- Cardano’s user activity has declined.

- ADA selling pressure has rallied.

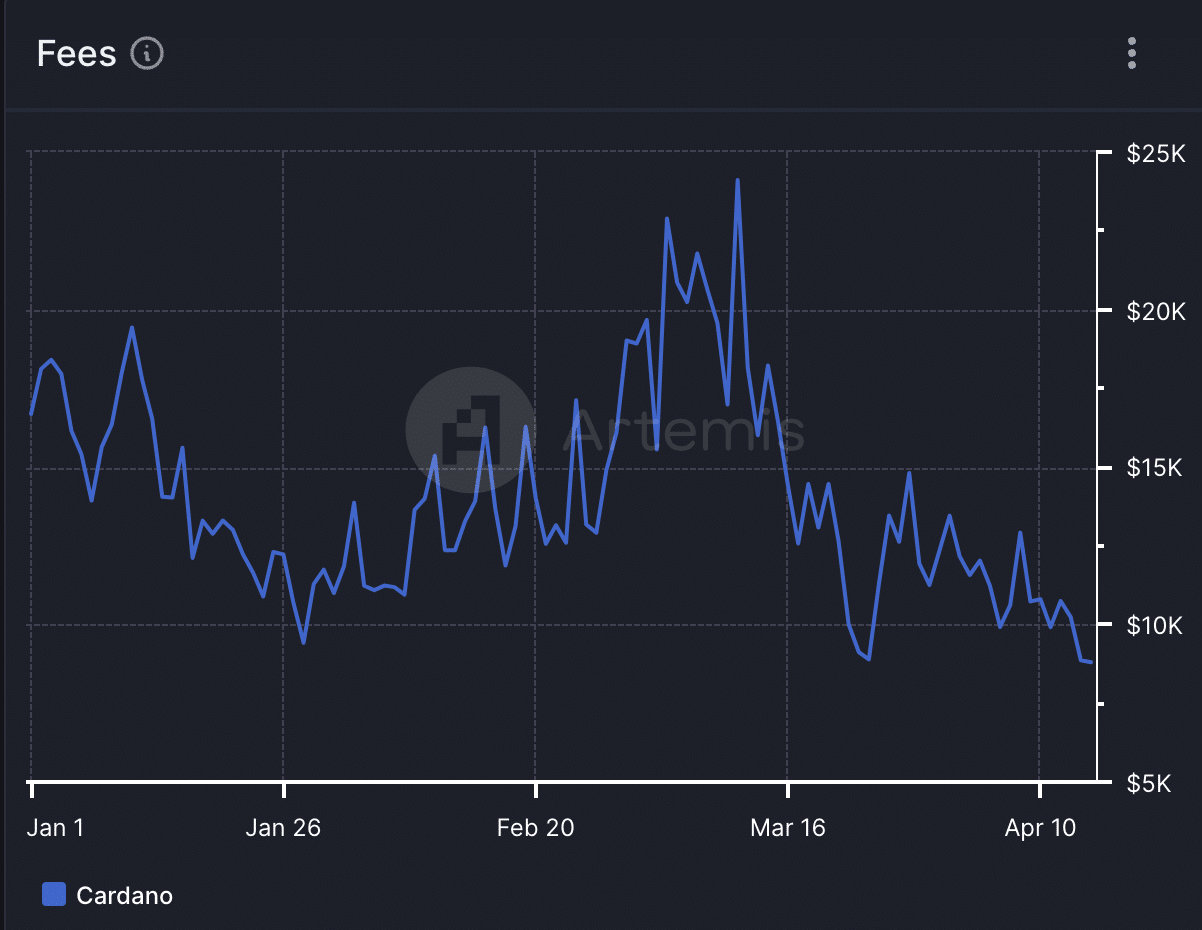

Cardano’s [ADA] daily network fees have dropped to a year-to-date (YTD) low as user activity on Layer 1 (L1) blockchain decreases, according to Artemis’ data.

As of the 15th of April, transaction fees paid by Cardano users totaled $9,000. This marked over a 90% decline from the $17,000 it recorded in fees on the 1st of January.

Data from Artemis showed that Cardano’s daily transaction fees peaked at $24,000 on the 11th of March and have since trended downward.

Source: Artemis

The decline in daily transaction fees on Cardano is due to the decrease in user activity on the network.

On-chain data showed that the daily count of unique wallet addresses interacting with Cardano reached a YTD high of 71,300 on the 6th of March and initiated a decline.

At 38,000 as of 14th April, Cardano’s daily active address count has since plummeted by 47%.

As the number of daily active addresses on the chain fell, the count of transactions completed on Cardano daily also dropped. Per Artemis, this has also decreased by 47% in the last month.

DeFi and NFT ecosystems suffer

The decline in Cardano’s user activity in the past few weeks has impacted its decentralized finance (DeFi) and non-fungible token (NFT) ecosystems.

