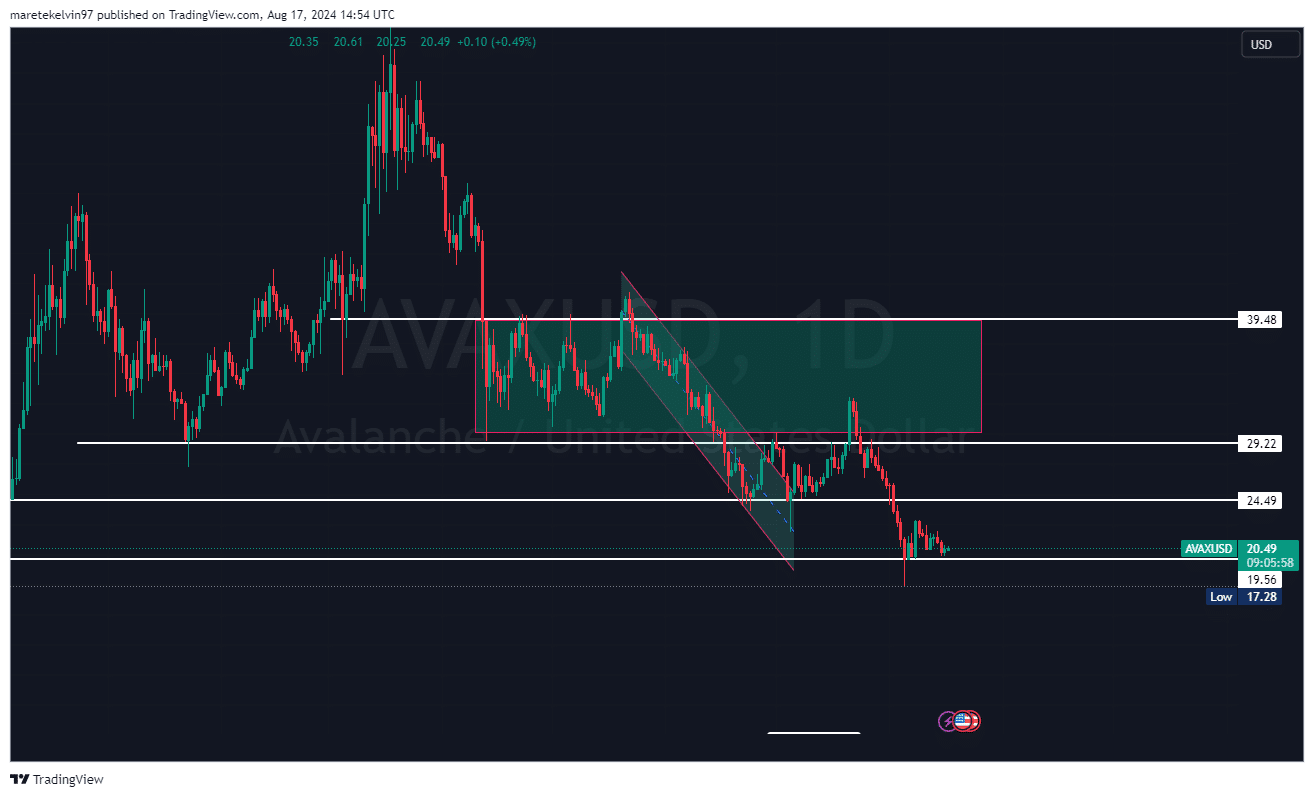

AVAX approaches critical support level

AVAX’s price has been under stress recently. In particular, the token was consolidating above the key support level at $19.48. Historically, this point has provided solid ground during past declines.

Source: TradingView

Setting the stage for a potential reversal

One AVAX crosses a critical support and on-chain activity surges, a mix of events can occur. Once $19.48 holds, the price can skyrocket to $25 and beyond.

The fact that network engagement is increasing means there are demands lying underneath that can support such an eventuality.

Realistic or not, here’s AVAX market cap in BTC’s terms

Recent price struggles notwithstanding, increased on-chain activity represented a ray of hope for bulls. An emerging support level of $19.48 will draw the line in the sand.

Should this level hold and on-chain momentum persist, AVAX may be entering a trend reversal.