- Solana regained a bullish market structure.

- The two key resistances overhead could initiate a trend reversal.

Solana [SOL] saw steady buying pressure in September. A recent report noted that the rising spot CVD indicated real demand, and reflected that the rally was likely to be sustainable.

This has proven to be the case. After a drop to $141.1 on Sunday ,the 22nd of September, SOL has gained 5.85% to trade at $149.3 at press time. In other news, technical analyst Peter Brandt also believed that the token is capable of a large rally after the consolidation of the past six months.

Mid-range resistance opposes SOL bulls

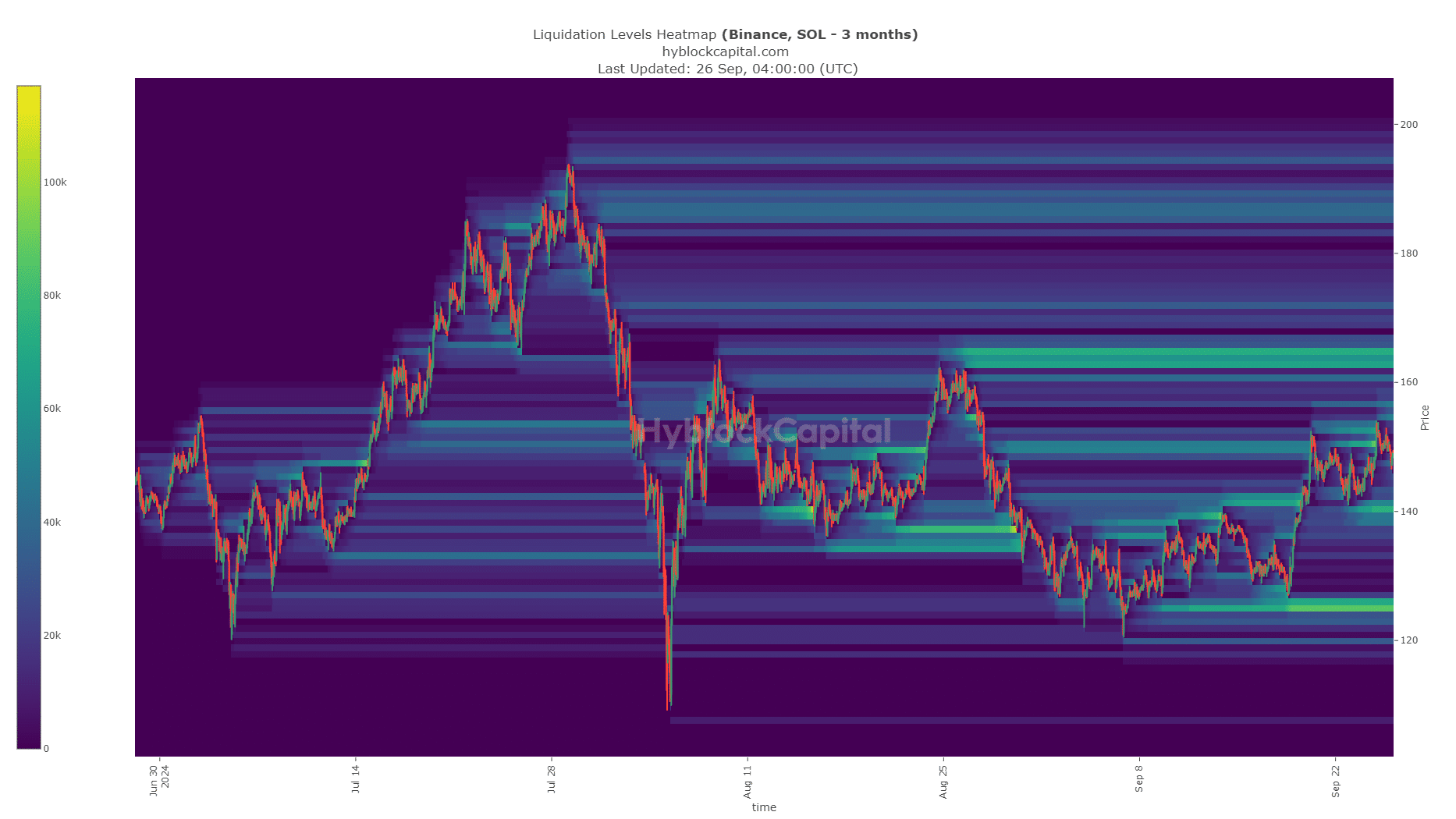

Source: SOL/USDT on TradingView

Over the past four months, Solana has traded within a range that extended from $122 to $186. The mid-range level at $154 was the 50% retracement level based on the rally in February and March.

This confluence of resistance zones made it a tough level to breach, but the bulls showed promise. The accumulation/distribution indicator was in a steady uptrend in September to underline continued buying pressure.

