- Bitcoin’s pre-halving volatility questioned post-Hong Kong’s ETF approval, drawing mixed sentiments.

- Historical data indicates post-halving price surges.

Amid significant double-digit declines across the crypto market’s weekly charts, Hong Kong’s recent approval of Bitcoin ETFs has sparked a wave of positive sentiment among Bitcoin [BTC] investors.

Estimations suggest that the introduction of Bitcoin ETFs could generate up to $25 billion in its first year.

Despite such optimism, Peter Schiff in his recent X (formerly Twitter) post questioned the growth of Bitcoin ETFs. He said,

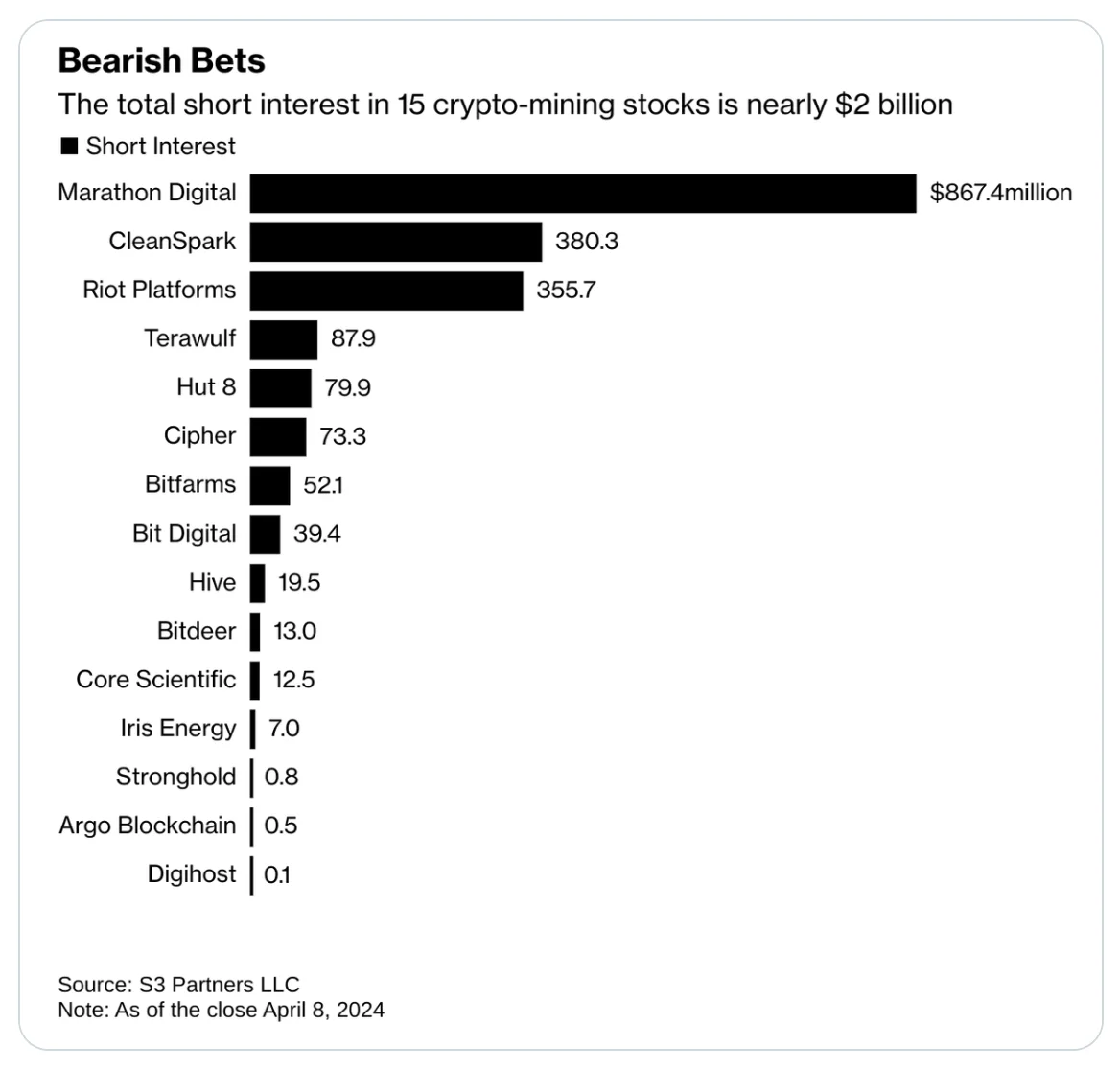

“If Bitcoin ETFs are really going to send Bitcoin to $100K or higher, why are all the Bitcoin-related equities in bear markets? For example, $COIN is down 21%, $GLXY is down 26%, $MSTR down is 33%…”

Bitcoin’s volatile moves

According to CoinMarketCap, BTC’s price chart displayed a series of red candles on the daily chart.

