- Key resistance point at $0.11 with 31 billion DOGE to be short.

- Large holders decrease as price eyes lower liquidity zones.

Dogecoin [DOGE], the leading memecoin, continues to draw attention from traders and investors.

Despite a decline in price over the past five months, recent developments ahead of Q4 2024 have raised questions about a potential breakout.

Dogecoin has shown a pattern of decline, with key resistance levels indicating potential selling pressure from large holders.

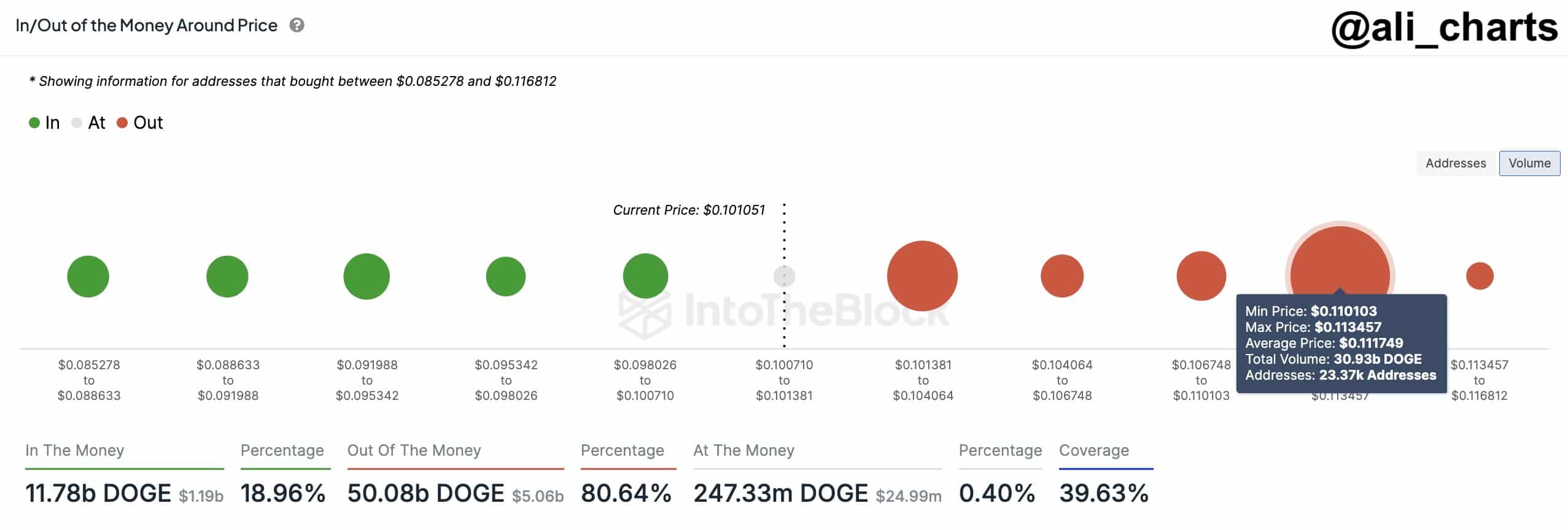

According to IntoTheBlock, significant whale buying has occurred between $0.085278 and $0.100710, where whales remain in profit.

Source: IntoTheBlock

However, traders should be cautious, as there is a notable cluster of sellers between $0.101381 and $0.116812, posing a challenge to DOGE’s upward movement.

A key resistance point at $0.11, involving over 23,000 addresses with over 31 billion DOGE ready to short, may further hinder DOGE’s price rise.

