- KAIA’s sentiment was overwhelmingly positive, with its TVL reaching levels last seen in 2023—its highest point this year.

- On-chain metrics further supported the bullish outlook.

Kaia’s [KAIA] growth over the past week has been extraordinary, with a 101% increase. This builds on a rally that started a month ago, resulting in a cumulative 197.6% gain—a performance matched by only a handful of tokens in the market.

The surge has attracted a wave of eager buyers, driving the price even higher and presenting a compelling opportunity for investors.

Collective interest in KAIA spikes

Interest in KAIA has surged, making it the fourth top earner on CoinMarketCap after a 35.05% price increase. This was accompanied by a dramatic 281.63% rise in trading volume, as reported by Coinglass, with active buyers and sellers exchanging positions in the market.

This heightened interest significantly impacted KAIA’s market performance. The token’s market capitalization, representing its total value, surged by 36.27% to $2.25 billion.

At the same time, KAIA’s Total Value Locked (TVL)—a key indicator of investor activity within the blockchain protocol—rose to $128.49 million.

This is the highest level this year, matching a peak last seen in December 2023 and reflects growing investor confidence and commitment to the platform’s growth.

Source: DeFiLlama

If this momentum persists, KAIA’s price is ready for further gains as market interest continues to build.

Warning sign: A potential drop in price

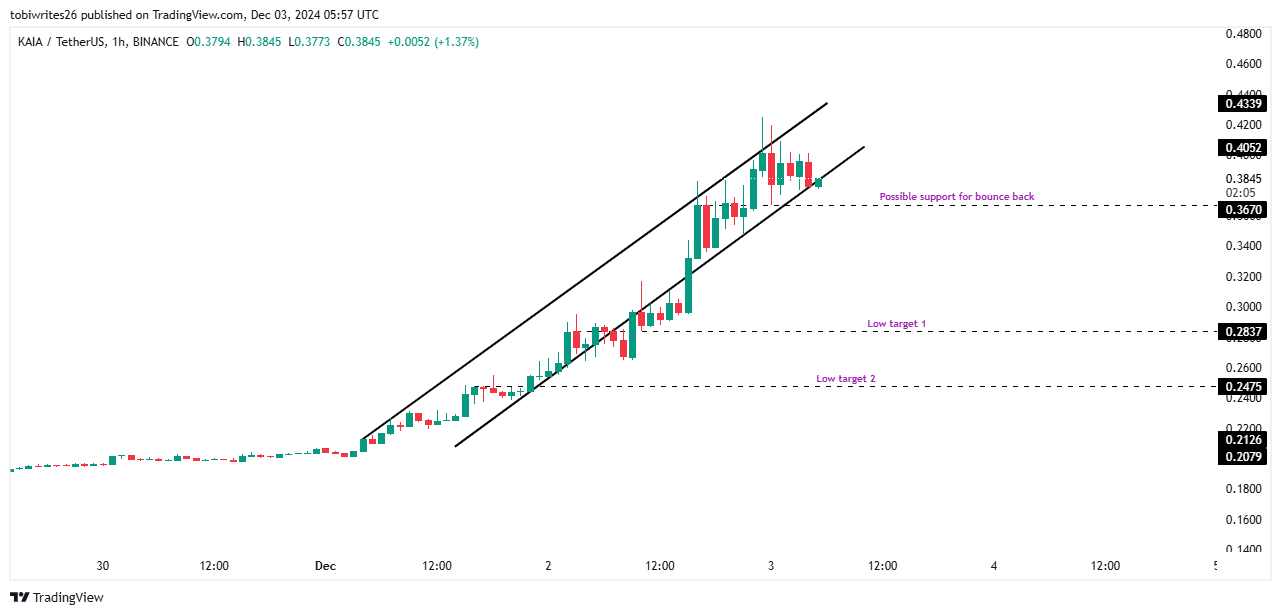

KAIA’s price might face a downturn as it trades within an ascending triangle pattern. This pattern, characterized by price movements between an upward-trending resistance and support line, often leads to a breakdown and significant decline when the support line is breached.

If this scenario occurs, KAIA’s price could retreat to the base of the channel. A rebound at $0.3670 may offer temporary relief, but failing to hold this level could push the price to two lower targets: $0.2837, and if no bounce occurs, $0.2475.

Further declines could follow, depending on on-chain sentiment.

Source: Tradingview

Despite these risks, AMBCrypto notes that current on-chain sentiment remains bullish, which may support the price and even raise it.

Bullish momentum sustained by on-chain activity

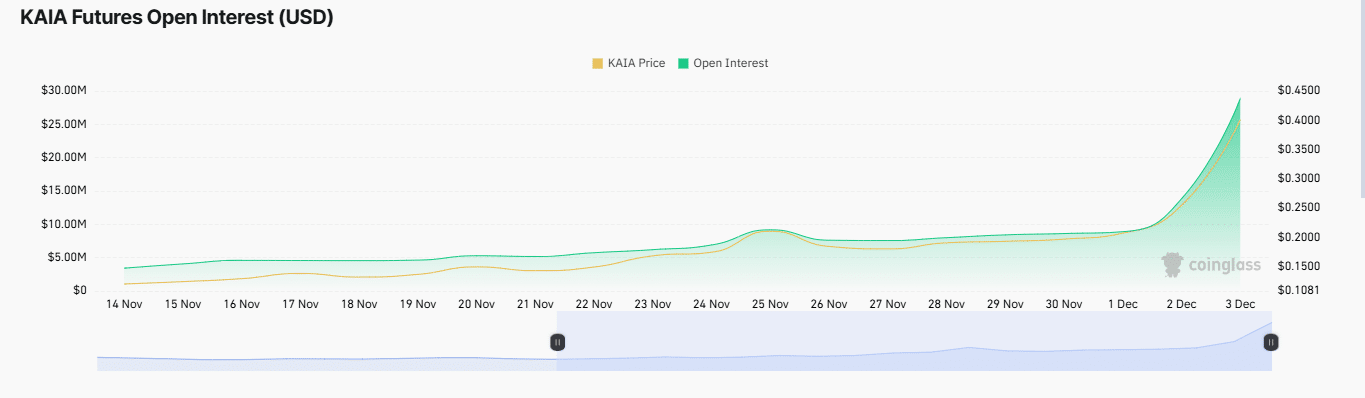

At the time of writing, Coinglass reported a bullish market sentiment for KAIA, with its Open Interest(OI) surging by 107% to reach $35.15 million.

An increase in OI typically signals market confidence, suggesting that bullish traders are dominating by opening or maintaining long positions. This indicates optimism in KAIA’s price trajectory and reinforces the prevailing bullish outlook.

Source: Coinglass

Read Kaia’s [KAIA] Price Prediction 2024–2025

Additionally, the Funding Rate has been positive at 0.00254%. This suggests that long traders are paying to maintain a balance between the perpetual and spot markets, which helps ensure price stability.

If these trends continue, KAIA’s price is likely to sustain its upward momentum, further boosting the ongoing rally.