- Key U.S. economic releases this week, including JOLTS and ADP data, may trigger volatility in crypto markets as traders assess macro trends.

- Stablecoins show resilience with rising inflows, while Bitcoin and Ethereum react to tightening liquidity concerns.

This week, the U.S. economic calendar is packed with significant events, including the release of employment data, Fed meeting minutes, and labor market surveys.

These developments could heavily influence investor sentiment and drive volatility across cryptocurrency markets. Understanding these events is critical for predicting potential market movements as crypto increasingly reacts to macroeconomic cues.

Major U.S. economic events to watch

The S&P Global Services PMI, released on Monday, reflects the health of the services sector, a key driver of the U.S. economy. A strong reading could signal economic resilience, potentially reinforcing the Federal Reserve’s hawkish stance.

Crypto markets might react negatively to this U.S. economic event, as expectations of higher interest rates could reduce liquidity.

Tuesday’s JOLTS Job Openings report will provide insights into labor market demand. An unexpectedly high number of job openings may fuel fears of further rate hikes, putting downward pressure on cryptocurrencies as investors seek safer assets.

The ADP Nonfarm Employment report and the Fed Meeting Minutes will take center stage on Wednesday. The ADP report previews the official jobs report, while the Fed meeting minutes will offer insights into policymakers’ views on inflation and rates.

A hawkish tone could weigh on risk assets like crypto, while a dovish outlook might provide relief and support market recovery.

The December Jobs Report, scheduled for Friday, is the most influential release of the week. This report includes nonfarm payroll data, unemployment rates, and wage growth figures.

A weaker-than-expected report could boost crypto markets as it raises the probability of the Fed slowing down rate hikes.

Throughout the week, eight Federal Reserve speaker events will provide additional clues on the monetary policy outlook. Hawkish remarks could cap any short-term rallies in crypto.

