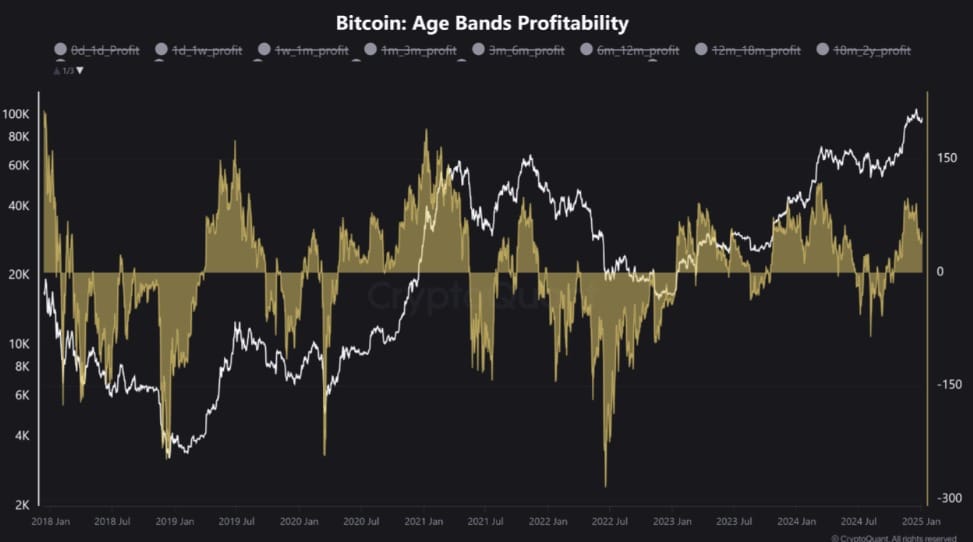

- Declining profitability for Bitcoin’s short-term holders signaled potential price corrections.

- BTC has surged by 6.08% over the past week as buyers regained the market.

Since the start of 2025, Bitcoin [BTC] has shown strong resilience, reclaiming $99k levels. Over this period, BTC has surged from $92768 to $99857.

Despite the recent price upsurge, analyst have shared their concerns with BTC’s current market conditions. Inasmuch, CryptoQuant analysts have suggested a potential correction, citing declining profitability among short-term holders.

Bitcoin’s short-term holders’ profitability decline

Analyst Crazzy Block observed that Bitcoin’s short-term holders were seeing their profitability drop.

Source: CryptoQuant

The subsequent failure to reclaim BTC’s $108K ATH caused the profitability margin for STHs to decline significantly.

When profitability for STH drops, it signals weakening market demand and rising bearish sentiment over the short and medium term.

Such a drop in demand suggests an elevated likelihood of price correction. So, short-term corrections are inevitable, while Bitcoin has massive potential for long-term growth.

Impact on BTC charts?

While short-term holder’s profitability has reduced with Bitcoin trading below $100k, the market seems positioned for more gains in the short term.

Therefore, other market indicators suggest that bulls are attempting to drive prices up and a huge market correction seems unlikely, especially in the short term.

