- Whale accumulation and a potential breakout suggested that Brett may surge past $0.18 soon.

- Technical indicators and rising Open Interest reinforced the bullish outlook.

A crypto whale has made a bold move in the Brett [BRETT] market, withdrawing 525 Ethereum [ETH] ($1.74M) from Coinbase and using 400 ETH to purchase 10.83M BRETT at $0.124.

The whale now holds 12.38M BRETT worth $1.61M and retains 125 ETH in reserve.

At press time, BRETT was trading at $0.1342, reflecting a 15.09% increase over the past 24 hours.

This significant accumulation indicates growing confidence in BRETT’s potential, with many traders anticipating a strong upward move.

Brett: Promise for breakout

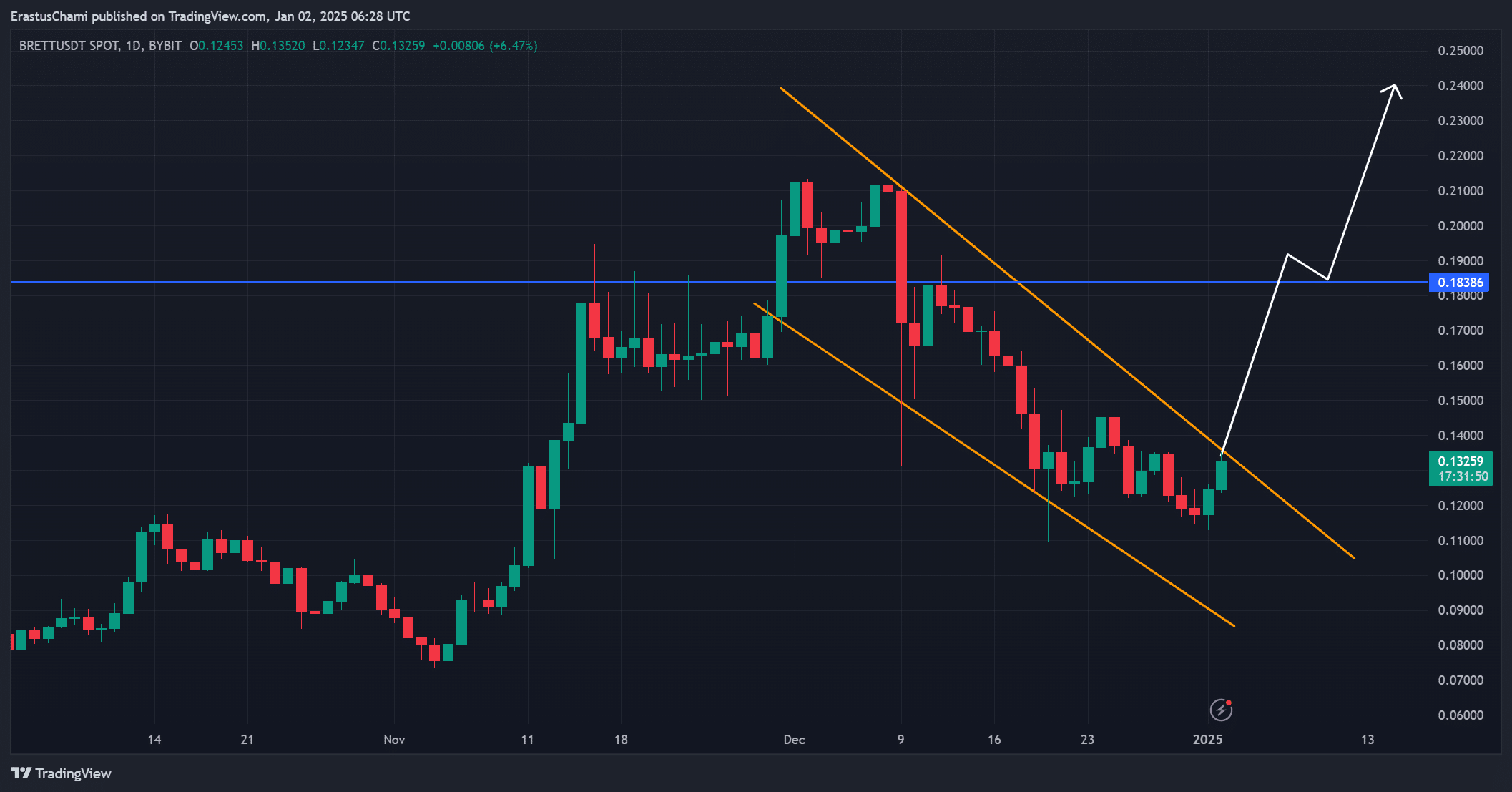

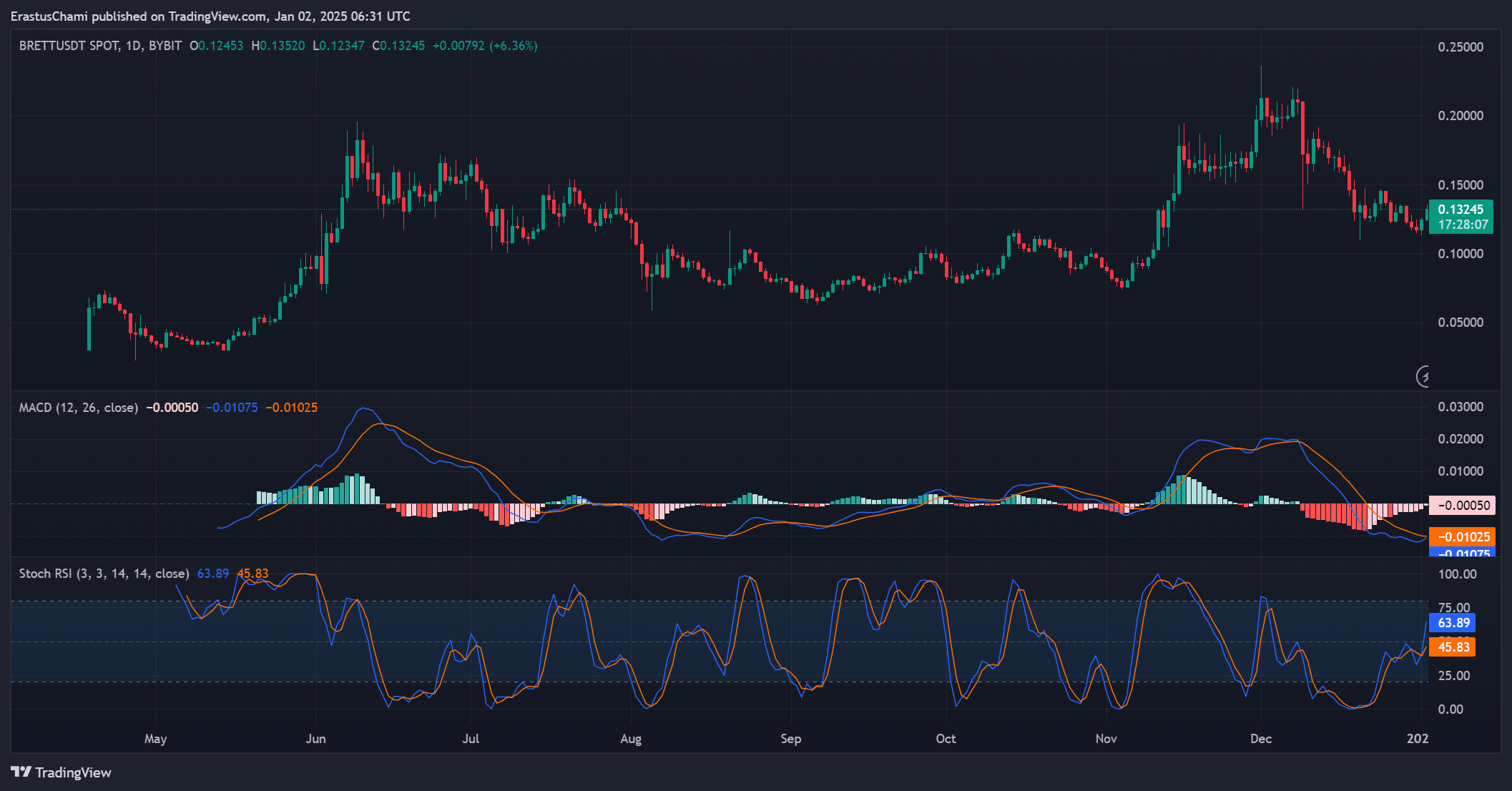

Brett was approaching a crucial turning point as it edged closer to breaking out of its descending wedge channel, a formation often linked to bullish reversals.

