- Stablecoin reserves and SSR trends suggested strong buying power and imminent Bitcoin rally potential.

- Technical indicators and liquidations confirmed bullish sentiment, with $110,000 as a realistic target.

Bitcoin’s [BTC] latest price surge has sparked discussions, fueled by Binance’s enormous stablecoin reserves and positive market trends. These reserves reached $44.5 billion on the 31st of December, showcasing immense buying power poised to drive BTC higher.

Bitcoin was trading at $93,592.03, at press time, up 1.20% in the past 24 hours. This combination of liquidity and momentum makes the cryptocurrency market’s outlook increasingly bullish.

How stablecoin reserves ignite Bitcoin rallies

Stablecoins provide instant liquidity, often acting as a catalyst for Bitcoin price increases. Historically, significant inflows of stablecoins to exchanges have led to BTC rallies by increasing demand.

For instance, during the rally on the 11th of December, a surge in stablecoin activity helped Bitcoin gain 4.7% in one day. Therefore, the current reserve levels suggest a similar rally could soon occur, reinforcing investor optimism.

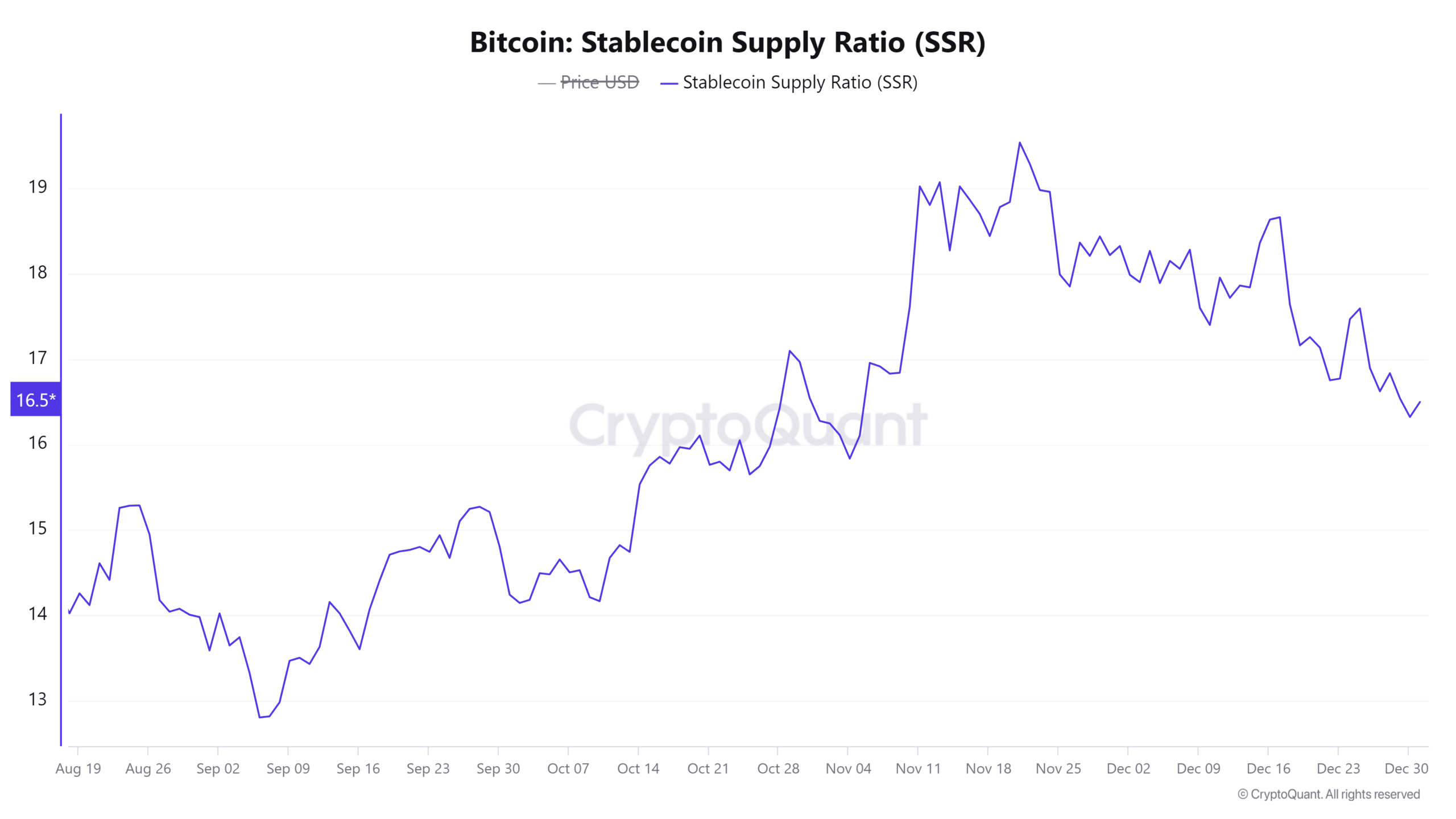

Does the SSR hint at more upward potential?

The Stablecoin Supply Ratio (SSR) is a key metric that indicates Bitcoin’s growth potential. Currently at 16.55, with a 1.01% daily increase, the SSR reflects ample liquidity compared to Bitcoin’s market cap.

This suggests a favorable environment for Bitcoin’s price to rise, as there is more stablecoin liquidity available to fuel demand. Consequently, SSR trends strongly support the possibility of continued upward momentum.

