- XRP has a track record of bouncing back when BTC hits its peaks

- If the right factors align, a $4 target could soon be within reach

XRP’s surge past $3, driven by whale accumulation, has rewarded patient investors, but holding steady has been no easy feat. With a 53% year-to-date growth, investors are clearly torn – Lock in gains now or stay the course for even greater rewards?

The age-old dilemma in a bullish market

Among high-caps, XRP’s 40% monthly gains stand out, with over half of that coming in the New Year alone. While this signals a strong rally, it also alludes to rapid appreciation – Perhaps too much, too soon. The RSI seemed to back this up, jumping from neutral to overbought in just three days.

In markets like this, profit-taking is almost inevitable.

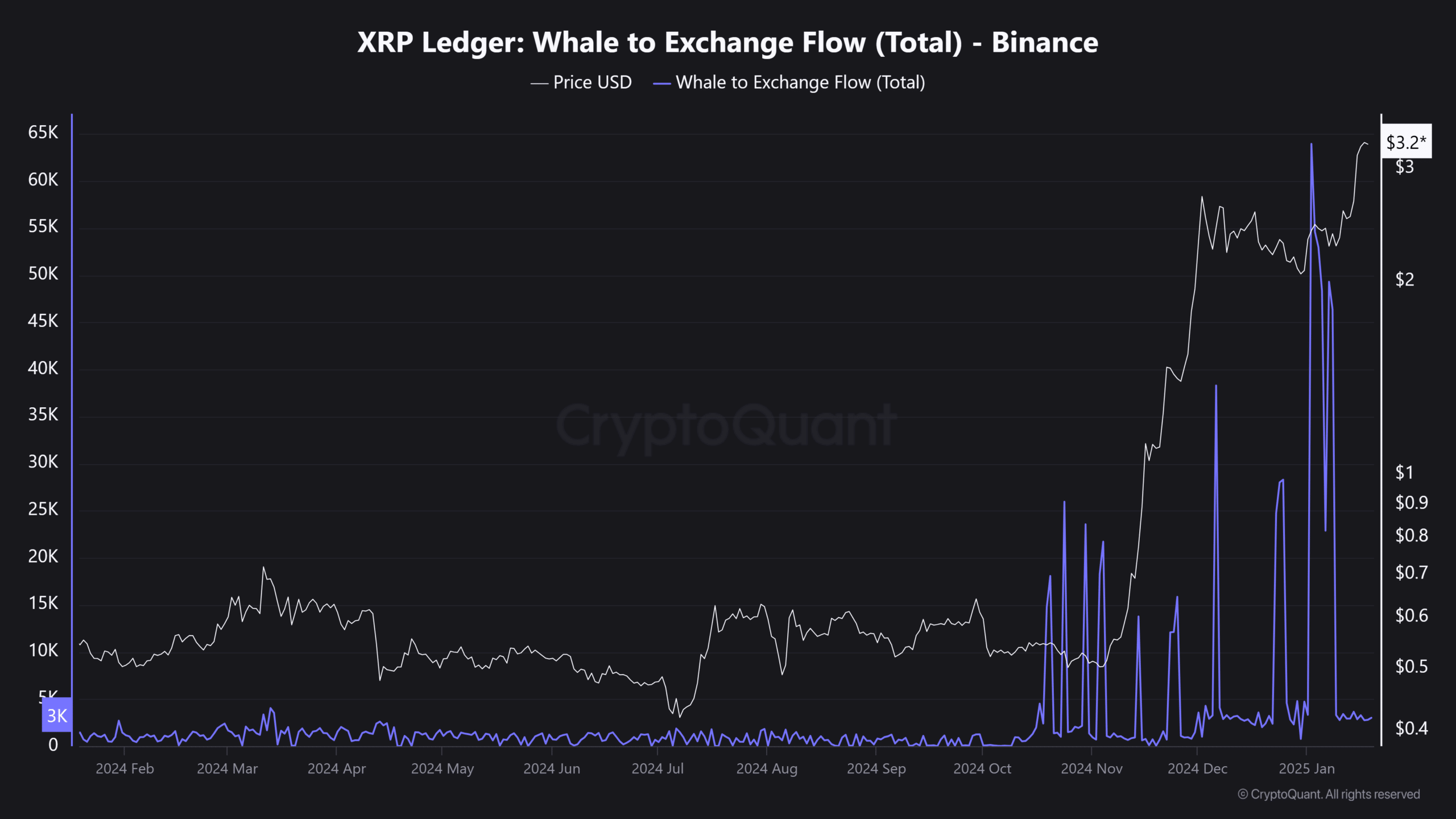

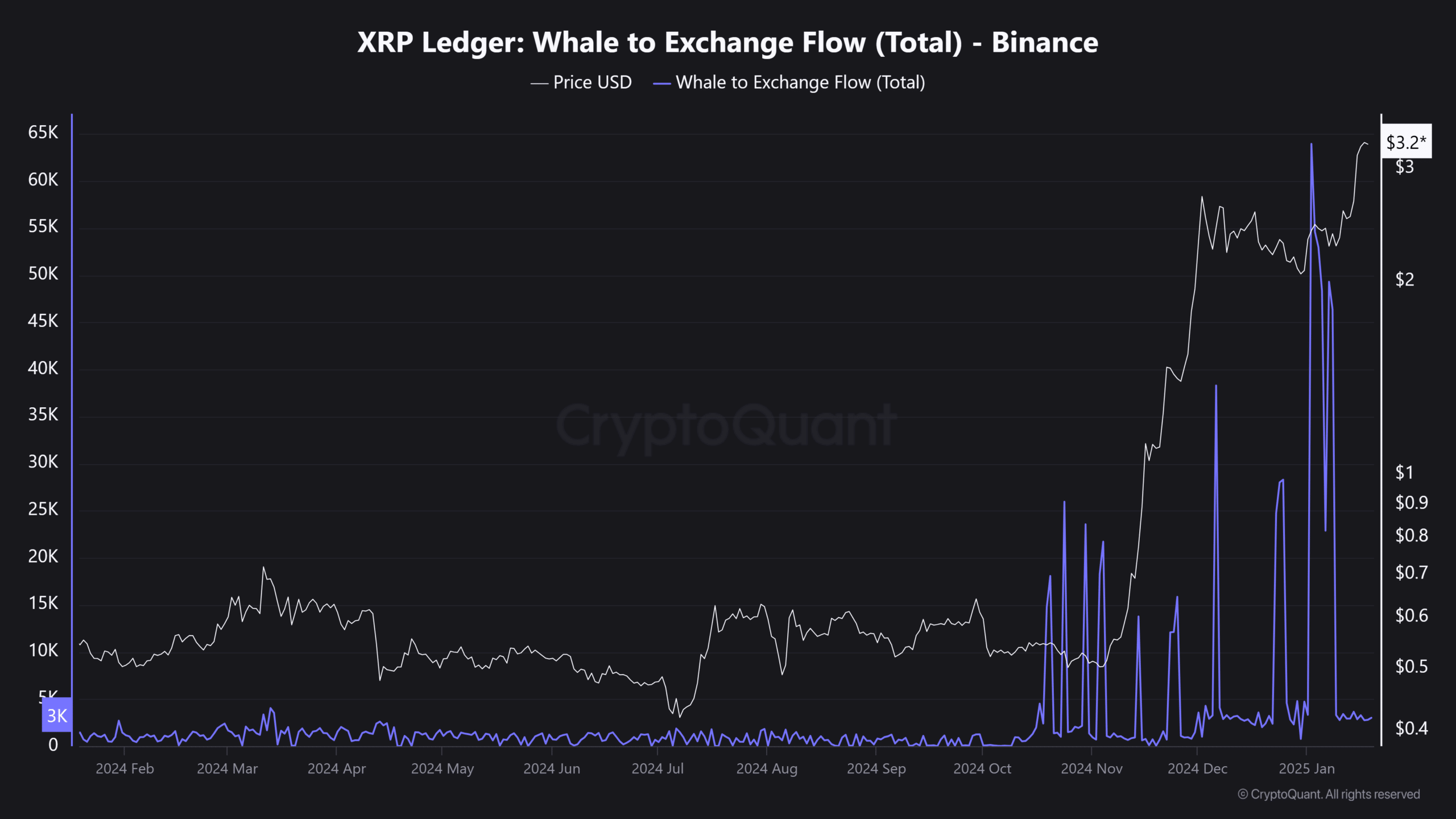

After a 53% surge in XRP in less than three weeks, it’s no surprise that traders are cashing out. In fact, in the last two day alines, XRP flowing into Binance has surged to nearly 350 million – A staggering 1567% hike.

Source: CryptoQuant

However, here’s where it gets interesting – Despite the profit-taking, whales are still holding firm. With around $4 billion accumulated since the last Trump pump, the anticipated ‘massive’ sell-off simply hasn’t materialized. Clearly, these whales aren’t in it for a quick win – They’re playing the long game.

