- Miner sell-offs may signal short-term bearish sentiment or liquidity struggles.

- Bitcoin’s price could face volatility depending on ongoing miner behavior and outflows.

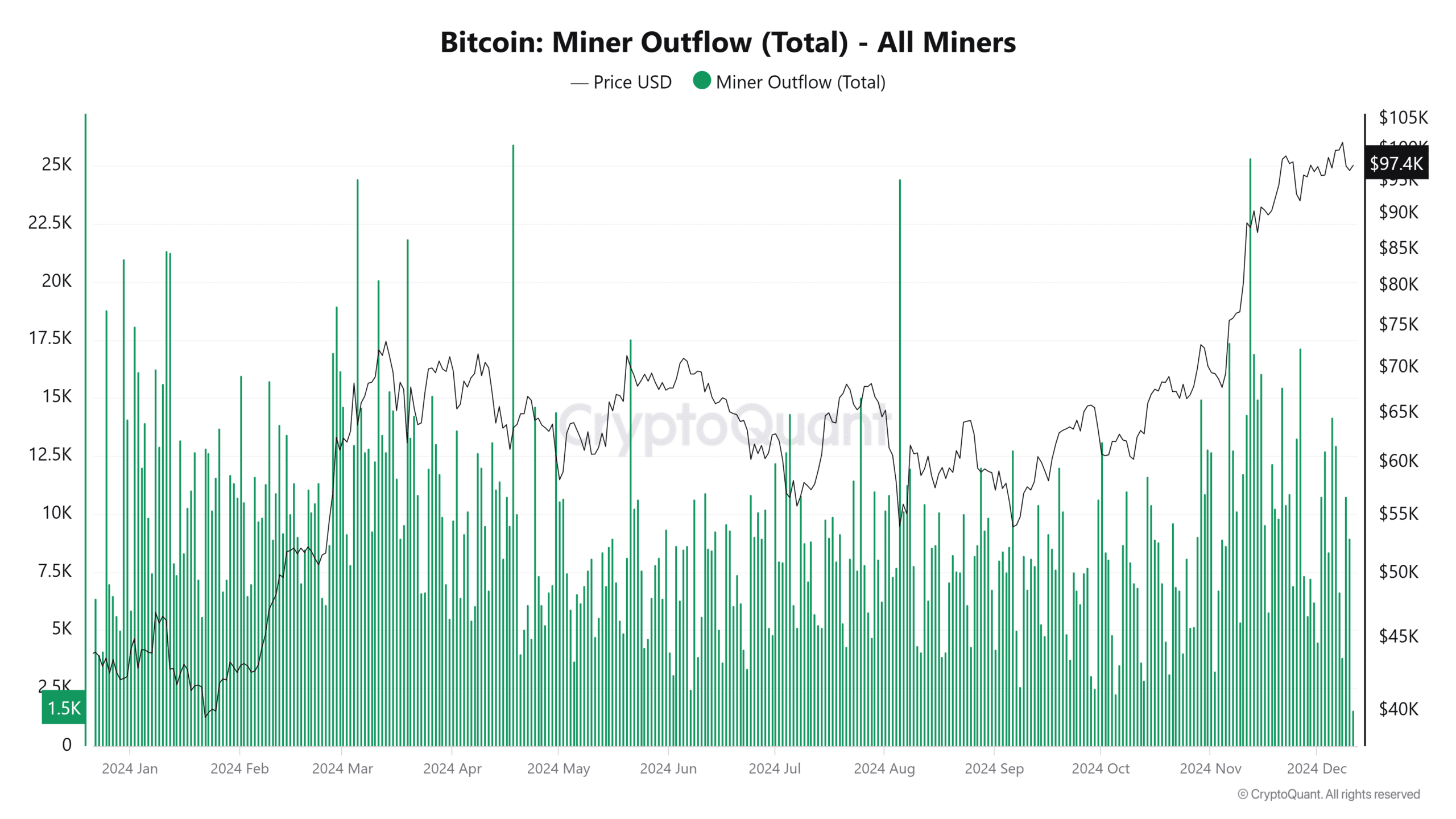

Bitcoin [BTC] miners have sold 771 BTC, totaling around $76 million, in the past 24 hours, raising concerns over its potential impact on the price. Such significant sell-offs often create supply-side pressure, which can affect market sentiment, especially during volatile periods.

As Bitcoin hovers near critical price levels, questions are mounting over whether this move signals short-term bearishness or reflects miners’ struggles to cover rising operational costs.

With the market in flux, all eyes are on miner behavior as a key indicator for the coming days.

Bitcoin miner outflows

The recent surge in Bitcoin miner outflows, coincides with rising operational costs and a market correction.

Notably, large outflows tend to signal a shift in miner sentiment, often reflecting the need to liquidate assets either for immediate cash flow or to hedge against volatile conditions.

