- Bullish sentiment soars as halving event nears.

- However, some indicators suggest the possibility of a further drop in BTC’s value.

As the market awaits a price hike post-Bitcoin’s halving event, pseudonymous CryptoQuant analyst Gaah noted in a new report that a further decline in the coin’s value is still possible.

The halving event, scheduled for the 19th of April, is expected to reduce the number of BTC in circulation by slashing miner rewards in half, from 6.25 BTC to 3.125 BTC.

History books tell us this about the coin’s next move

Historically, the coin’s price has surged following halving events. According to Bloomberg’s data, BTC’s price climbed 8,691% one year after the 2012 halving, 295% after the 2016 event, and 559% after the 2020 event.

Despite recent market troubles, these precedents have led to a spike in bullish sentiment. However, according to Gaah, some indicators hint at the possibility of a further decline in BTC’s price.

Gaah assessed BTC’s Funding Rates on a 30-day moving average and noted that it has climbed,

“To the levels of the 2021 all-time high.”

When an asset’s Futures Funding Rate witnesses a surge and are significantly positive, it suggests a strong demand for long positions.

It is considered a bullish signal and a precursor to an asset’s continued price growth.

Is your portfolio green? Check out the BTC Profit Calculator

However, excessively high Funding Rates increase the risk of long liquidations, often leading to high market volatility and unpredictable price swings.

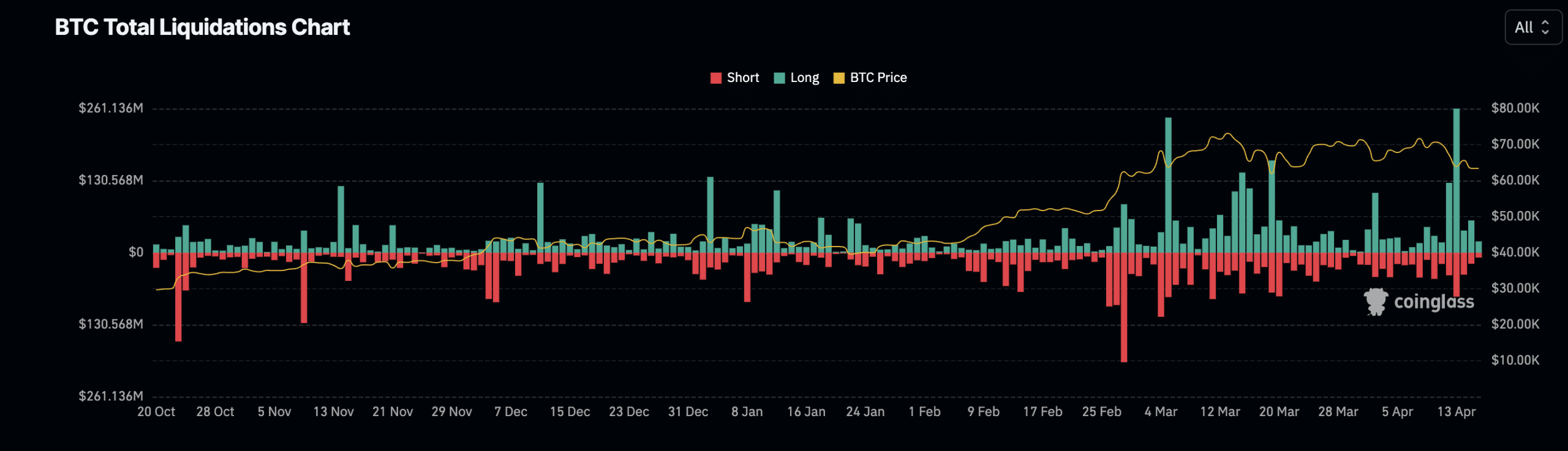

This happened on the 13th of April, when the coin’s price suddenly fell from the $67,000 price region to close the day at $62,000.

On that day, long liquidations rose to a multi-month high of $261 million, according to AMBCrypto’s look at Coinglass’ data.

Source: Coinglass

Gaah noted that BTC’s current all-time high, $73,750, represents,

“Its greatest resistance ever.”

This means there is high selling pressure at this price level, making it difficult for the price to rally past it to reach new highs.

Additionally, Gaah found that the rally in BTC’s price since October 2023 has spiked retail activity in the market, saying,

“It’s the first time in 3 years that the Retail flow hasn’t reached values above the mid-range, strongly indicating the presence of this category of investors in the market.”

Taking a cue from BTC’s historical performance, the analyst noted that a spike in BTC’s retain activity –

“Means a potential top is in the making.”

Hence, a price drop may be on the horizon.