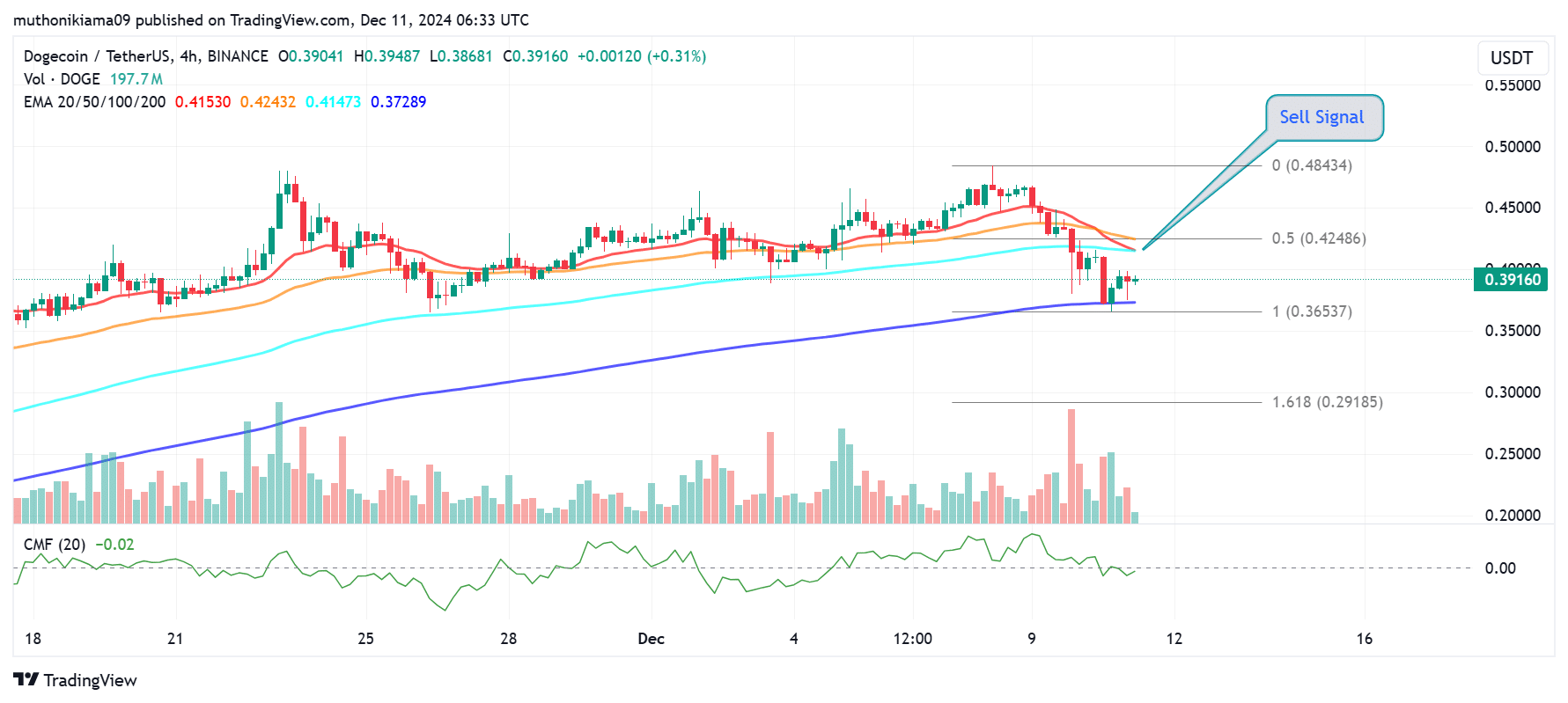

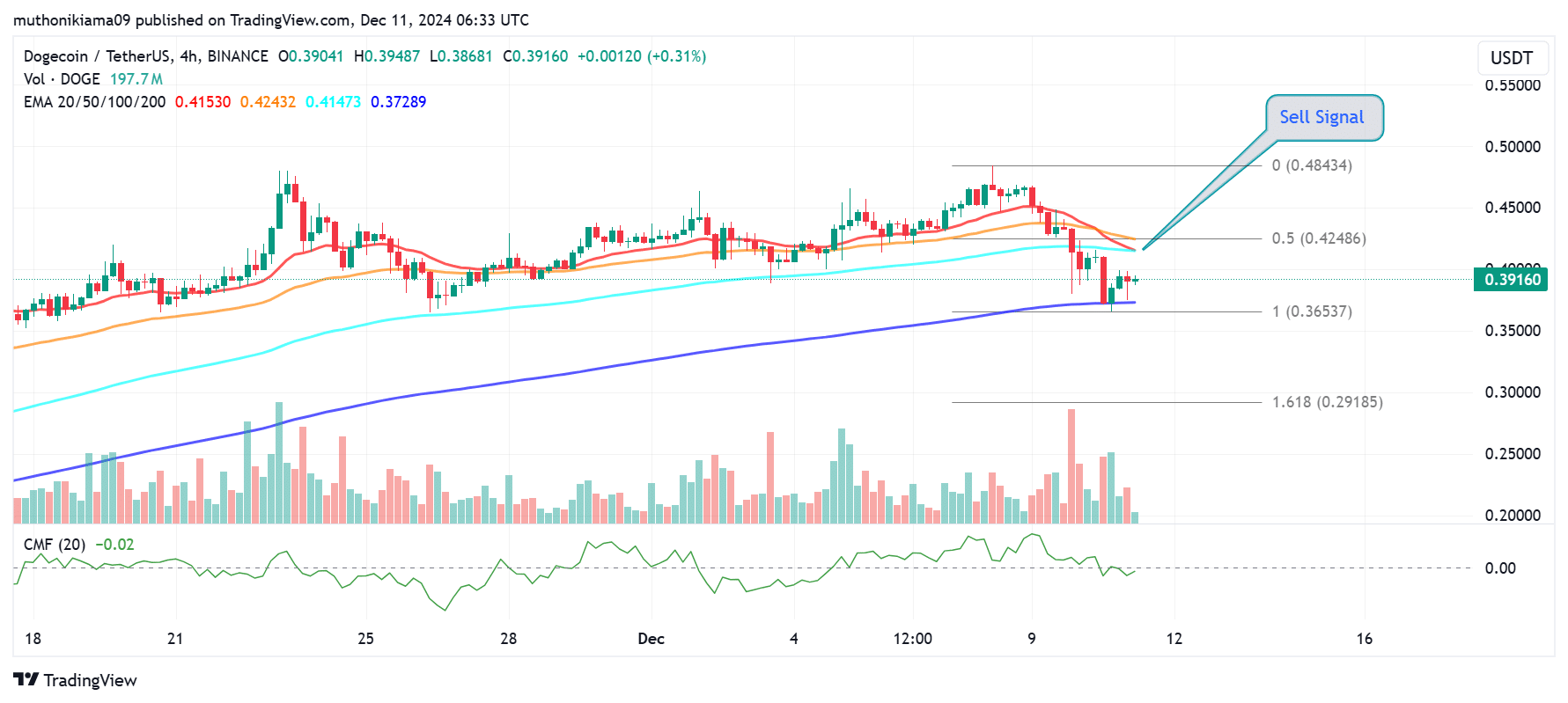

- Dogecoin formed a sell signal after the 20-day EMA converged with the 100-day EMA, which depicts a weakening short-term trend.