Source: CryptoQuant

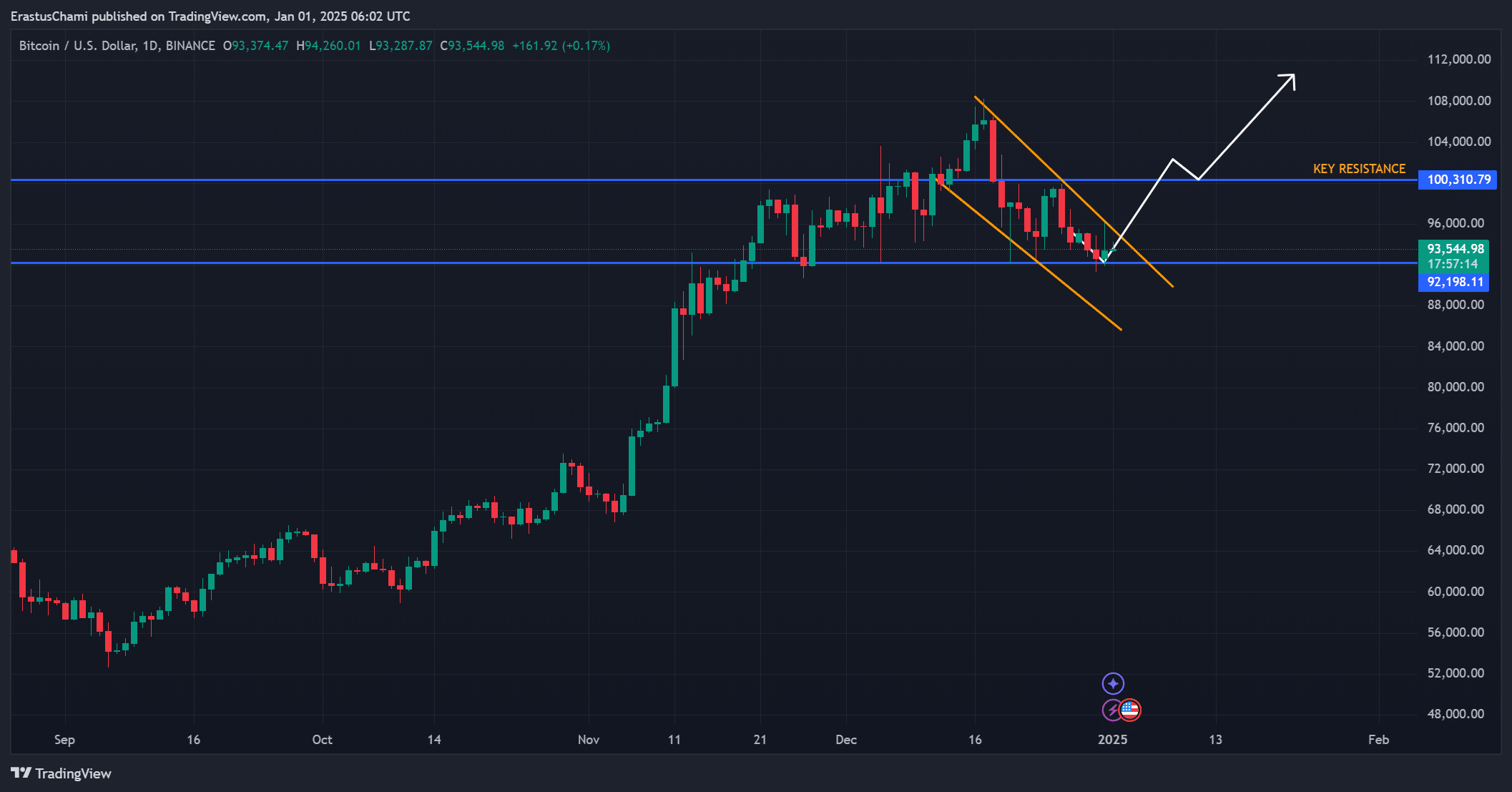

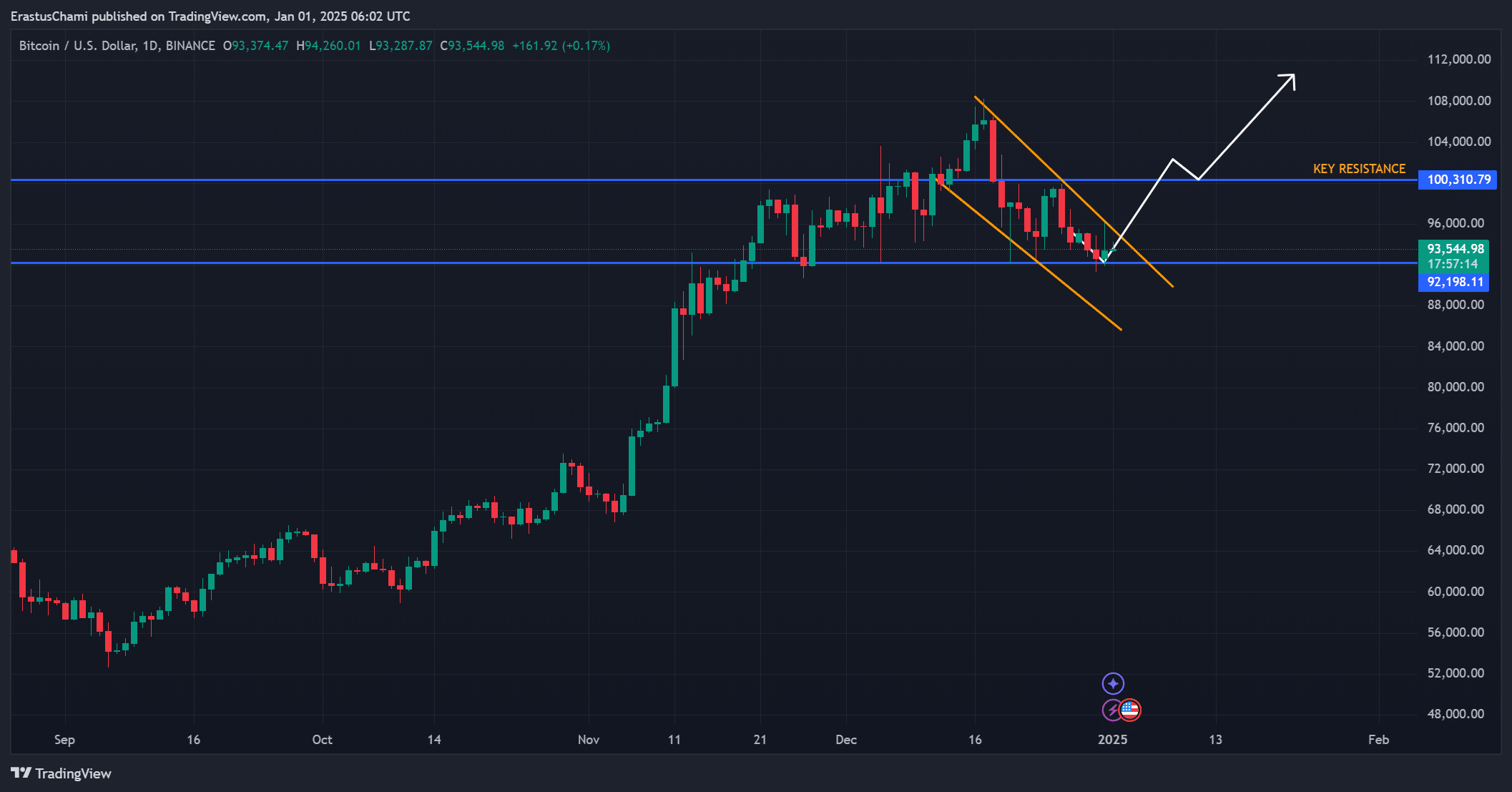

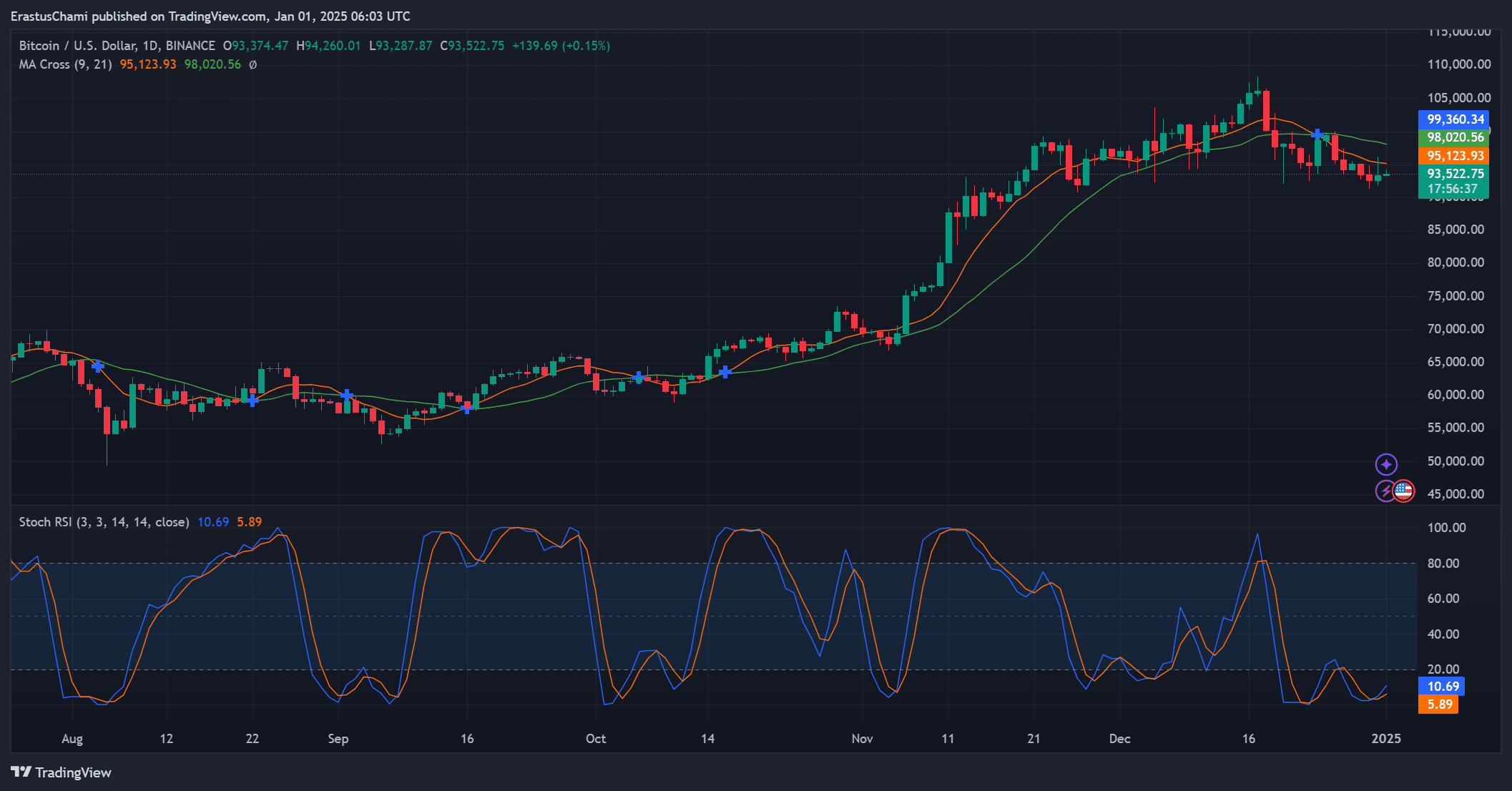

BTC price action: Is a breakout imminent?

Bitcoin’s price has rebounded from the demand zone at $92,198.11 and is now approaching a potential breakout from a descending wedge. Historically, such patterns indicate bullish reversals, and Bitcoin’s movement suggests a similar outcome.

Key resistance at $100,310.79 could pave the way for a mid-term target of $110,000. Therefore, BTC’s price action strongly indicates a continuation of the current uptrend.

