- Shiba Inu’s trading volume dipped while its price surged.

- The Fear and Greed Index showed that the market was in an “extreme greed” phase.

Shiba Inu [SHIB] has once again come in the limelight with its massive price hike. Though this was benefiting investors, but will this trend continue?

Shiba Inu gains momentum

The world’s second-largest memecoin surprised investors in the recent past with its double-digit price growth.

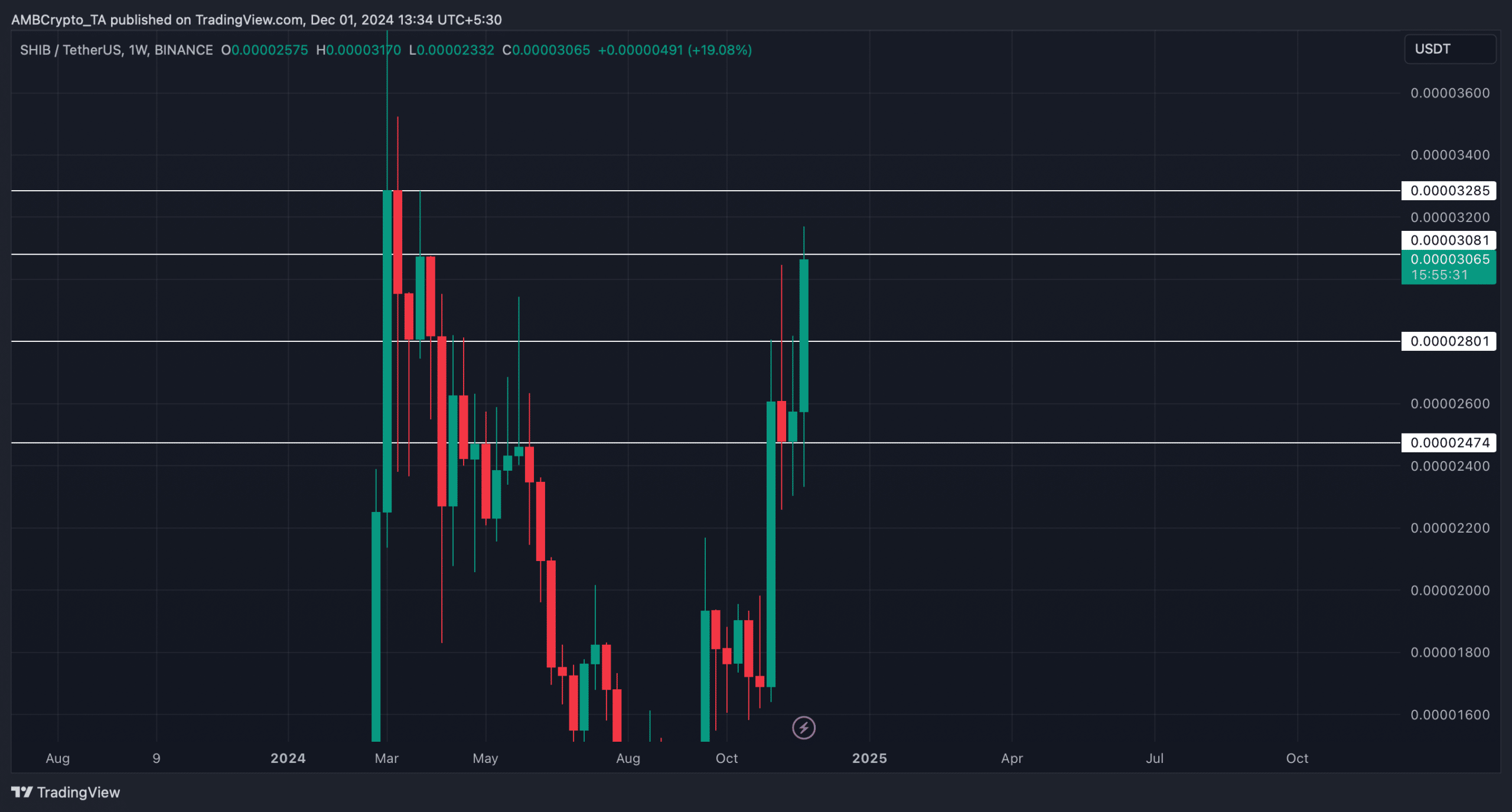

SHIB’s price surged by 18% in the last 24 hours, pushing its value to $0.0000309 with a market capitalization of over $18 billion. Thanks to that, the memecoin entered the top 10 list of cryptos by market cap.

