- Avalanche’s liquidation will increase if its price touches $61.4.

- Market indicators looked bearish on the token.

Avalanche [AVAX] caught investors off guard as it decoupled from the entire crypto market in the last few days. Therefore, let’s have a closer look at the token’s metrics to see what is causing AVAX to act differently from the rest.

Avalanche bulls are here

While most cryptos suffered losses because of the recent bearish market condition, AVAX moved the other way around. According to CoinMarketCap, AVAX was up by more than 40% in the last seven days.

In fact, in the last 24 hours alone, the token’s value surged by over 22%. At the time of writing, AVAX was trading at $60.18 with a market capitalization of over $22 billion. The good news was that the token’s trading volume also surged by 35% in the last 24 hours, acting as a foundation for the price uptick.

Thanks to the bull rally, Avalanche’s 1-week price volatility spiked substantially. Moreover, positive sentiment around the token was also high, meaning that investors were confident in AVAX’s bull rally and expected its value to surge further.

Source: Santiment

Things in the derivatives market also looked pretty optimistic. AMBCrypto’s analysis of Coinglass’ data revealed that AVAX’s funding rate increased, suggesting that derivatives investors were actively buying the token.

Additionally, its open interest also went up along with its price. Whenever the metric moves up, it increases the chances of the current price trend continuing further.

Source: Coinglass

High liquidation ahead

Though the aforementioned metrics look bullish, AVAX will witness high liquidation if its rice moves up.

To be precise, an analysis of Hyblock Capital’s data revealed that Avalanche’s liquidation will rise when its price touches the $61.5 and $62 marks.

High liquidation means a rise in selling pressure, which might put an end to the token’s bull rally.

Source: Hyblock Capital

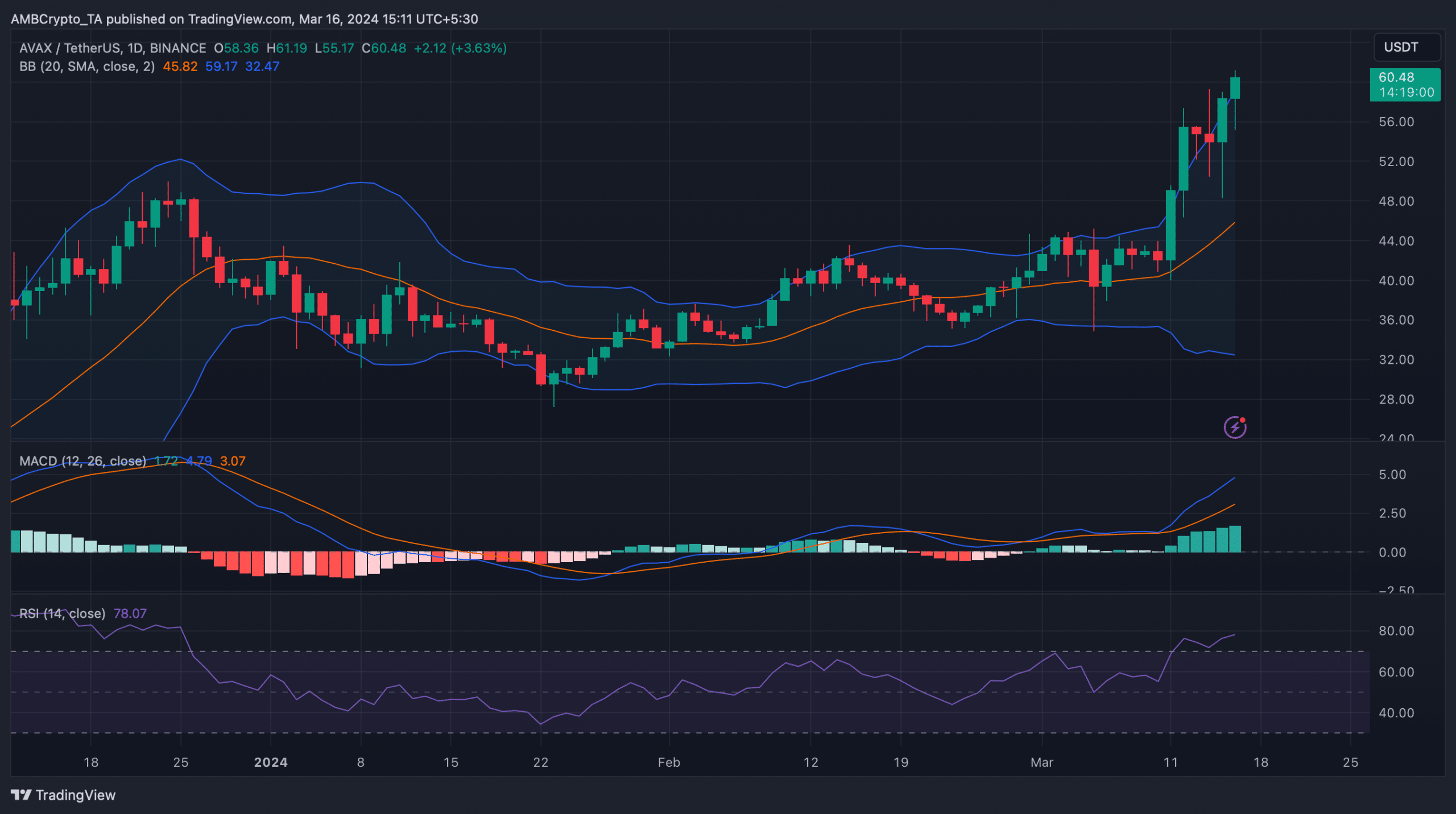

To better understand whether AVAX will manage to sustain its rally, AMBCrypto took a look at its daily chart. We found that the token’s price touched the upper limit of the Bollinger Bands.

Read Avalanche’s [AVAX] Price Prediction 2024-25

On top of that, Avalanche’s Relative Strength Index (RSI) also entered the overbought zone. Both of these metrics indicated that selling pressure on AVAX might rise, which can cause a price correction in the near term.

Nonetheless, the MACD remained in buyers’ favor as it displayed a bullish advantage in the market.

Source: TradingView