The key resistance level lay at $0.18, and successfully breaking through this point could trigger a surge toward $0.24 or higher.

Additionally, the whale’s recent accumulation suggested that large investors saw significant upside potential in the memecoin.

The steady recovery in price over the past 24 hours underscored the growing market optimism as Brett attempted to confirm its breakout.

Source: TradingView

Brett sees increasing attention

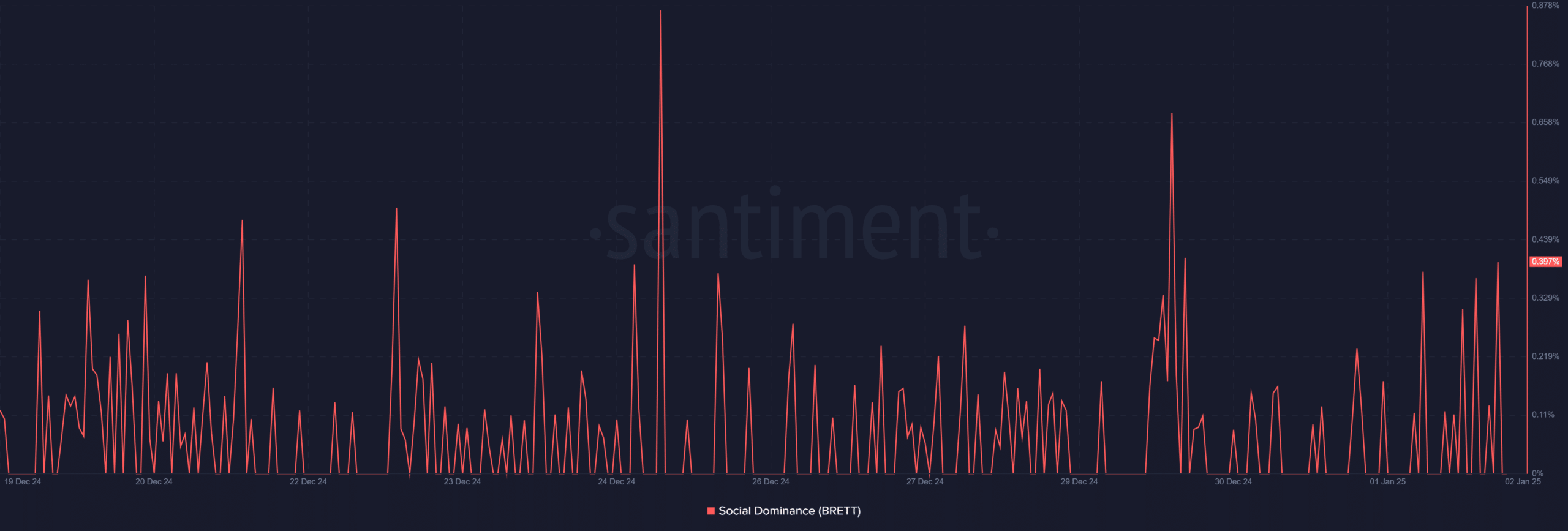

