- Solice (SLC) surged by 28.33% in a week, attracting new interest despite a low market cap.

- Technical indicators signal bullish momentum, but declining volume raises sustainability concerns.

Solice [SLC] was trading at $0.001098 at press time, reflecting an impressive 28.33% surge over the past 7 days. This rapid climb highlights renewed interest in SLC as it gains traction among traders.

The market cap remains steady at $47.42K, positioning Solice as a smaller market player with significant growth potential.

With a total supply of 400 million SLC, this recent rally has attracted fresh attention to the token, sparking curiosity about its future trajectory in the market.

Is SLC on the verge of a breakout?

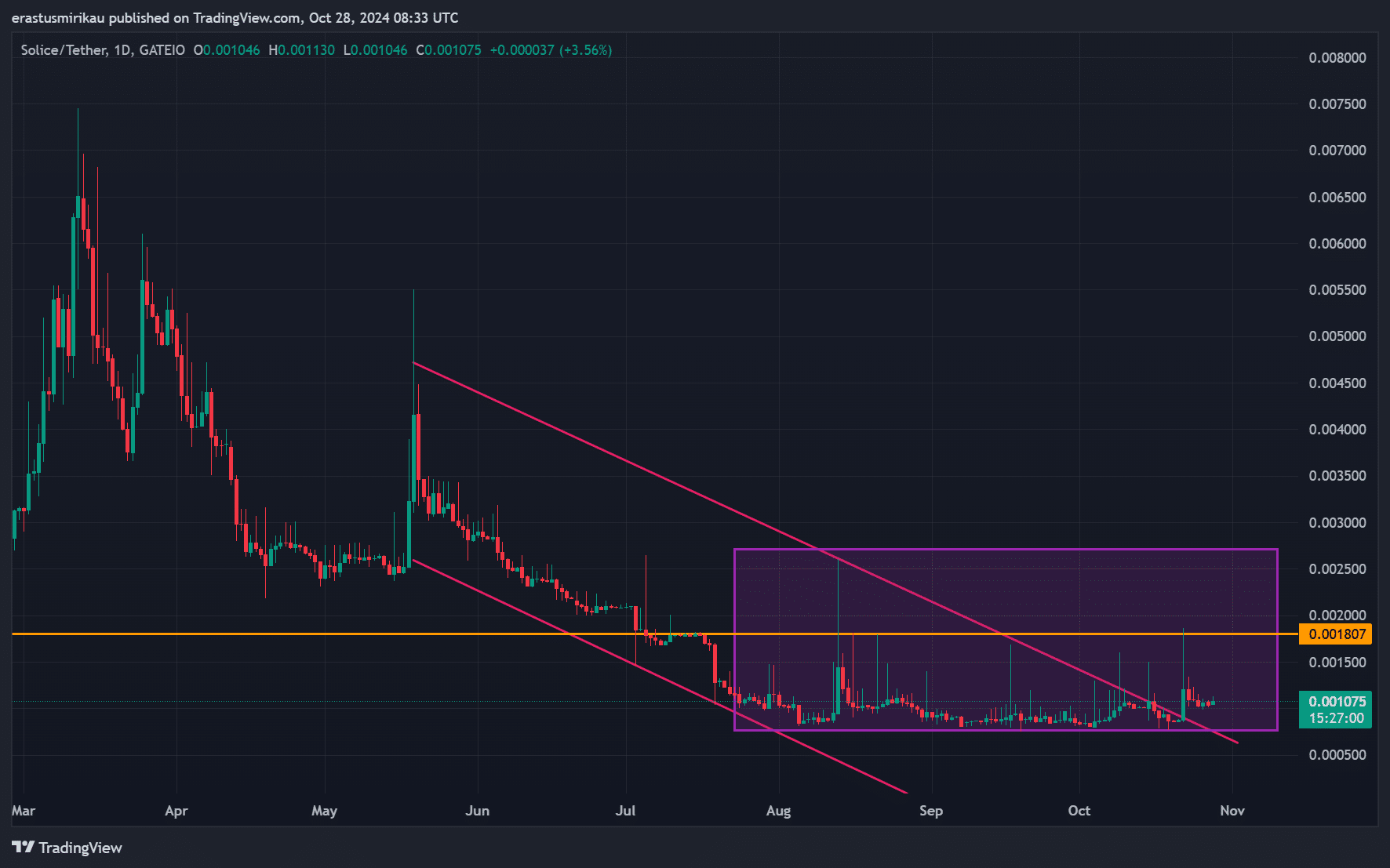

Examining the SLC chart, we see the price attempting to break out from a descending channel established after a major sell-off earlier this year. Recently, SLC has entered a consolidation phase, trading within a tight range, which often serves as a precursor to a breakout.

