- The Altcoin Season Index registered an uptick, but was still aligned in Bitcoin’s favor

- SOL’s RSI entered the overbought zone, which could trigger a price correction

Bitcoin’s latest bout of appreciation turned the crypto market bullish. Several altcoins soon followed suit, with these cryptos recording major hikes on the price charts too. In fact, Solana [SOL] was one of the market’s top performers, with SOL hitting a new milestone in the process too.

Now, SOL’s latest achievement could be a catalyst for a fresh altcoin season. Hence, it’s worth looking at whether that’s even possible.

Solana’s latest milestone

AMBCrypto reported previously that Solana recent performances have been pretty impressive. For instance – The altcoin registered a +20% price hike in the last seven days, allowing it to go above $200. At the time of writing, Solana was trading at $201 on the charts.

This price hike also allowed the altcoin to hit a new milestone. SolanaFloor, a popular X account that shares updates related to the blockchain’s ecosystem, recently revealed that SOL’s market capitalization dominance reached 3.8% – An all-time high. Since SOL crossed $200 and its market dominance hit an ATH, it seemed likely that this surge could in turn help begin a fresh altcoin season soon.

Is an altcoin season around the corner?

To see whether Solana’s latest achievement and its bull rally were enough for an altcoin season, AMBCrypto checked other datasets. Our analysis revealed that the altcoin season index did register an uptick, suggesting that altcoins might soon witness a summer.

Source: Blockchaincenter

However, despite the hike in this metric, it still had a value of 37. For initiators, a value closer to 25 hints at a Bitcoin [BTC] season, whereas a value near 75 means an altcoin season. Therefore, investors might have to wait longer to see a major altcoin rally.

In fact, AMBCrypto also reported that an altcoin season might as well get delayed till 2025. Nonetheless, investors shouldn’t lose hope. AMBCrypto’s look at CoinStats’ data pointed out an optimistic development for altcoins like Solana.

We found that the Bitcoin dominance chart dropped sharply over the last week. At press time, BTC’s dominance stood at 55.7%. A decline in this metric is a sign that the chances of altcoins shining again are high.