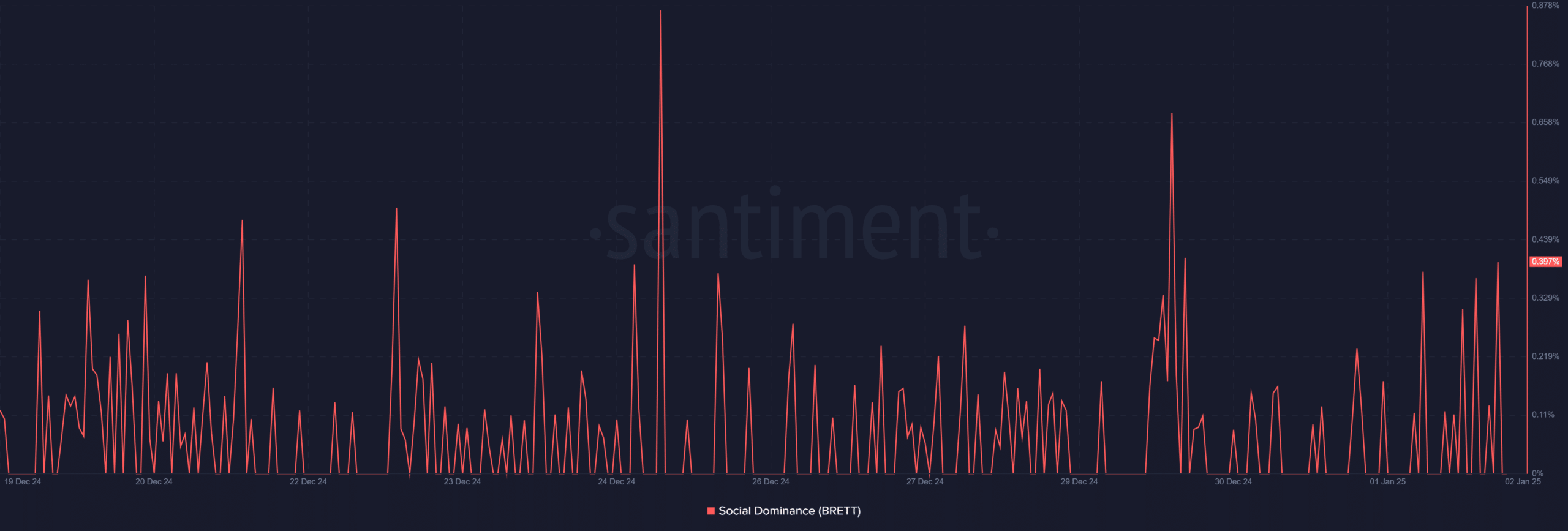

Social Dominance highlighted growing interest in the token, with a slight increase from 0.30% the previous day to 0.397.

This rise signals heightened community engagement, which often coincides with stronger price movements.

Furthermore, increased mentions and discussions across platforms boosts visibility and attracts additional investors.

This growing momentum within the community is creating a favorable backdrop for BRETT’s price action as enthusiasm builds.

