11 years ago, Billy Markus and Jackson Palmer created Dogecoin, which features the iconic image of the Japanese Shiba Inu dog, based on the Bitcoin source code. Although it was initially created as a joke, over time, Dogecoin has grown into a symbol of crypto culture and has become the highest-market-cap meme coin.

Looking back at the development of Dogecoin, we have witnessed its growth miracle. What breakthroughs can we expect in its future ecosystem, and how will they impact miners and users? On the 11th anniversary of Dogecoin’s creation, ViaBTC, the world’s largest Dogecoin mining pool, invited Dogecoin miner and loyal user Leo, community developer Patrick Lodder, L2 scaling QED protocol founder Carter Feldman, ElphaPex’s product VP Ben Weng, as well as all the listeners, to have an in-depth open discussion on X Space.

The following content is a summary and condensation of the exciting Q&A from this X Space event for our readers.

Q1: What does the 11-year milestone of Dogecoin mean to each of you? What are your thoughts on its development?

Leo: It’s like the tips you give to waiters or at events—what I think was the earliest form of an airdrop. To me, this is the initial impression of Dogecoin’s origins.

However, today’s Dogecoin is completely different. Now, even companies like Tesla are accepting DOGE as a payment method, which is truly unbelievable. Overall, I’ve witnessed Dogecoin transform from a token that was initially like “tip money” to one that can be used to buy a supercar or even meet daily expenses. Yes, I’ve seen it undergo a complete transformation over the years.

Patrick: To me, it means that after eleven years, it’s still here, and it’s still very close to what it was originally. Of course, we’ve made some technical adjustments and fixed things that didn’t go as expected. Overall, what’s truly amazing is that this thing was completely created out of nothing, and it didn’t really have a purpose at first. It wasn’t meant to be the so-called “people’s currency,” it started as a joke and was supposed to disappear after a while. But it didn’t disappear; it kept going.

Now, it still exists, and it will continue to exist. That’s really awesome! Being able to witness something that was meant to be short-lived attracts so much attention and allows people to participate in ways they want to is the key to its longevity.

Ben: In the past, many people viewed cryptocurrencies as unfamiliar and mysterious, almost like something high-tech and out of reach. However, Dogecoin, as an emoji-style cryptocurrency, greatly lowered the entry barriers to this industry, making cryptocurrency more approachable and easier to accept. In other words, it allowed people to learn about and use cryptocurrency with a more relaxed attitude.

From a technical perspective, Dogecoin has a fixed inflation rate and no supply limit, which makes it closer to a true universal currency. Perhaps one day, we won’t just use DOGE for daily purchases around the world, but we might even use it in Elon Musk’s Mars colonization plan. From our perspective, we will continue to push the boundaries of technology and develop more efficient and energy-saving mining equipment for Dogecoin. I firmly believe that in the future, DOGE will become the true “people’s cryptocurrency.”

Carter: My first exposure to Dogecoin was in high school when I joined the computer science club. One particularly talented member was suspended from school for mining Dogecoin on multiple computers at school. This piqued my interest, and I started digging deeper into Dogecoin. Since then, I’ve held onto it.

Looking back over these eleven years, I’ve realized one truth: friends are more important than money. DOGE’s price hasn’t always been high; it has gone through countless ups and downs. But what has supported it through all the turbulence is not money—it’s people’s love and recognition of it. This love and persistence are especially evident in the developers’ dedication, particularly people like Patrick, who have remained committed despite facing tough times. Dogecoin, which started as a joke, has survived due to a special sense of community. Why has Dogecoin continued to exist? Because there’s no reason not to let it continue.

Q2: Merged mining brings new opportunities for miners. How do you see the impact of merged mining on miners, the mining industry, and the entire Dogecoin ecosystem?

Leo: In fact, these cryptocurrencies in merged mining are essentially the same thing; they all use the Scrypt algorithm. By providing hashrate to the blockchain, we can earn at least two different coins as mining rewards.

