- Ethereum fell 24% in seven days amidst the broader crypto market bloodbath.

- Though selling pressure remained high, the NVT ratio dropped, showing increased chances of a price rebound soon.

Ethereum [ETH] has witnessed a major setback last week as its price dropped in double digits. However, the token has shown signs of recovery in the last 24 hours.

Let’s have a better look at Ethereum’s current state to understand what’s going on with the token.

Ethereum’s fate

CoinMarketCap’s data revealed that ETH was down by more than 24% over the last seven days. At the time of writing, ETH was trading at $2,514.29 with a market capitalization of over $302 billion.

While that happened, Lookonchain, a popular X (formerly Twitter) handle, recently posted a tweet regarding a notable development.

As per the tweet, a wallet of LonglingCapital transferred 20,000 ETH, worth over $50.3 million, to wallet “0x3478” after being dormant for nearly two years.

Therefore, AMBCrypto planned to have a better look at the token’s state to find out what to expect.

Which way is ETH headed?

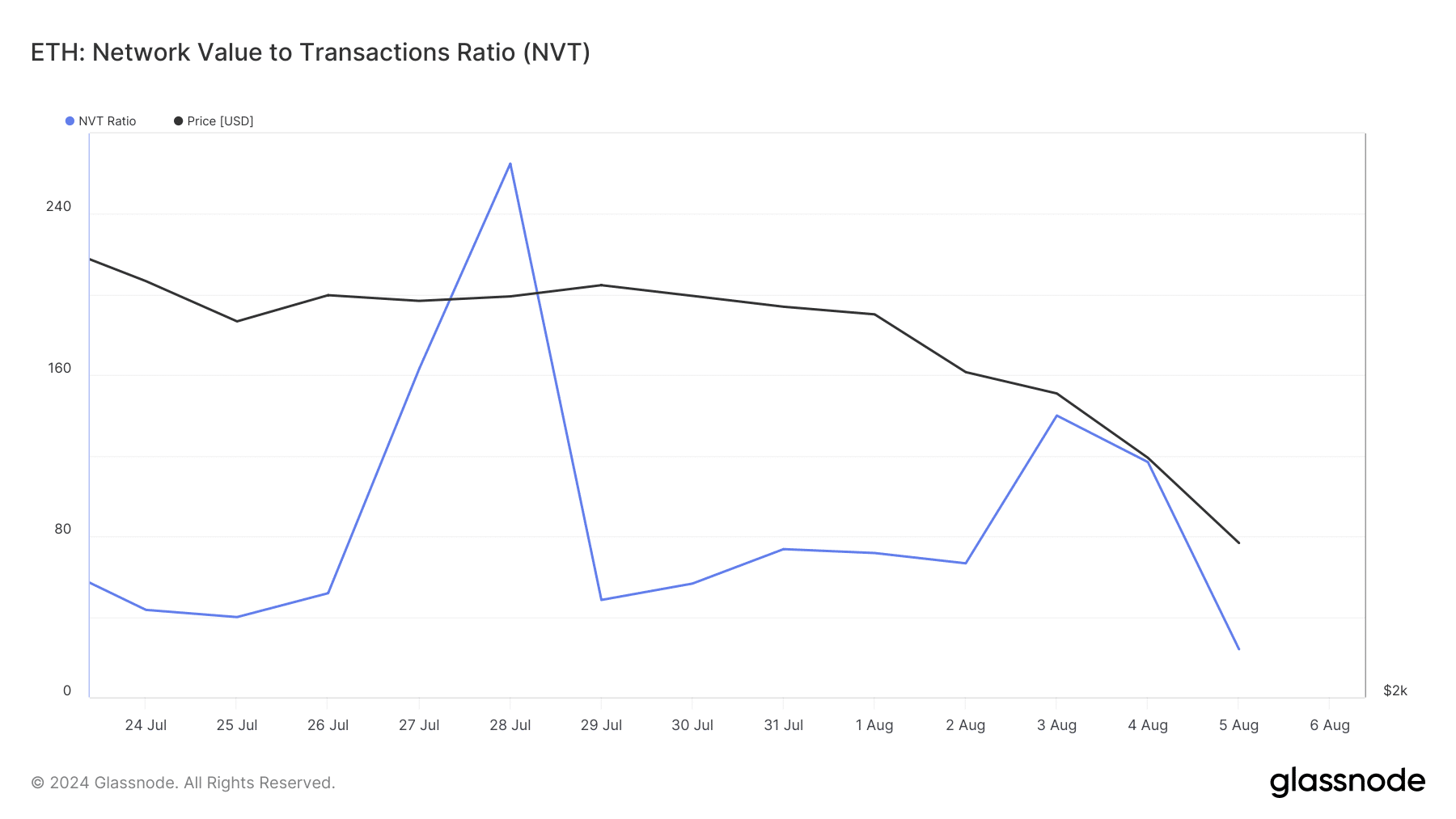

As per our analysis of Glassnode’s data, Ethereum’s NVT ratio dropped sharply. Whenever the metric drops, it suggests that an asset is undervalued, indicating that the chances of a price increase are high.

