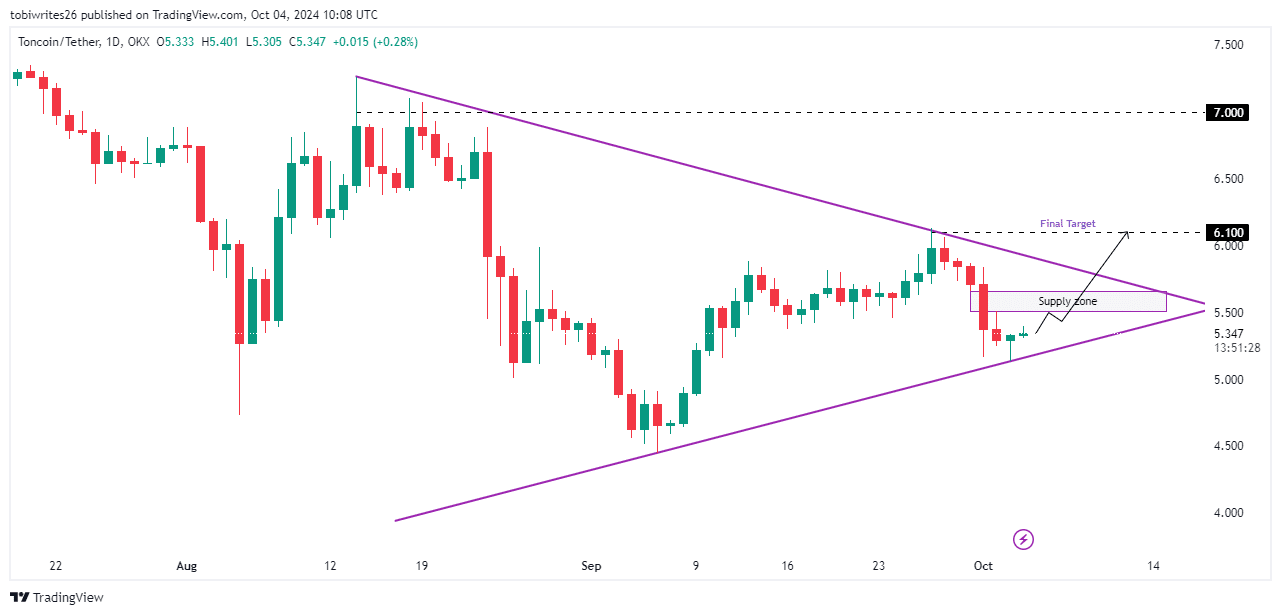

- TON was navigating a large symmetrical triangle formation, suggesting a potential price move that could propel it toward $7.

- A nearer-term rally to $6 is conceivable but contingent on overcoming substantial selling pressure.

Following a market-wide downturn that saw Toncoin [TON] value decrease by 8.0% over the past week to $5.135, the cryptocurrency is showing signs of recovery. It has risen by 2.41% in the last 24 hours, buoyed by strong support levels, with the price trend appearing to ascend.

While TON targets a short-term goal of reaching $6.1, it encounters potential risks that could precipitate further declines. AMBCrypto provides an in-depth analysis of TON’s potential for a rally.

Evolving patterns in TON’s market dynamics

Previously, TON’s downturn was largely attributed to a fallback from a resistance line and breaching an ascending trendline. However, the scenario has shifted and now trades within a larger symmetrical triangle.

This symmetrical triangle, typically a bullish indicator, is where Toncoin is currently trading. The recent uptick in its market value is linked to rebounds from the support edge of this pattern, resulting in two consecutive daily bullish candles.

Despite the momentum of this rally, there are looming risks of a decline. TON is approaching a supply zone between $5.510 and $5.657, which could drag down its price further if the support fails to sustain buying pressure.

Conversely, breaking past this level could propel TON towards a target of $6.1.

Source: Trading View

AMBCrypto has analyzed whether this rally can be maintained and if the short-term target of $6.1 is achievable.

