- RLUSD launched on the 17th of December.

- There have been bids of over $1,200 for a tiny fraction of the stablecoin.

Ripple’s much-awaited stablecoin, RLUSD, has officially launched today, triggering significant interest and a ripple effect across the market.

The launch has also fueled positive momentum for XRP, positioning it for further gains as investor sentiment strengthens.

RLUSD launches into a $200 billion stablecoin market

On the 16th of December, Ripple announced that RLUSD, its new stablecoin, would begin trading on the 17th of December following approval from the New York Department of Financial Services (NYDFS) on the 10th of December.

This regulatory green light gives Ripple a competitive foothold in the expanding stablecoin market, valued at over $209 billion.

Tether [USDT] remains the dominant player, with a market capitalization of $140.5 billion. USDC and Ethena USDe rank as the second and third-largest stablecoins, holding $42.3 billion and nearly $6 billion, respectively.

Early bids push RLUSD prices far beyond its peg

Ripple CTO David Schwartz revealed that RLUSD has already attracted extraordinary bids ahead of its launch, with some offers reaching as high as $1,200 per RLUSD.

Schwartz suggested that these bids are likely sentimental or speculative, and emphasized that the price will stabilize as liquidity improves post-launch.

Due to liquidity constraints, RLUSD may experience challenges maintaining its intended $1 peg in its early hours.

However, Schwartz reassured the market that RLUSD tokens are redeemable for $1 each, making any deviation from the peg temporary.

The price discrepancies are expected to resolve as trading volume increases and liquidity deepens.

XRP price surges: Can it hit $3?

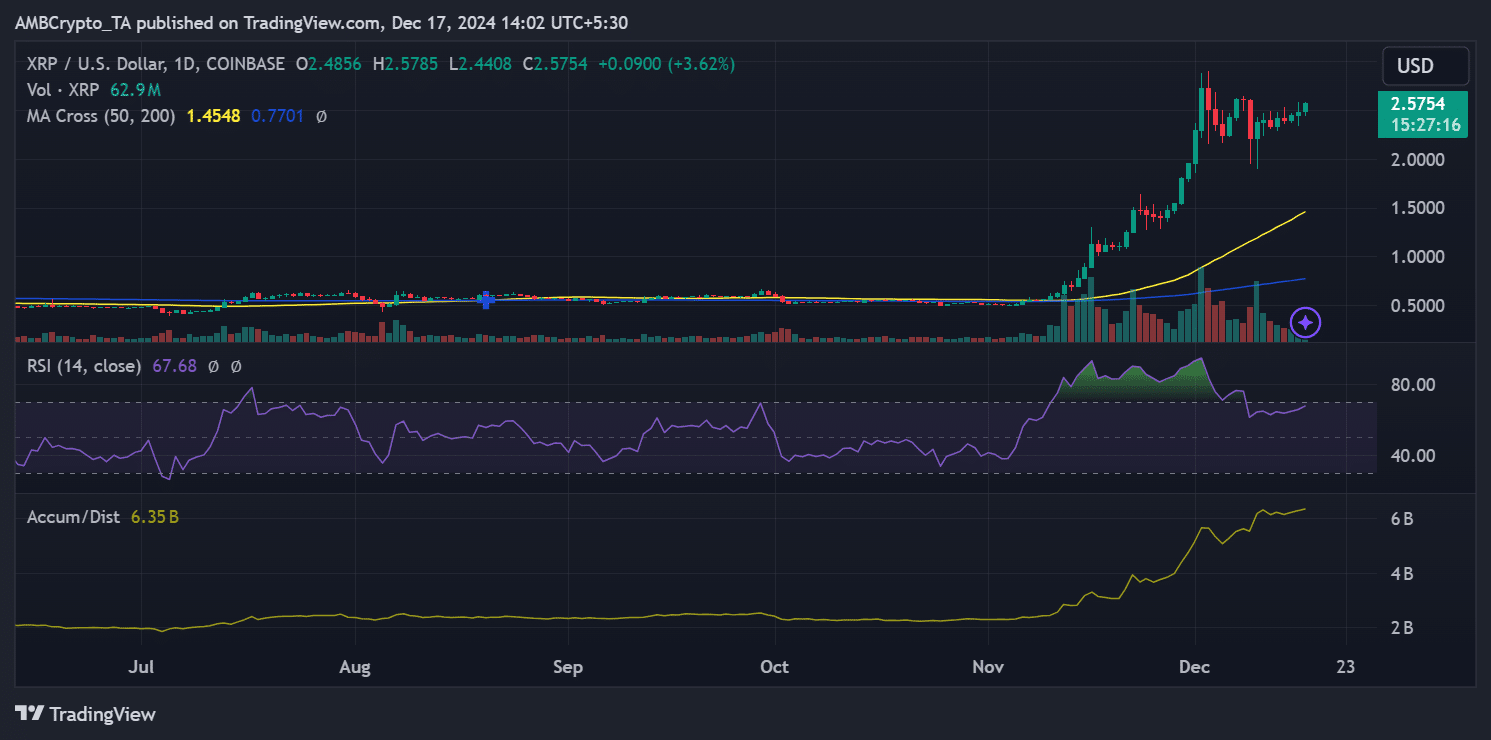

XRP’s price has surged to $2.57 on the back of RLUSD’s launch, benefiting from strong bullish sentiment and technical momentum.

The 50-day moving average at $1.45 acts as strong support, while the 200-day moving average at $0.77 underlines the strength of XRP’s long-term bullish trend.

Source: Trading View

Technical indicators suggest sustained buying pressure, with the Relative Strength Index (RSI) at 67.68 signaling growing demand, albeit nearing overbought territory.

Additionally, the Accumulation/Distribution (A/D) indicator, sitting at 6.35 billion, highlights significant investor accumulation amid RLUSD-driven optimism.

For XRP to achieve the highly anticipated $3 mark, it must maintain momentum above key support at $2.40. A breakout above immediate resistance at $2.80 could clear the path for further upside.

However, traders should remain cautious, as profit-taking may trigger a short-term pullback, potentially testing support at $2.20 before any renewed push higher.

Ripple’s dual momentum with RLUSD and XRP

The RLUSD launch marks a significant step for Ripple, combining regulatory approval and market excitement.

While RLUSD’s initial trading phase may witness volatility, its long-term success hinges on liquidity and adoption.

Read XRP’s Price Prediction 2024–2025

Meanwhile, XRP’s bullish momentum places it in a favorable position to test new highs, with $3 as a plausible target if the current trend holds.

The coming days will reveal whether XRP can capitalize on the growing investor enthusiasm to sustain its upward trajectory.