Potential impacts on the Crypto market

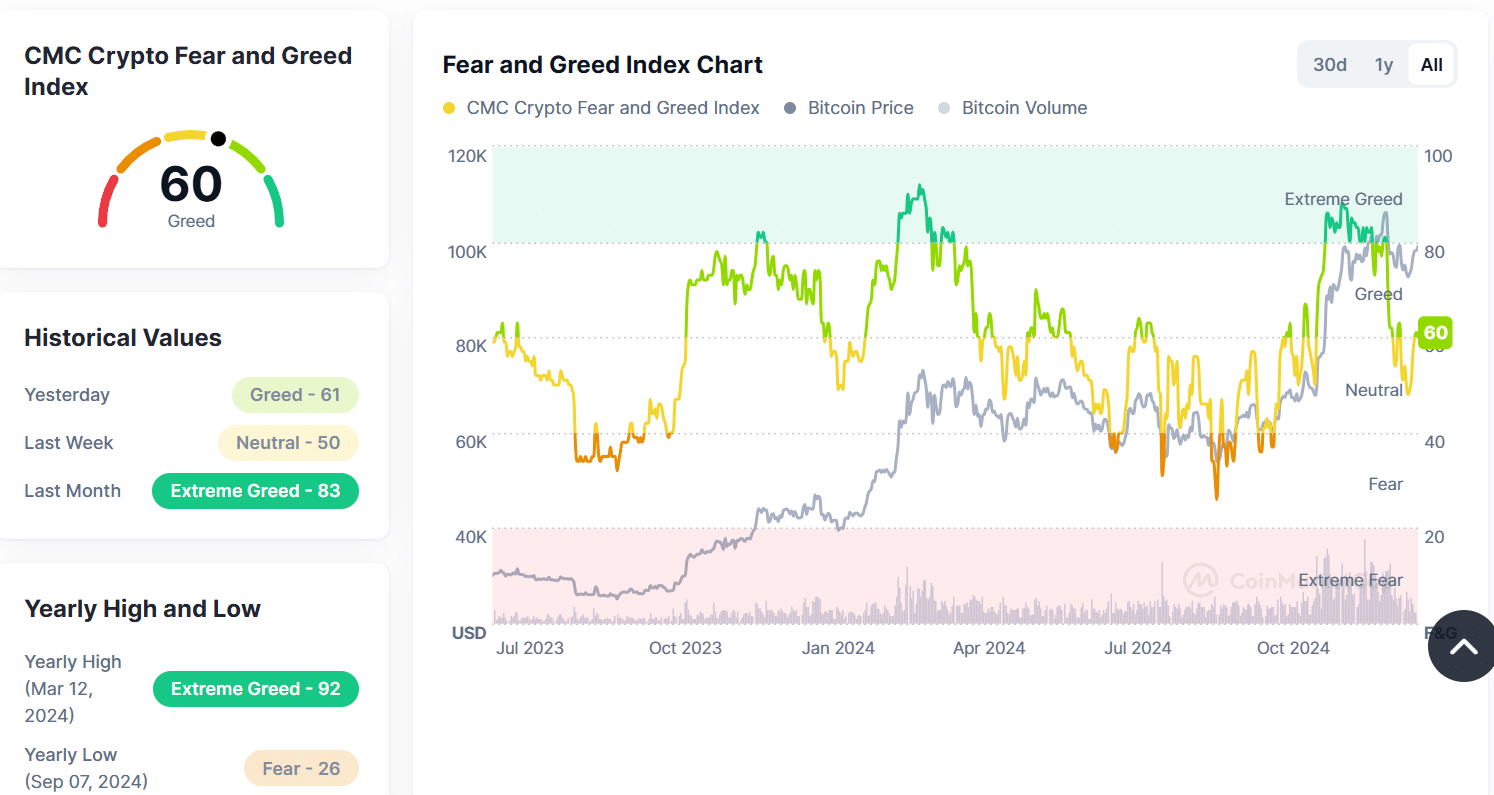

At the time of writing, the Crypto Fear and Greed Index sat at 60 (Greed), reflecting cautious optimism. This marks a shift from Extreme Greed (83) last month and Neutral (50) last week, suggesting a more balanced sentiment among traders.

This week, Macroeconomic events could push sentiment toward greed if dovish signals emerge or toward fear if stronger data supports aggressive Fed tightening.