Source: Glassnode

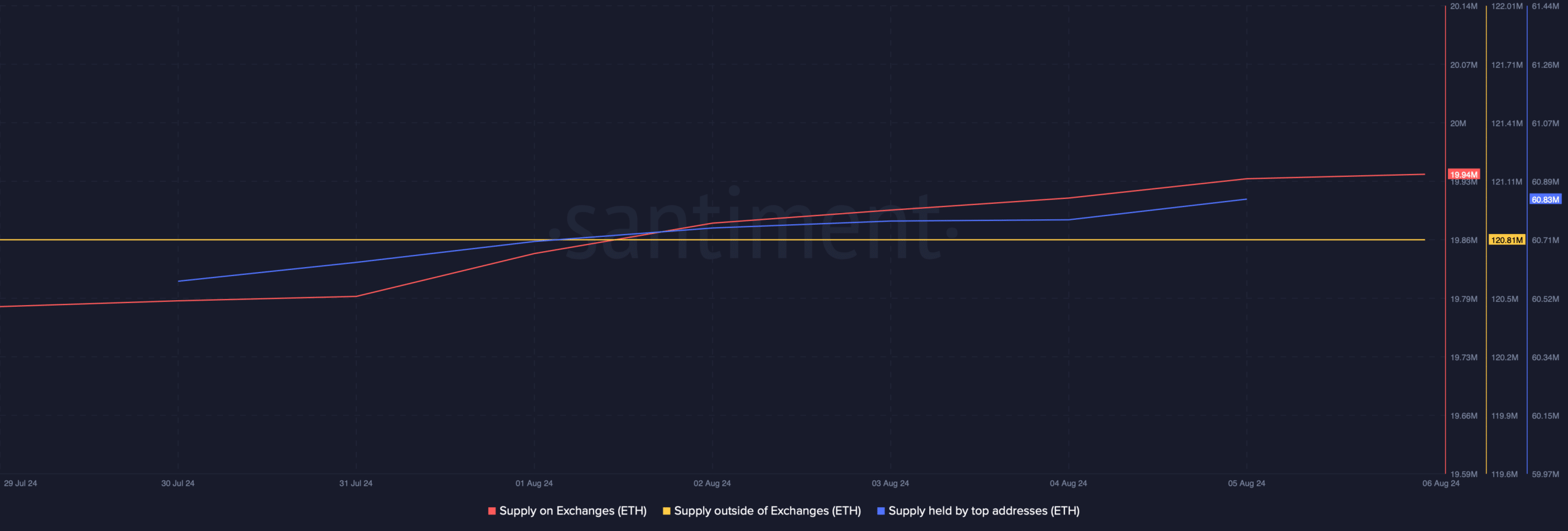

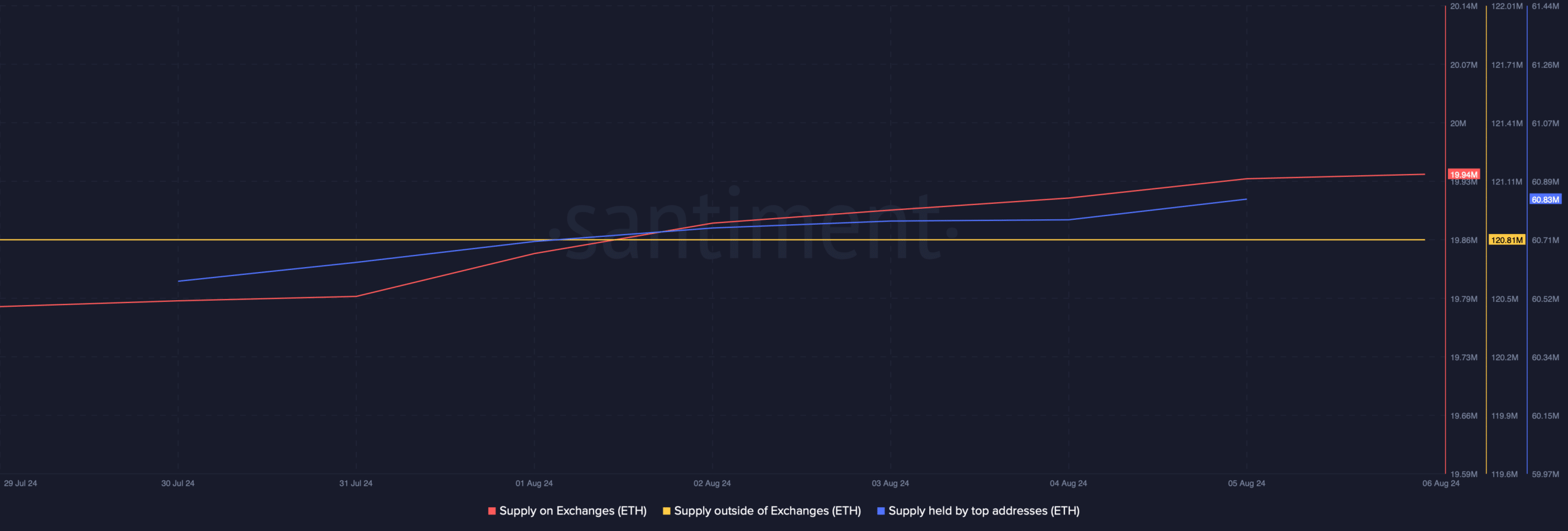

AMBCrypto then took a look at Santiment’s data. As per our analysis, ETH’s supply on exchanges increased over the last seven days. This meant that selling pressure was high.

Its supply outside of exchanges was flat, meaning that investors were not actively buying ETH at press time. However, whales were buying ETH, which was evident from that rise in its supply held by top addresses