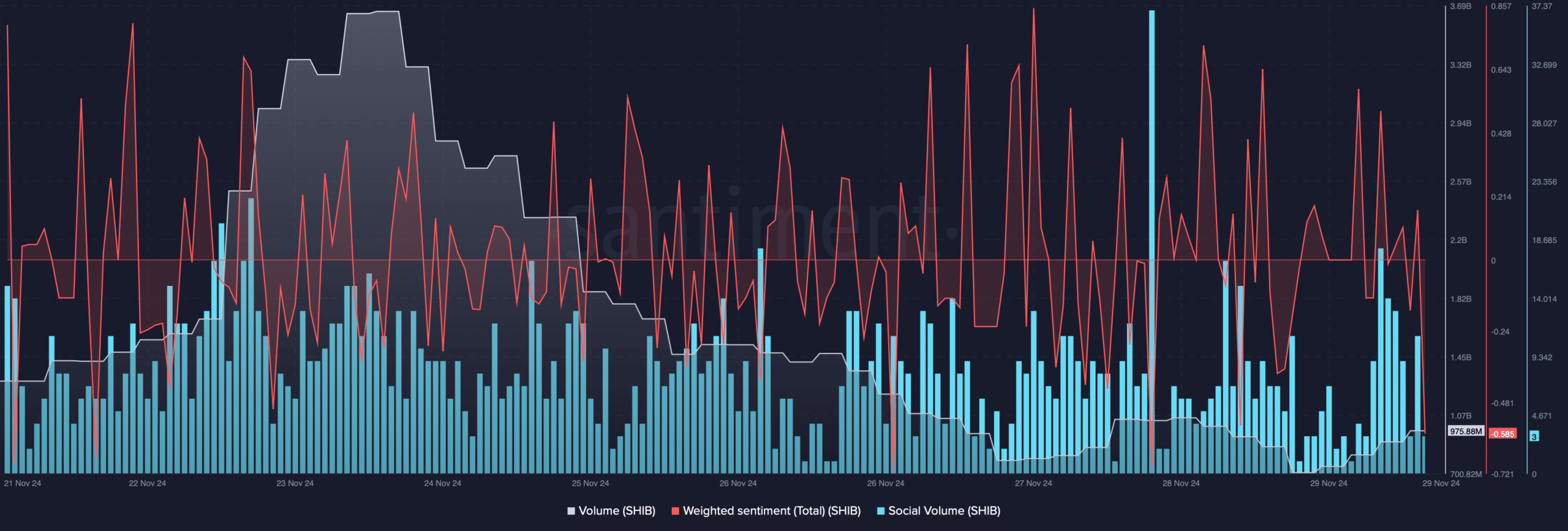

However, signs of trouble brewed. While the token’s price rallied in double digits, its trading volume plummeted sharply.

A drop in trading volume amidst a price hike indicates that the chances of a bearish trend reversal are high.

Its Weighted Sentiment also declined in the last few days, signaling a rise in bearish sentiment. Nonetheless, its Social Volume spiked, which can further contribute to its bull rally.

Source: Santiment

Is a price correction inevitable?

Coinglass’ data revealed that Shiba Inu’s Open Interest shot up substantially. While a rise in OI often suggests the ongoing price trend continuing, things on this occasion were different.

As evident from the past spikes in SHIB OI, it was clear that whenever the memecoin’s OI shot up to its current level, it witnessed a price correction. If history repeats, then SHIB might soon fall victim to a pullback.

