- Stacks has surged by 11.63% over the past 24 hours.

- With a potential bullish crossover on DMI and RSI, STX could see more gains.

After experiencing a market correction that saw Stacks [STX] retrace to $1.89, the altcoin has made a strong upswing over the past day, hitting a high of $2.62 after hiking by 19.63%.

Since then, it has experienced a slight pullback. As such, at the time of writing, Stacks was trading at $2.53. This marked an 11.63% increase over the past day.

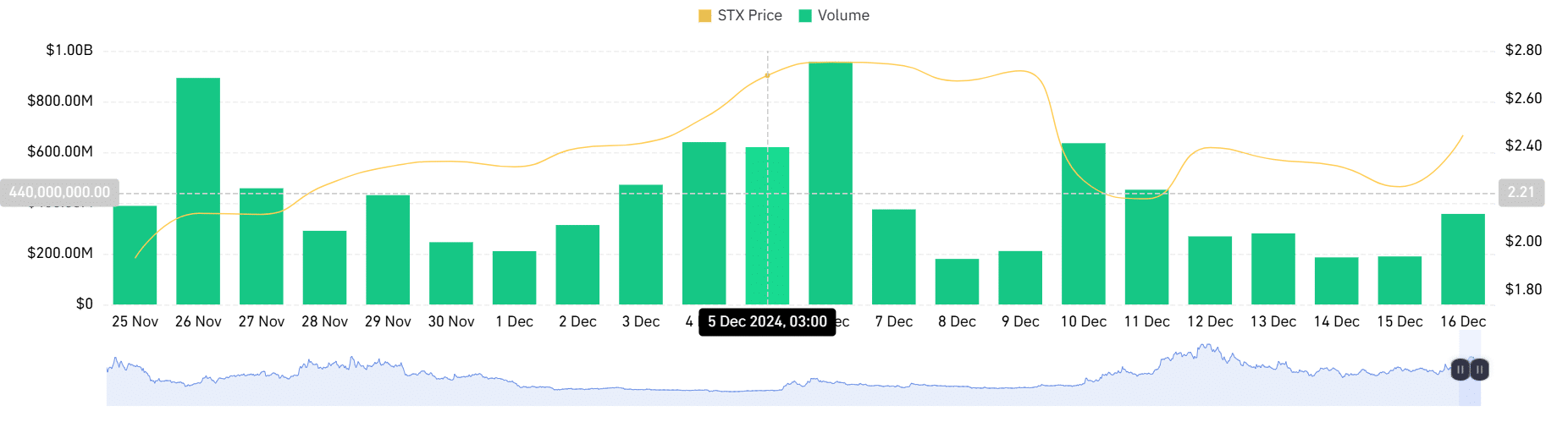