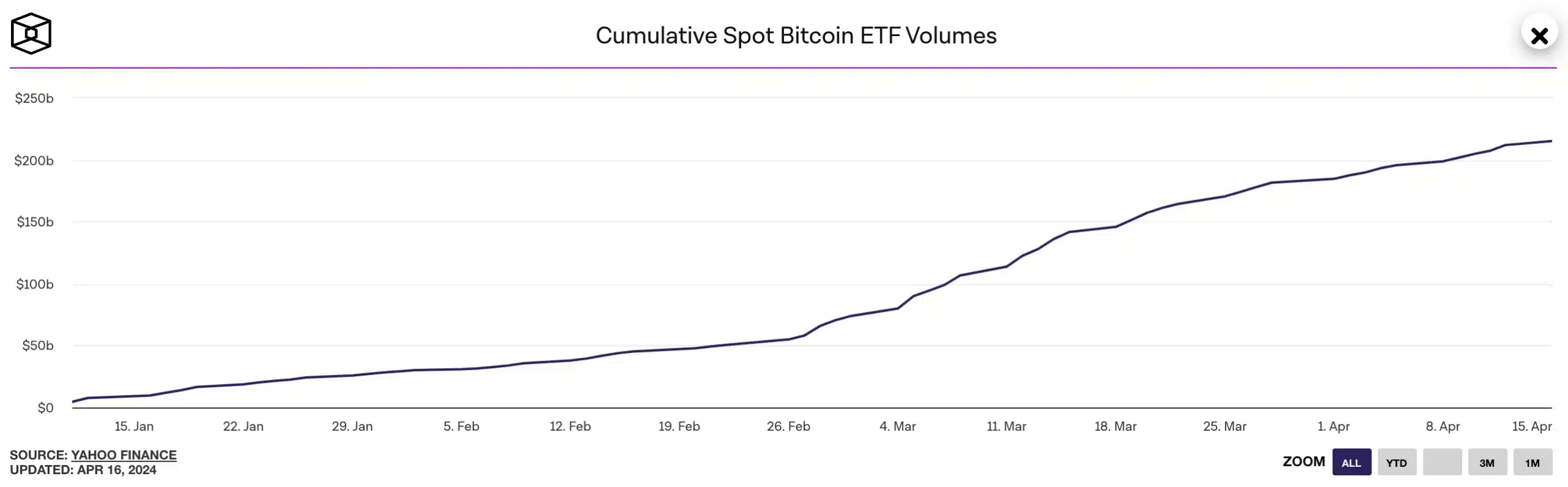

In contrast, The Block reported that the cumulative spot Bitcoin ETF volume chart was showing an upward trajectory.

This juxtaposition led to a question — Is the upcoming BTC halving the reason behind such price volatility?

Responding to the same, Anthony Pompliano in conversation with LizClaman, noted,

“Bitcoin is the global alarm system. It leads all assets in a crash and it leads all assets in moments of acceleration.”

This highlights the divergence of views between bullish investors and cautious “halving bears.”

While optimists anticipate a price rally due to increased scarcity, skeptics fear a downturn as miners receive fewer rewards.

This sentiment clash is further confirmed by the current market, with BTC experiencing heightened volatility.

Additionally, insights suggest that BTC miners could face significant losses post-halving, further fueling bearish sentiments as highlighted by the Barchart.

BTC’s price action

Sharing a nuanced perspective regarding the upcoming Bitcoin halving, Kris Marszalek, CEO of crypto.com, in an interview with Bloomberg, noted,

“Bitcoin selling may become evident as the date of the so-called halving nears but the event is set to bolster the price of the largest digital asset longer term.”

Adding to the fray, Ash Crypto, outlined how BTC experiences significant price increases after each halving event. He said,

“Bitcoin pumps heavily after each halving.

- 2012 halving: 9900%

- 2016 halving: 2900%

- 2020 halving: 700%

But this time, something interesting will happen.”

So, as the world awaits the halving event, it would be interesting to watch how the year 2024 will be unique for Bitcoin and the overall crypto landscape.