The key resistance level sits around $0.001807. If SLC can surpass this point, it could indicate stronger upward momentum.

Source: TradingView

What do the technical indicators reveal?

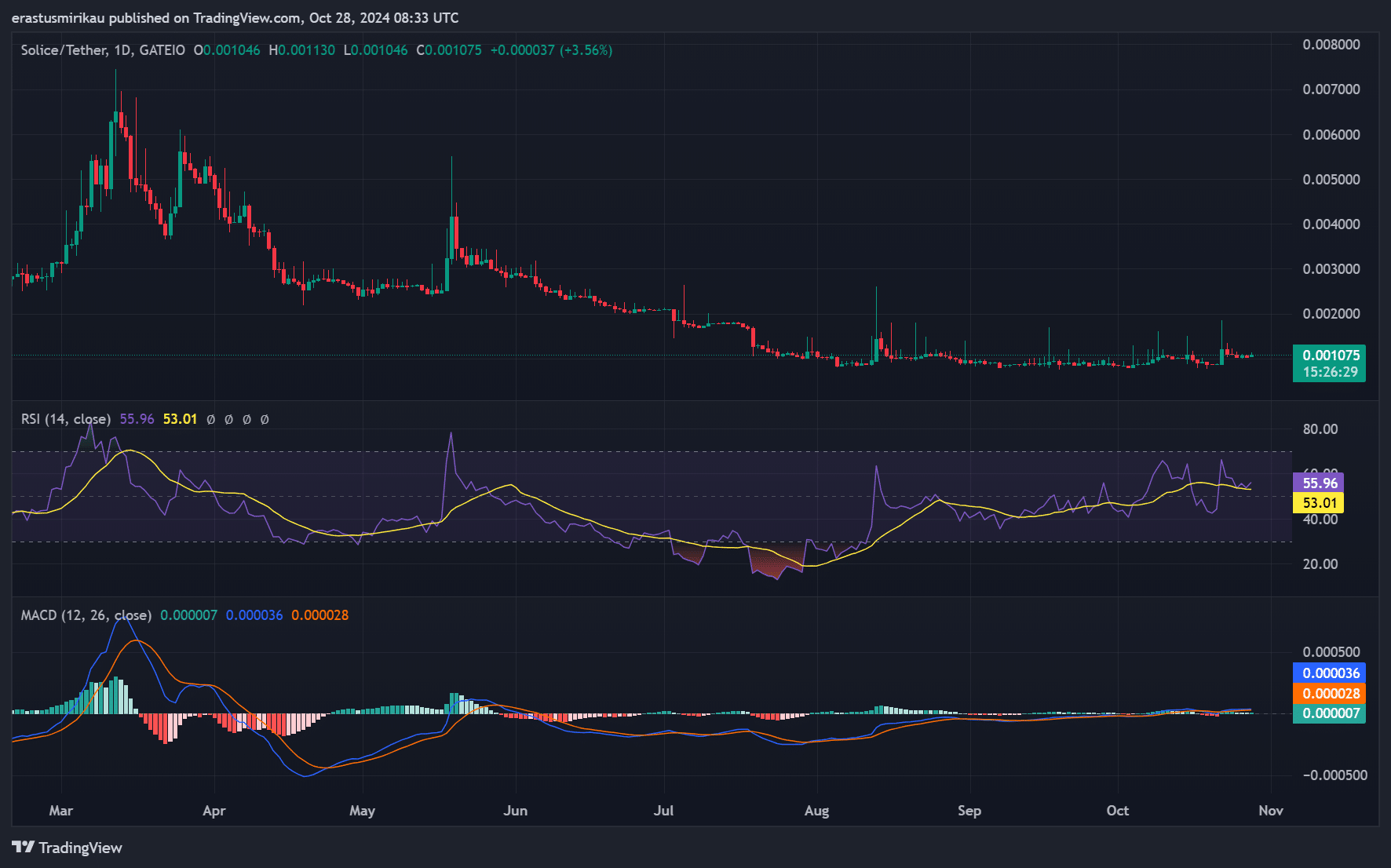

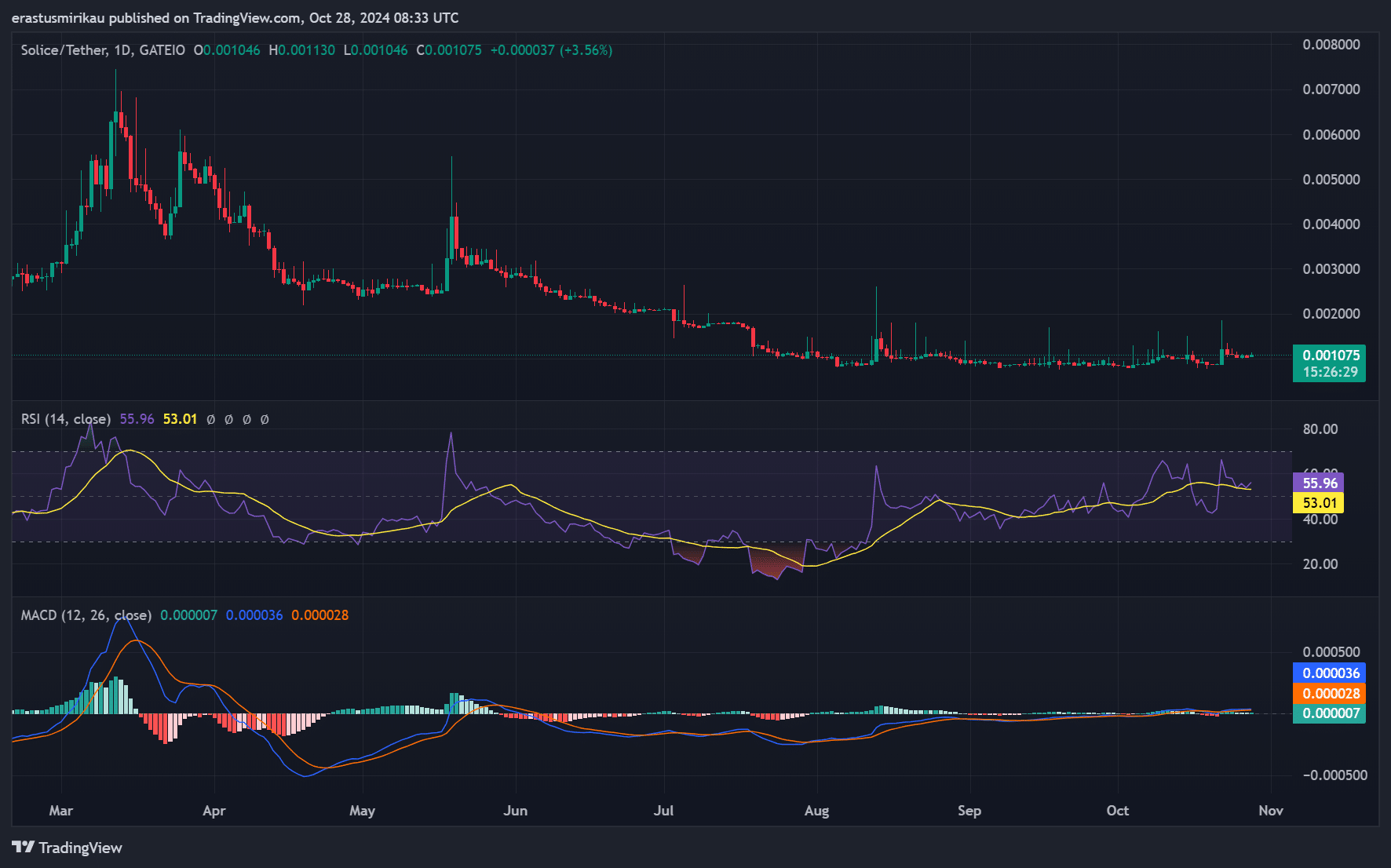

The Relative Strength Index (RSI) is currently at 55.96, suggesting that buying interest is building. Therefore, while SLC has not yet entered overbought territory, it could continue to attract buyers if the RSI remains above 50.

Additionally, the Moving Average Convergence Divergence (MACD) indicator displays a subtle bullish crossover, with the MACD line (in blue) inching above the signal line (in orange). This crossover, while modest, may indicate early positive momentum.

Consequently, if the MACD trend continues upward, it could strengthen the bullish outlook and attract further attention from traders.

Source: TradingView

Declining trading volume: Warning sign or a pause?

While SLC’s price has risen, its trading volume tells a different story. Over the past 24 hours, volume decreased by 39.40%, settling at $1.3K according to CoinGecko. This decline may indicate weakening buyer interest or merely reflect market consolidation following recent gains.

Typically, decreasing volume during an uptrend can signal caution, as it suggests fewer traders are backing the rally. Therefore, for SLC to sustain its momentum, an increase in volume is crucial, especially if the price nears and tests the critical resistance level.

Is SLC ready to maintain its momentum?

Solice has shown significant growth, with a 28.33% increase over the past week. The RSI and MACD indicators point to continued bullish potential, provided volume picks up to support the rally.

However, the sharp decline in trading volume serves as a warning, suggesting that the current surge may lack solid backing.

Thus, while SLC displays promising technicals, traders should closely watch resistance levels and volume trends to gauge whether this rally has staying power or is merely a short-lived spike.