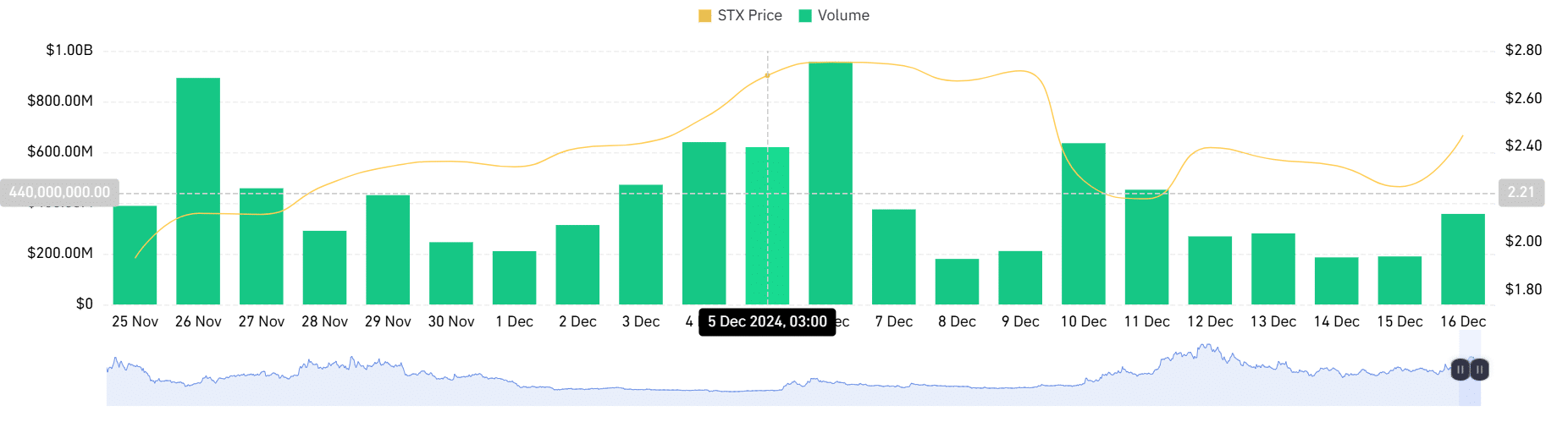

Over the same period, STX’s trading volume has spiked by 202.25% to $534.69 million, according to Coinglass.

Source: Coinglass

Prior to these gains on daily charts, STX had seen a decline on weekly charts, dropping by 1.79%. However, the altcoin has surged by 29.42% on monthly charts.

Despite the recent gains, STX remains approximately 34.3% below its ATH of $384.

With Stacks experiencing a newfound demand, the question that arises is whether the altcoin is on the verge of a more sustained uptrend.

