- Mining supply dropped from 655k LTC to 645k LTC as the CMF hovered at 0.07

- Accumulation/Distribution line has climbed from 60M to 67.37M since March 2024

Litecoin (LTC) miners recently intensified their selling pressure across the board, with on-chain data showing significant supply movements. In fact, the cryptocurrency was trading at $119.06 at press time, down 4.96% in the last 24 hours. It had a trading volume of 156.29k, as miners continued to adjust their positions amid the market’s volatility.

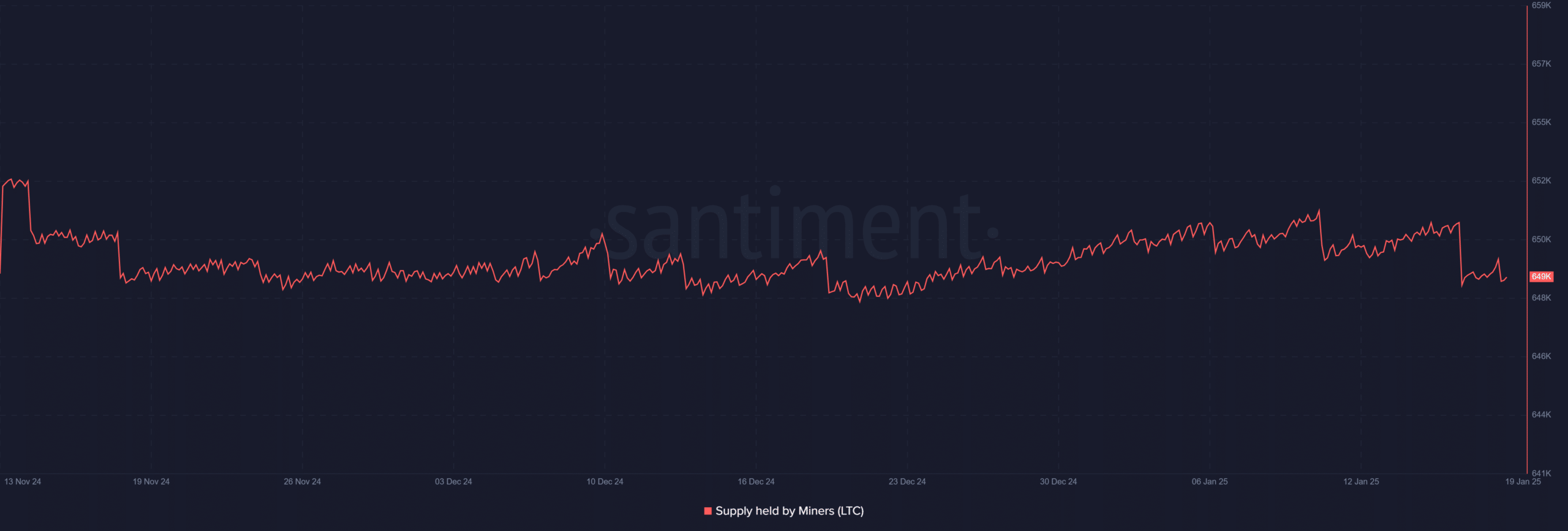

Litecoin supply movement and miner behavior

On-chain data revealed a clear shift in Litecoin miners’ holdings, with supply levels dropping to approximately 645k LTC from previous peaks of 655k. This decline, while not drastic, seemed to represent a consistent selling pattern over the last two months.

Source: Santiment

The steady nature of this sell-off, rather than sharp dumps, hinted at a calculated approach to liquidations rather than panic selling.

Notably, the supply chart revealed greater volatility in mid-January, indicating heightened miner activity during price fluctuations.