Source: Coinglass

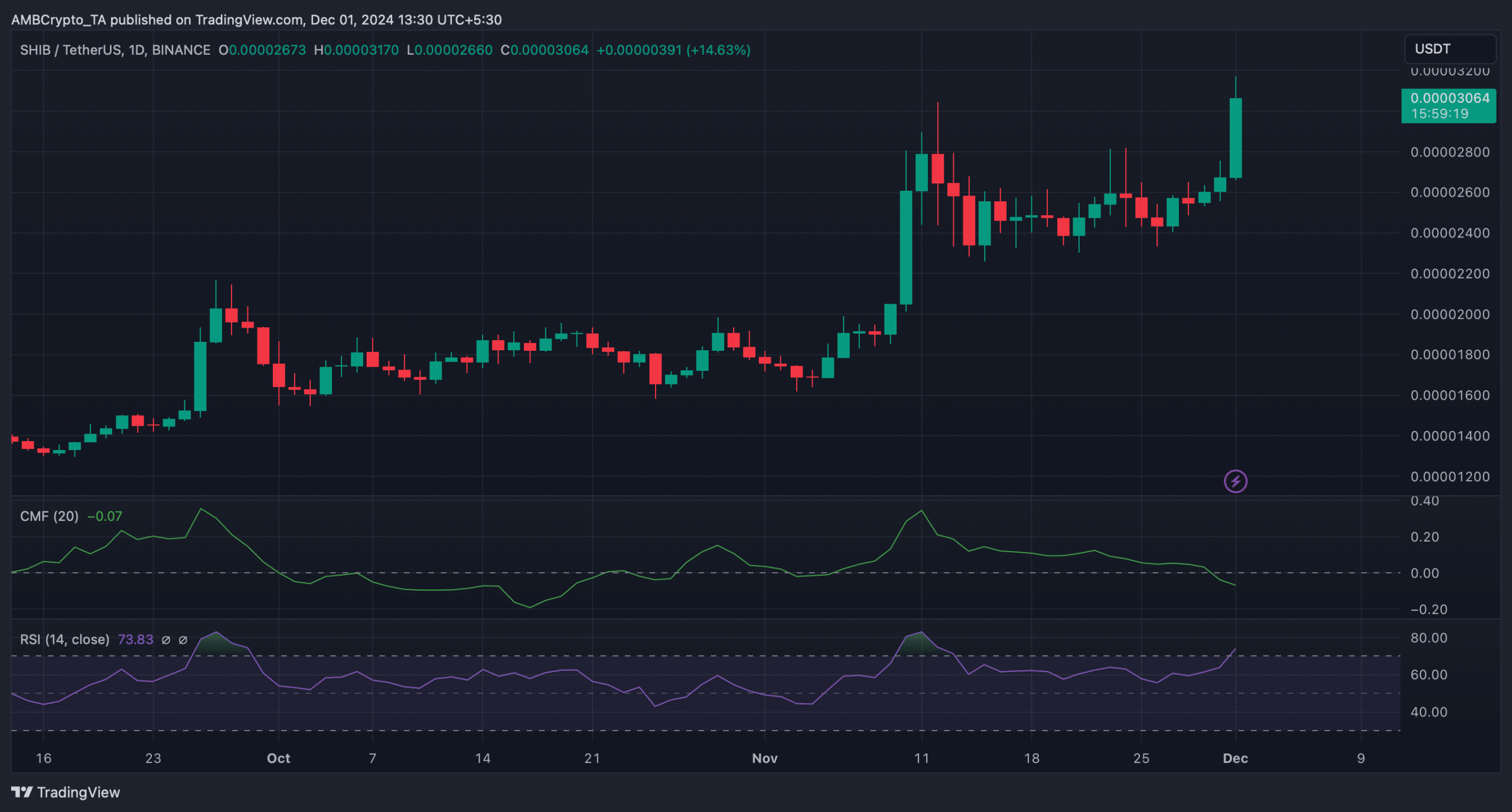

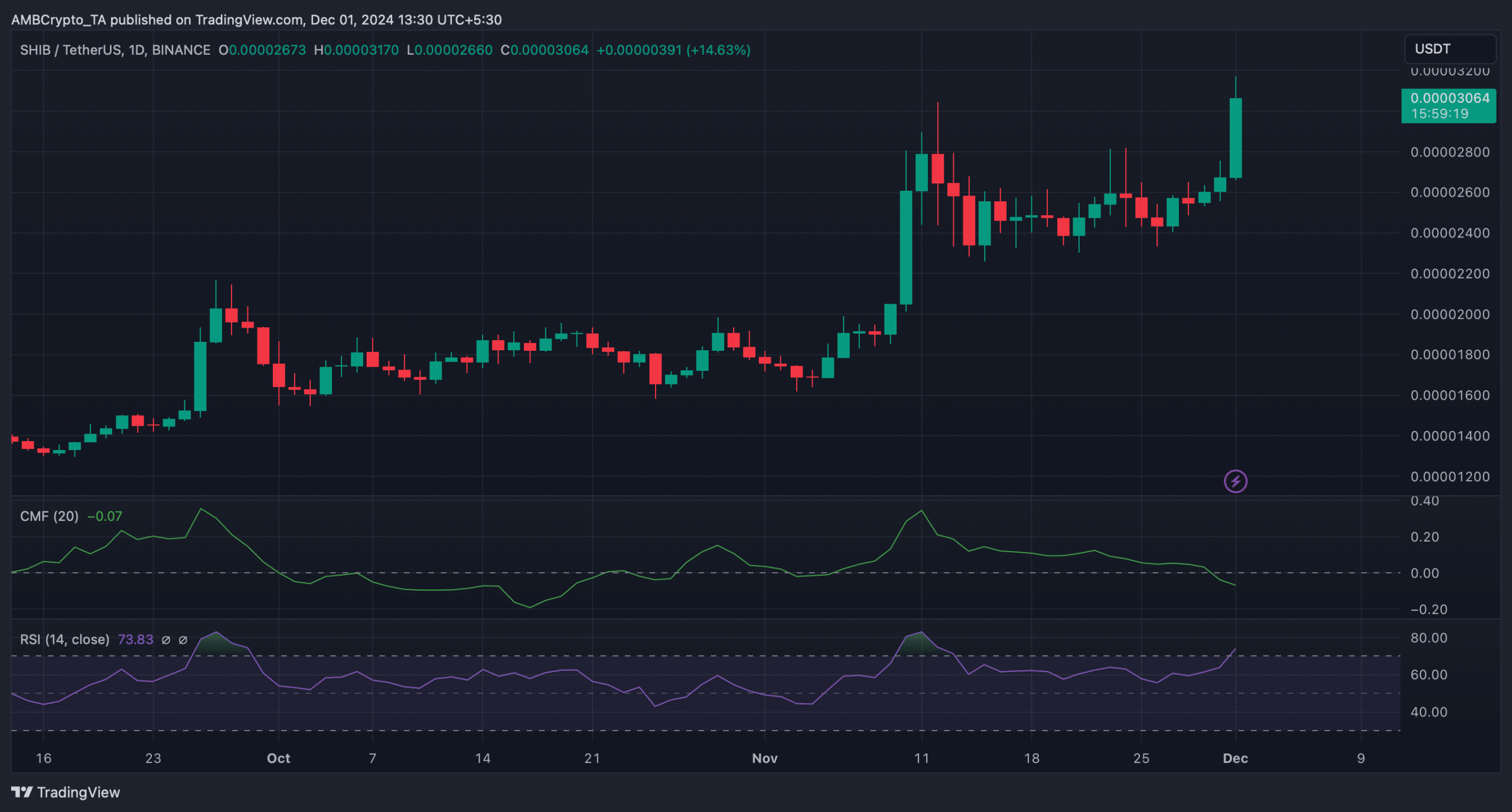

Another concern was revealed when we checked the token’s Fear and Greed Index. At press time, the market was in “extreme greed,” which was a potential sell signal. Technical indicators also hinted at a similar possibility.

For instance, the Relative Strength Index (RSI) entered the overbought position, which can trigger a sell-off soon. The Chaikin Money Flow (CMF) registered a down tick — a sign of investors already selling SHIB.

