- Beam was approaching a crucial support level of $0.0202 at press time.

- On-chain metrics pointed to declining whale and trading activity.

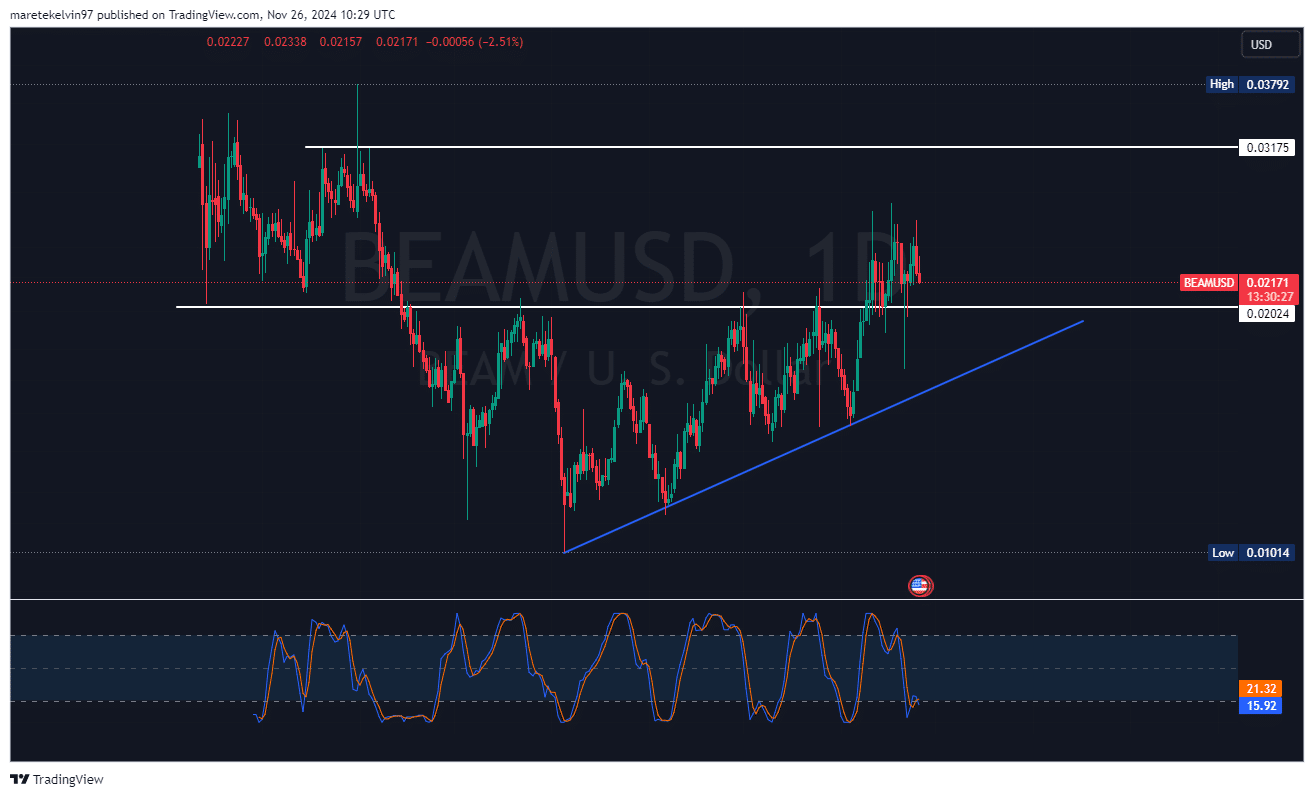

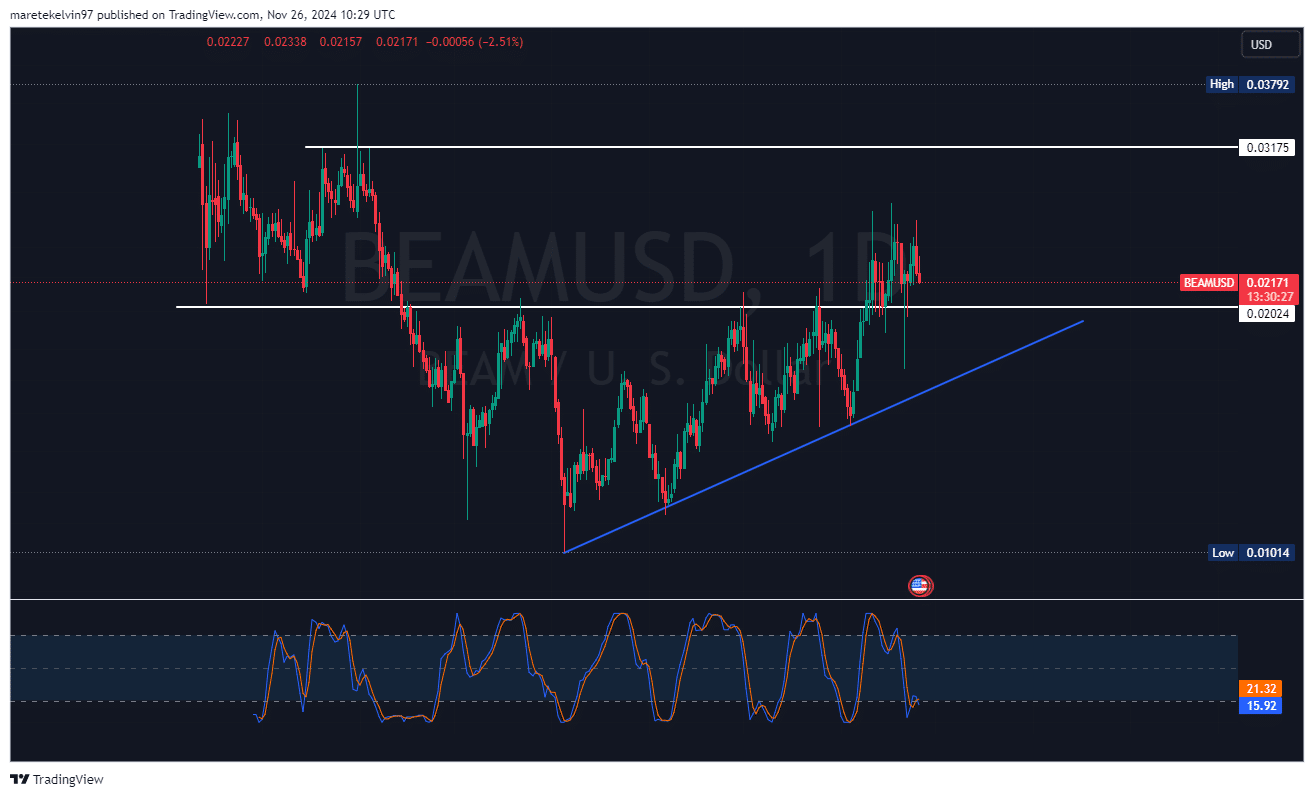

Beam [BEAM], a privacy-focused crypto, was in for a critical test as its price neared a key support level of $0.0202 on the daily chart.

The asset has dipped sharply by over 16% in less than 48 hours alone, raising concerns among market participants about its short-term trajectory.

Source: TradingView

As Beam’s price continued to slide, the stochastic RSI was approaching an oversold zone at press time.

This development could signal a potential price reversal, a near-term bounce, and thus offering a glimpse of hope for the Beam bulls.