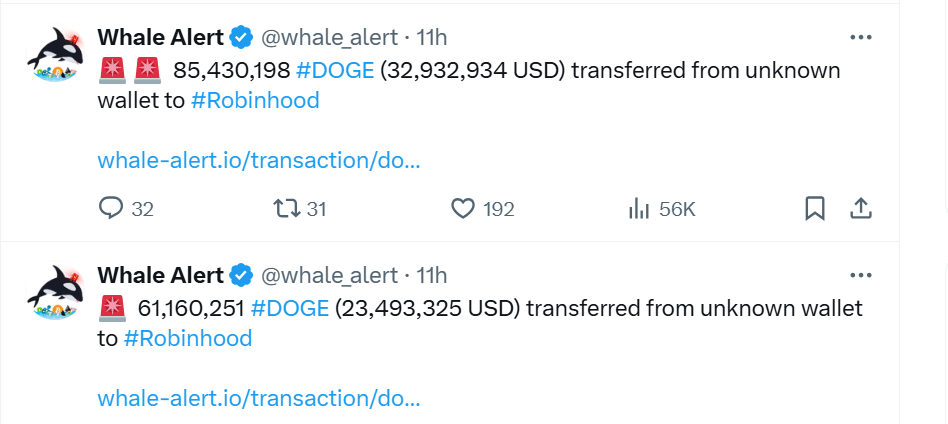

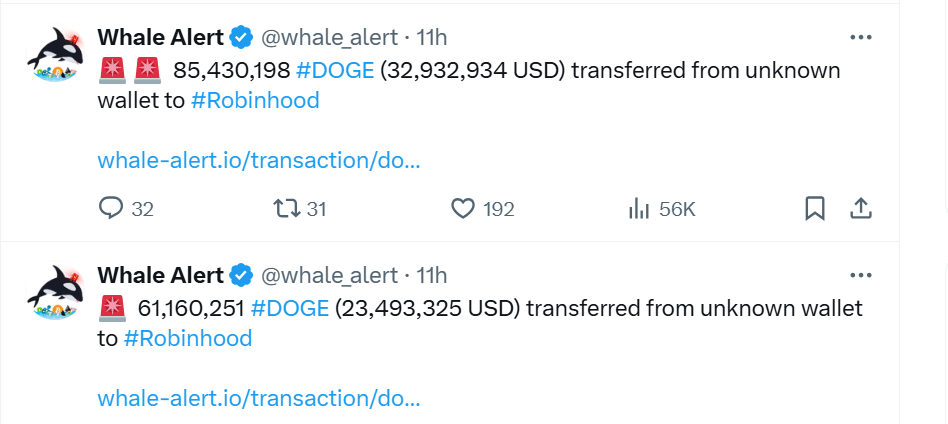

- Whales could also profit after two large addresses moved $56M worth of DOGE to Robinhood.

Dogecoin [DOGE] is facing a correction after its remarkable rally that saw it hit a multi-year-high above $0.48. At press time, the largest memecoin was trading at $0.39 having dropped by 3.49% in 24 hours.

Dogecoin faces more bearish trends, as depicted in its four-hour chart. DOGE is trading below the 20-day, 50-day, and 100-day Exponential Moving Averages (EMAs), suggesting a bearish short-term trend.

A crucial support level lies at the 200-day EMA ($0.34). If Dogecoin falls below this price, the long-term trend could also flip negative.

A sell signal was emerging on this lower timeframe after the 20-day EMA converges with the 100-day EMA. If the 20-day EMA falls below $0.41 and moves below the longer-term moving average, it will confirm this sell signal and cause a downturn.

Source: TradingView

The Chaikin Money Flow (CMF), with a negative value of -0.02 also showed that sellers were already active.

If Dogecoin’s trend continues to weaken, as sellers dominate the market, it could dip to the 1.618 Fibonacci level ($0.29).

Conversely, a crucial resistance level lies at the 0.5 Fib level of $0.42, which is also the 50-day EMA. If the dip attracts buyers, DOGE could flip this level, and resume its uptrend.

Are Dogecoin whales taking profits?

Data from Whale Alert shows that two whale addresses transferred 146M DOGE tokens, valued at more than $56.42M, to the Robinhood exchange on the 10th of December. This transfer could indicate an intent to sell.

Source: X

As AMBCrypto reported, Dogecoin whales rapidly accumulated the memecoin last month, which influenced the short-term price action.

If these whales begin to sell at the same rate at which they bought, DOGE is at risk of wiping out its recent gains.