What STX charts says

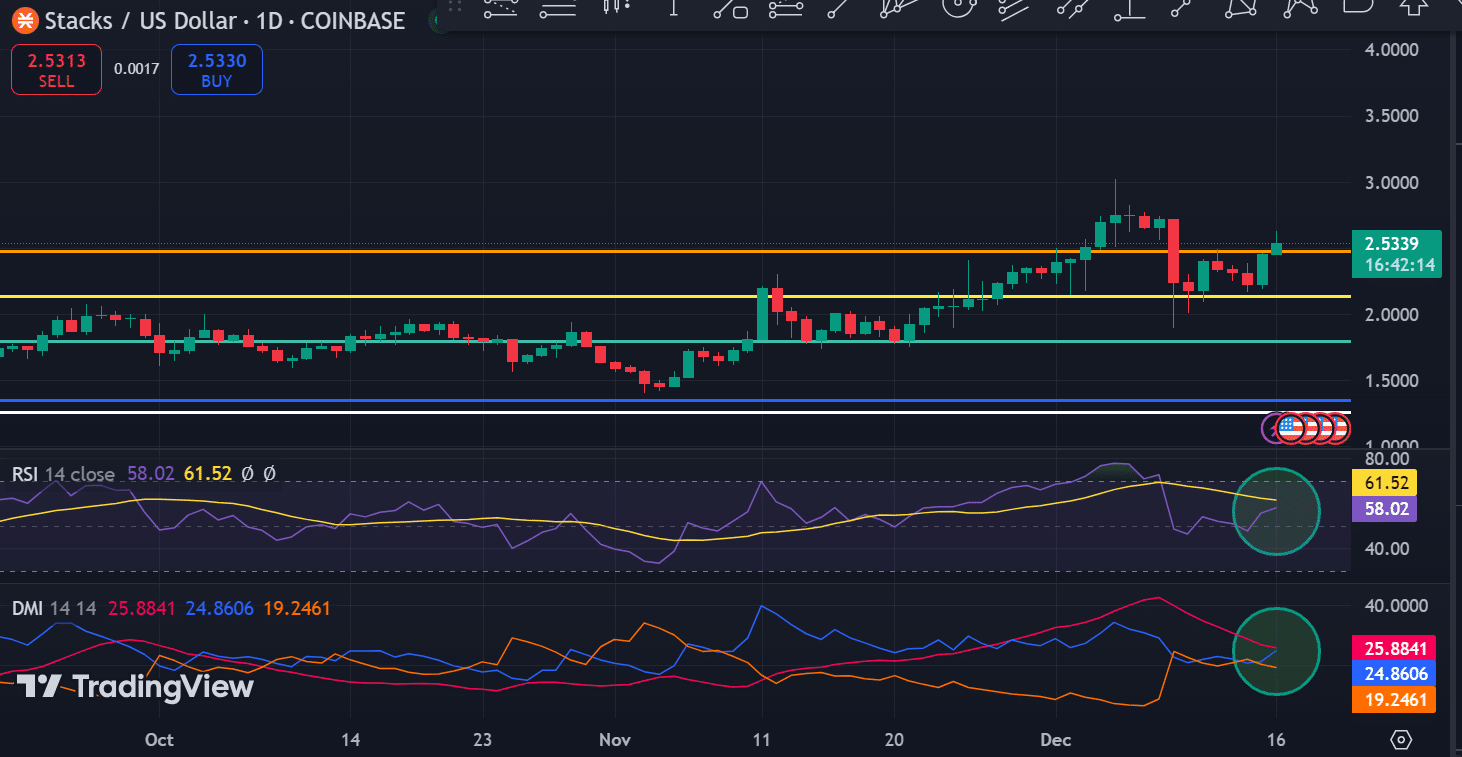

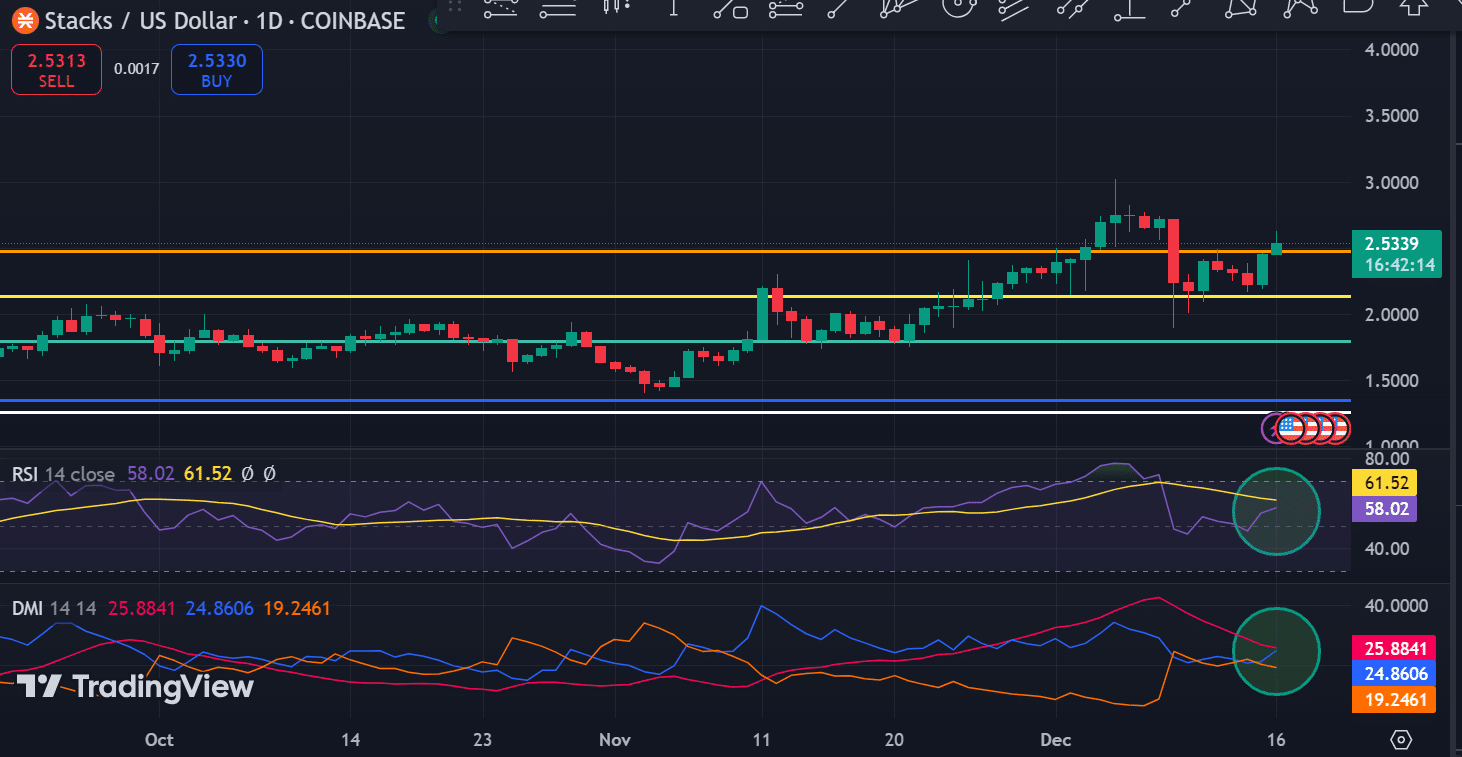

According to AMBCrypto’s analysis, Stacks is experiencing a strong upward momentum amidst higher buying pressure.

Source: Tradingview

This upward momentum is confirmed as STX is closing to make a bullish crossover from the two sides. As such, the altcoin’s Relative Strength Index has spiked from 47 to 56 while its MA has dropped from 64 to 61.

This rise suggests that buyers are entering the market while seller’s dominance is dwindling.

This phenomenon is further evidenced as +DI on the Directional Movement Index continues to rise, while -DI has dropped. STX’s +DI has risen to 24.86 while -DI has declined to 25.

This movement shows that STX is on the verge of a bullish crossover. A crossover from here will confirm the strength of the uptrend.