Let’s talk about Litecoin (LTC) mining. As a miner, I earned both LTC and DOGE by contributing hashrate to the blockchain. Back then, I might have just stored the mined DOGE in my wallet because it wasn’t very popular. Now, with the push from Elon Musk, DOGE has become well-known, and the entire Scrypt algorithm ecosystem has changed dramatically.

Honestly, this development path is much more interesting than the days when I used ASIC miners to mine Bitcoin. Back then, I almost dedicated all my hashrate to the Bitcoin network. Now, with the rise of DOGE, I’ve shifted a large portion of my hashrate to the LTC/DOGE pool. So far, this strategy has been very effective. I’ve accumulated quite a bit of Scrypt hashrate. Moving forward, I’ll continue to hold DOGE and, like many others, contribute to the continued development of this ecosystem.

Ben: Just like the evolution of all crypto mining equipment, Scrypt miners have gone through the development process from early GPU miners to FPGA miners, and now to ASIC miners. Today, it’s more obvious than ever that mining hardware manufacturers are constantly pushing the limits of physics and technology, focusing on improving energy efficiency. We use the most advanced chip design and manufacturing technologies, which has resulted in much better energy consumption ratios. This is a direct reflection of advancements in chip technology.

What’s more, the form of a mining rig is constantly evolving to meet broader applications. Traditional mining rigs were often large, air-cooled machines the size of shoe boxes, producing a lot of noise and running continuously. But recently, we’ve seen the emergence of new types of mining rigs. For example, we’ve just released a home mining rig that plugs directly into a household power outlet and runs incredibly quietly. At the same time, in the industrial sector, we’re seeing many new applications. For instance, the heat produced by mining is being used to support heating systems in some Nordic countries. Looking ahead, mining rigs may no longer be standalone machines—they may, like refrigerators, cleverly utilize excess energy, contributing to the Scrypt algorithm-based coins while also generating revenue.

Patrick: I can explain why we chose merged mining with LTC, as I was involved in the process back in 2014.

We did this because, at that time, Dogecoin was just reusing certain Proof of Work algorithms, which directly competed with other coins. When everyone is competing for network security and computing resources, the system becomes unstable: sometimes mining Litecoin is more profitable, and sometimes mining Dogecoin is more profitable. As a result, the hashrate in major mining pools was scattered across different coins. To solve this problem, we adopted the strategy of merged mining, which brought stability to the Scrypt mining ecosystem. Since Dogecoin introduced merged mining, the entire Scrypt mining ecosystem has become more robust. This not only benefits Dogecoin but has had a positive impact on the entire Scrypt mining ecosystem.

Carter: I believe that the concept of “merged mining” is actually the key to driving the development of Layer 2 solutions in the crypto ecosystem. Through merged mining, the work done on one blockchain can be reused to verify blocks on another blockchain. This innovation is undoubtedly one of the greatest breakthroughs in the cryptocurrency field and an important driving force for future scalability and development.

As members of the blockchain community, we should be grateful to people like Patrick—who have put this technology into practice and proven its feasibility. For miners, this is a major advantage because they can earn mining rewards from one blockchain while also earning coins from another blockchain or multiple blockchains, thus increasing their overall returns.