Source: TradingView

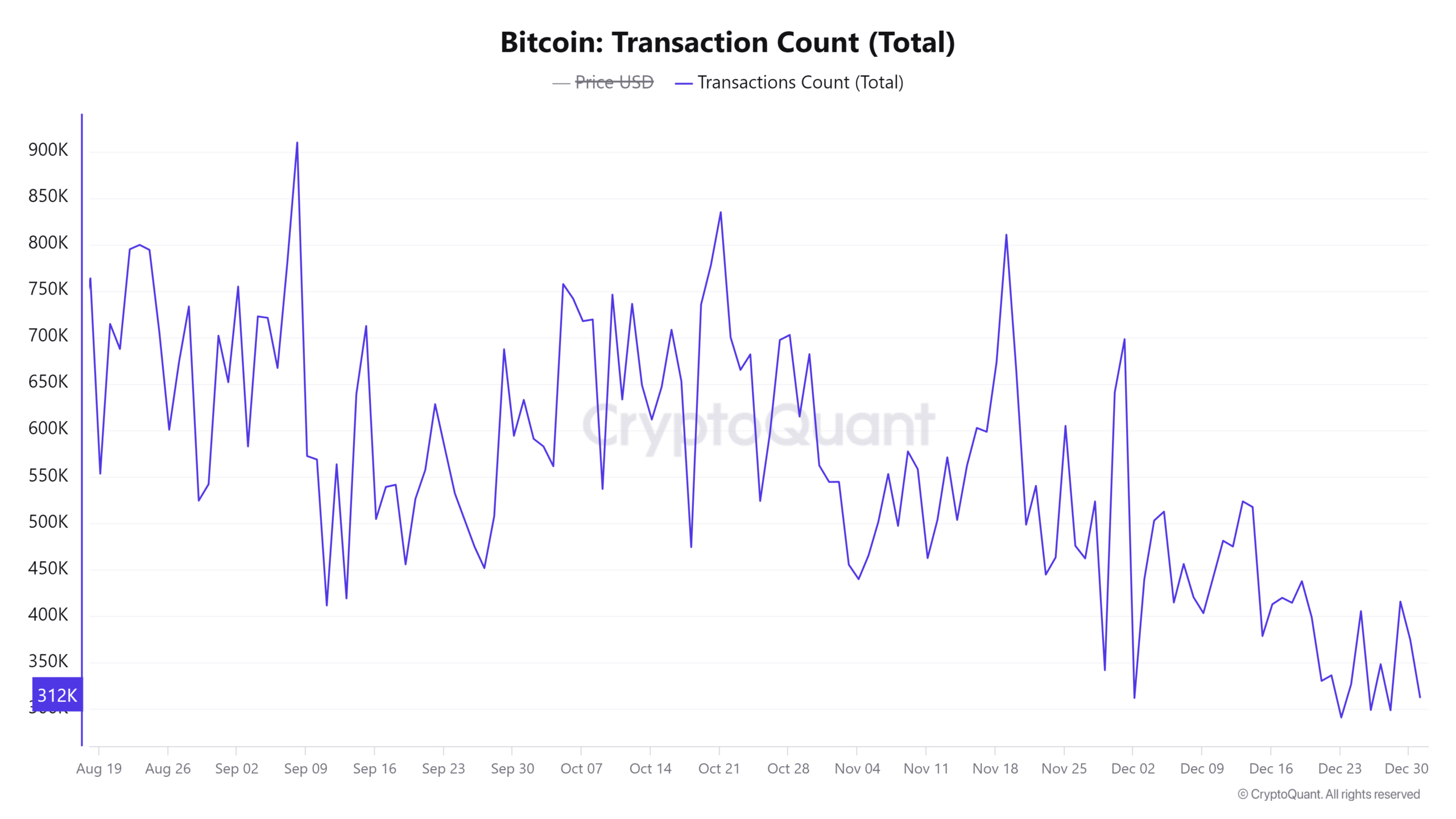

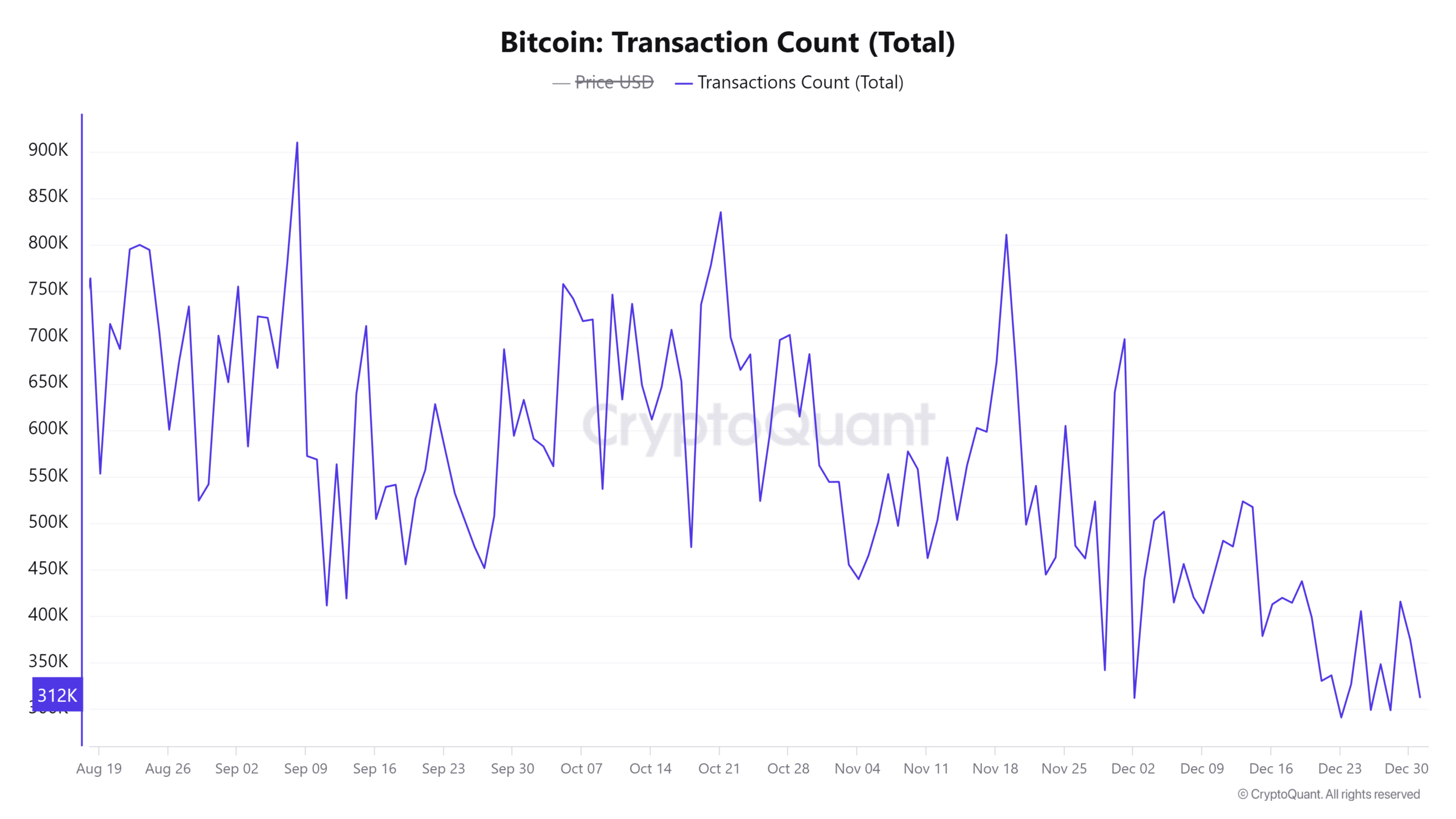

Transaction trends confirm investor confidence

Transaction counts reveal consistent activity, with 312,056 recorded at press time, marking a 0.92% increase over 24 hours. This metric indicates heightened participation in the Bitcoin network, typically observed when investors are actively accumulating.

Therefore, the steady transaction volume reinforces positive sentiment and suggests robust market engagement moving forward.

Source: CryptoQuant

Technical indicators support further gains

Technical analysis highlights BTC’s bullish potential. The Stochastic RSI shows an oversold condition of 10.69, suggesting an upward reversal is imminent.

Moreover, the 9-day Moving Average(MA) at $95,123.93 remained above the 21-day MA at $98,020.56, indicating strong buying momentum. These signals collectively forecast a continuation of Bitcoin’s rally.