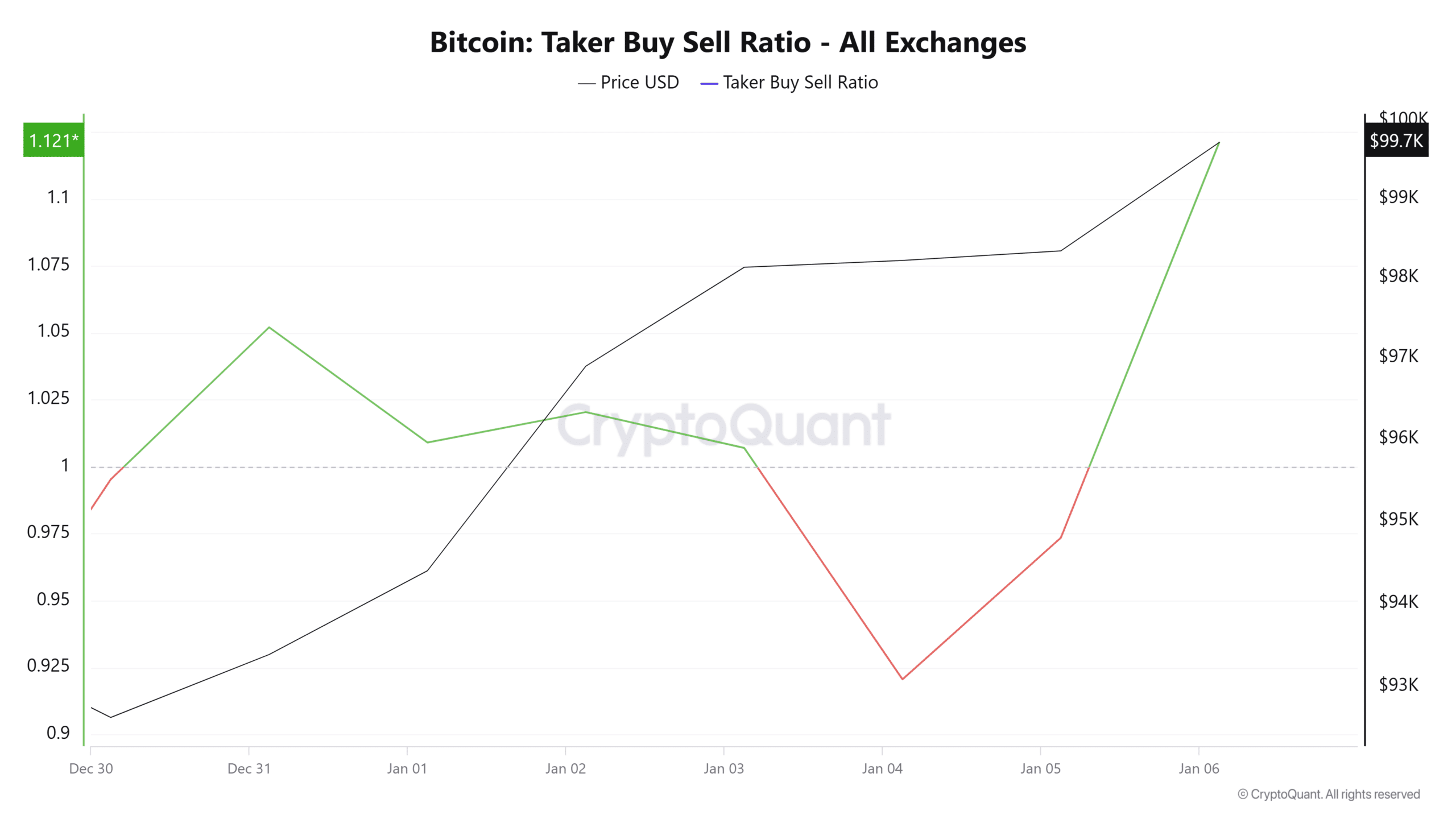

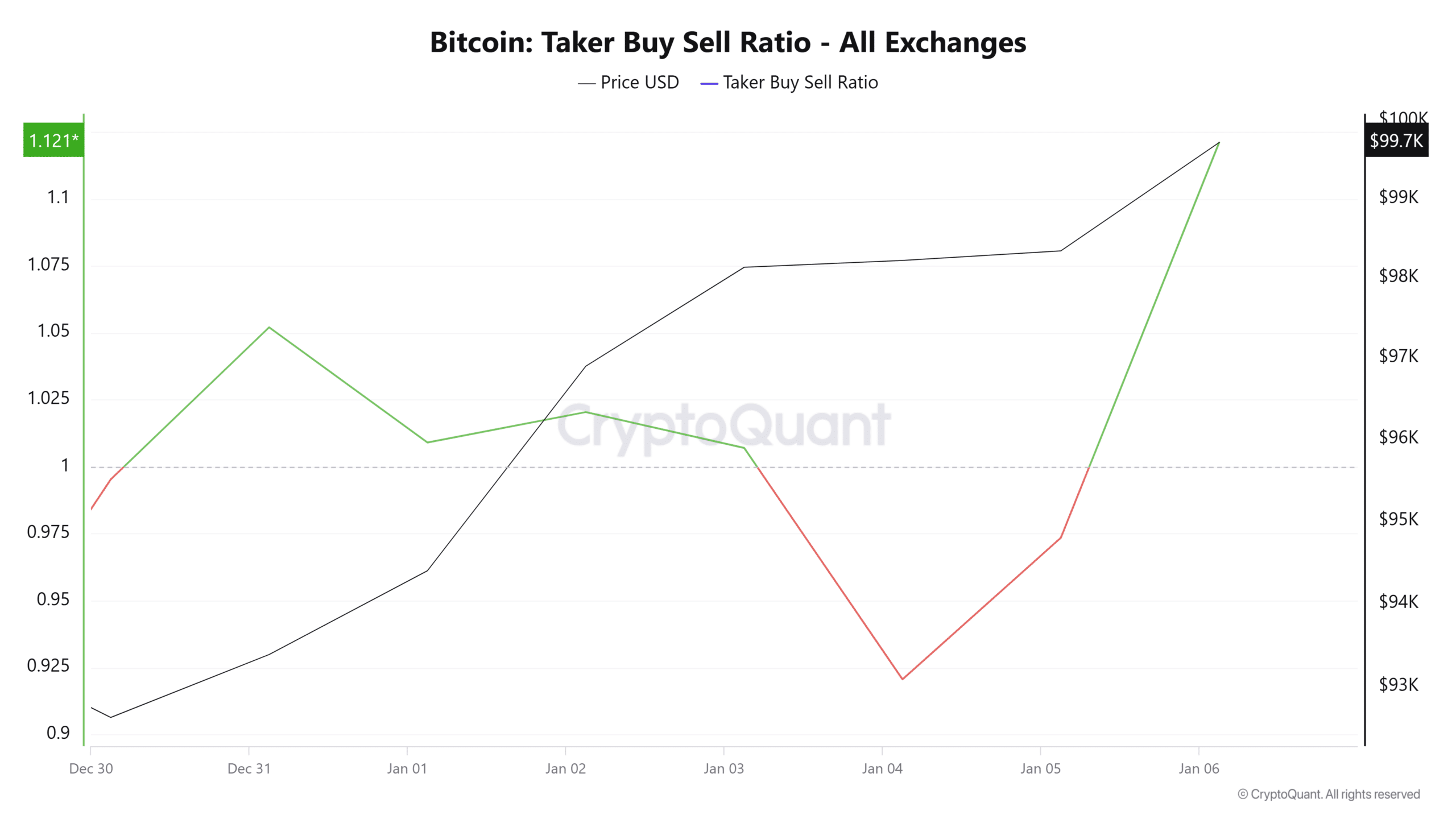

Source: CryptoQuant

For example, Bitcoin’s Taker buy-sell ratio has surged over the past 48 hours to reach 1.121. With a ratio above 1, it suggests that BTC experiencing aggressive buying activities, with buyers outpacing sellers.

This reflects bullish sentiment as short-term momentum towards the upside, with buyers dominating the market.

