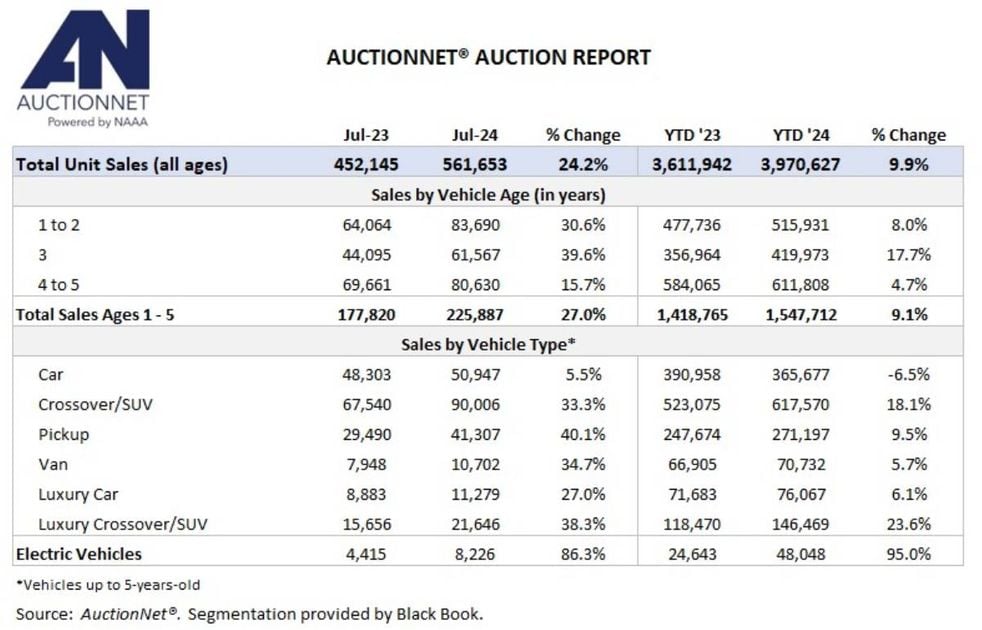

Total AuctionNet sales through the first seven months of the year reached 3.97 million units, a 10% improvement over 2023’s YTD total, while sales of units up to 5-years-old rose 9.1% to 1.55 million units (comprising 39% of total sales).

Total AuctionNet wholesale auction sales grew appreciably on an absolute basis in July, reaching 561,653 units, an increase of more than 24% compared to July 2023, AuctionNet reported Aug. 8.

There were two more selling days last month than July 2023, but sales were up a stout 13% even after adjusting for selling days.

Among key indicators:

- Auction sales of later model units (up to 5-years-old) were up even more year-over-year in July, rising by 27%/15.5% on an unadjusted/adjusted basis.

- Total AuctionNet sales through the first seven months of the year reached 3.97 million units, a 10% improvement over 2023’s YTD total, while sales of units up to 5-years-old rose 9.1% to 1.55 million units (comprising 39% of total sales).

- Dealer and commercial sales finished the month up 7% and 26%, respectively, compared to last July (again, selling day adjusted). Year-to-date, commercial sales growth stands at +30%, while dealer sales are down 1.6%.

3-Year-Old Vehicle Boost Starting to Fade

As has been the case all year, the number of 3-year-old vehicles sold at auction rose again in July, increasing by nearly 40% on a prior year basis (or 27% after adjusting for selling days).

That said, growth in 3-year-old vehicle auction sales, which include many off-lease units, appears to be starting to wane somewhat. There was a substantial decline in new lease originations over the back half of 2021 and given that most new lease agreements are based on a 36-month term, we should expect to see 3-year-old off-lease volume follow a similar pattern over the back half of this year.

Sales volume for trucks and SUVs continuing to move substantially higher on a year-over-year basis while car sales remained relatively depressed.

Truck, SUV Sales Exceed Car Sales

As for segments, July’s performance was like previous months, with sales volume for trucks and SUVs continuing to move substantially higher on a year-over-year basis while car sales remained relatively depressed.

The diverging volume patterns between cars and trucks/SUVs is due to what has occurred with new vehicle sales over the past several years, as light truck share of new vehicle sales has grown from just over 76% in 2020 to nearly 81% year-to-date, while car share fell from 23.6% to just over 19%.

EV Auction Sales Spike

Whether adjusted for selling days or not, auction sales of EVs continued their rapid rise last month, exceeding 10,300 overall, 80% of which were sales of later model units.

July marked the first month in which EV auction sales surpassed 10,000 units. Year-to-date, EVs comprised 1.6% of total AuctionNet sales, up from 0.9% versus 2023.

Monthly AuctionNet data is derived from 265 NAAA member auctions that use AuctionNet. It is considered the most comprehensive source of wholesale auto auction sales data in the U.S. Starting in June 2024, monthly figures reflect all sales, not just fleet/lease sales, as they did in the previous monthly releases due to underlying changes in how the data is reported.