72,407 vehicles were sold into rental fleets in October 2024, compared to 47,482 in October 2023, for a 52.5% spike.

A spike in rental fleet sales and a healthy increase in government fleet sales helped narrow a gap in year-to-date fleet sales compared to the same period in 2023, according to monthly Bobit fleet sales data released Nov. 1.

Fleet sales through October 2024 were 1,807,057, down 1.3% from 1,831,258 vehicles sold during the same period of 2023.

That compares with fleet sales for the first three quarters of 2024 that were 1,651,900, down 2.7% from 1,698,052 vehicles sold during the same period of 2023. 2024 fleet sales began flatlining in July.

- Commercial fleet sales so far this year stood at 695,719 vehicles, down 8.4% from 759,287 fleet vehicles sold in the first 10 months of 2023.

- Rental fleet sales are slightly up YTD at 876,496, for an increase of 4.2% compared to 841,043 rental vehicles sold the first 10 months of 2023.

- Government fleet sales stand at 234,842 vehicles sold YTD, up 1.7% from 230,928 sales in the same period last year.

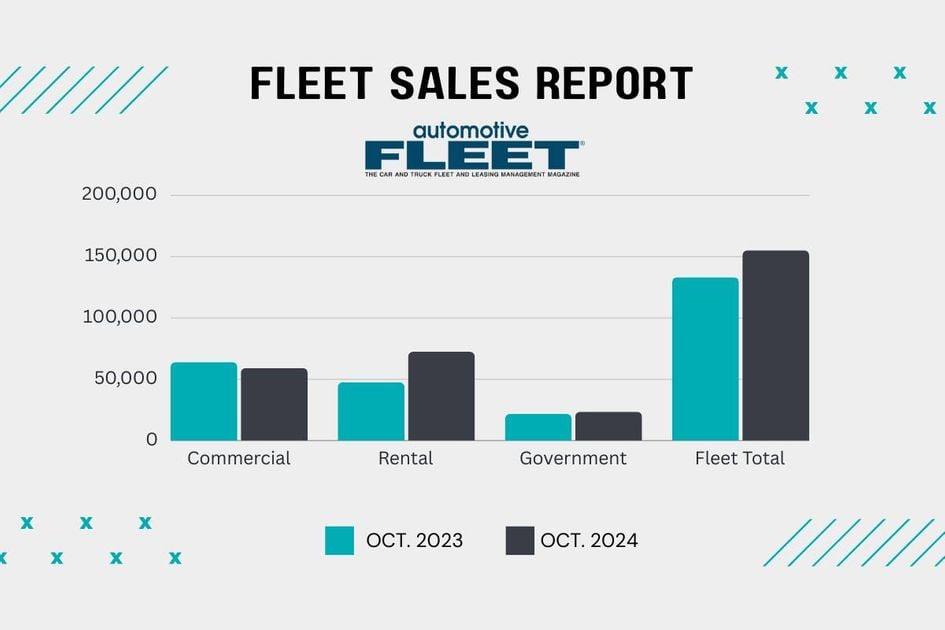

The fleet sector breakdown of October 2024 versus October 2023 sales:

- Commercial Fleets: 59,186 vehicles were sold into commercial fleets in October 2024, compared to 64,045 in October of last year, for a decline of 7.6%.

- Rental Car Fleets: 72,407 vehicles were sold into rental fleets in October 2024, compared to 47,482 in October 2023, for a 52.5% spike.

- Government Fleets: Sales rose 8.7% to 23,564 vehicles in October 2024 from 21,679 in October of last year. (Note: Apples-to-apples comparisons with government fleet sales are not possible because one or more OEMs do not report sales month to month. In July, Hyundai, Nissan, Subaru, and Toyota did not report sales to government fleets.)

The combined sales for the three fleet sectors in October totaled 155,157 vehicles, up 16.5% from the October 2023 total of 133,206 fleet vehicle sales.

“Auto manufacturers appear to be making up for weak retail new vehicle sales by selling more fleet units, particularly rental fleet units,” said industry analyst and economist Tom Kontos. “Sales into the rental fleets were up by more than 50% year-over-year in October. If rental sales continue to be strong in November and December, total fleet sales of all types for 2024 may end up being above 2023 levels, which bodes well for future used vehicle supply of attractive late-model units.”

Bobit, owner of Automotive Fleet, Vehicle Remarketing, and Auto Rental News, compiles fleet sales numbers that reflect aggregate figures from the three major Detroit-based auto manufacturers and the Asian Big 6 automakers.