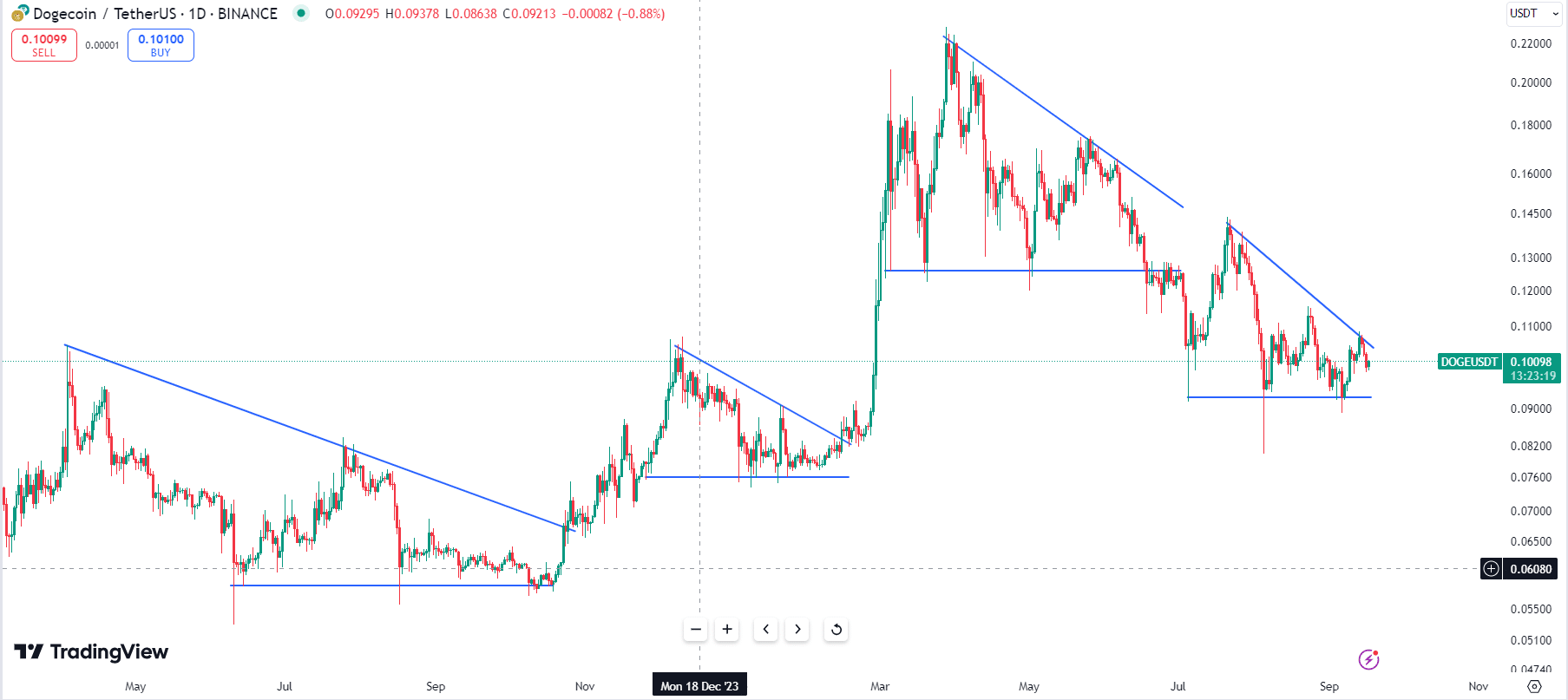

DOGE/USDT price action not looking good…

Looking at the price action of Dogecoin, the recent patterns suggest a downward bias. Historically, DOGE/USDT pairs formed triangle patterns that led to price surges.

However, since hitting $0.23 in April 2023, DOGE has started to behave differently, with current triangle formations leading to price declines.

The recent rejection at the $0.11 level highlights the potential for more downside movement. If the price breaks below $0.092, a further decline could follow due to large-volume shorts from whales.

Source: TradingView

On the flip side, if DOGE manages to break above the resistance, traders must reevaluate the price action to avoid being caught off guard.