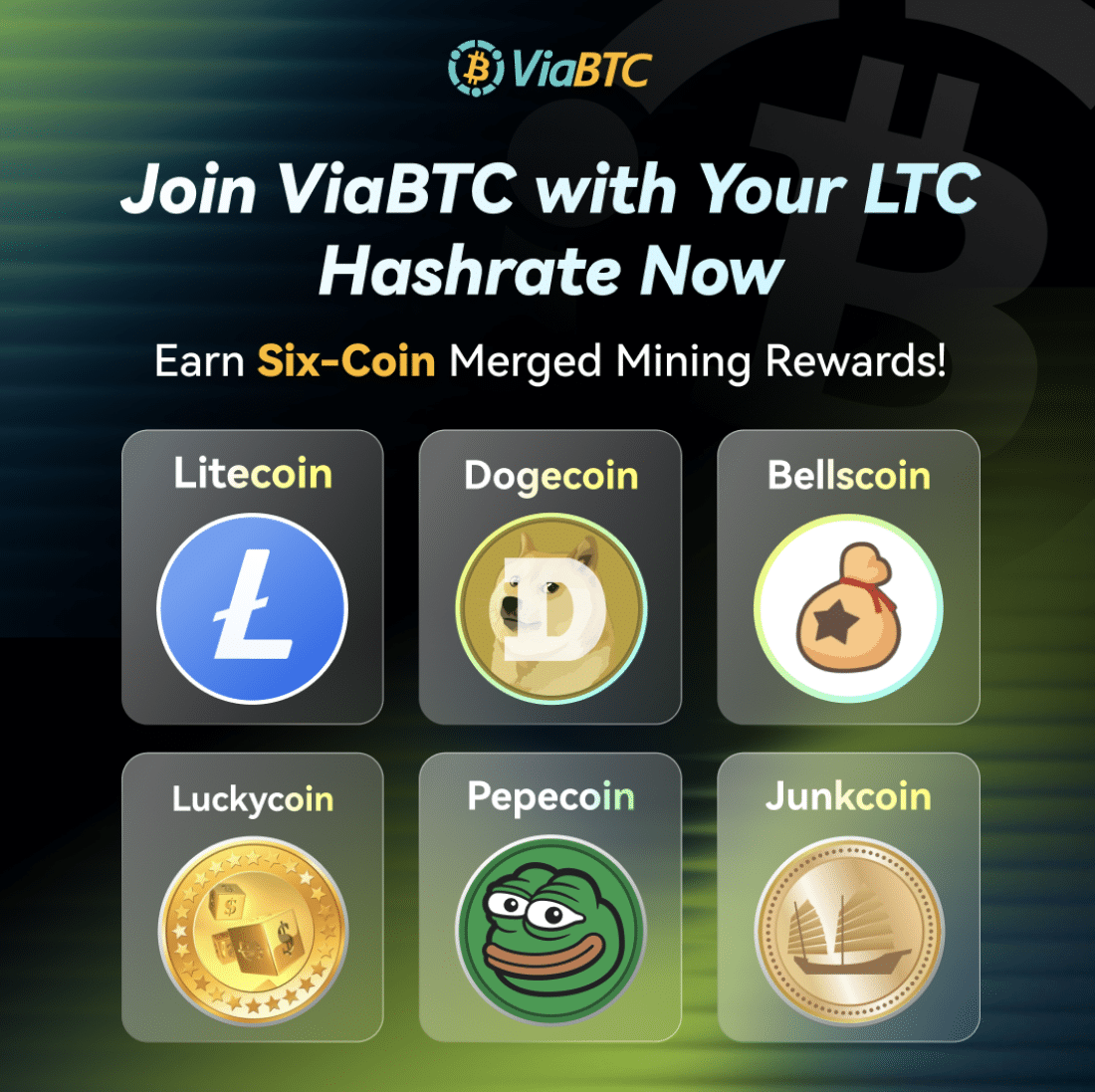

*This year, multiple coins using the Scrypt algorithm have joined merged mining. For example, the ViaBTC Pool now supports six-coin merged mining, so miners can earn six types of coins—LTC, DOGE, BELLS, LKY, PEP, and JKC—by contributing a single unit of hashrate.

Q3: What is the impact of the surge in DOGE’s price on the entire mining ecosystem?

Carter: Whenever DOGE’s price soars, a wave of new users floods into the community. Now, many new faces have joined the Dogecoin community. Whether we can retain them long-term and help Dogecoin continue to develop or even reach new all-time highs largely depends on whether we can provide real added value.