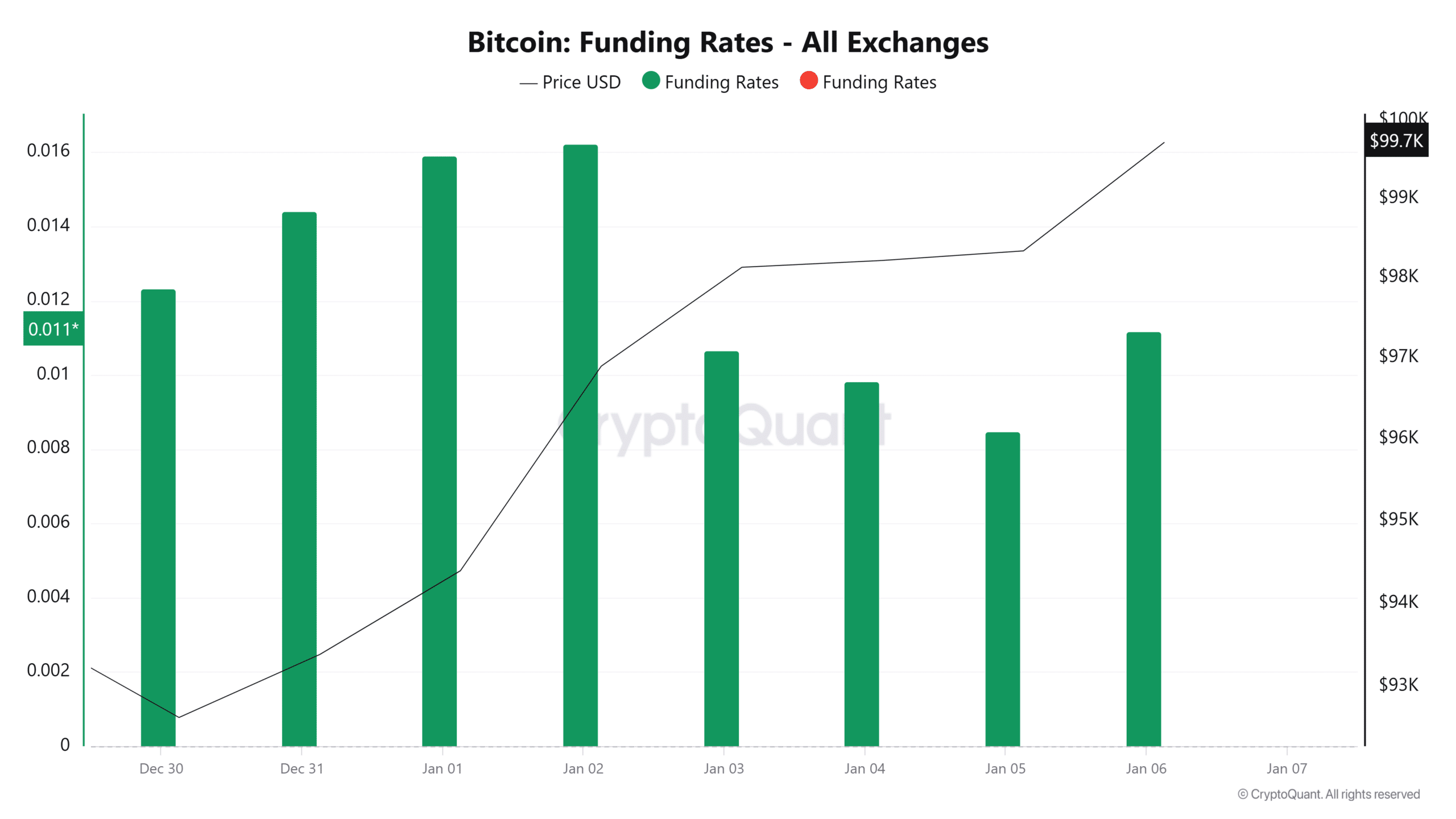

Source: CryptoQuant

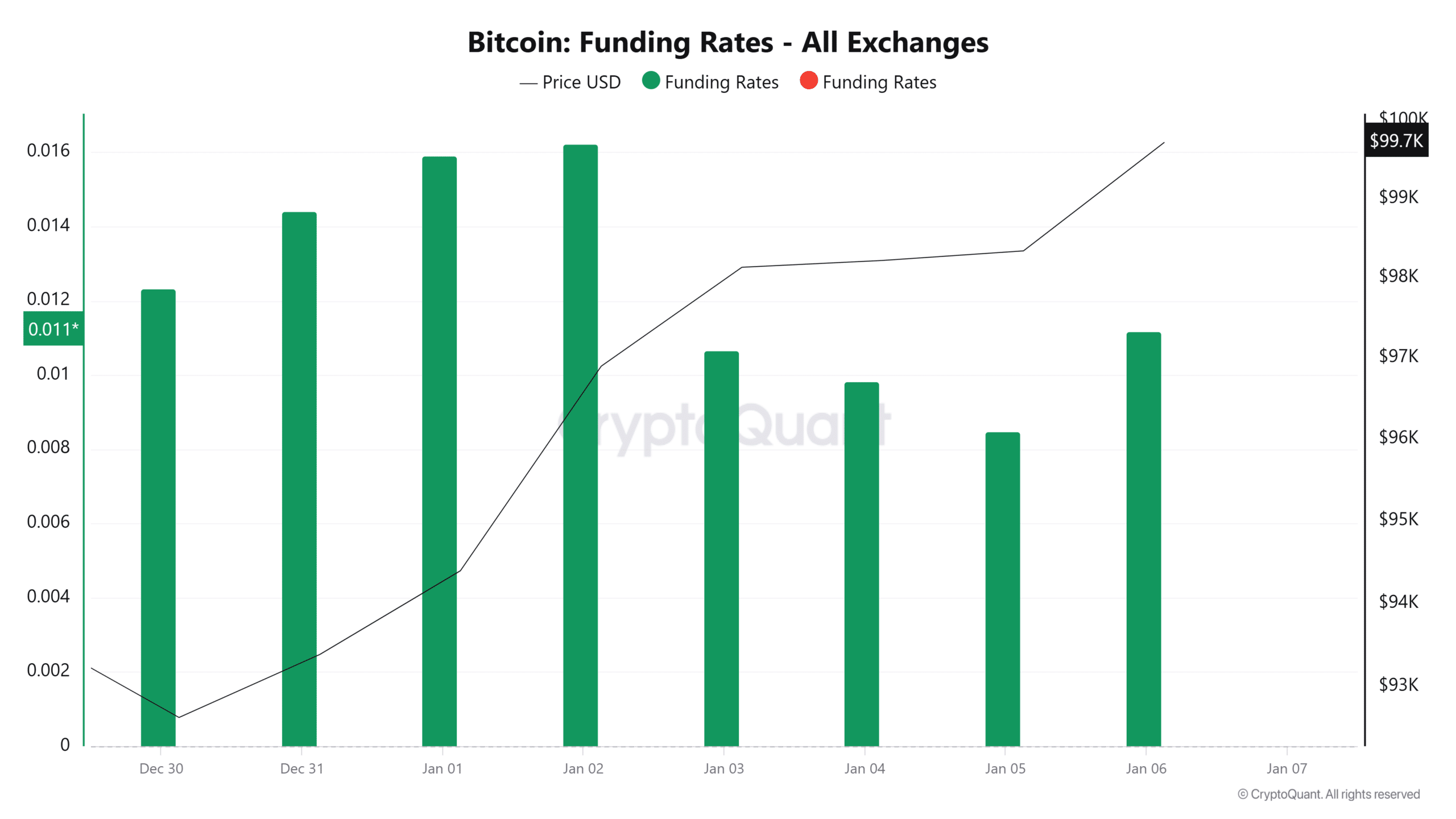

Additionally, Bitcoin’s Funding Rate surged over the past day from 0.0084 to 0.0124. When the Funding Rate rises, it shows that more traders are bullish and are opening long positions.

A demand for long positions reflects market confidence, with investors anticipating BTC prices to rise.