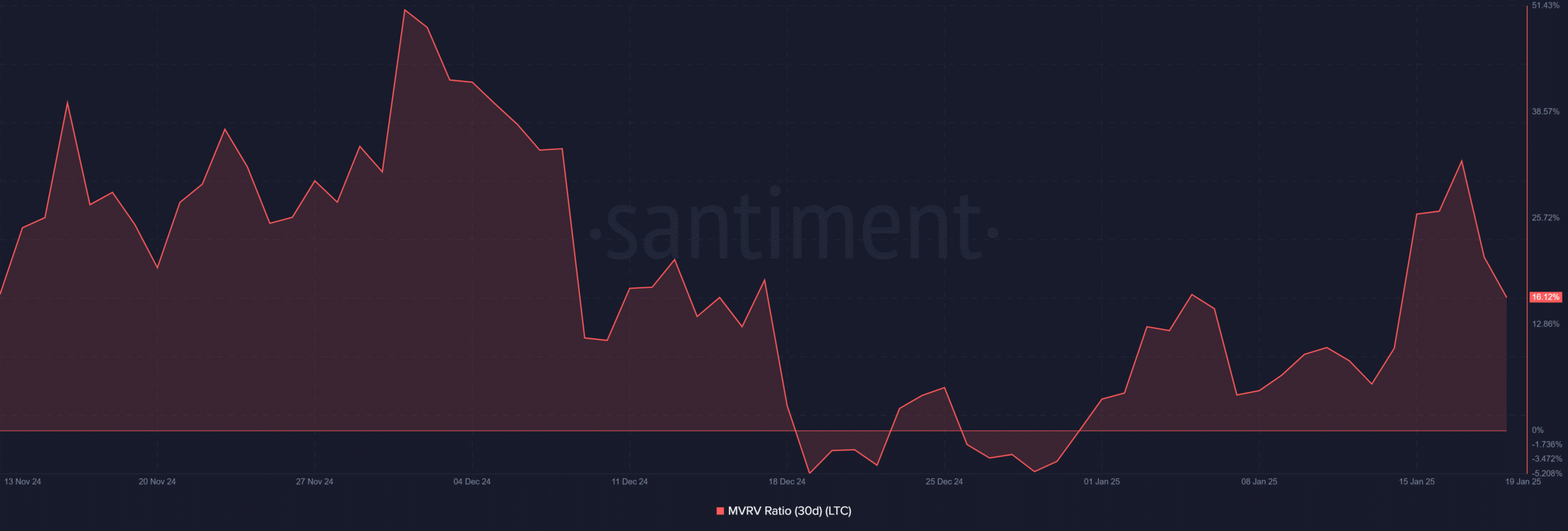

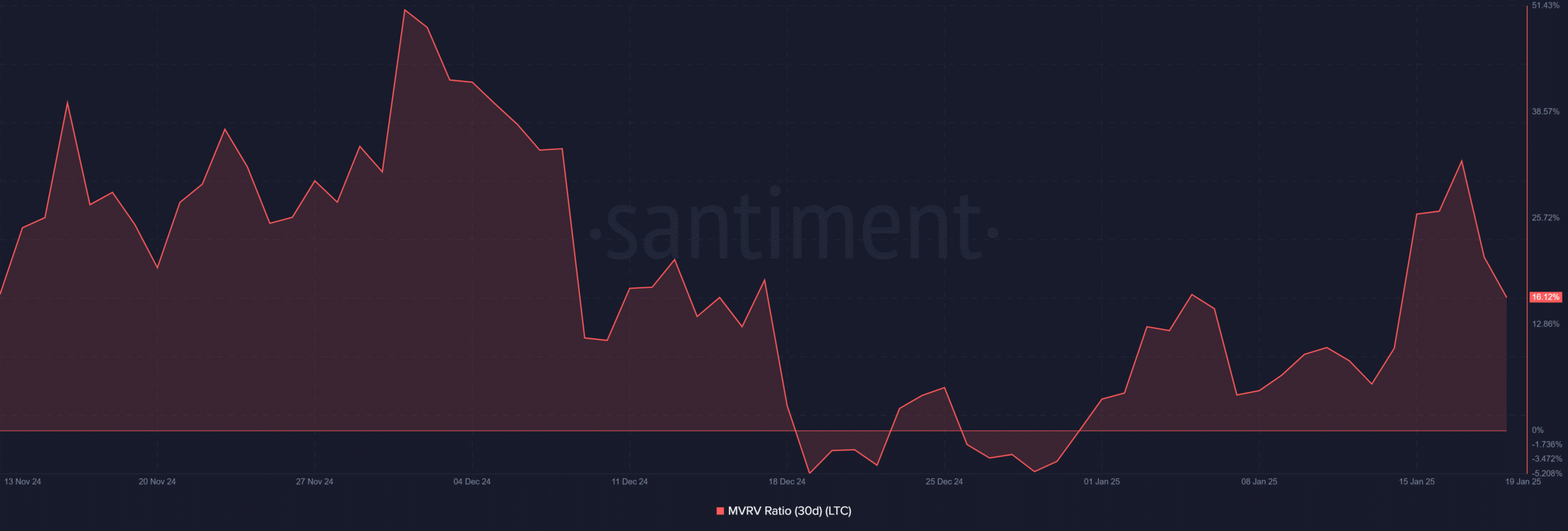

MVRV analysis points to market sentiment

Litecoin’s 30-day MVRV (Market Value to Realized Value) ratio tells us a compelling story of market sentiment shifts.

After hitting peak levels of 38.57% in early December 2024, the ratio saw a sharp decline to its press time levels of 16.12%.

Source: Santiment

Such a significant drop indicated that short-term holders who bought within the last 30 days have been seeing significantly reduced profit margins.

In fact, the MVRV’s downward trajectory since December alluded to the cooling of speculative interest, potentially signaling a shift towards a more sustainable market valuation.

Litecoin’s technical analysis and price action

Litecoin’s daily chart underlined several critical technical developments too.

The 50-day moving average at 113.31 and the 200-day moving average at 80.84 maintained a bullish cross formation – Historically a positive indicator for medium-term price action.

The Accumulation/Distribution line also noted remarkable strength, climbing steadily to 67.37M from 60M in March 2024. This can be interpreted to be a sign of sustained buying pressure, despite miner sell-offs.

Source: TradingView

The Chaikin Money Flow (CMF) oscillating around 0.07 provided some additional context, indicating that despite recent price weakness, buying pressure has been marginally stronger than selling pressure. This seemed to create an interesting divergence with the miners’ selling pattern, suggesting retail and institutional investors might be absorbing the selling pressure.

Also, trading volume patterns highlighted significant spikes during price declines, particularly in recent weeks. The volume profile hitting 156.29k indicated active market participation during the sell-off periods.

Finally, despite the hike in selling pressure, the price has maintained support above the crucial 50-day moving average, demonstrating underlying market strength.

Looking ahead – Market implications

The prevailing market structure presents an intriguing scenario, one where Litecoin miner behavior appears disconnected from the broader market sentiment. While miners continue their methodical sell-off, possibly due to profit-taking or operational costs, steady accumulation metrics hinted at strong buyer interest at press time levels. The MVRV ratio’s position, while lower than recent peaks, has remained in positive territory too – Underlining the potential for price recovery if selling pressure subsides.

The interplay between these various metrics suggested that Litecoin is in a critical phase where miners’ behavior could significantly influence short-term price action. The coming weeks will be crucial in determining whether the current miner sell-off represents a healthy market redistribution or the beginning of a more significant trend shift.

– Read Litecoin (LTC) Price Prediction 2024-25

The sustained support levels around $113, coinciding with the 50-day moving average, will be vital for maintaining market structure. If these levels hold despite sustained miner selling, it could allude to strong fundamental demand for LTC at its press time valuation.