To that end, we hope to expand DOGE’s real-world use cases and encourage new users to move their DOGE from exchanges to pay for miner fees. This will not only enhance miners’ competitiveness and profitability but also create more opportunities for interaction and engagement for users. We are also actively developing zk-proof-based applications, aiming to provide users with fun and practical decentralized applications, allowing them to stay engaged in the ecosystem rather than cashing out quickly during price fluctuations.

Whether the price rise is driven by Bitcoin or triggered by a brief fluctuation due to mentions from Elon Musk, our goal is to retain new users and keep them confident and interested in DOGE. By supporting the Dogecoin core development team, enriching the application ecosystem, and attracting users to participate deeply and hold DOGE long-term, miners can also earn greater rewards and stability within this ecosystem.

Q4: What is the latest major update for Dogecoin? Looking ahead, what are the next steps?

Patrick: The two versions we recently released are mainly security updates aimed at fixing existing issues. These updates didn’t introduce new features, but they are still important to install. We intend to keep updates small and focused to minimize unexpected issues. Therefore, while the recent updates didn’t add new features, they ensure the stability and security of the system.

In previous versions, we began focusing on how to help users make better use of Dogecoin. For example, some users wanted to run specific applications, but without the right API interfaces, the use of core Dogecoin data would be limited. To address this, we improved the API to support future development and applications.

We’ve been working for a long time to ensure network stability, so that no matter what happens, the nodes can operate normally and transactions can proceed smoothly. Over the past 11 years, network activity hasn’t always been stable, with periods of inactivity and spikes of activity. Our job has been to ensure that when network activity increases, Dogecoin’s core software can handle it smoothly. This may sound a bit boring, as it’s a basic-level improvement, but these foundational functions lay a solid foundation for a richer ecosystem in the future.

Looking ahead, over the past year, we’ve discussed that it’s time to not only optimize the software but also push for upgrades to the protocol itself. How to enable more features within the network and expand the protocol’s adaptability is our main focus at this stage. So, in the near future, you may see community members propose various expansion ideas. Whether it’s miners, node operators, or other participants, they will be able to evaluate whether these proposals meet their needs and whether they are worth further development. My goal is to encourage more people to participate in such expansions and developments.

Q5: What measures is Dogecoin considering to maintain decentralization in the face of concerns about mining pools potentially leading to network centralization?

Patrick: Maintaining decentralization benefits everyone by preventing any single person or group from dominating the entire network. If a mining pool’s hashrate becomes too high, other miners may feel uneasy, leading to price drops, loss of trust, and a sell-off. In fact, this threat of centralization has always existed since the birth of Dogecoin.

Although large mining pools and companies still exist, no one is willing to dominate the entire blockchain, as this would undermine the network’s consensus and cause panic, potentially destroying the chain. This threat of centralization goes against the interests of those involved and is therefore unlikely to happen. Furthermore, as the overall network hashrate increases, it becomes more difficult for any single entity to dominate the network, as the cost of “bad behavior” rises.

Carter: As our friend Ben from ElphaPex mentioned, launching home mining rigs for Scrypt mining provides ordinary users with more opportunities to participate in mining. The more participants there are, the more decentralized the hashrate becomes, and as the community grows, the long-term development of DOGE will also become more stable.

However, we must also recognize that mining pools are not the same as miners; they are simply organizations that provide services to miners. Dogecoin’s consensus is not centralized because of mining pools. Miners can always choose to join or switch pools. For example, if they initially mined with another pool, they can switch to ViaBTC at any time. Mining pools are not dictators; they are collections representing many small miners. While mining pools may appear to have a certain level of centralization, they do not control the consensus.

The above is just a brief excerpt of some insightful points shared. If you’d like to hear more details on these topics, we invite you to listen to our full replay:

https://x.com/ViaBTC/status/1865033089728287130

Disclaimer: This is a paid post and should not be treated as news/advice.