Speculative interest wanes

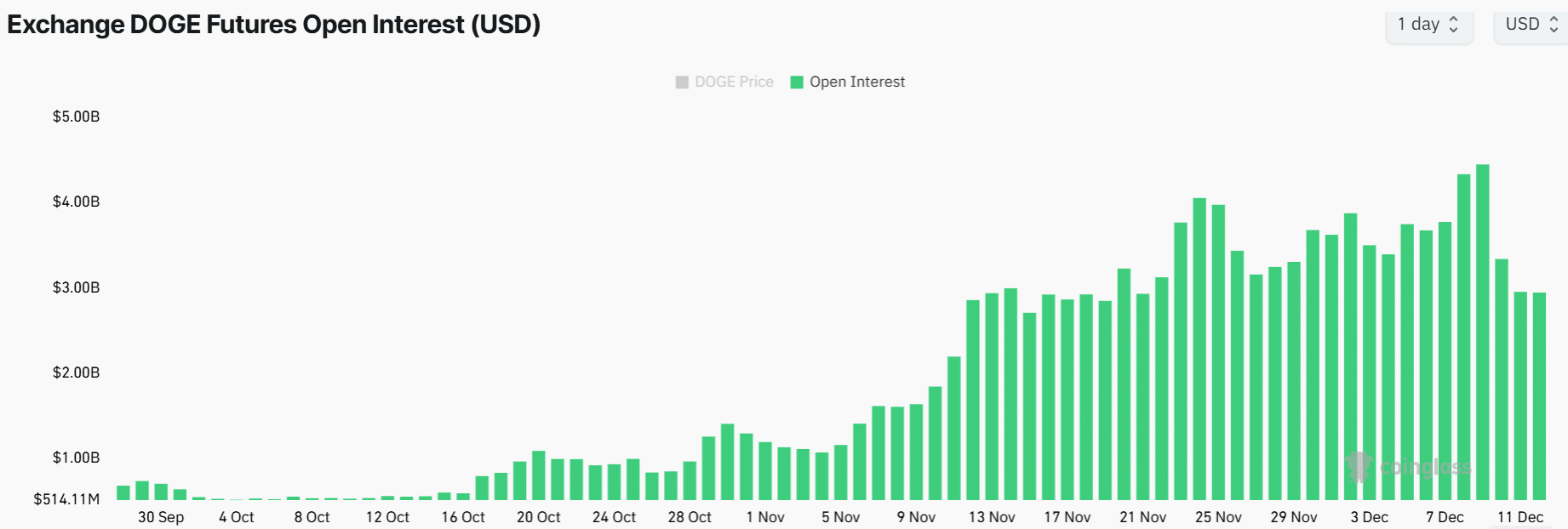

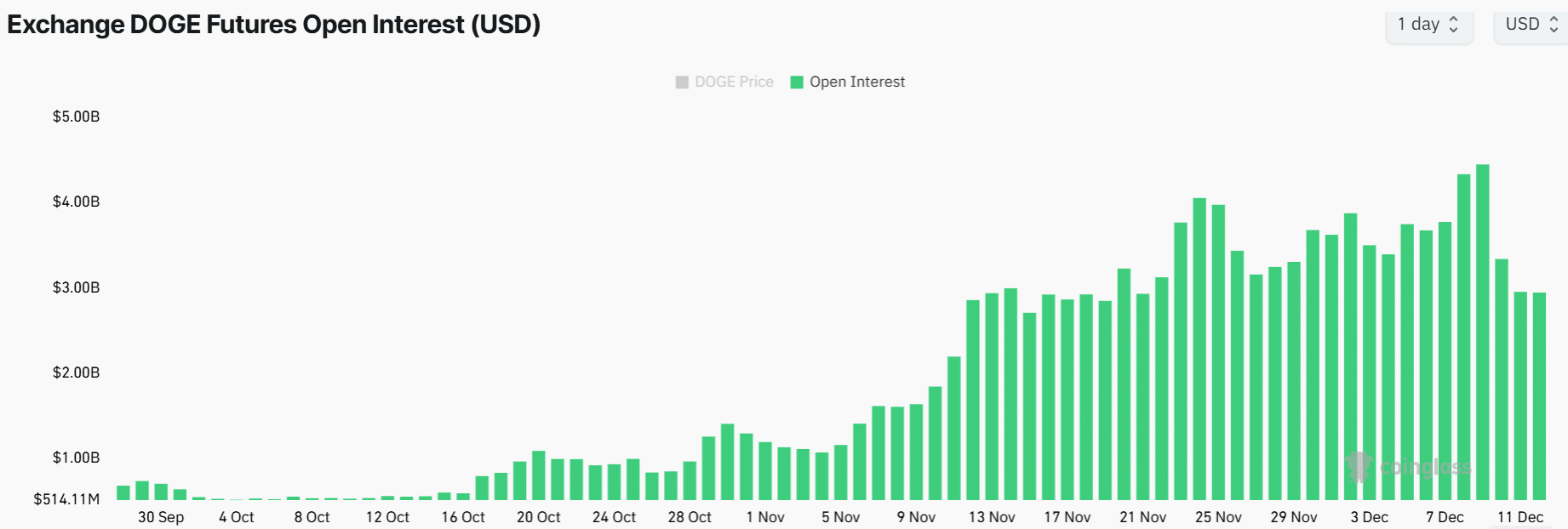

Dogecoin’s Open Interest(OI) reached an all-time high of $4.45 billion on the 9th of December after tripling in less than one month as speculative interest in the memecoin increased.

However, in the last two days, OI has dropped by more than $1.5 billion to $2.95 billion at press time.

Source: Coinglass

Declining OI indicates that traders are closing their positions on Dogecoin. The reduced market participation is further seen in the derivative trading volumes that had dropped by 34% to $14.23 billion at press time per Coinglass.

The shift in sentiment in the derivatives market could reduce price volatility and push DOGE into consolidation.