During periods of high volatility, such as the one we are currently experiencing, miners may release larger quantities of BTC to cover energy expenses or repay debts, particularly as the price hovers near key levels.

Source: CryptoQuant

This trend of escalating outflows could be seen as a short-term bearish indicator, especially when coupled with declining miner profitability.

However, it is also crucial to consider that such behavior could indicate an overleveraged mining sector, which might exacerbate price corrections if further liquidity pressures mount in the coming days.

The sell offs signal rising pressure in the market. JPMorgan upgraded price targets for miners like Riot and CleanSpark, factoring in their BTC holdings and power assets.

While the sell-offs suggest short-term bearishness, these miners may be hedging against operational pressures, positioning themselves for future gains despite volatility.

The role of miners in the Bitcoin ecosystem

Bitcoin miners are pivotal in maintaining the network’s security and validating transactions. However, their sell-offs have historically exerted a significant influence on price dynamics.

When miners liquidate large amounts of BTC, it increases market supply, potentially triggering downward pressure on prices.

This is particularly evident when miner sentiment turns bearish, often linked to rising operational costs or decreasing profitability. In previous cycles, substantial miner sell-offs have marked local tops or signal periods of consolidation.

While not always indicative of a prolonged bear market, these sell-offs are a crucial market signal to monitor.

