- Traders were over-leveraged at $1.597 on the lower side and $1.663 on the higher side.

- POPCAT’s Long/Short Ratio stood at 1.045, indicating a strong bullish sentiment among traders.

Popular Solana [SOL]-based memecoin Popcat [POPCAT] has been making waves in the cryptocurrency landscape with its impressive performance.

On the 24th of October, while major cryptocurrencies like Bitcoin [BTC], Ethereum [ETH], and Binance Coin [BNB] struggled to gain momentum, the memecoin registered a significant gain.

POPCAT’s current price momentum

At press time, POPCAT was trading near $1.644 after experiencing a price surge of over 18% in the past 24 hours.

During this period, its trading volume increased by 23%, indicating heightened participation from traders and investors compared to the previous day.

The potential reason for this rally is Solana’s recent consolidation breakout and the growing popularity of Solana-based meme tokens.

Technical analysis and key levels

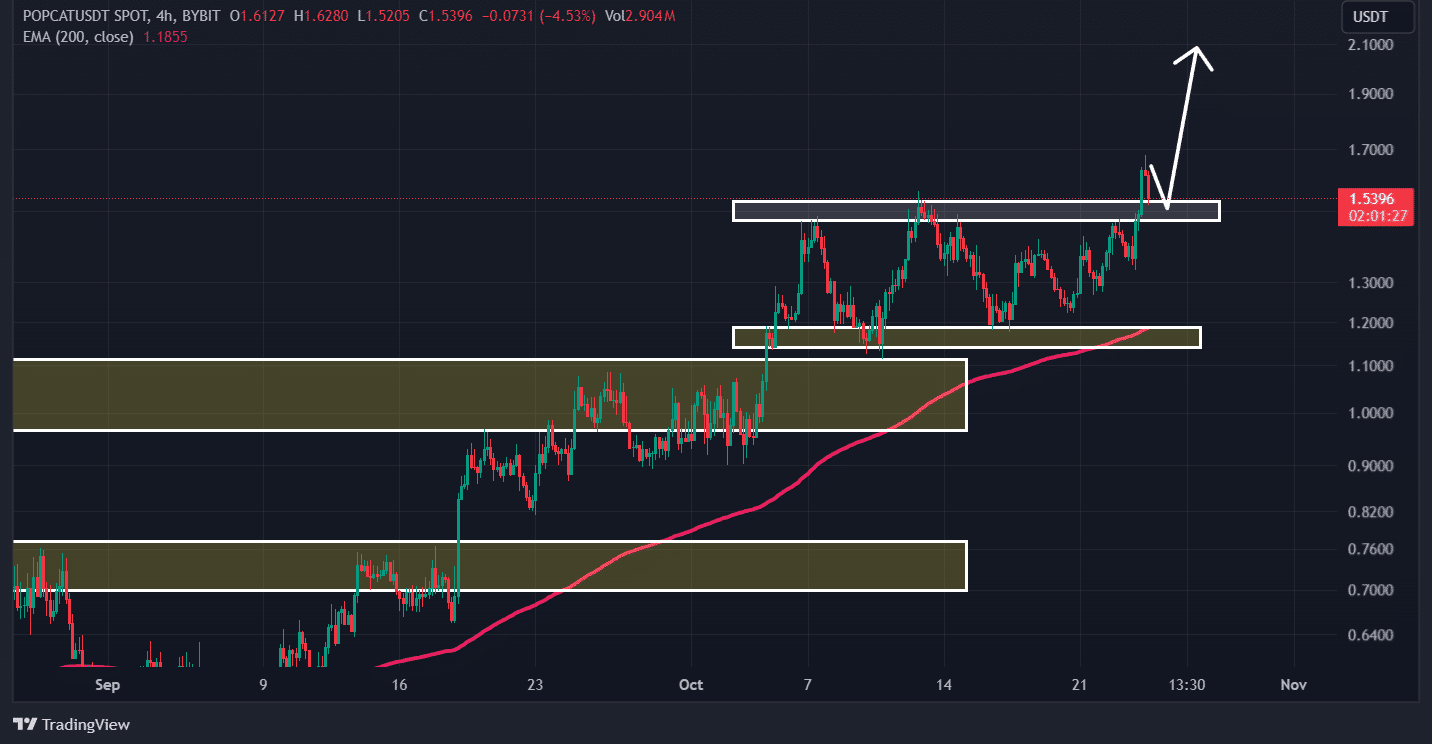

According to AMBCrypto’s technical analysis, POPCAT appeared bullish as it had broken out from a strong consolidation zone between $1.13 and $1.54, shifting sentiment from a downtrend to an uptrend.