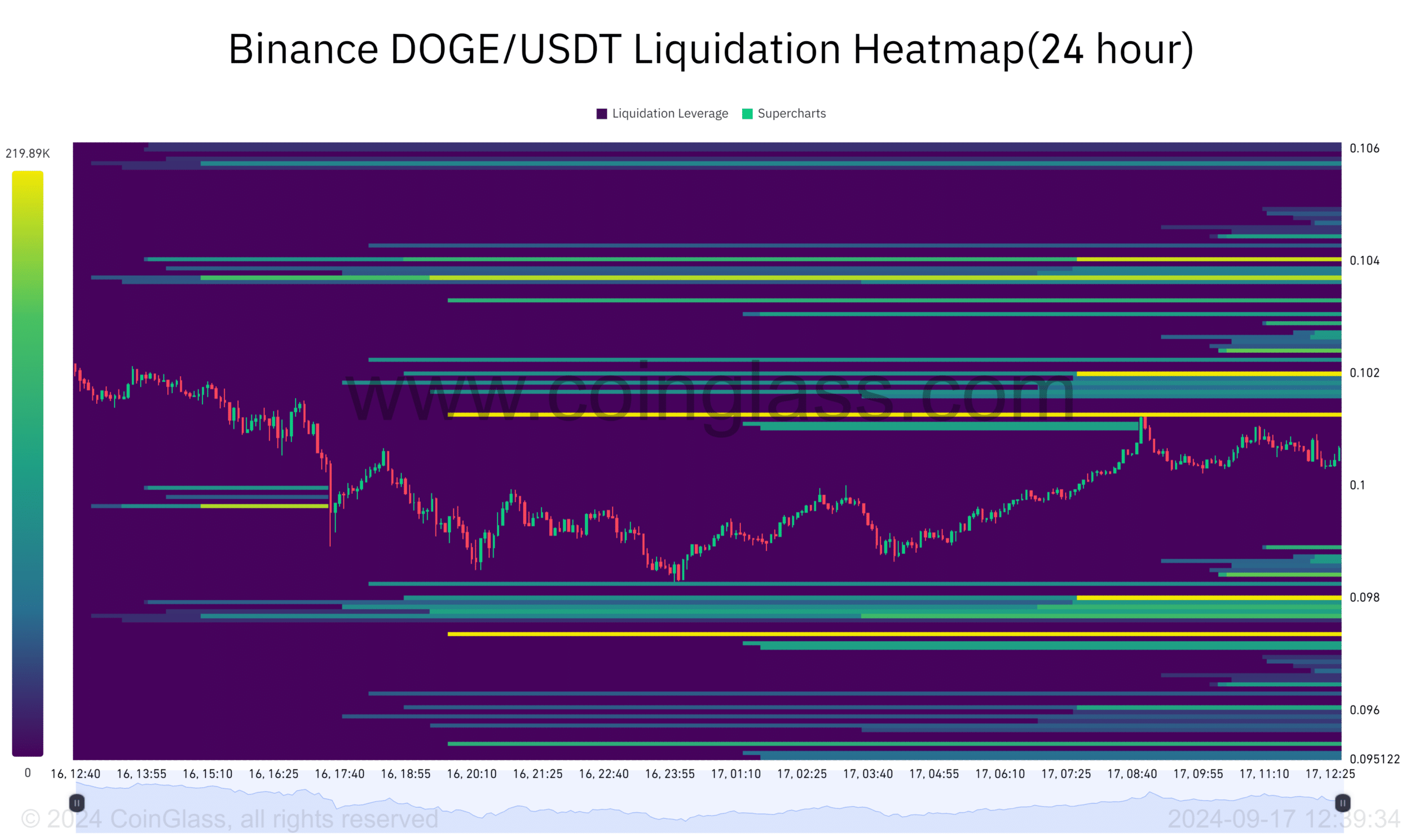

DOGE liquidation levels

Liquidation levels for DOGE also paint a mixed picture. A cluster of $219K worth of long liquidations sits above the $0.101 price level, while another $195K worth of shorts is positioned below $0.098.

The market is likely to move toward one of these levels, with the current sentiment favoring a move to the lower liquidity zone.

Following this, the next price target after the downward move could be $0.109, given the previous rejection from this level.

Source: Coinglass

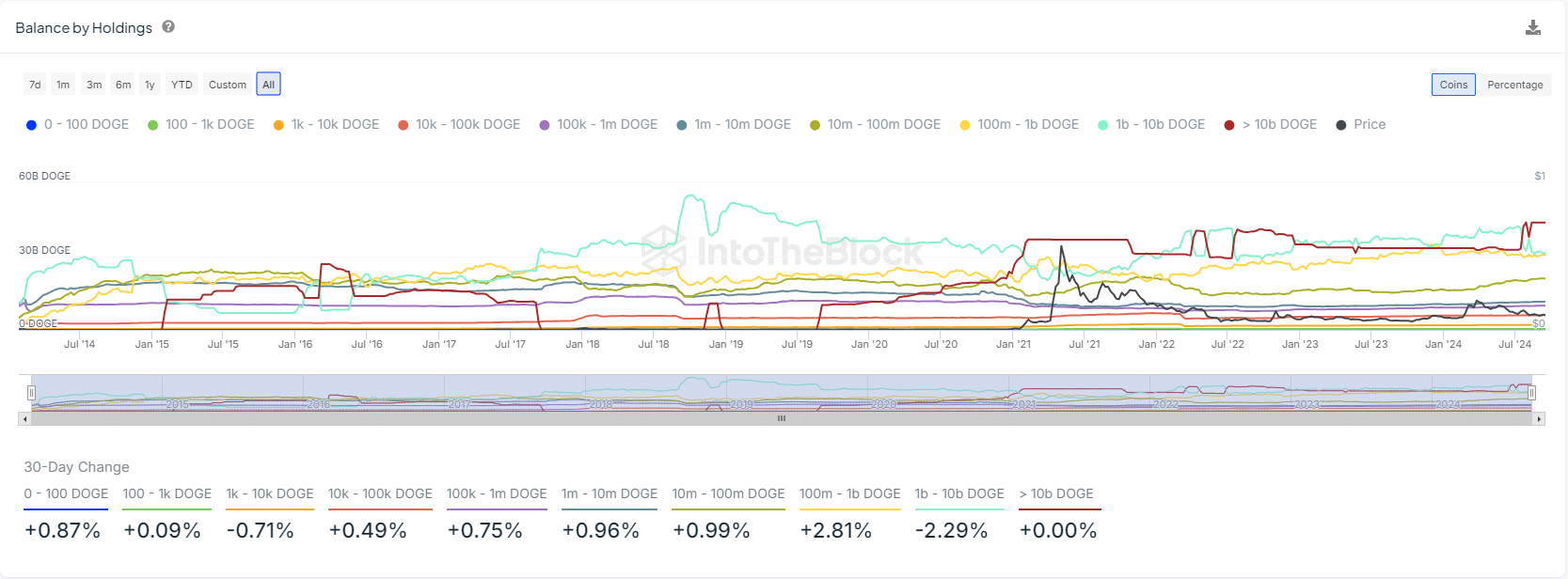

Holding distribution

In terms of holding distribution, the number of addresses holding more than 10 billion DOGE has remained constant, while those holding more than 1 billion DOGE have decreased by 2.29%.

This decline is a bearish indicator when combined with the metrics mentioned earlier. However, addresses holding more than 100 million DOGE have increased by 2.81%, which is a slightly bullish sign.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Despite this, the large whale holdings continue to exert significant influence on DOGE’s price, making it difficult for smaller increases in holdings to counteract their impact.

Source: IntoTheBlock

Ultimately, whether Dogecoin’s price will continue to fall or stage a recovery remains uncertain, but the current indicators lean toward a bearish outlook in the short term.