Source: Santiment

Technical indicators reveal bullish momentum

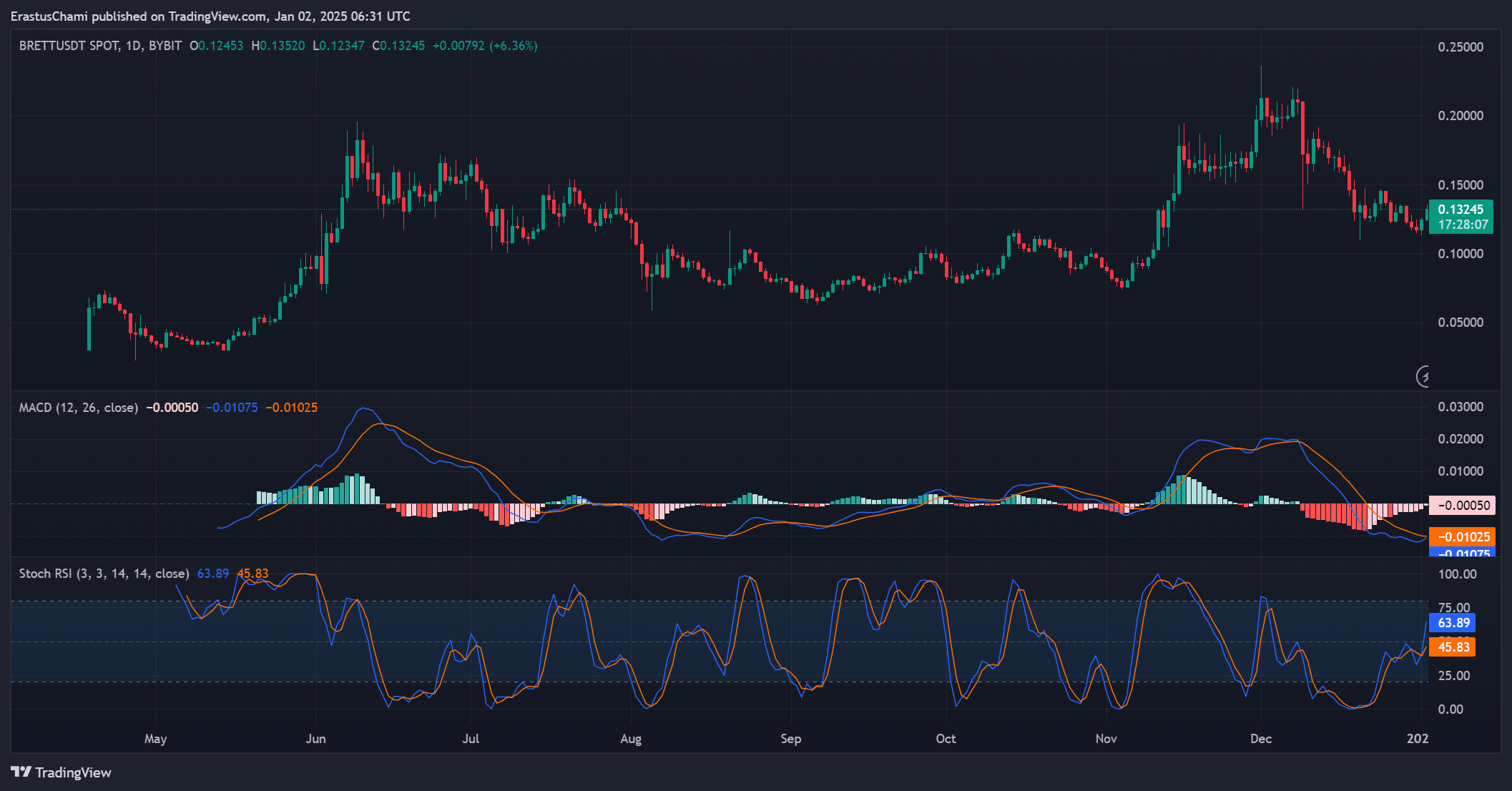

Technical indicators also point to strengthening bullish momentum. The MACD on the daily chart is at -0.01025, indicating the potential for a bullish crossover.

Additionally, the stochastic RSI, at 63.89 at press time, showed increasing buying pressure.

Thus, Brett’s price action was gaining traction, supported by favorable technical conditions. With these indicators aligning, Brett appeared well-positioned for a continued upward trend in the near term.