The daily RSI also climbed above neutral 50 to signal a momentum shift. Hence, it is likely that SOL will advance past $154.

Another hefty supply zone right above the key resistance

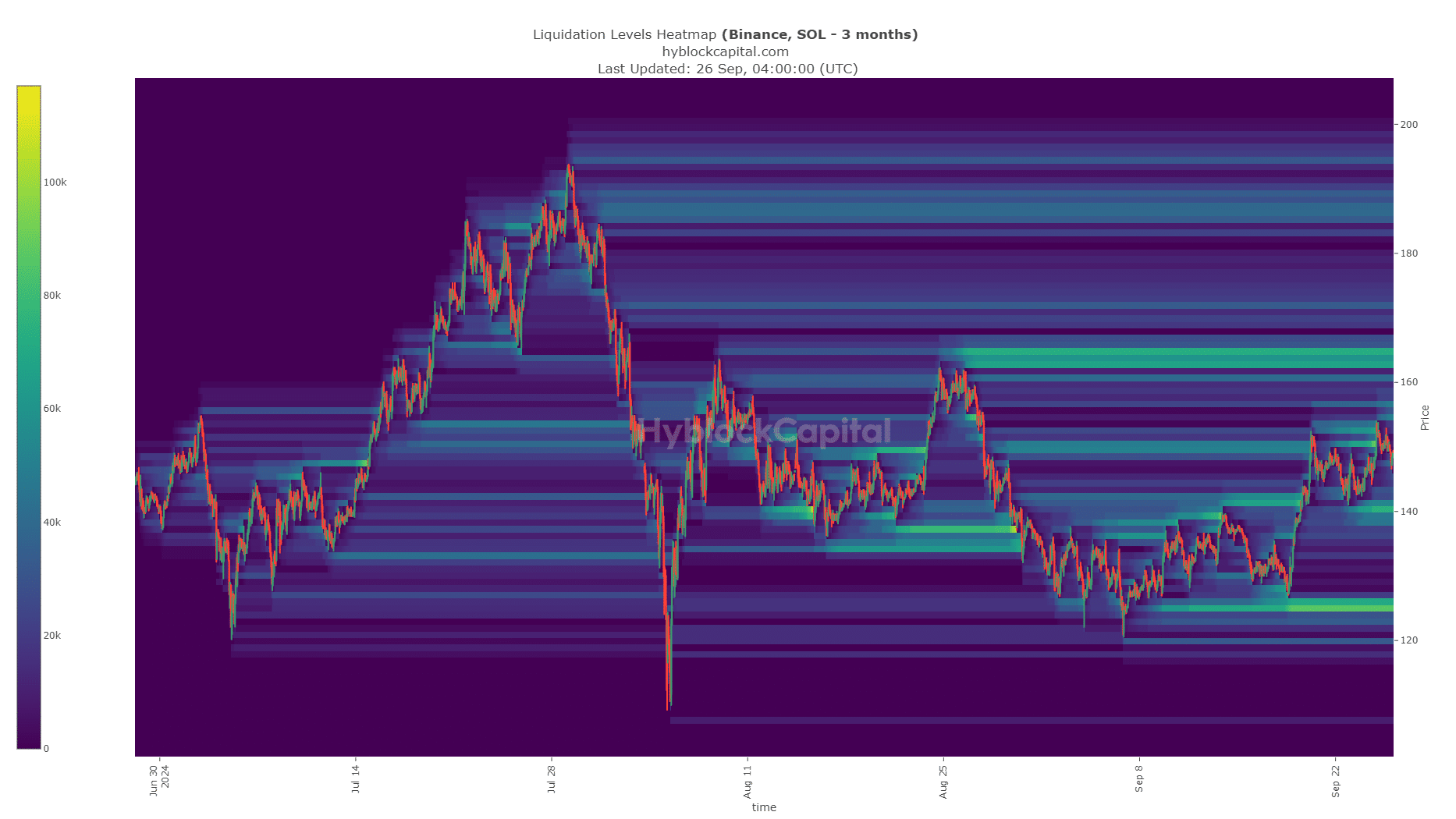

Source: Hyblock

While a daily session close above $154 would be encouraging, the battle would not be over even then. The price chart showed the local highs of the past two months were formed at $160-$163.

Read Solana’s [SOL] Price Prediction 2024-25

AMBCrypto analyzed the liquidation heatmap and found a cluster of liquidation levels at the $162-$166 area. This magnetic zone will likely attract Solana prices to it before forcing a bearish reversal.

Therefore, until the $165 level is breached, bulls will have to be cautious. The more risk-averse participants can take profits at $154 and $160 and remain sidelined until the $165 level is breached.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion