- Though assets locked increased, the overall TVL lost 22% of its value.

- Sentiment around BNB remained positive but search for the coin fell.

Two days after BNB Chain disclosed that it had added native liquid staking on the Binance Smart Chain [BSC], the value of staked assets on the network rose.

For context, BNB Chain is a smart contract blockchain, but it is compatible with the Ethereum [ETH] Virtual Machine.

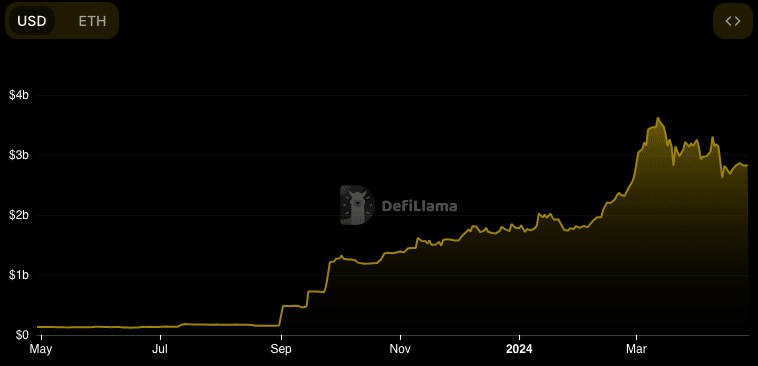

According to DeFiLlama, the Total Value Locked (TVL) of Binance [BNB] Staked ETH, the top liquid staking protocol on the chain, increased by 2.75% in the last seven days.

Quick impact but it’s still early days

At press time, the exact value was $582.76 million. The TVL of Stader, another liquid staking protocol on the network, registered a 6.98% increase within the same period.

Source: DeFiLlama

The increase in the metric implied that market participants deposited more assets on the BSC. Furthermore, the increase was proof of increased trust in the protocol.

According to BNB Chain, the Beacon Chain sunset fork set to be finalized in June was its reason for the introduction. The chain explained that,

“By issuing liquid staking tokens that represent staked BNB, users can engage in DeFi activities without sacrificing asset utility. The LSDFi integration is scheduled to take place between April and early May of 2024.”

With the development, delegators can compound staking rewards. Also, cross-chain migration between the BSC and BNB Beacon Chain might become easy.

BSC can’t catch up, can BNB?

Despite the increase in assets staked, the TVL of the BSC at large fell by 22.16% in the last 24 hours. If staking on the network improves, then the metric might climb.

Otherwise, the chain might not produce a substantial yield for participants. However, staking activity could also affect BNB Chain’s revenue. In Q1, AMBCrypto reported how the chain registered a 70% growth.

But April has not been so kind to the network, and revenue declined on several days. However, since the full liquid staking integration could be ready before the end of May, the revenue condition might improve.

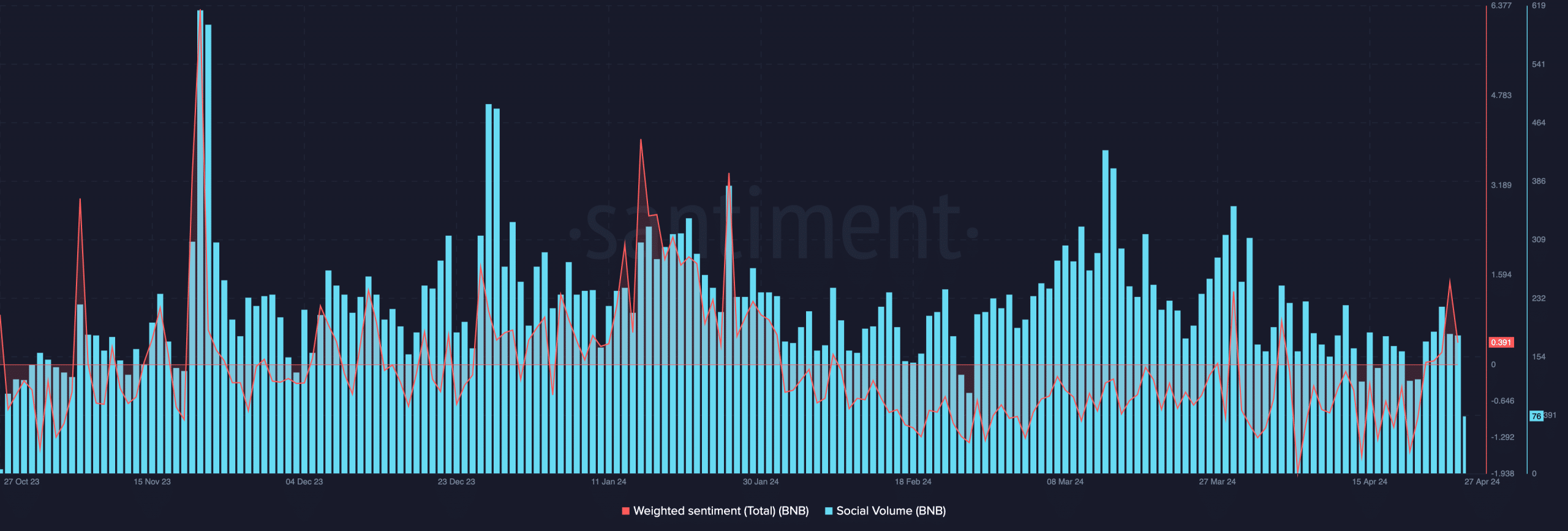

Looking at other aspects of the project, we noticed that the sentiment around it improved. According to Santiment, the Weighted Sentiment was as low as -1.631 on 20 April.

Meanwhile, press time data showed that the reading was positive. The boost was a hint that the perception around BNB was not as bearish as it was a week ago.

Source: Santiment

If this reading rises, then assets allocated to staking on BNB Chain might increase. If not, the value might stall, or in the worst case, participants might take out their assets.

Is your portfolio green? Check out the BNB Profit Calculator

In addition, on-chain data showed that social volume dropped. This means that arbitrary search for BNB, as an asset, decreased.

While this might affect demand for the cryptocurrency negatively, it is not a prerequisite that activity on the network will plunge.