Source: TradingView

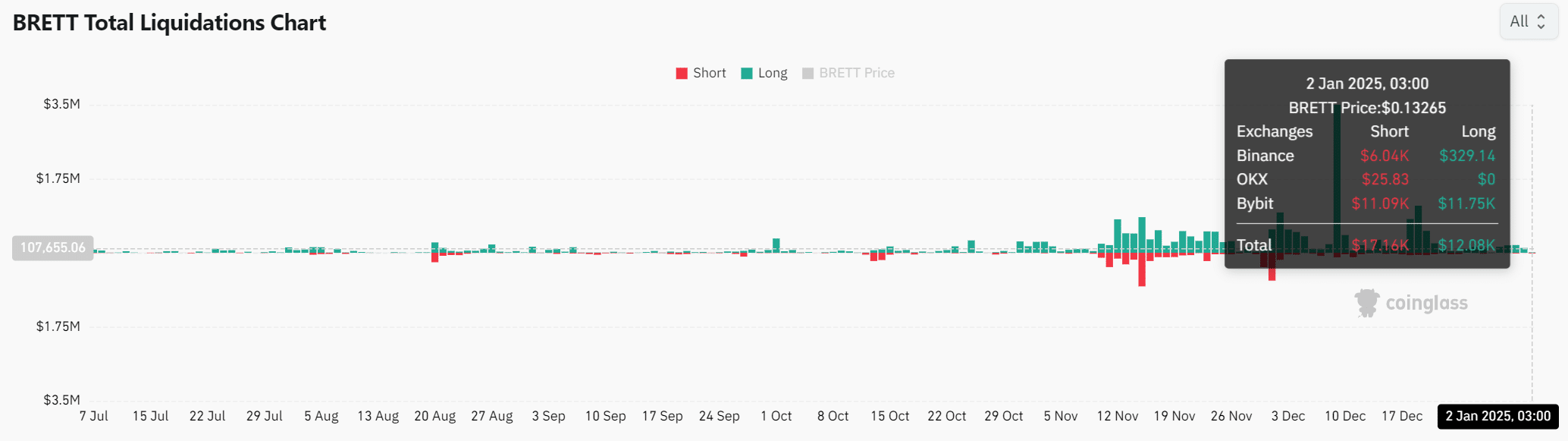

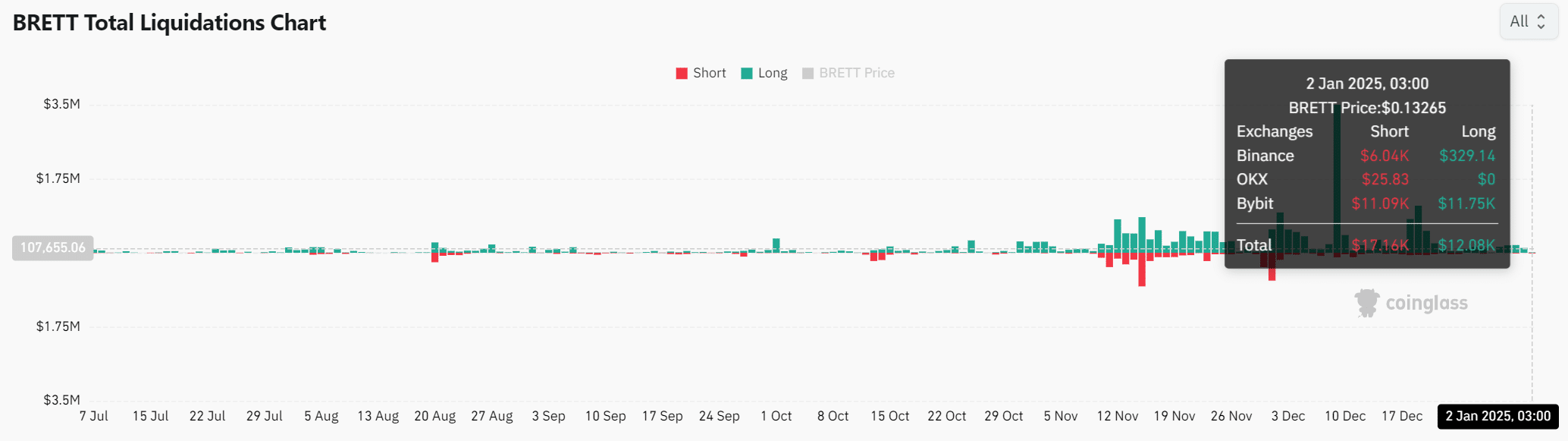

Liquidations and OI reflect market confidence

Brett’s total Open Interest has increased by 13.65% to $61.66M, highlighting heightened activity in the futures market.

Liquidation data revealed $17.16K in short positions and $12.08K in long positions, showing active positioning on both sides.

The higher liquidation of short positions indicated strong buying pressure as traders betting against Brett faced losses, reinforcing the bullish momentum.

However, the presence of long liquidations suggested caution among some traders, possibly due to price volatility.

This balanced dynamic underscored a market poised for significant movement, driven by rising participation and anticipation of a breakout.

Source: Coinglass

Read Brett’s [BRETT] Price Prediction 2024–2025

Brett’s price action, technical indicators, and increased market activity suggest a strong bullish outlook.

The token is primed for a breakout above $0.18, which could lead to a surge toward $0.24 and beyond. Brett appears ready to deliver significant gains in the coming days.