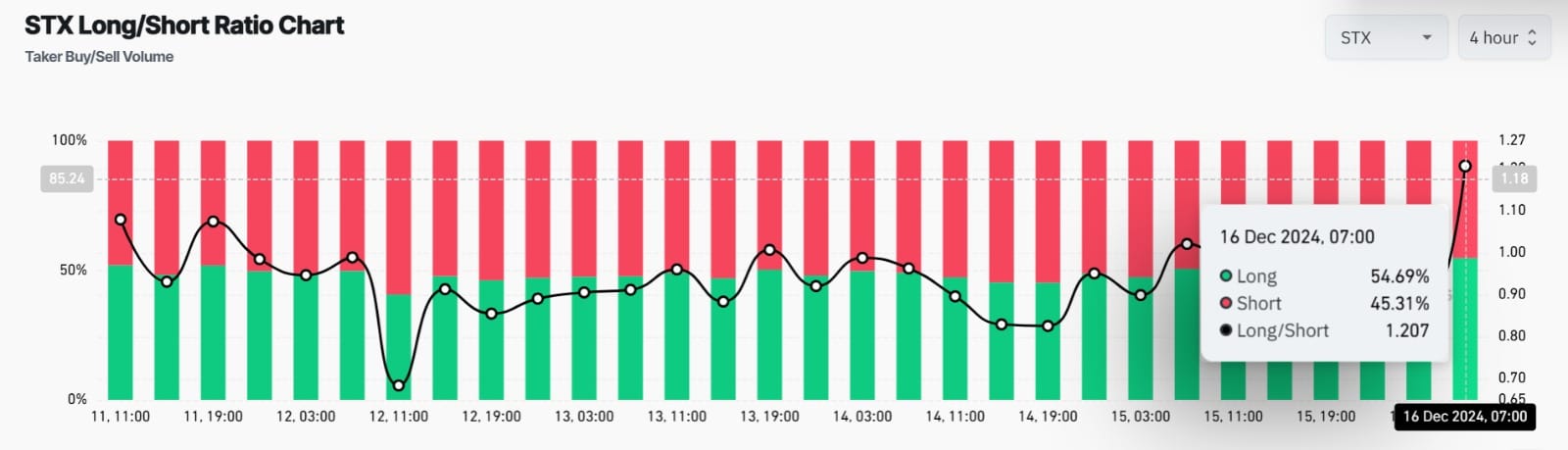

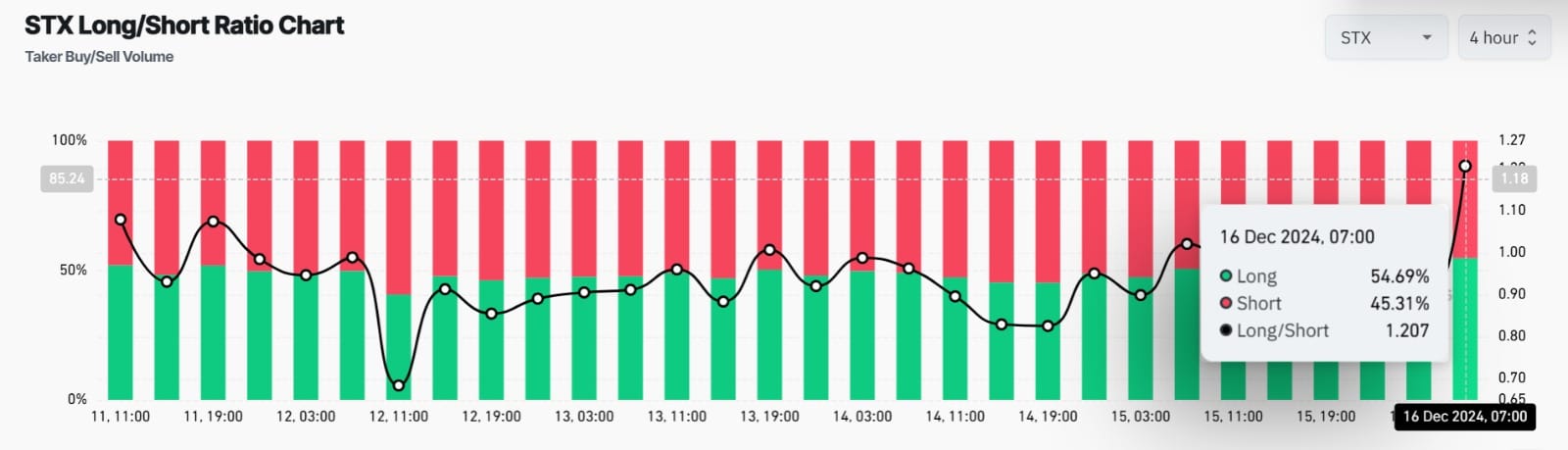

Source: Coinglass

Looking further, this bullishness is further witnessed among long position holders. According to Coinglass, longs are dominating the market.

Notably, the Long/Short Ratio shows that longs are dominant with 54.69% of the total in a 4-hour time frame. This dominance implied that most investors were betting on prices to rise.