Source: CryptoQuant

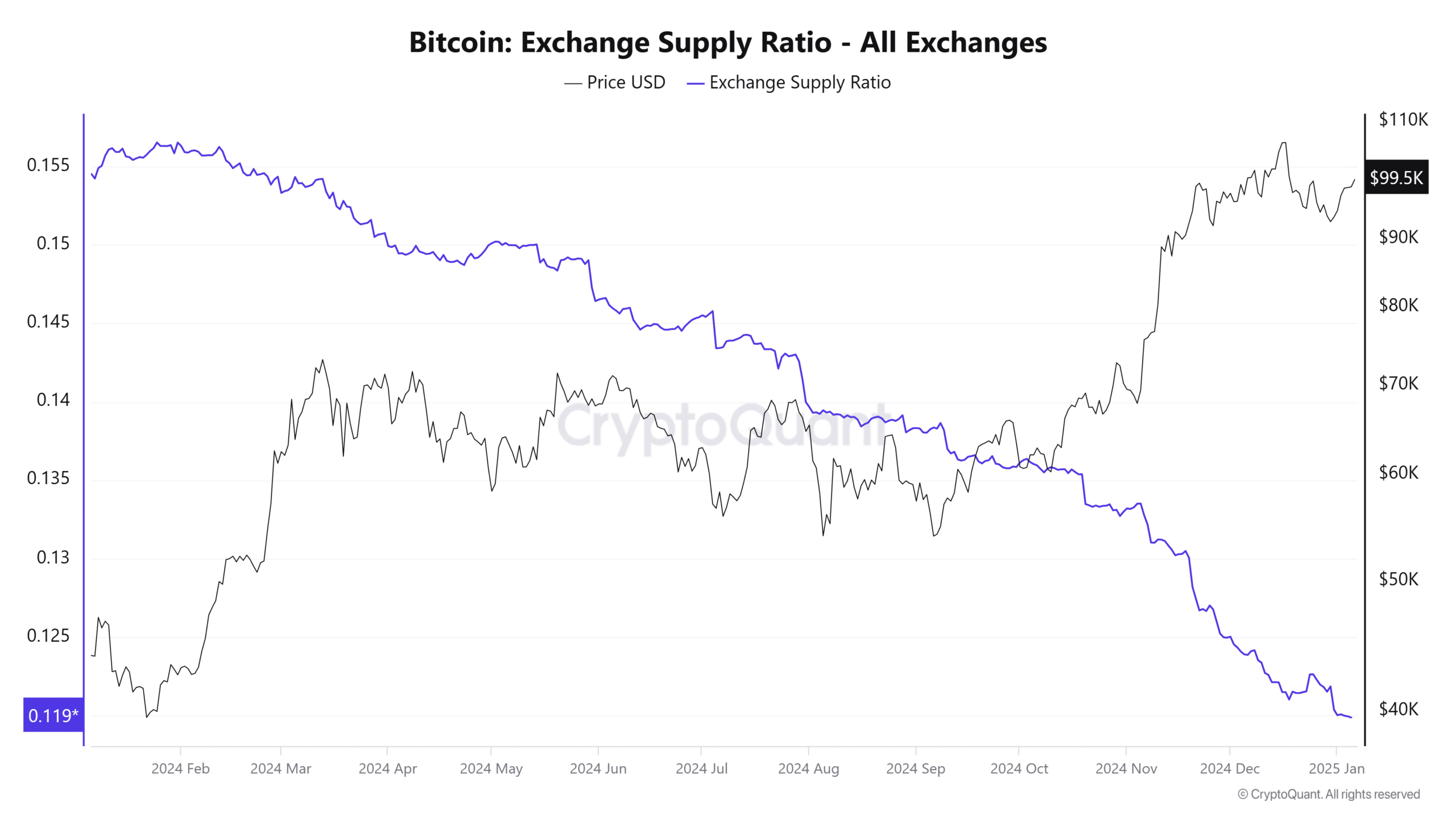

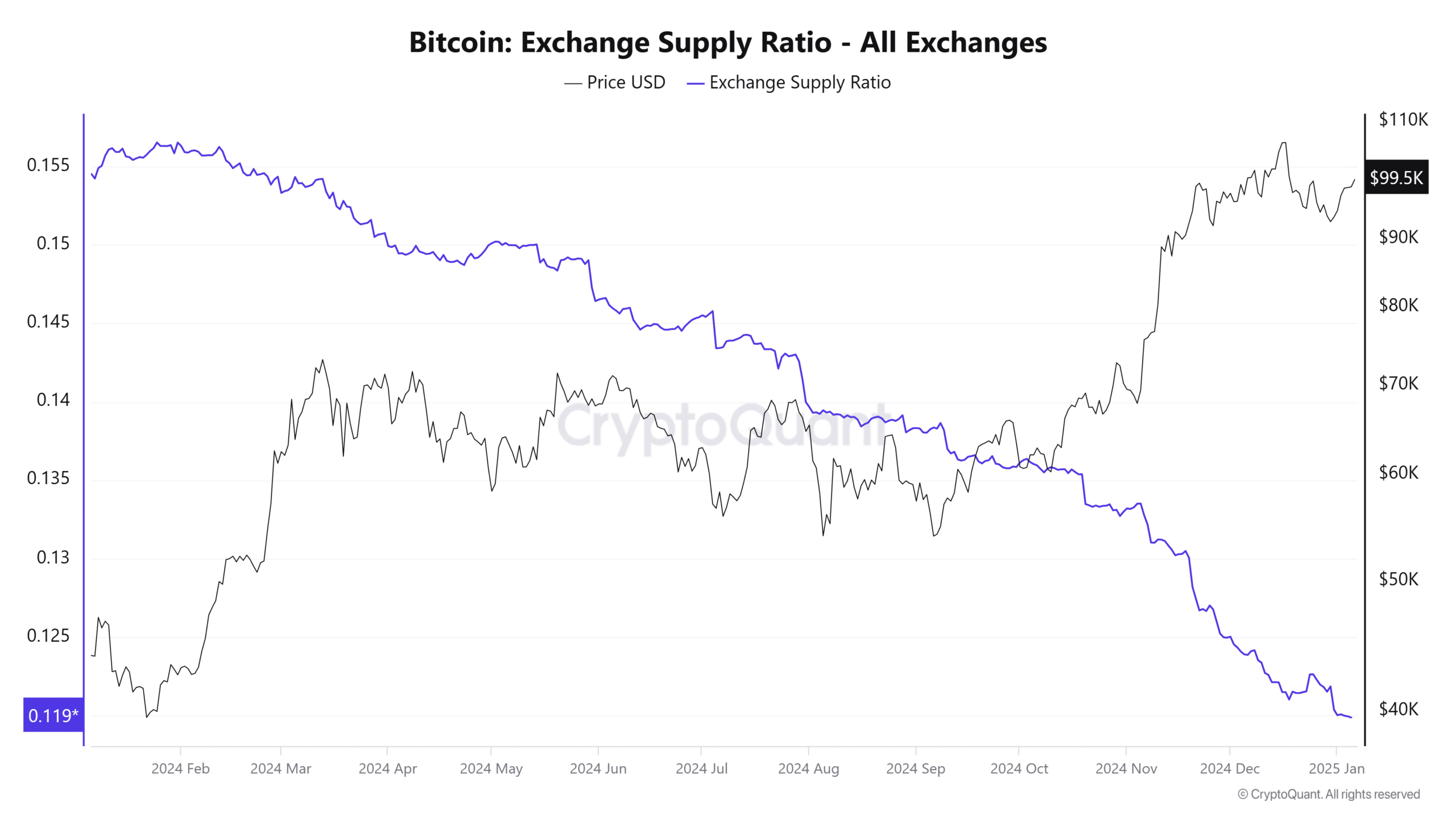

Finally, Bitcoin’s Exchange supply ratio has declined to hit a yearly low.

With a dip in supply to exchanges, it implies that investors are accumulating BTC by transferring to private wallets, expecting prices to rise further.

Simply put, although short-term holder’s profitability has declined, the market still seems strong, especially in the short term.

Therefore, this reduced profitability is yet to signal short-term market correction as investors are still bullish.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

With bullish sentiments still prevailing in the market and buyers regaining control, we could see BTC reclaim $100k and surge to $102,777.

Consequently, if the anticipated correction occurs, Bitcoin will drop to $95000.