If this trend continues, their strategy could pave the way for a powerful push towards $4, making holding XRP the savvy move for those eyeing long-term rewards.

XRP in an economic imbalance

As XRP surged past $3 with a 17% jump, hitting $3.50 – just 11% shy of its all-time high from seven years ago – it then pulled back by 8% at press time. This dip came as market dynamics shifted, with supply overtaking demand, creating an economic imbalance.

Now, the sell sentiment is taking over in the perpetuals market, as highlighted by the taker buy/sell ratio, giving shorts a clear advantage. The result? $8.44 million in long liquidations.

It’s clear the Futures market is growing riskier for XRP holders. And yet, the Open Interest (OI) has only dropped by 0.70%. This means more long positions could soon be squeezed out in the days ahead.

Why? In the short term, volatility may increase as investors focus on Bitcoin with the Trump pump in full swing. As capital moves from XRP to BTC, the XRP/BTC pair has turned red too, signaling a shift in market focus.

Unless whales re-enter the accumulation phase, we may see more profit-taking and forced closures of XRP long positions. So, caution is needed in the derivatives market.

Source: CryptoQuant

Realistic or not, here’s XRP market cap in BTC’s terms

That being said, in the spot market, the lack of aggressive selling by whales is a sign of strong conviction.

If Bitcoin peaks and profit-taking slows, XRP could see a push towards $4, making HODLing a smart move in the long run.