Source: TradingView

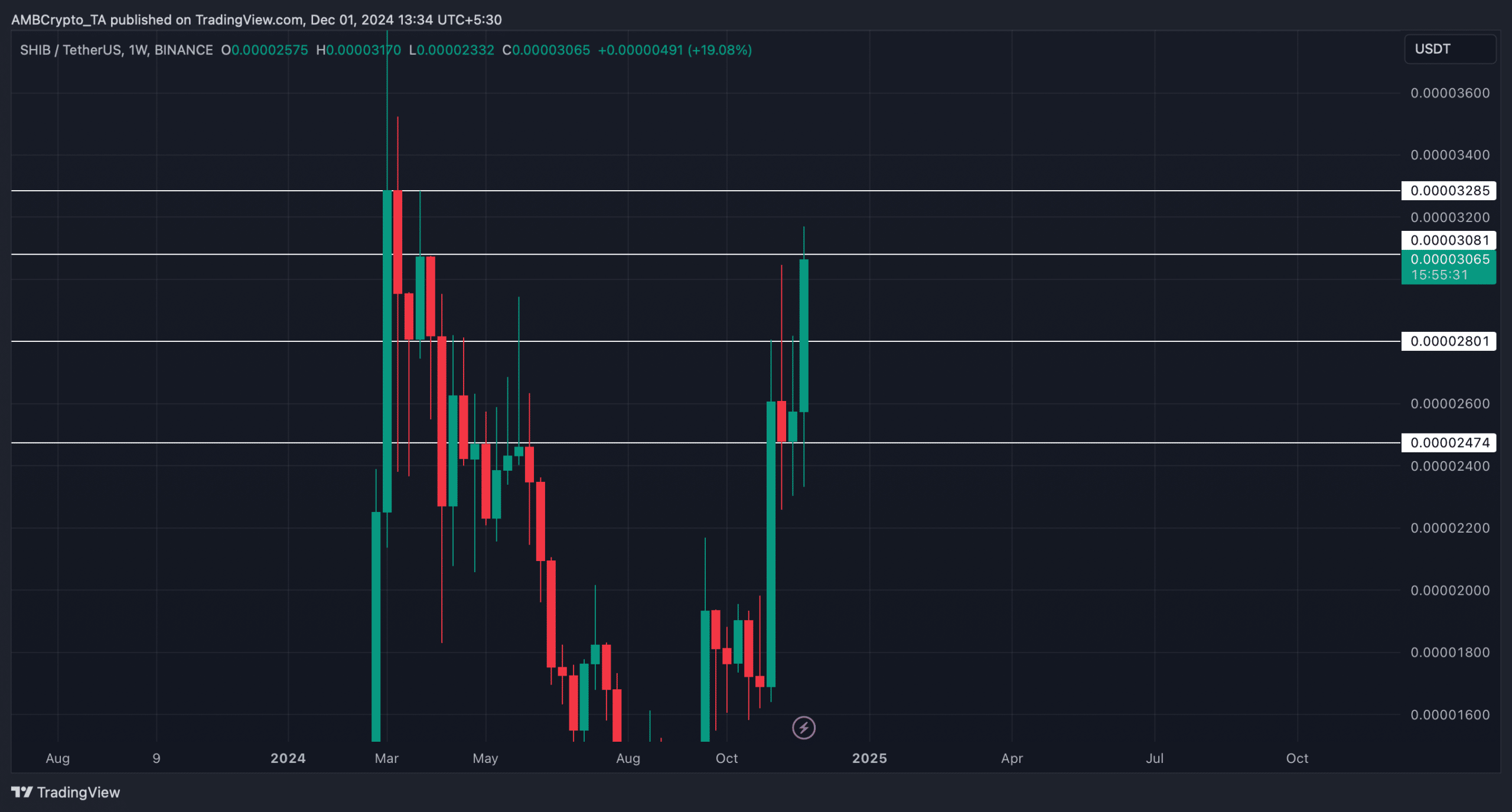

Nonetheless, there were still chances of bulls pushing the memecoin’s value upward.

Is your portfolio green? Check out the SHIB Profit Calculator

Shiba Inu’s Network to Value (NVT) ratio remained low despite the recent price pumps. A low NVT ratio means that an asset is undervalued, which indicated the possibility of a continued price rise still exists.

If that happens, then SHIB might break a resistance and move towards $0.000032. But in the event of a correction, the memecoin might drop to $0.000028.

Source: TradingView