Source: TradingView

Following this breakout, the memecoin has a strong possibility of reaching a new high in the coming days.

Bullish on-chain metrics

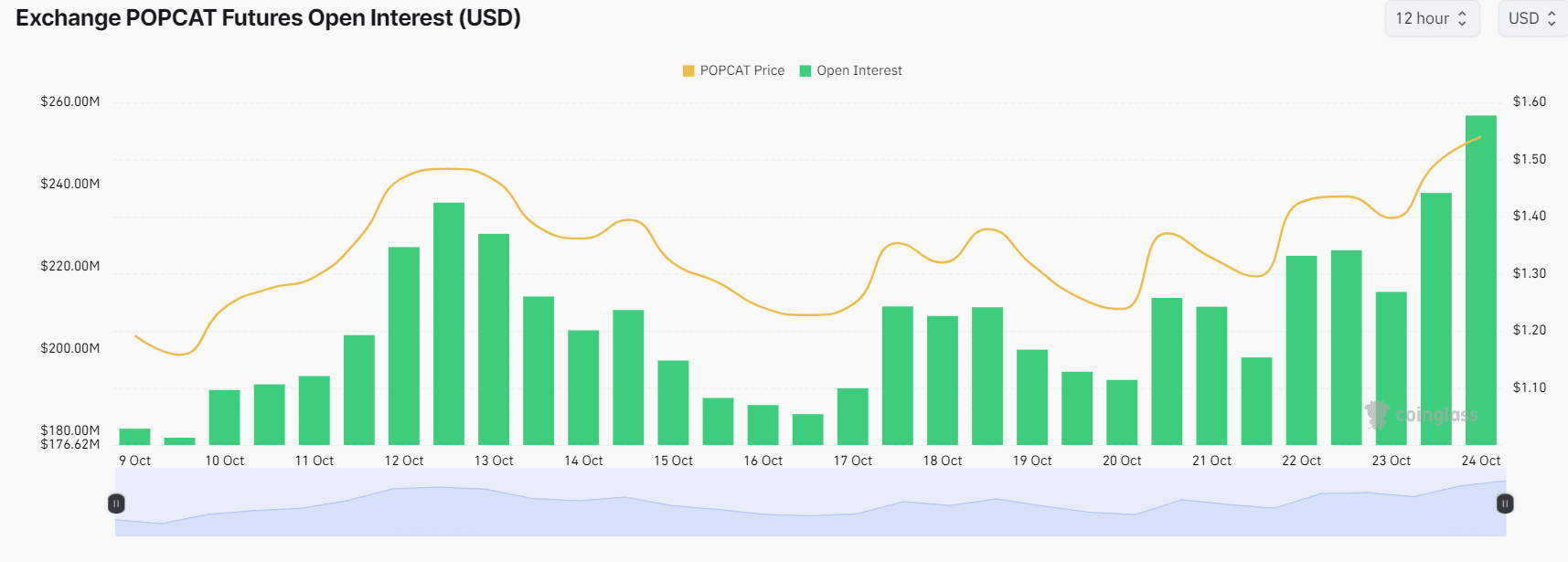

POPCAT’s bullish outlook is further supported by on-chain metrics. According to the on-chain analytics firm CoinGlass, POPCAT’s Long/Short Ratio was 1.045 at press time, indicating strong bullish sentiment among traders.

Additionally, its Open Interest (OI) has skyrocketed by 29% over the past 24 hours and 8.6% over the past four hours.

This suggested growing trader and investor interest, along with a buildup of more positions compared to previous days.

Source: Coinglass

At the time of writing, 53.2% of top traders hold long positions, while 48.8% held short positions. Traders and investors often consider this rising Open Interest and a Long/Short Ratio above 1 when building long positions.

Major liquidation levels

As of now, the major liquidation levels were near $1.597 on the lower side and $1.663 on the higher side, with traders over-leveraged at these levels, according to the Coinglass.

If the sentiment remains unchanged and the price soars to the $1.663 level, nearly $1.27 million worth of short positions will be liquidated.

Read Popcat’s [POPCAT] Price Prediction 2024–2025

Conversely, if sentiment changes and the price declines to the 1.597 level, approximately $2.16 million.

This liquidation data indicates that bulls are currently dominating the asset and may continue to support the ongoing bullish trend.