- Baby Doge eyed a new all-time high as the recent price surge pushed close to its previous historic high.

- Recent performance underpinned growing interest in the memecoin in both the spot and derivatives segments.

Baby Doge [BABYDOGE] was one of the top trending cryptocurrencies on X (formerly Twitter) in the last 24 hours, and for good reason. The memecoin has extended the bullish uptick reignited by Elon Musk more than two days ago.

More importantly, the latest wave of demand pushed its market cap above $1 billion for the first time in history, making BABYDOGE one of the few top memecoins that have achieved this milestone.

Baby Doge is on the verge of attaining a new all-time high. The memecoin rallied as high as $0.0000000067 in the last 24 hours at the time of observation.

This means it came close to retesting its previous ATH achieved in January 2022.

Source: TradingView

Baby Doge was only a 7% rally away from a new all-time high at its latest peak. However, the cryptocurrency demonstrated some profit-taking. But could this limit its ability to push to new highs?

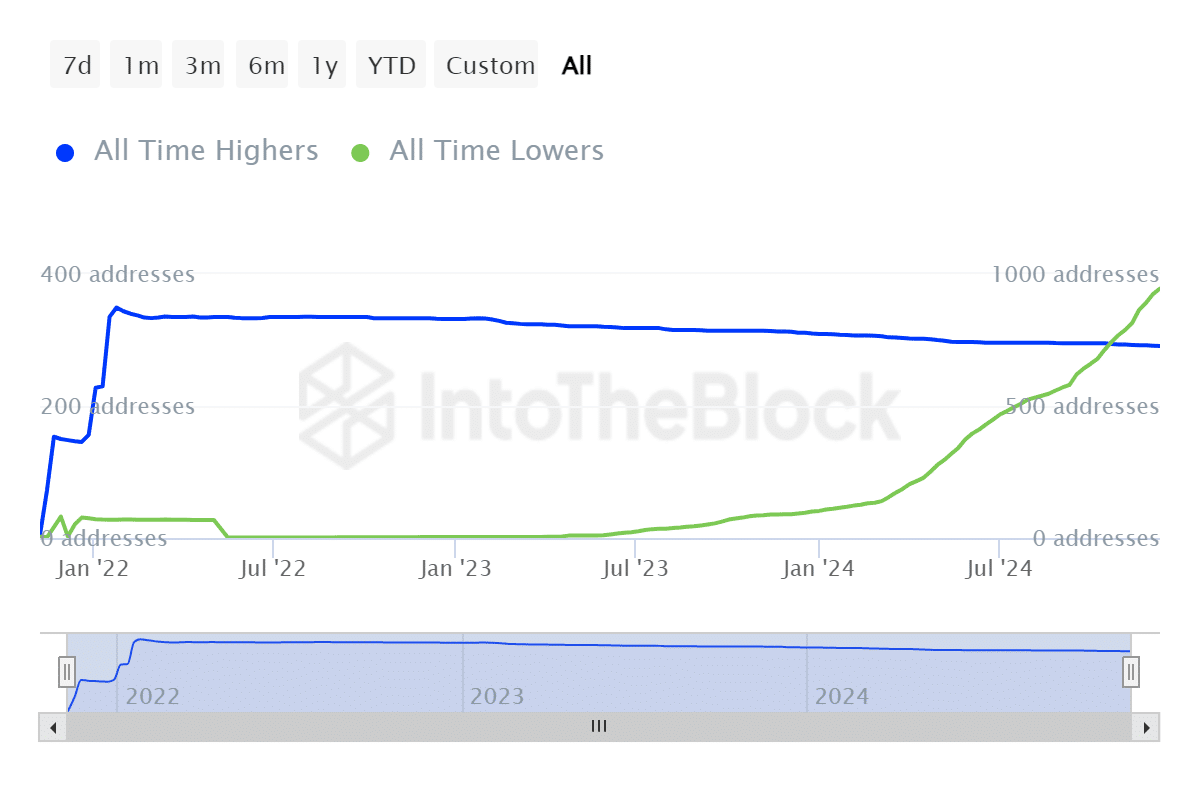

IntoTheBlock data revealed that the number of addresses at an all-time high were significantly lower compared to the 2022 peak.

However, the number of addresses at an all-time low have been growing rapidly over the last few months despite the rally.

Source: IntoTheBlock

This observation signaled that new addresses have been driving the recent surge. It may also suggest that they may not be in deep enough profits to trigger a major sell-off.

Evaluating Baby Doge’s demand

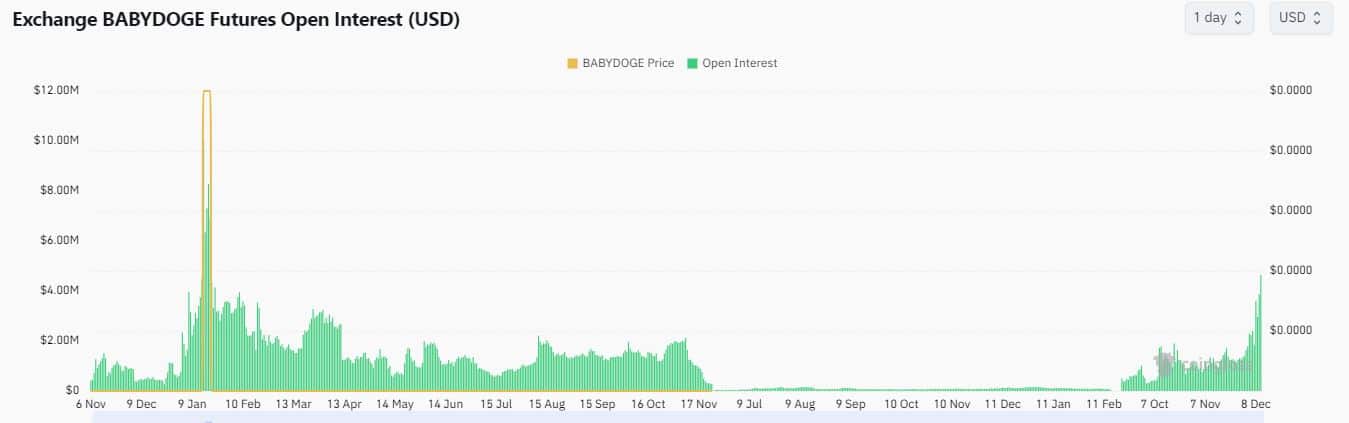

Speaking of demand, Baby Doge’s demand was backed by a surge in Open Interest. The latter rallied as high as $4.63 million in the last 24 hours.

Source: Coinglass

However, this was lower than the level of Open Interest that the cryptocurrency achieved in 2021 at $8.28 million.

This suggests that there may be room for more growth, especially now that Baby Doge is experiencing renewed interest.

Baby Doge coin’s latest rally was also backed by a resurgence of strong demand in the spot market. Spot inflows surged by $3.28 million on the 9th of December. This marked the highest spot inflows recorded in 2024.

Source: Coinglass

Note that the surge occurred after previously recording its highest spot outflows on the 7th of December. This outcome barely had an impact in terms of sell pressure, courtesy of the strong demand wave.

However, it underscored the presence of sell pressure.

The derivatives segment confirmed the presence of sell pressure in the surge in short liquidations. Over $167,000 worth of liquidations were observed on the 9th of December.

Source: Coinglass

The recent liquidations were the highest observed in the last three months. This signaled growing interest in the derivatives segment, but it also underscores potential for more volatility ahead.