Data from DefiLlama showed that the total value of assets locked (TVL) across the DeFi protocols housed within Cardano has fallen to a three-month low. At press time, this was $306 million.

The network’s TVL reached a YTD peak of $456 million on 15th March and has since declined by 33%.

Regarding its NFT sector, Cardano has witnessed a similar decline.

Per CryptoSlam, the network’s NFT sales volume has cratered by 39% in the last month, and total NFT sales transactions completed have dropped 46%.

Low demand for ADA as well

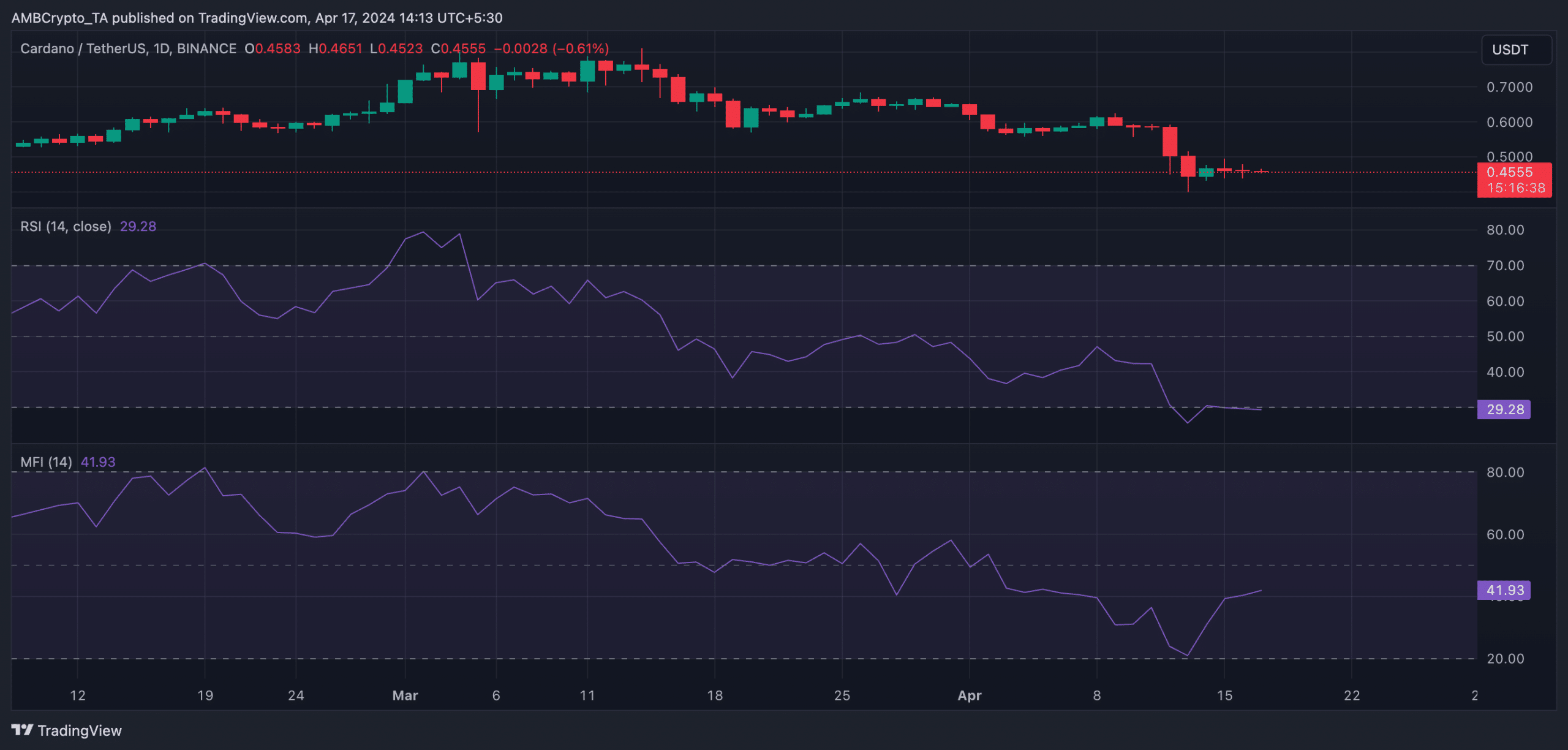

The network’s native coin, ADA, has not been spared from the decline. Exchanging hands at $0.45, the coin’s price has decreased by 21% in the last seven days.

The altcoin’s key momentum indicators, observed on a daily chart, revealed a significant decline. At press time, its Relative Strength Index (RSI) was 29.51, showing that it was oversold.

Read Cardano’s [ADA] Price Prediction 2024-25

Likewise, its Money Flow Index (MFI) trended downward at 41.94.

Source: ADA/USDT on TradingView

At these values, these indicators showed that selling activity outpaced coin accumulation.