- DeFi TVL hits $133 billion, the closest to the 2021 highs.

- Ethereum leads with 58%, and Bitcoin Layer-2 networks gain traction.

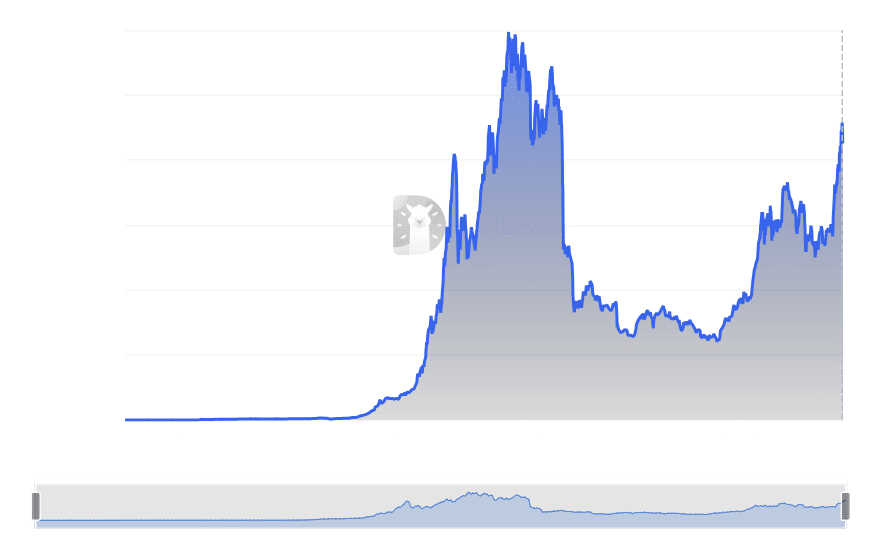

The Total Value Locked (TVL) in decentralized finance (DeFi) has seen remarkable growth throughout 2024, particularly in the final quarter. On the 5th of December, the TVL spiked to approximately $133 billion.

This was its highest level since the sharp decline in 2022.

Although it has slightly dropped to $127.7 billion as of this writing, the metric still signals a significant recovery. However, it remains far from the all-time high of $171 billion in 2021.

Liquid staking and lending platforms lead DeFi TVL’s growth

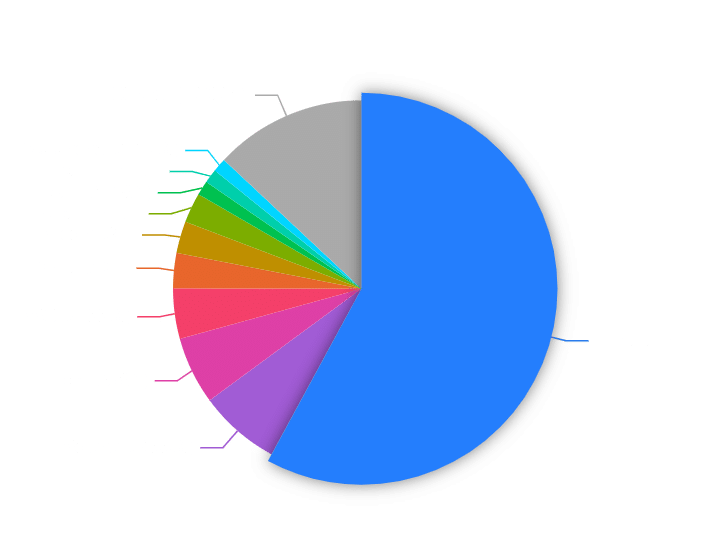

A detailed analysis of DeFi protocols on DefiLlama showed that platforms specializing in liquid staking and lending have been pivotal to the surge in TVL.

Lido [LDO], a liquid staking platform, currently leads the pack with a massive $39 billion TVL, accounting for nearly 30% of the total DeFi value.

Following is Aave [AAVE], a lending platform boasting almost $22 billion, while Eigenlayer [EIGEN], a staking-focused platform, holds the third-largest share with over $18.5 billion.

Source: DefiLlama

The rise of these platforms highlights a growing trend among users seeking yield-earning opportunities while maintaining liquidity.

Their dominance underscores a shift in DeFi priorities as platforms offering staking solutions become the backbone of the ecosystem.

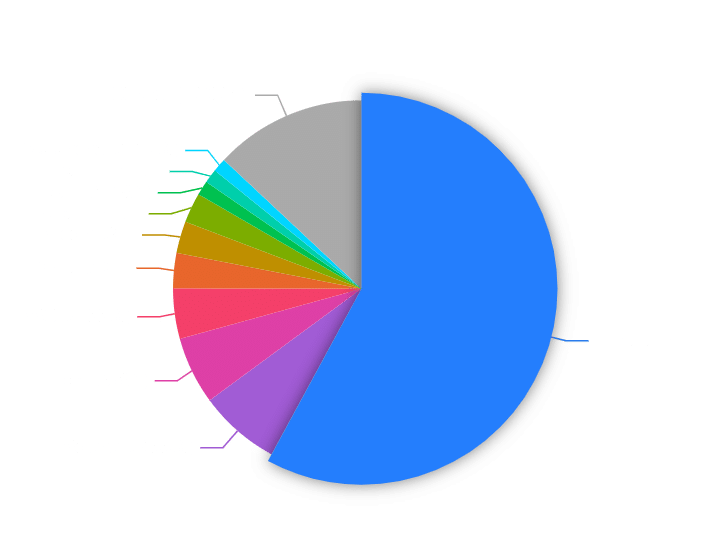

Ethereum maintains dominance in DeFi TVL

Ethereum [ETH] continues to dominate the DeFi landscape, serving as the foundation for most leading platforms. The Ethereum network accounts for over 58% of the total DeFi TVL, with nearly $74 billion locked.

This solidifies Ethereum’s status as the go-to chain for decentralized finance, with its ecosystem fueling a majority of staking, lending, and trading activities.

Source: DefiLlama

Interestingly, Solana [SOL] has emerged as the second-largest contributor to DeFi TVL with almost $9 billion and holding 7% of the total TVL. Tron [TRX] followed closely behind with $7.4 billion, representing 5.8%.

Solana’s growth highlights its increasing role in the DeFi ecosystem.

Bitcoin’s Layer-2 networks push TVL to new heights

Bitcoin [BTC] has also seen a resurgence in DeFi activities, primarily due to the rapid adoption of its Layer 2 (L2) networks.

Recently, Bitcoin’s TVL hit a historic high of over $3.7 billion, pushing its share of the DeFi market to above 2%.

Although the figure has slightly dropped to $3.5 billion, its dominance remains steady, reflecting growing interest in Bitcoin-based DeFi solutions.

Source: DefiLlama

Furthermore, the increasing popularity of Bitcoin’s L2 networks, such as the Lightning Network, enables a new wave of DeFi use cases for the leading cryptocurrency.

These advancements are helping Bitcoin evolve beyond its primary role as a store of value, paving the way for broader utility in decentralized finance.

Recovery for DeFi?

The ongoing growth in DeFi TVL reflects recovery after the market downturn in 2022.

While the total TVL is still below its 2021 highs, the rise of innovative platforms and expanding adoption across blockchains like Ethereum, Solana, and Bitcoin signals a maturing ecosystem.

As liquid staking and lending protocols lead the charge, the future of DeFi appears poised for continued growth.

Whether the 2021 all-time high will be surpassed remains uncertain, but the steady momentum offers a promising outlook for decentralized finance as it attracts more users and capital.