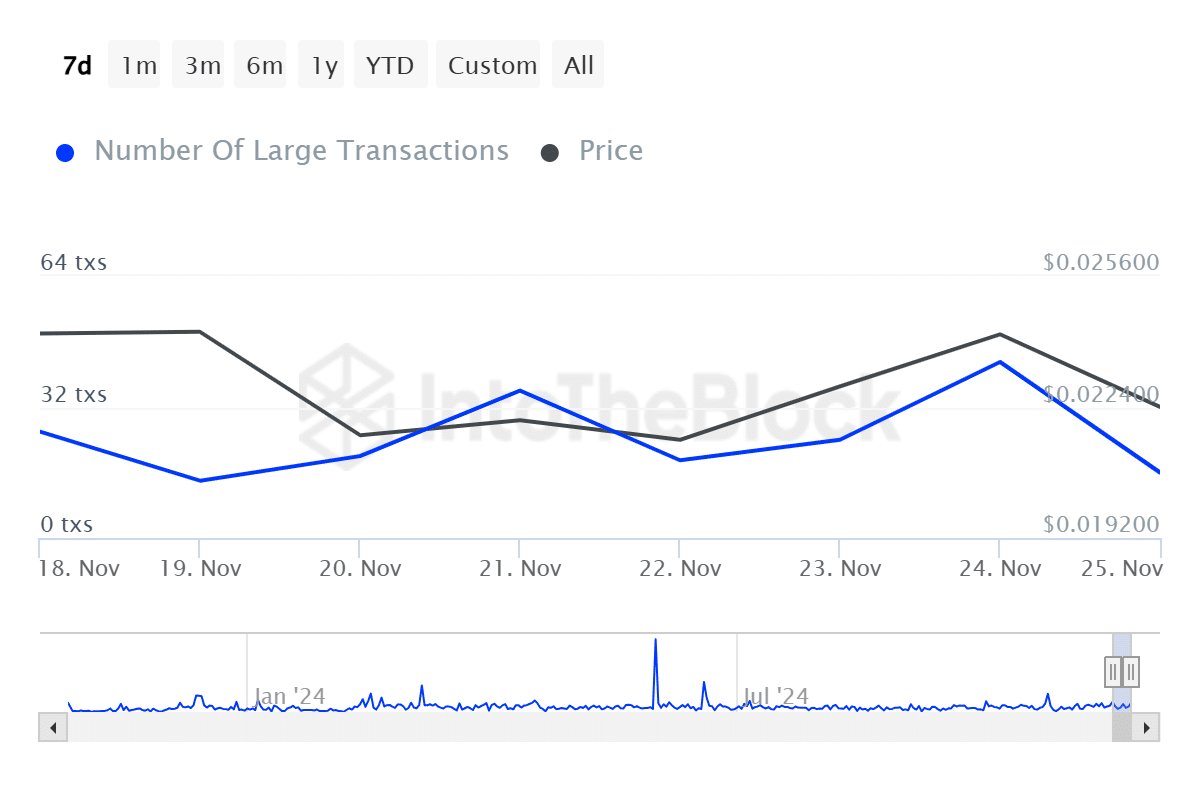

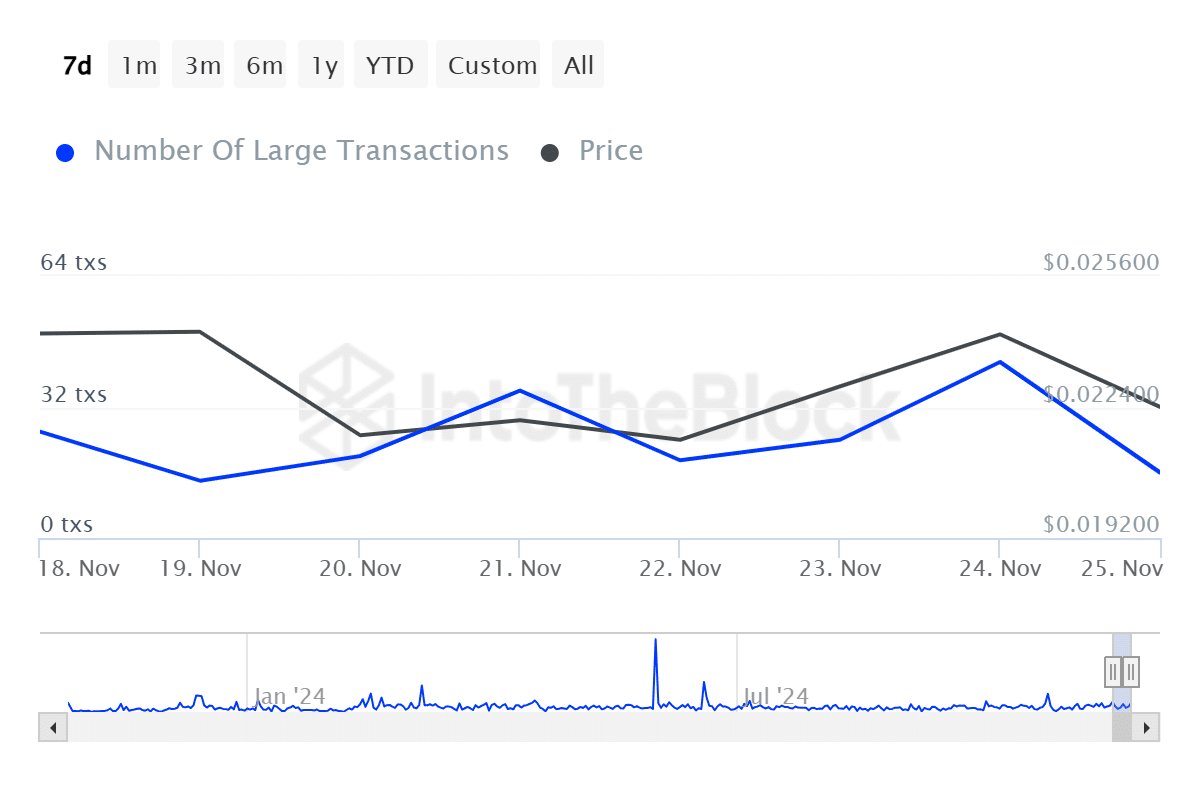

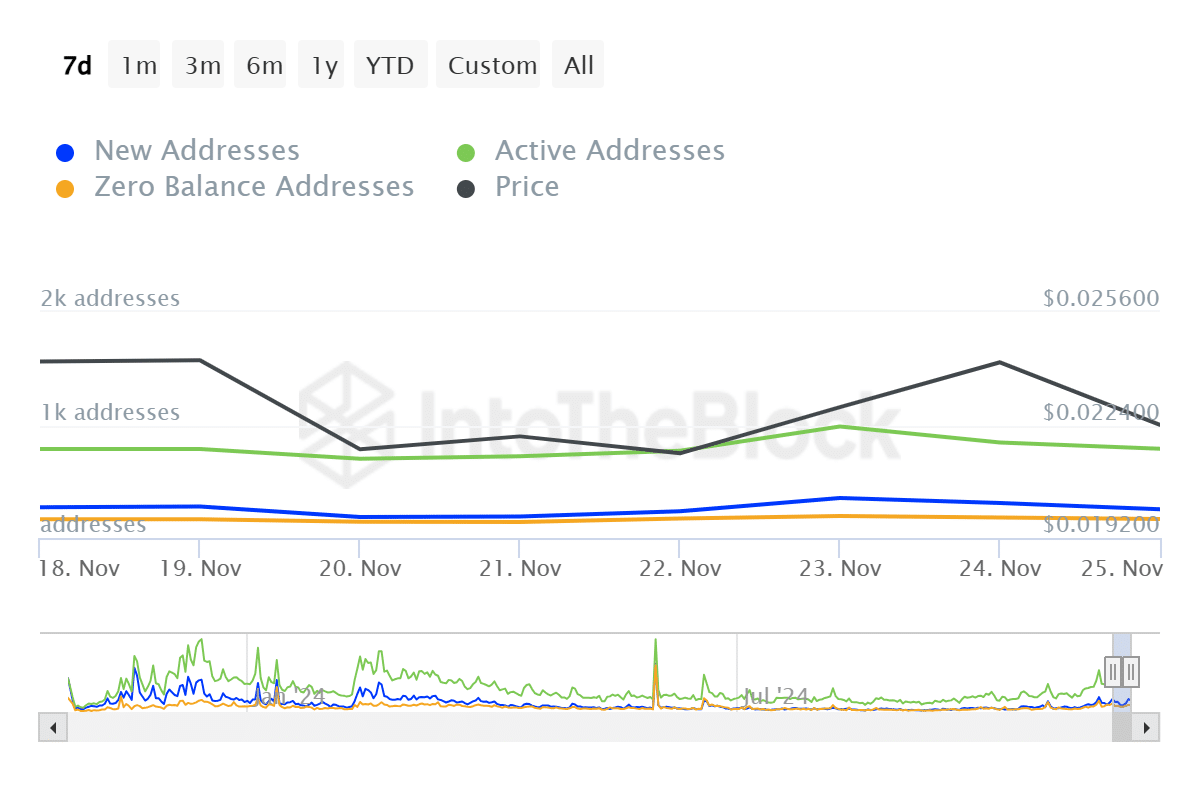

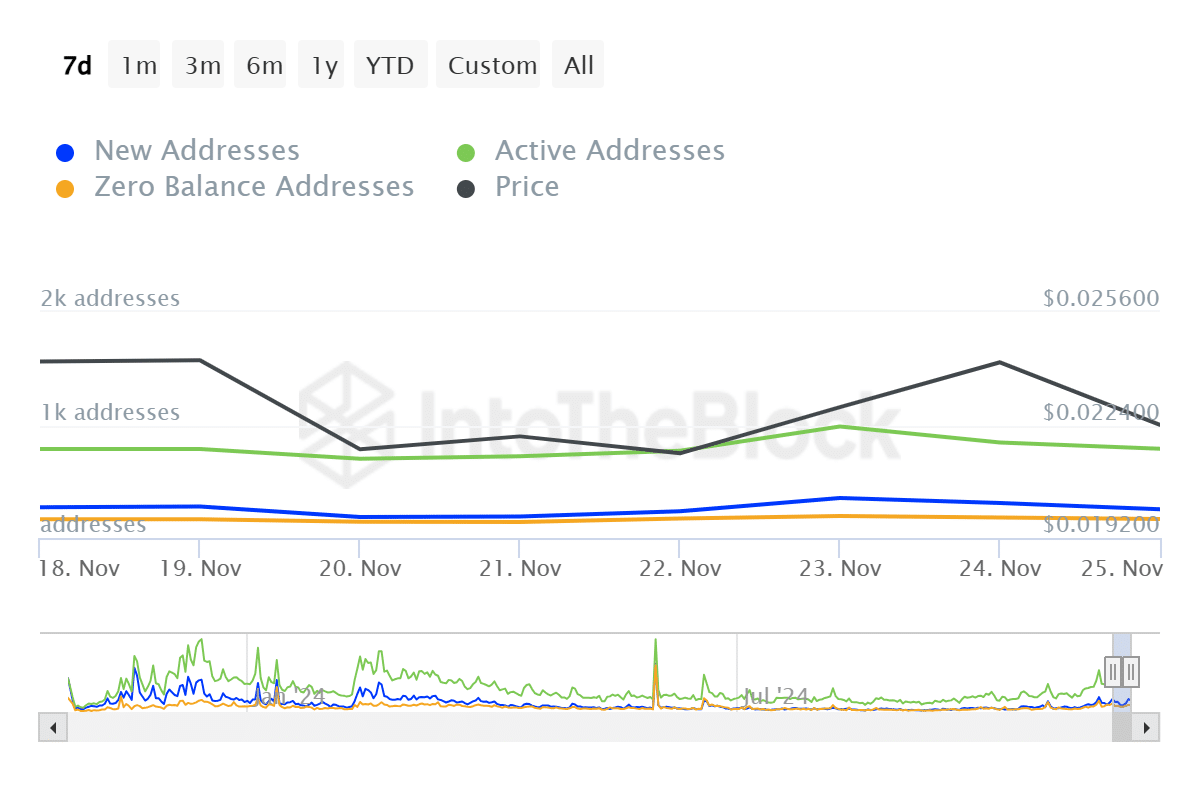

Declining whale and trading activity

Based on AMBCrypto’s analysis of IntoTheBlock’s data, the majority of the parameters were leaning bearish. This was majorly propelled by the decline in large transactions, which were down 69% over the past 24 hours.

This suggested that the big players are in a “wait-and-see” situation — whales are observing Beam’s reaction to the $0.0202 support level.

Source: IntoTheBlock

The shrinking whale activity was further reinforced by a 7% drop in active addresses. This significant drop in the number of active addresses indicated a reduction in overall Beam trading activity on the network.