Market sentiment is bearish

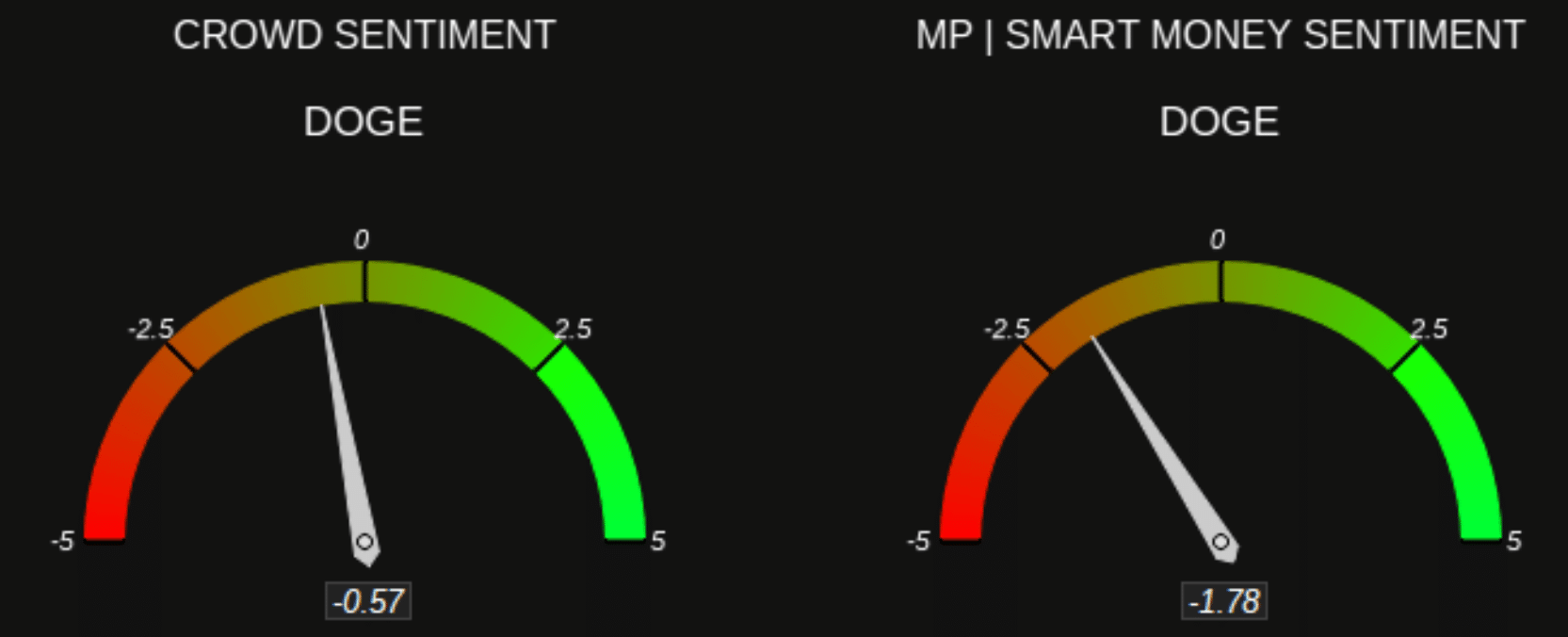

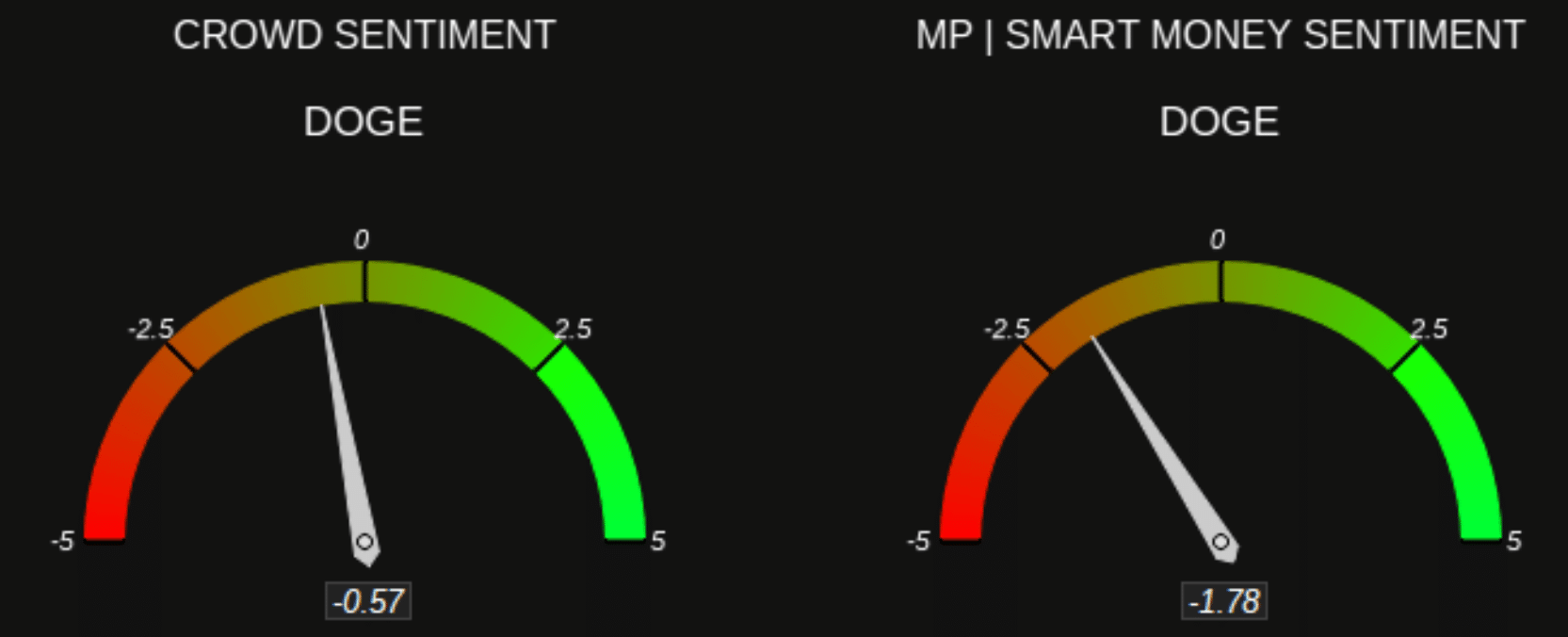

These bearish signs have dampened the market sentiment around Dogecoin, as depicted by Market Prophit. Both the crowd and smart money sentiment on DOGE are bearish, indicating that traders anticipate further dips.

Source: Market Prophit

Read Dogecoin [DOGE] Price Prediction 2024-2025

If the market sentiment remains dull, it could inhibit buying activity, resulting in more dips for DOGE.