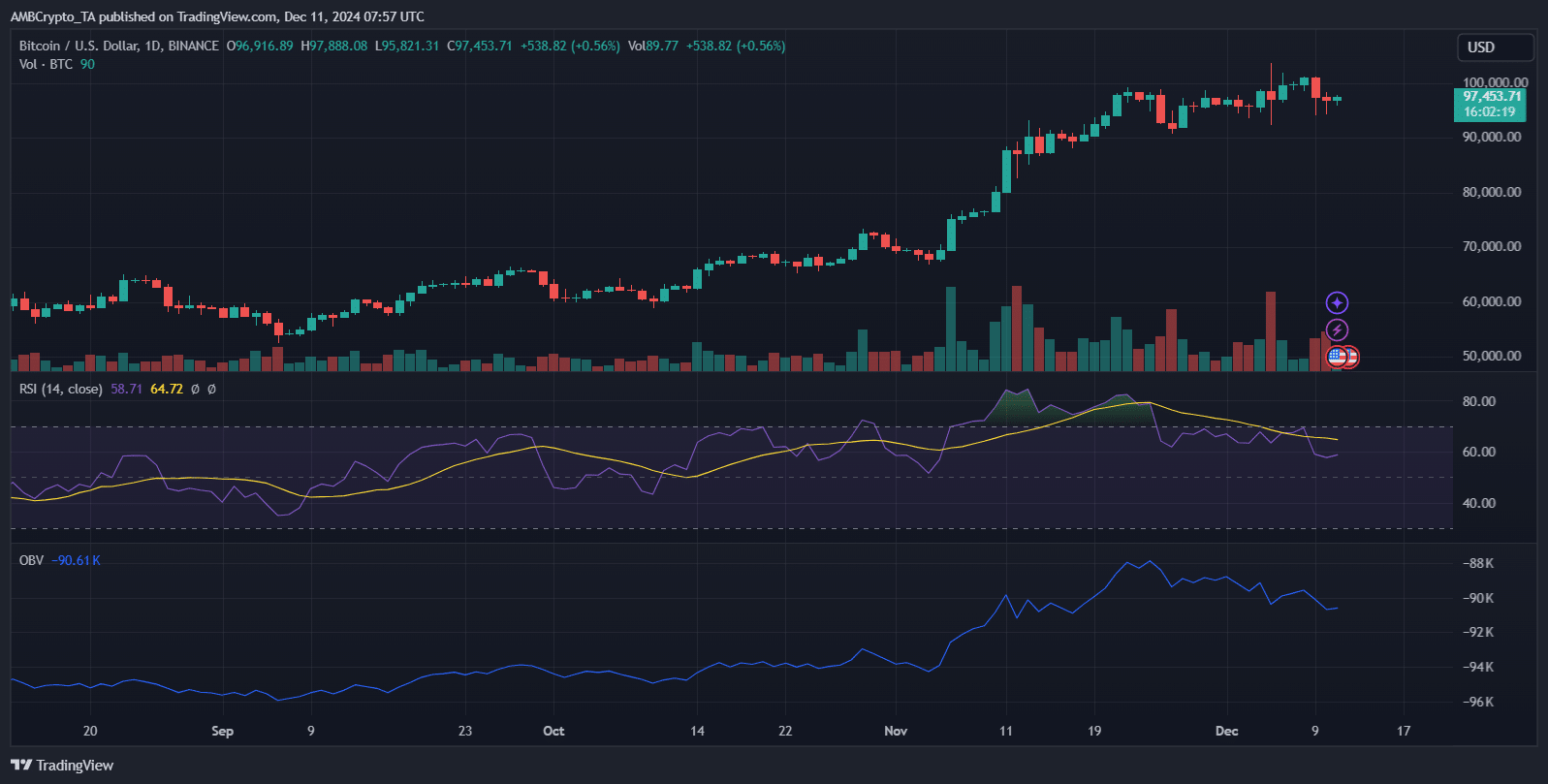

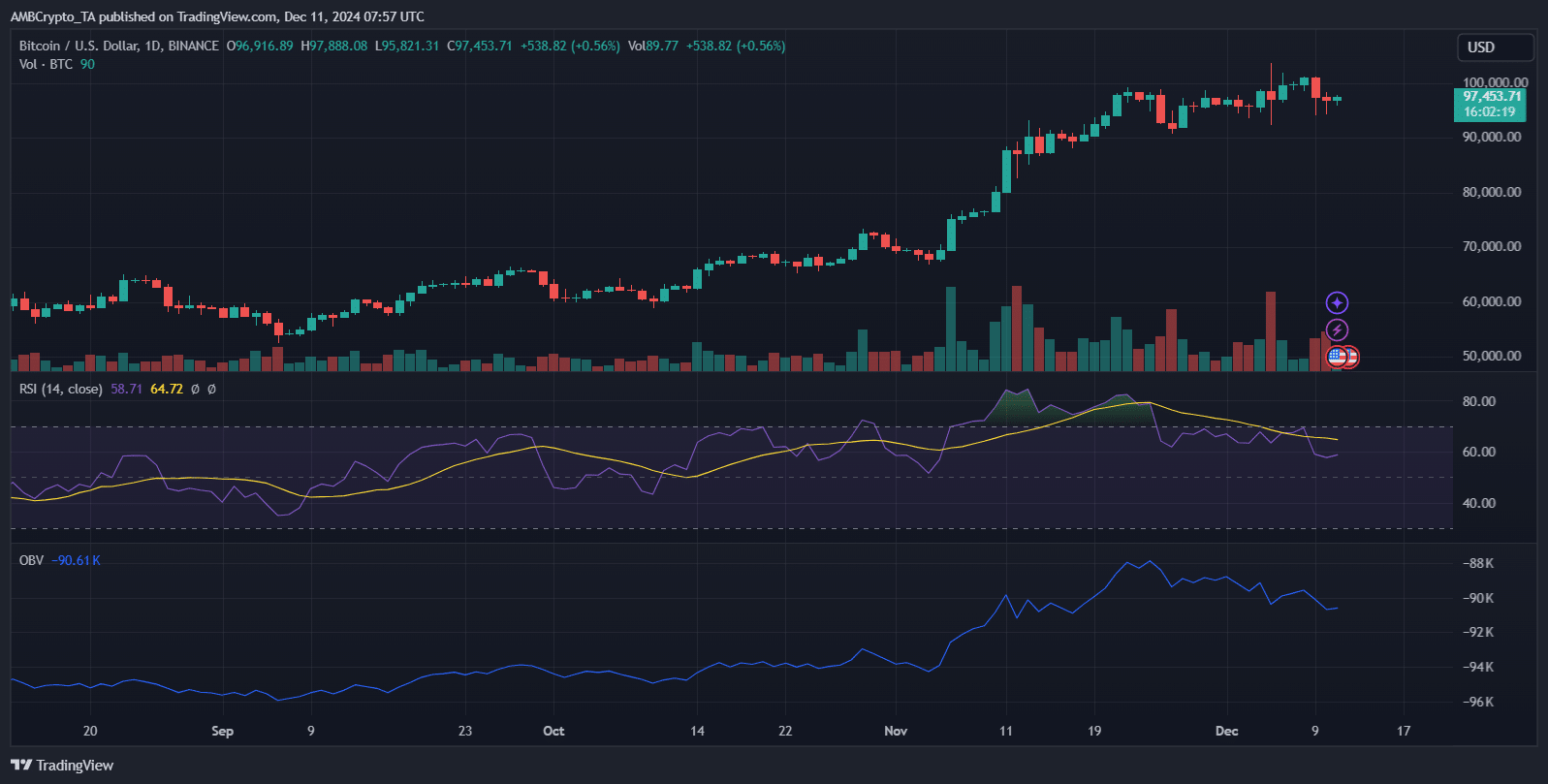

Impact on BTC price performance

The miner sell-off coupled with Bitcoin’s current price trends, highlights a potential challenge for the market’s bullish momentum. Bitcoin has been exhibiting strong upward movement, but miner behavior suggests caution.

The outflows could create temporary downward pressure, especially if miners continue liquidating large positions due to rising operational costs.

Source: TradingView

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Given Bitcoin’s proximity to key psychological levels, miner sell-offs could trigger increased volatility.

With market sentiment at a crossroads, Bitcoin’s ability to maintain upward momentum will depend on whether miners decide to scale back their outflows or further intensify selling.