- Dogecoin’s Open Interest (OI) surged by 15%, indicating traders’ belief and confidence in the memecoin

- Whales’ large transaction volume jumped by 41% too

Dogecoin (DOGE), the world’s largest memecoin, is likely to grab the attention of whales and institutions now since it may be poised for a 28% upside rally. This positive speculation can be attributed to its strong price action, significant interest from traders and investors, and growing political support.

In fact, the larger cryptocurrency market currently appears bullish, with major cryptocurrencies like Ethereum (ETH), Solana (SOL), and XRP continuing to climb north. The larger altcoin market doing well will only contribute to Dogecoin’s own bullish outlook.

Dogecoin’s technical analysis and key levels

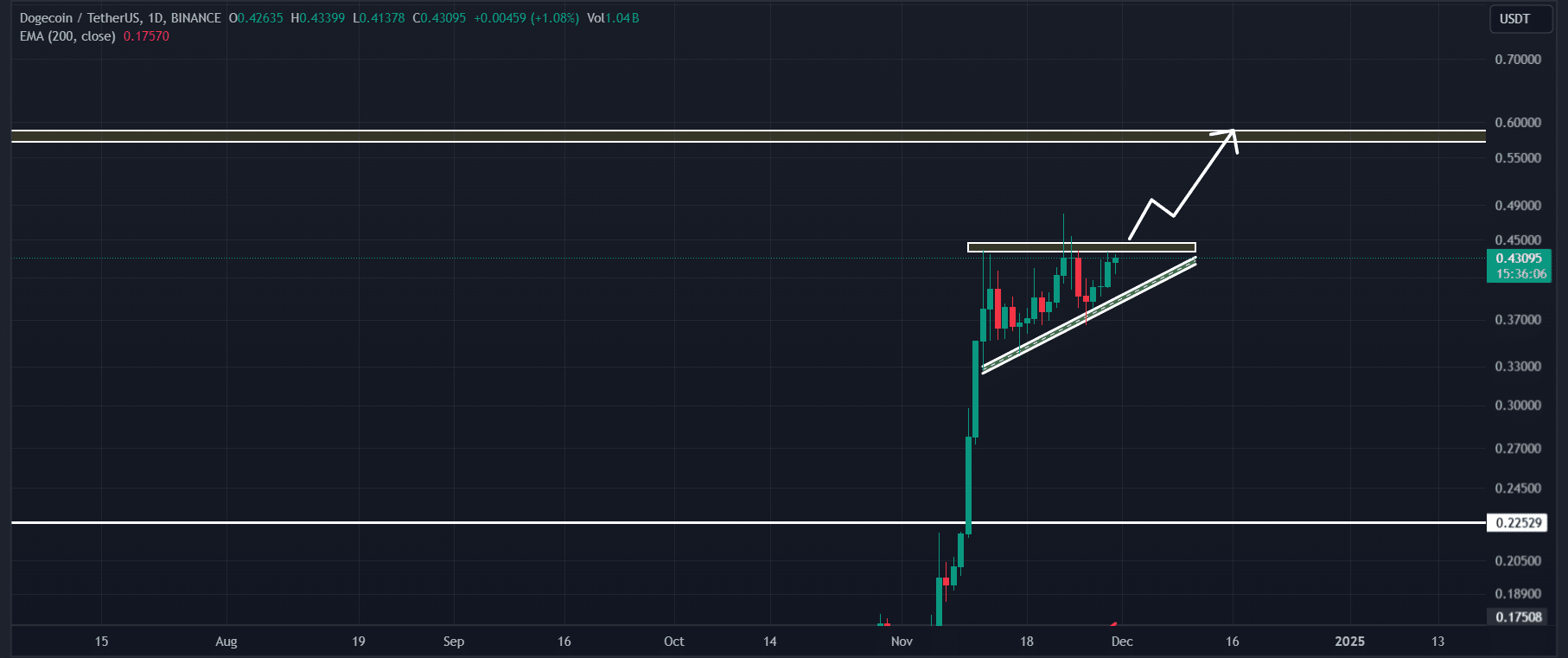

After a significant 150% rally, DOGE entered a consolidation zone over the last two weeks. However, this consolidation appeared to be forming an ascending triangle pattern on the charts, as noted by AMBCrypto’s technical analysis.

Source: TradingView

Based on historical momentum and recent whale participation, if DOGE breaches the neckline of the ascending triangle pattern and closes a daily candle above $0.45, it could soar by 28% to hit the $0.58 level in the coming days.

On the positive side, DOGE seemed to be trading above the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating an uptrend. The 200 EMA is a technical indicator used by traders and investors to determine whether an asset is in an uptrend or a downtrend, helping them make informed positioning decisions based on the asset’s behavior.

In addition to technical analysis, whales and traders appear to be heavily participating in the memecoin, as reported by on-chain analytics firms such as IntoTheBlock and Coinglass.

Whales and traders’ participation

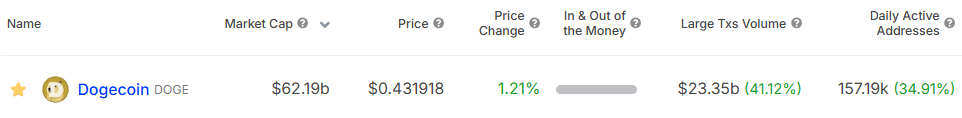

By 30 November, the large transaction volume by whales had increased by 41%, reflecting their belief and confidence in the memecoin.

Source: IntoTheBlock

Alongside long-term holders, traders have also shown greater interest in the memecoin, as reported by Coinglass. For example – DOGE’s Open Interest (OI) surged by 15% in the last 24 hours and by 7.8% in the last four hours. This hike in OI alludes to the formation of new positions as DOGE’s price approached the breakout level.

Combining these on-chain metrics with technical analysis suggested that bulls are strongly dominating the memecoin and this could help DOGE achieve its predicted target.