Source: CoinStats

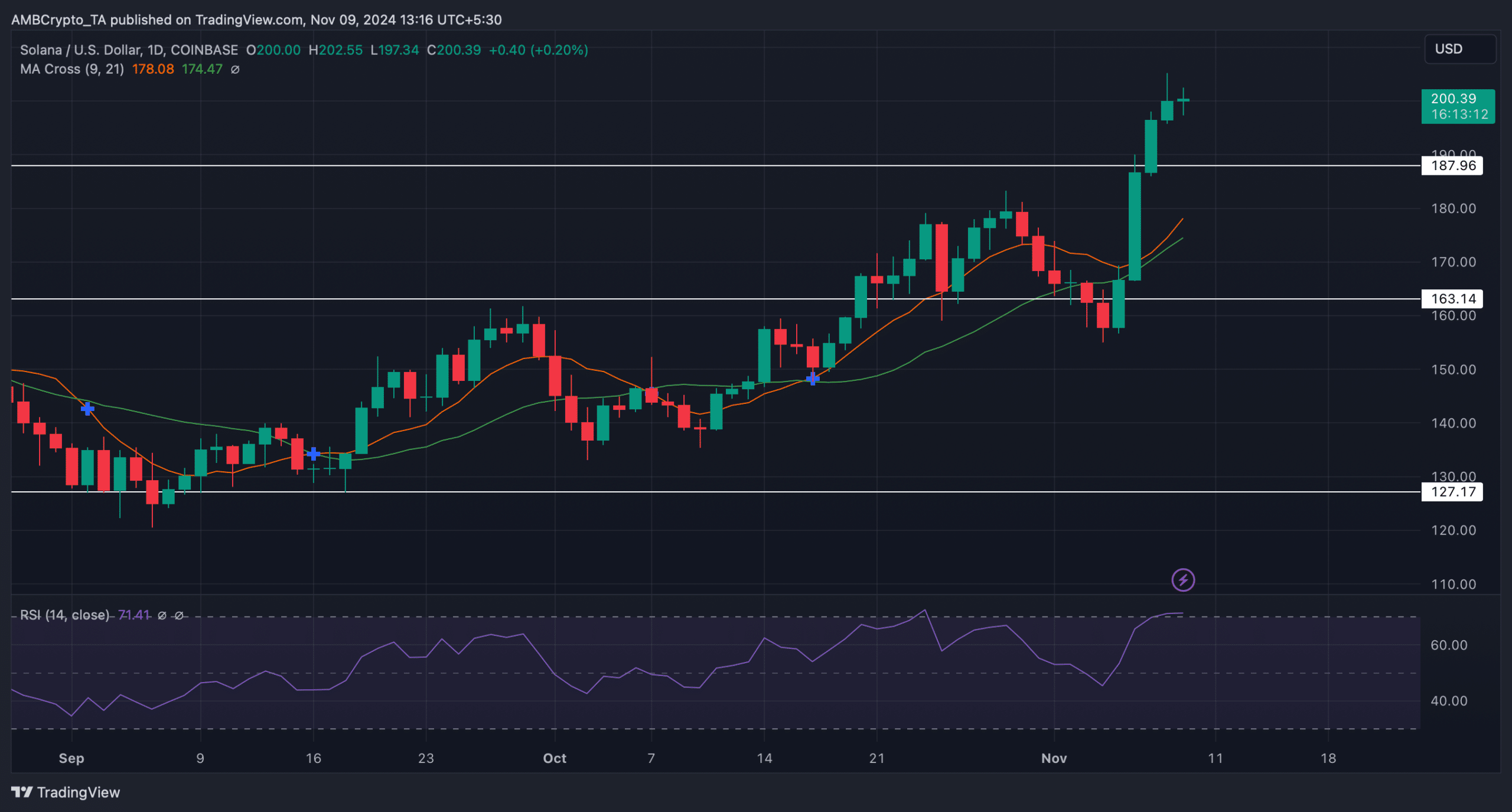

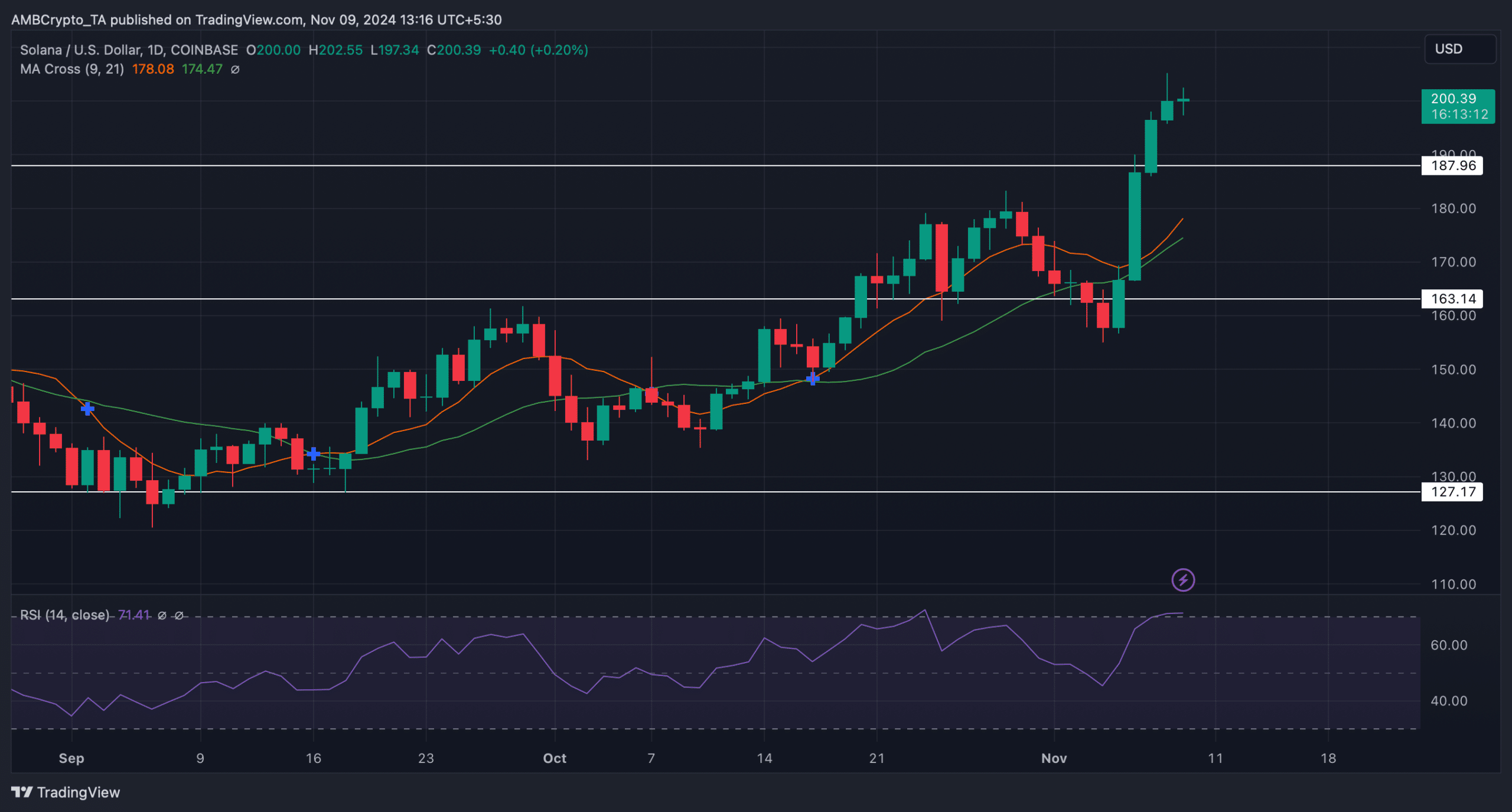

Finally, we took a look at SOL’s daily chart to find whether the drop in BTC’s dominance and SOL’s market dominance hitting an ATH will allow the coin to grow further.

As per our analysis, the MA cross technical indicator flashed a clear bullish advantage in the market. This was the case as the 9-day MA was resting above the 21-day MA.

Read Solana’s [SOL] Price Prediction 2024–2025

However, the possibility of a price correction can’t be ruled out as Solana’s Relative Strength Index (RSI) entered the overbought zone. If a correction happens, then SOL might again fall to its support at $187.

Source: TradingView