Source: Santiment

What to expect from Ethereum

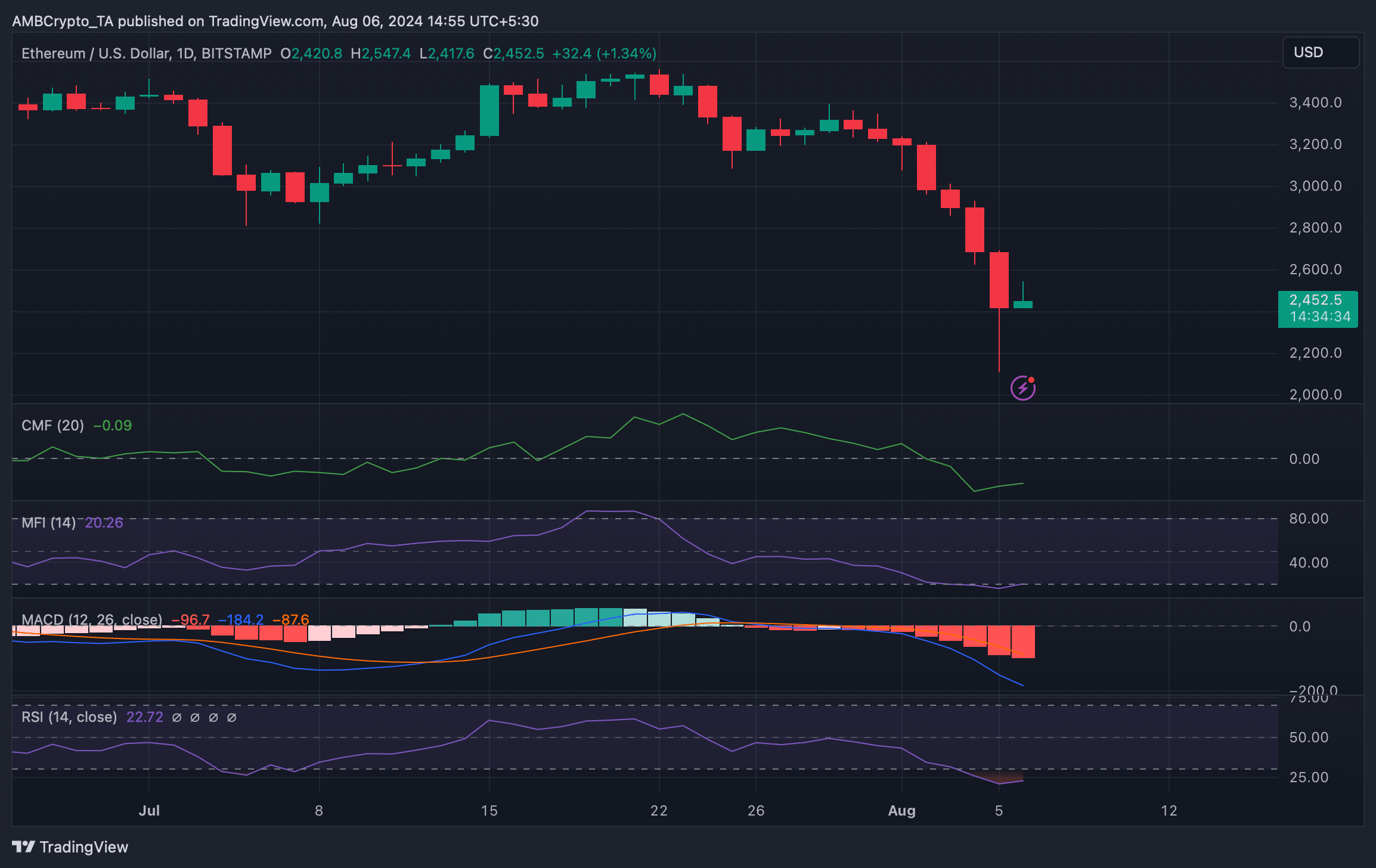

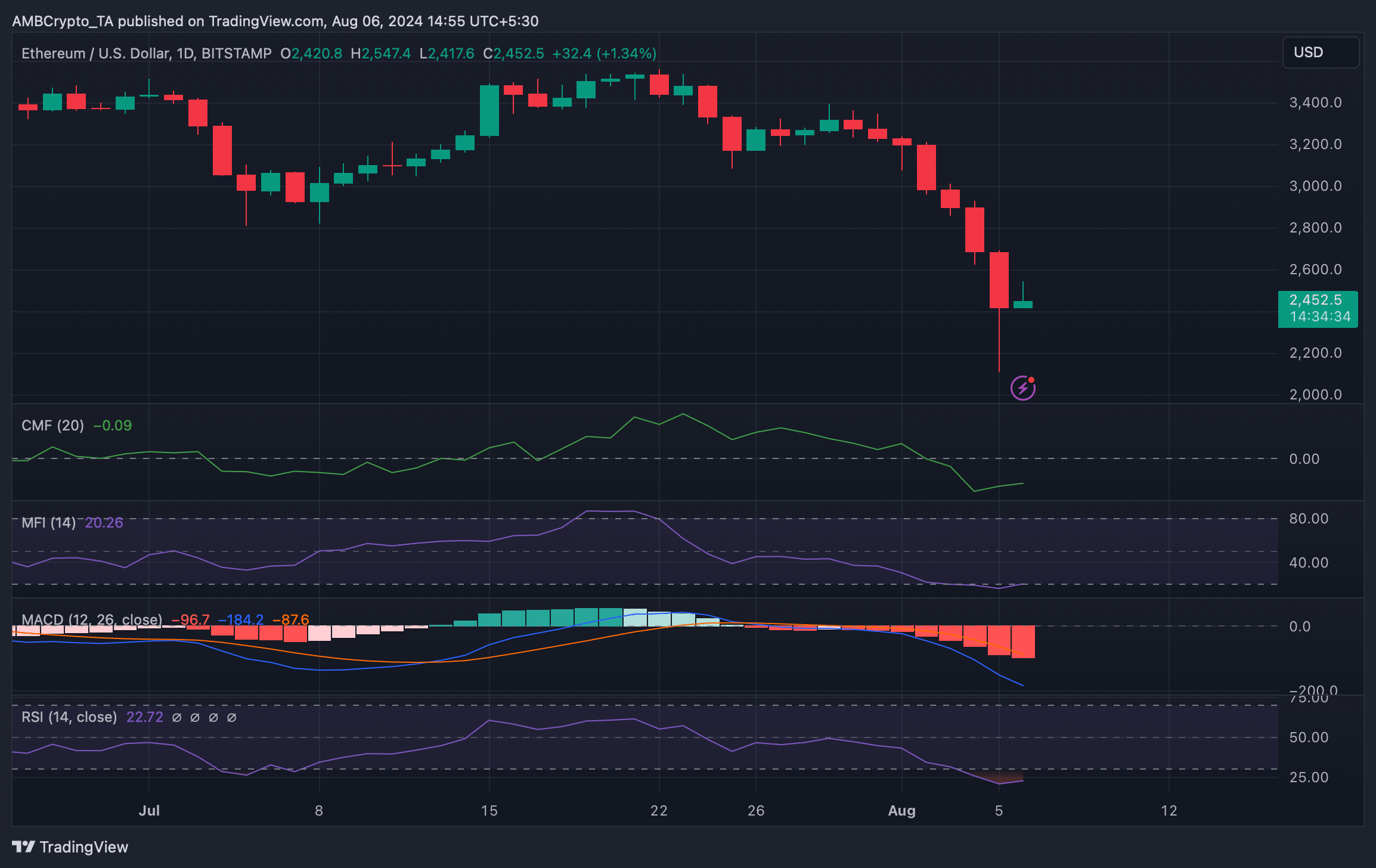

AMBCrypto took a look at ETH’s daily chart to better understand what to expect from it. As per our analysis, the technical indicator MACD displayed a bearish advantage in the market.

Both the Relative Strength Index (RSI) and Money Flow Index (MI) were in the oversold zone. These indicators suggested that there were high chances of ETH to recover from its losses.

Additionally, the Chaikin Money Flow (CMF) registered an uptick, further indicating that ETH’s price might increase in the coming days.

Source: TradingView

Read Ethereum’s [ETH] Price Prediction 2024-25

Our analysis of Hyblock capital’s data revealed that if ETH turns bullish, then it might soon reclaim the $3.3k mark. This was the case as liquidation would rise at the level, which often results in price corrections.

However, if the bears continue to control the mallet, then it won’t be surprising to witness ETH dropping to $2k in the coming days.

Source: Hyblock Capital