Source: IntoTheBlock

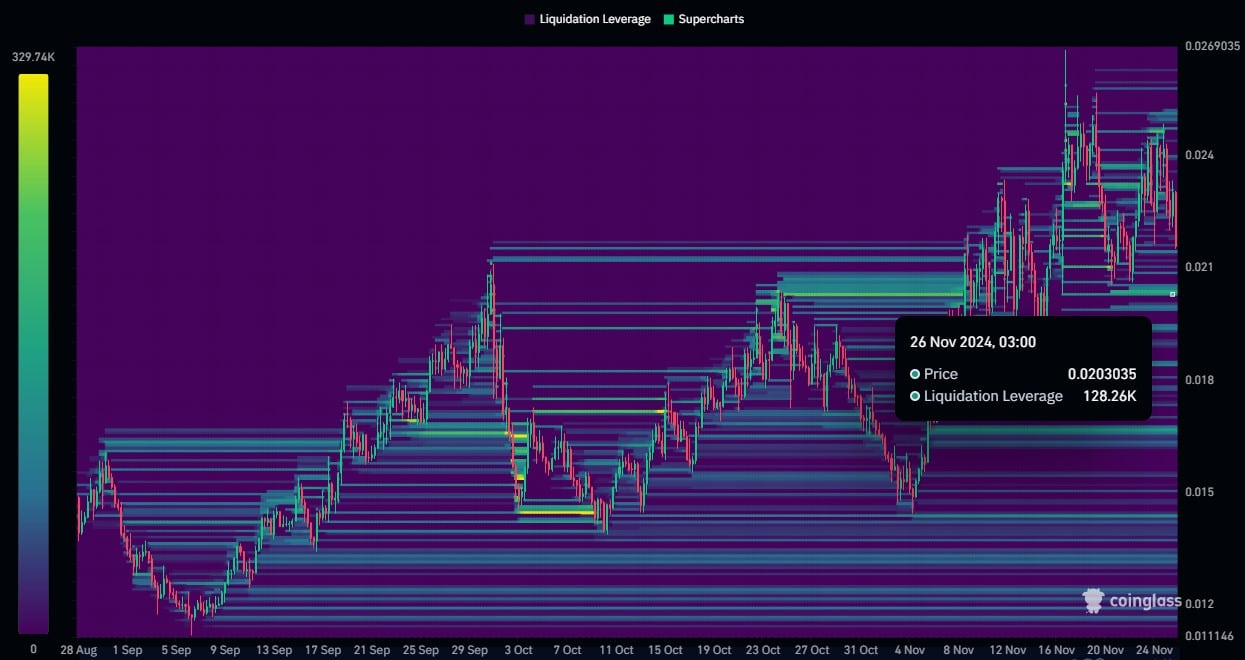

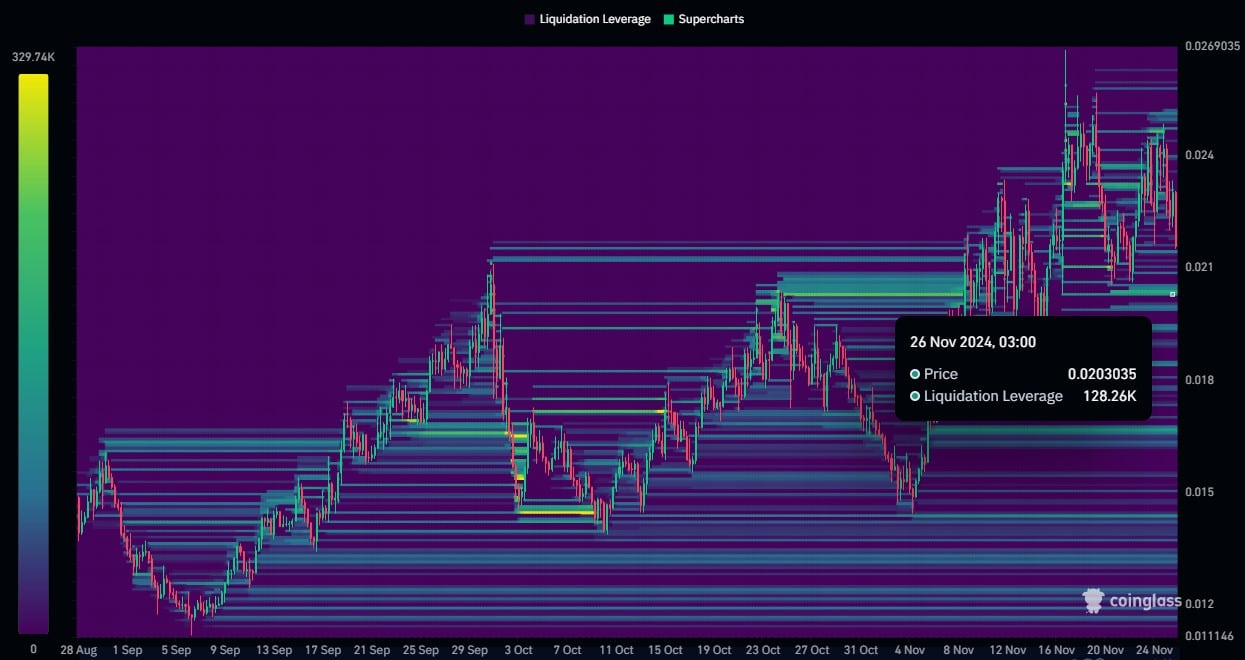

Liquidation pool to pull price further

However, a substantial liquidation pool worth 128.26K on the price level of $0.0203 added to the Beam’s bearish outlook.

This pool coincided with the key support level at $0.0202, and any breach could lead to further downward pressure on Beam’s price.

Source: Coinglass

What’s next for Beam?

The confluence of declining on-chain metrics and a bearish price action paints a concerning picture for Beam’s short-term outlook.

Read BEAM Price Prediction 2024-25

However, the stochastic RSI gives positive support for the bull, as there could be a price correction in store in the long run.

The $0.0202 support will be crucial for the next price setup. A breach below the price level could suggest a further bearish run, while a bounce back could build a basis for a potential bullish rally.