Source: TradingView

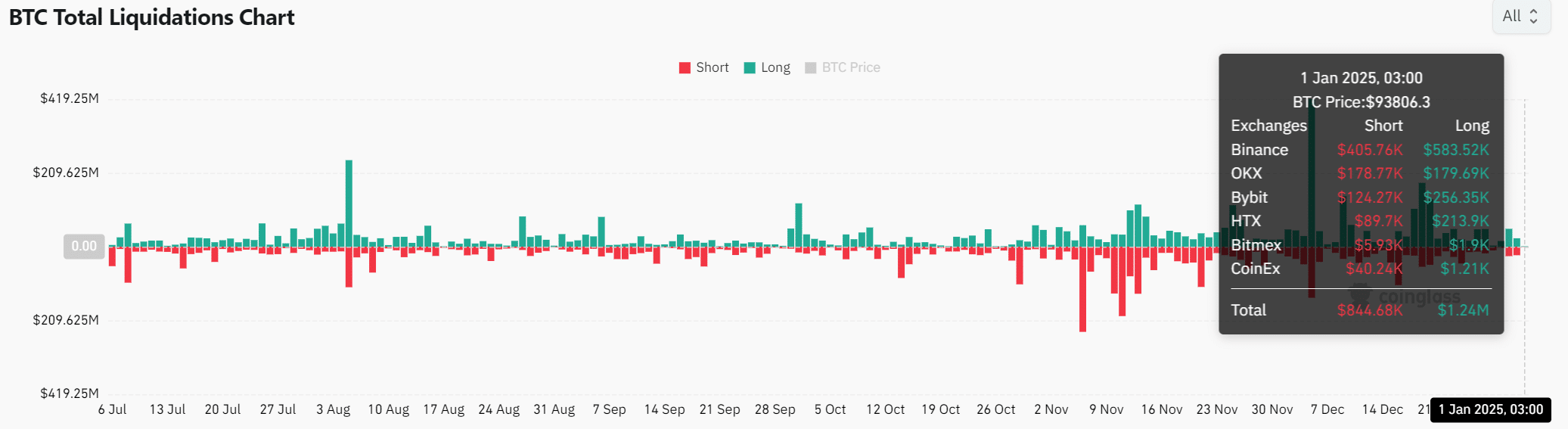

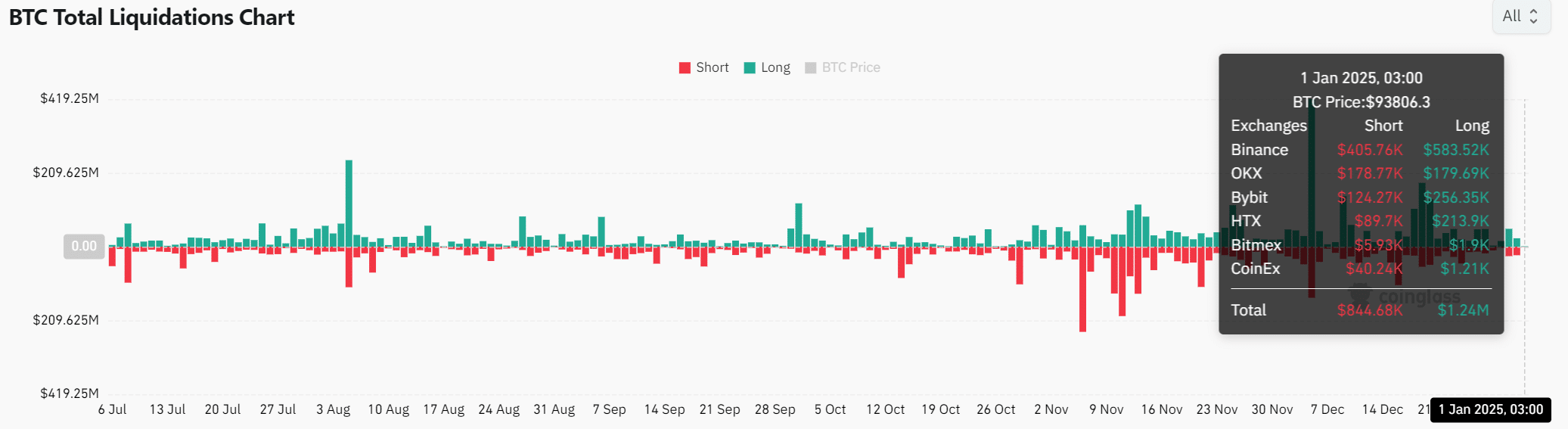

BTC liquidations reveal bullish market sentiment

Liquidation data shows a dominant bullish sentiment, with $1.24 million in long positions cleared compared to $844,000 in short liquidations.

This imbalance underscores significant buying pressure, further confirming the market’s confidence in BTC’s upward trajectory. Additionally, it suggests that bullish momentum will likely persist in the near term.

Source: Coinglass

Read Bitcoin’s [BTC] Price Prediction 2024-25

Binance’s $44.5 billion stablecoin reserves present immense liquidity that strongly supports BTC’s ongoing rally.

Combined with technical and transaction trends, investors can confidently anticipate Bitcoin reaching $110,000 in the mid-term.