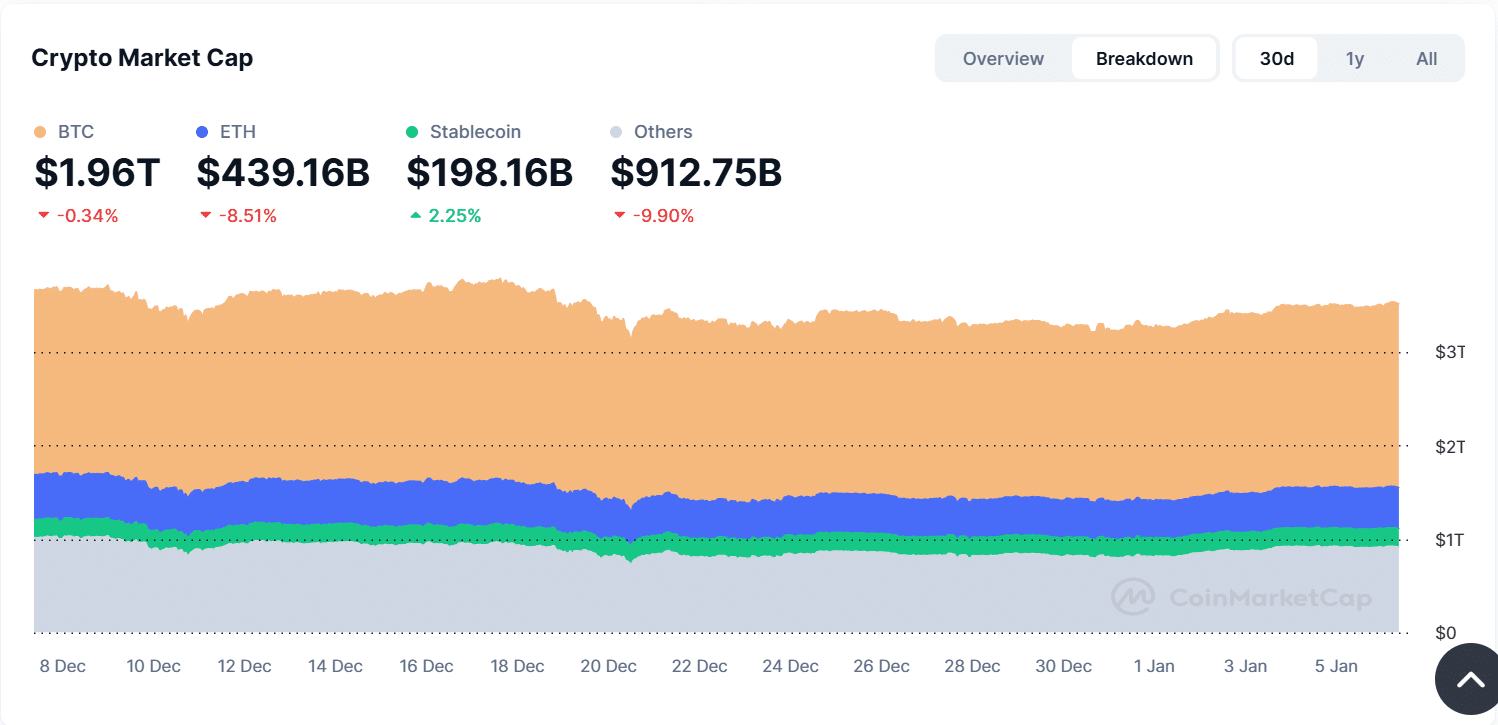

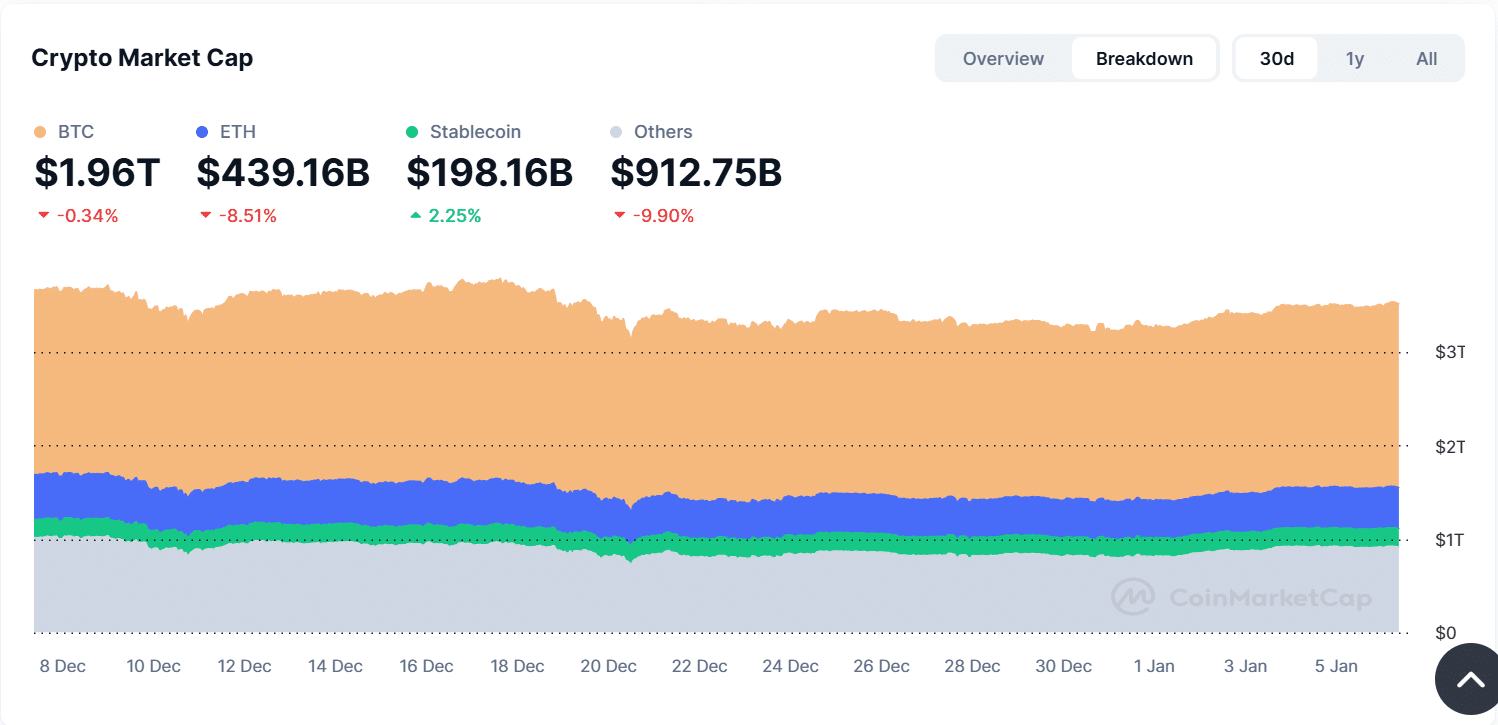

Source: CoinMarketCap

The total crypto market cap remains at $3.51 trillion, with notable differences across asset classes. Bitcoin[BTC] and Ethereum[ETH] have seen declines of 0.34% and 8.51%, respectively, indicating sensitivity to macroeconomic conditions.

Meanwhile, stablecoins have gained 2.25%, reflecting a cautious pivot toward safety. These trends highlight how crypto investors are reacting preemptively to potential rate changes.

Source: CoinMarketCap

Over the past 30 days, the crypto market has consolidated, with the total market cap dipping to $3.28 trillion on December 22 before recovering. This indicates a “wait-and-see” approach as traders balance macroeconomic uncertainties with potential buying opportunities.

Broader implications of these U.S. economic events

This week’s U.S. economic events could significantly influence the crypto market. Strong economic data may support further interest rate hikes, reducing liquidity and weighing on crypto prices.

Dovish signals or weaker employment data could bolster risk appetite, prompting renewed interest in cryptocurrencies. Stablecoins may continue to see inflows if risk aversion persists, while altcoins could face further sell-offs.

The bottom line

As crypto markets continue to mirror broader economic trends, this week’s U.S. economic events will provide critical signals for traders.

Whether it’s the labor market’s health or the Federal Reserve’s policy trajectory, these events will likely set the tone for the next phase of market sentiment and price action in cryptocurrencies.