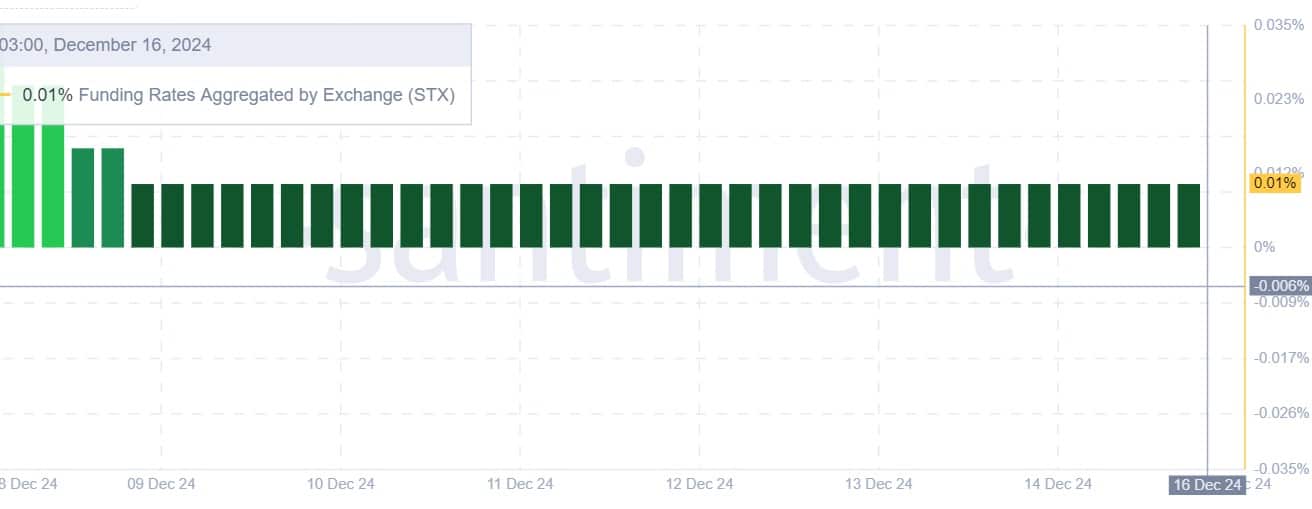

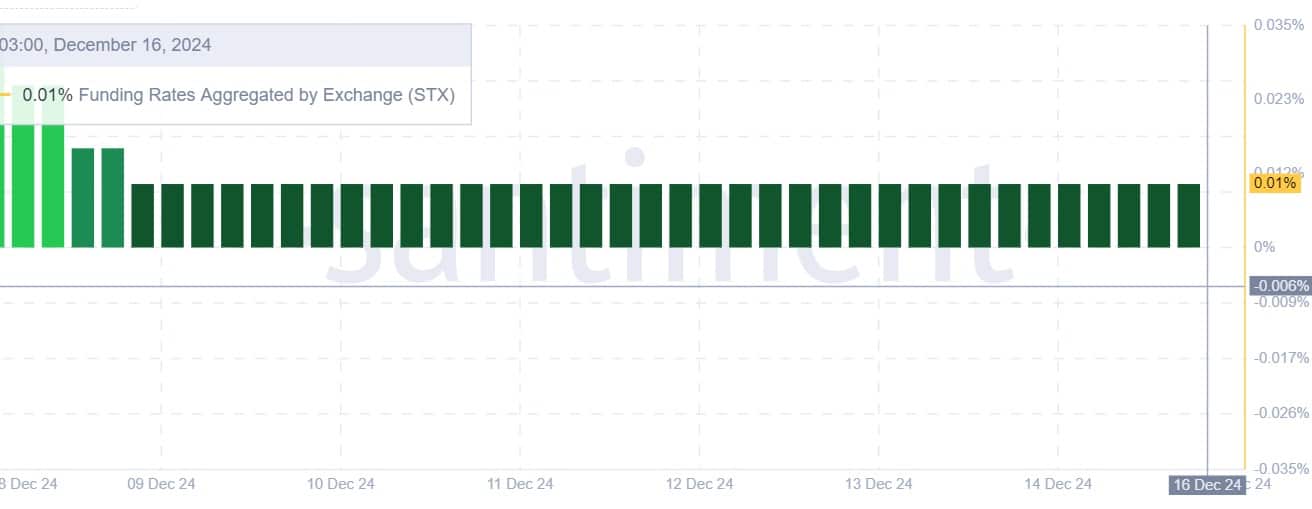

Source: Santiment

Finally, this demand for long positions is further supported by a positive Funding Rate aggregated by the exchange.

This suggests that investors are taking positions and when the altcoin sees a drop, they are willing to pay a premium fee for these positions.

Simply put, Stacks is currently experiencing a strong upward momentum with buyers entering the market.

Read Stacks’ [STX] Price Prediction 2024–2025

With a bullish crossover signal appearing, STX could see more gains on its price charts. Therefore, if the current conditions hold and a bullish crossover is confirmed, Stacks will reclaim $2.7 resistance.

A breakout from this level could see the altcoin reach $3.04. Subsequently, if sellers renter the market, STX could drop to $2.4.