- Bitcoin is trapped because the market is in a new phase where the old rules don’t work.

- Rising gold imports signal a demand for traditional inflation hedges, weakening BTC’s dominance.

Despite the U.S. Dollar Index [DXY] plunging to a five-month low of 103, Bitcoin [BTC] remained stagnant, breaking its historically strong inverse correlation with the greenback.

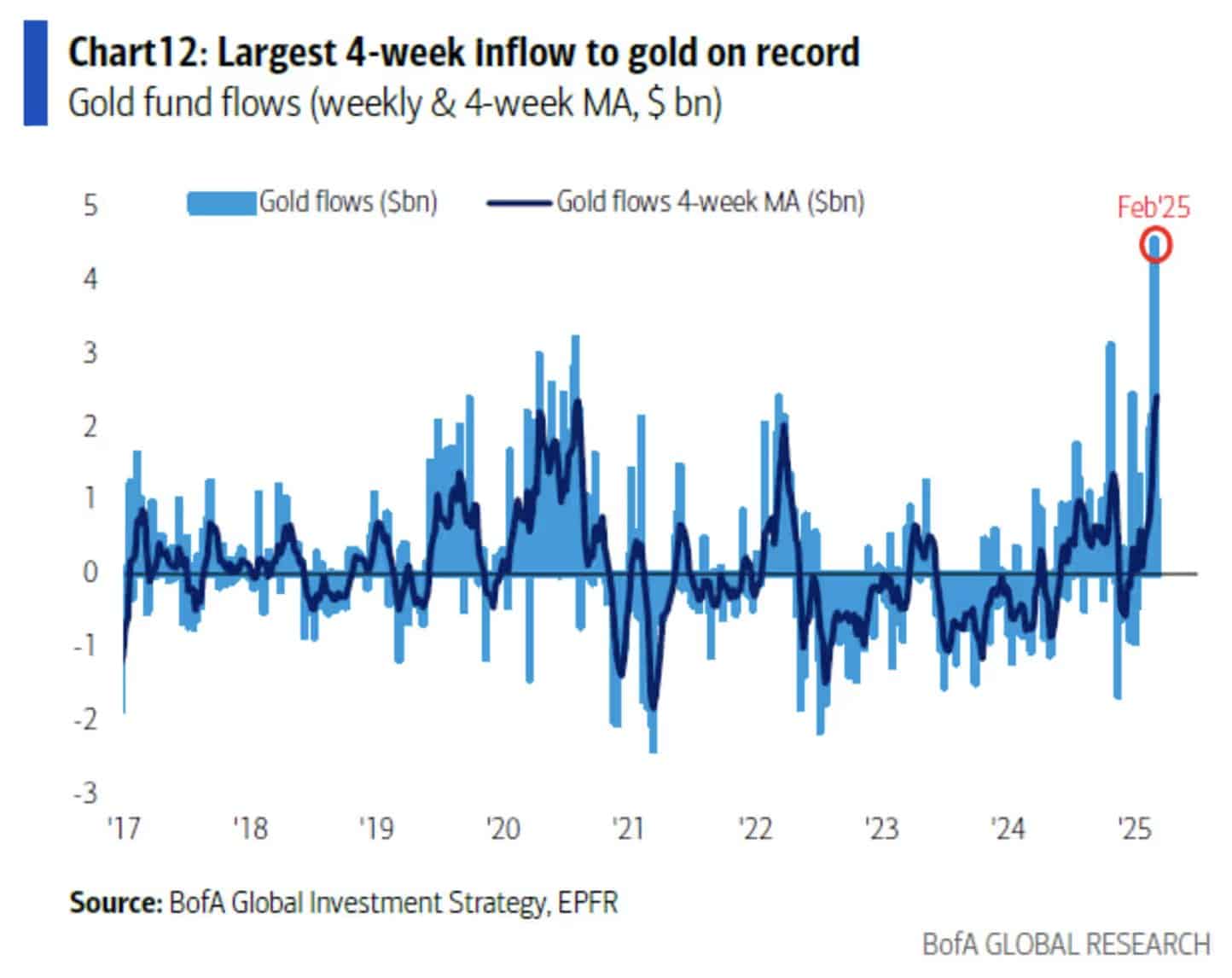

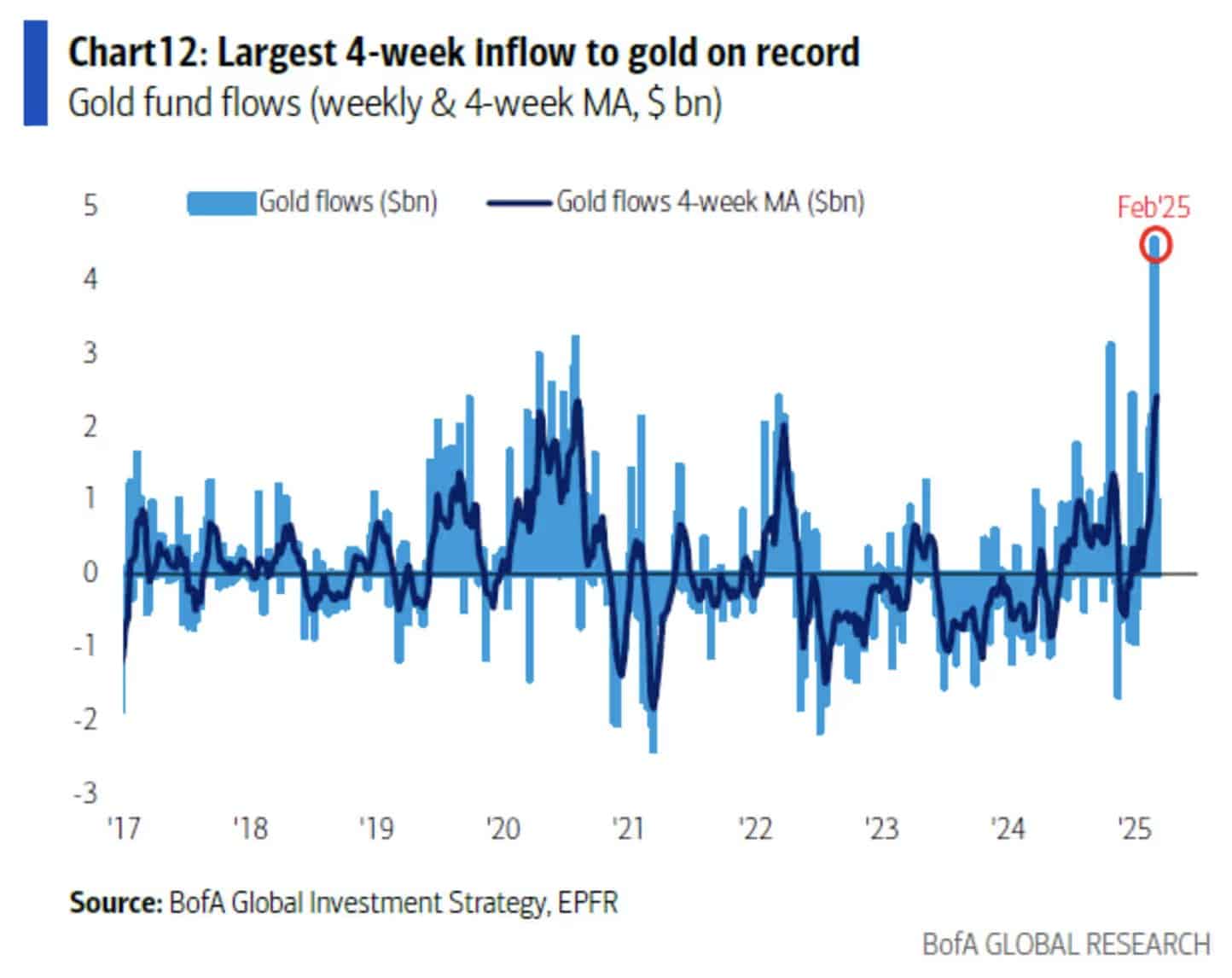

At the same time, U.S. gold imports surged, with inflows hitting a record $4.9 billion in a single day. This shift suggests that investors are favoring traditional safe havens, diverting liquidity away from the crypto market.

With gold absorbing capital and BTC struggling to gain momentum, has the macro landscape changed the game for Bitcoin’s next move?

Has Bitcoin outgrown the DXY signal?

The DXY’s sharp 3.70% drop to a five-month low is a rare event that has historically preceded major Bitcoin rallies.

In the 2017 cycle, BTC surged 87x as DXY broke below 90. Four years later, in the 2021 cycle, BTC 10x’d into the peak.

Yet this time, despite the dollar’s weakness, BTC is printing its fourth consecutive red candle, trading 22% below its all-time high of $109K set earlier this year.

Source: TradingView (BTC/USDT)

This DXY breakdown followed a weaker-than-expected jobs report, fueling expectations of three Fed rate cuts in 2025.

However, Fed Chair Powell remains hawkish, warning that a rate hike is possible if inflation spikes due to Trump’s tariff threats.

This signals a fundamental shift in macro drivers.

In past cycles, BTC thrived on monetary easing, rallying as DXY weakened.

But this time, fiscal forces – rising debt, tariffs, and inflation – could take precedence, weakening Bitcoin’s historical inverse correlation with the dollar.

Market sentiment turns defensive as liquidity shifts

Despite a crypto summit, a weak jobs report, and the announcement of a Bitcoin Strategic Reserve, market sentiment remains fragile.

Investor uncertainty and risk aversion are mounting, with market makers questioning whether BTC has exhausted its bullish catalysts.

As liquidity tightens and momentum fades, the possibility of a break below $80K continues to grow.

Meanwhile, gold is emerging as the preferred hedge, absorbing $4.9 billion in inflows over four weeks – the largest in history.

Source: BofA Global Research

This shifting macro landscape is redefining BTC’s role. With capital rotating into traditional hedges, Bitcoin’s safe-haven status is being tested.

As old correlations weaken and new risks emerge, BTC faces an increasingly volatile and uncertain market ahead.