Sustained upward momentum in TON trading

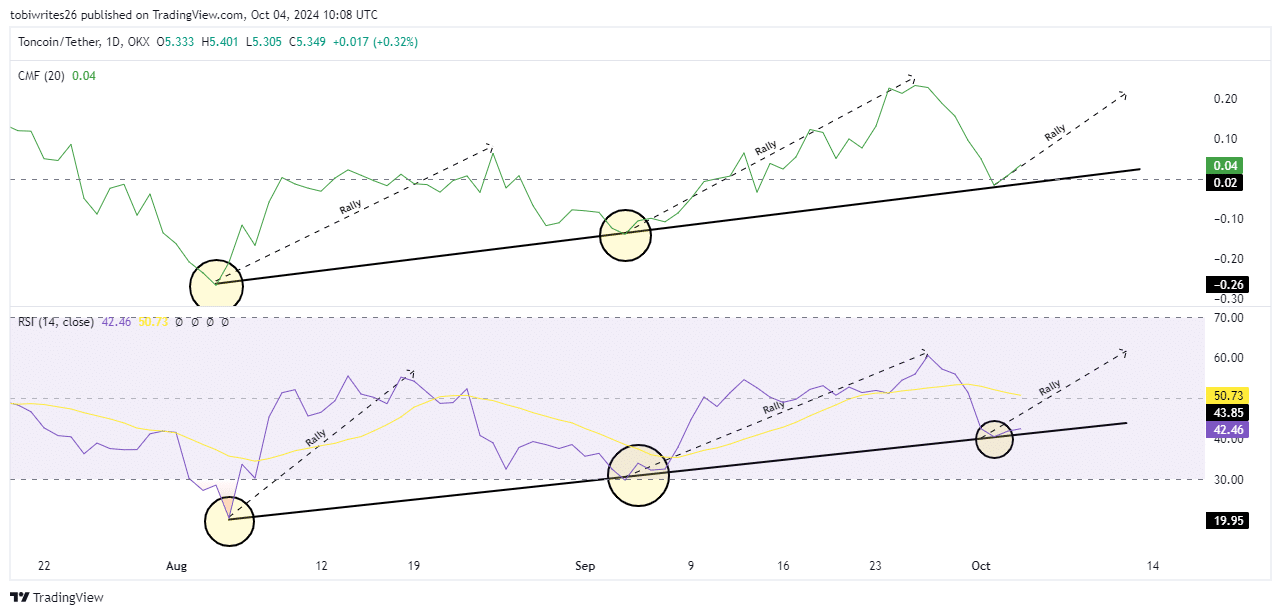

Recent trends indicate a rising momentum among traders interested in acquiring TON, as evidenced by two key indicators: the Chaikin Money Flow (CMF) and the Relative Strength Index (RSI).

The CMF is an important technical tool that assesses the flow of money into and out of an asset. A CMF value above zero that is trending upward indicates a growing buying interest, a trend currently mirrored in TON’s market activity.

Similarly, the RSI, which measures the speed and change of price movements, aligns with this upward trend. It is currently at 42.54 and climbing which suggests that TON has peaked for a significant rally, particularly once it surpasses the 50 threshold.

Source: Trading View

Given the influx of liquidity and increasing bullish momentum, there is a heightened likelihood that TON will break through its anticipated supply level.

Capital trends favor a bullish outlook for Toncoin

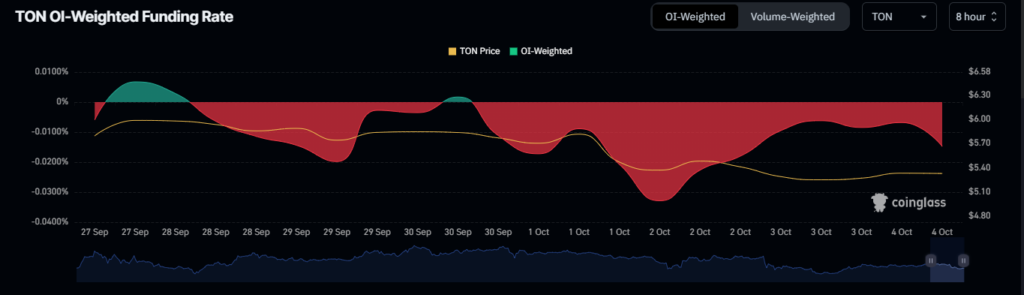

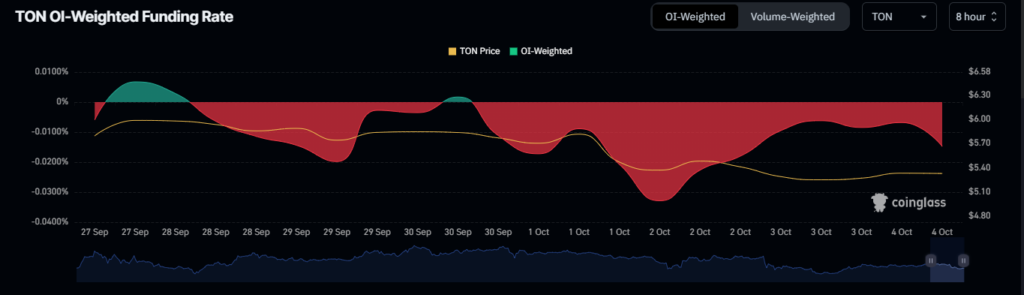

Utilizing the Open Interest (OI) Weighted Funding Rate, AMBCrypto has determined that the prevailing market sentiment is decidedly bullish, indicating a strong inclination of capital flow in that direction.

Read Toncoin’s [TON] Price Prediction 2024–2025

The OI-weighted funding rate chart indicates that TON is progressively exiting bearish territory, which signals an increase in long-position traders entering the market.

Source: Coinglass

Crossing into the bullish zone would confirm that TON is well-positioned to achieve its short-term and long-term price targets of $6.1 and $7.0, respectively.