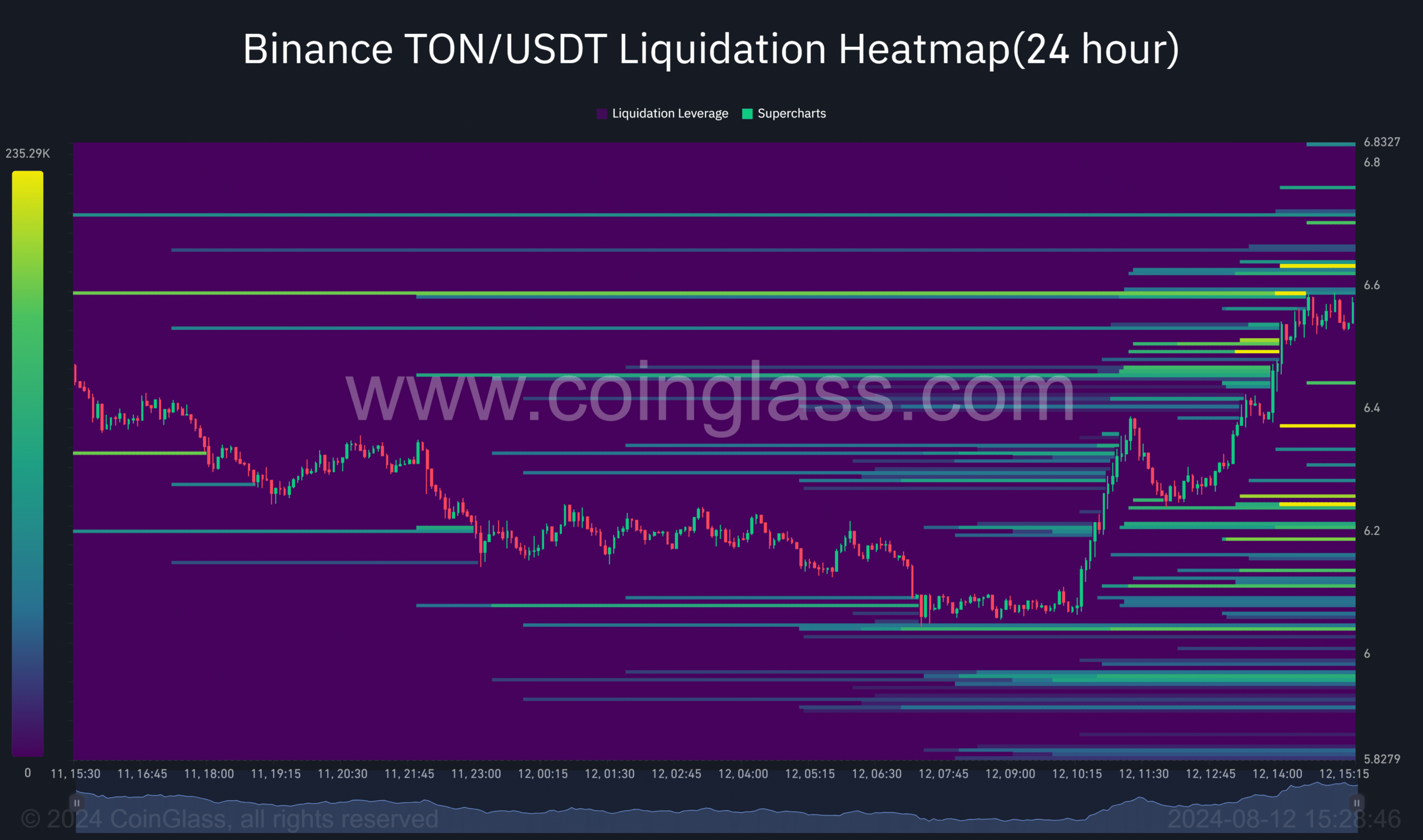

- TON was navigating a significant liquidation pool of 204k at the $6.63 price point.

- The number of active addresses has grown by 10.69%, with new addresses surging by 19.49%.

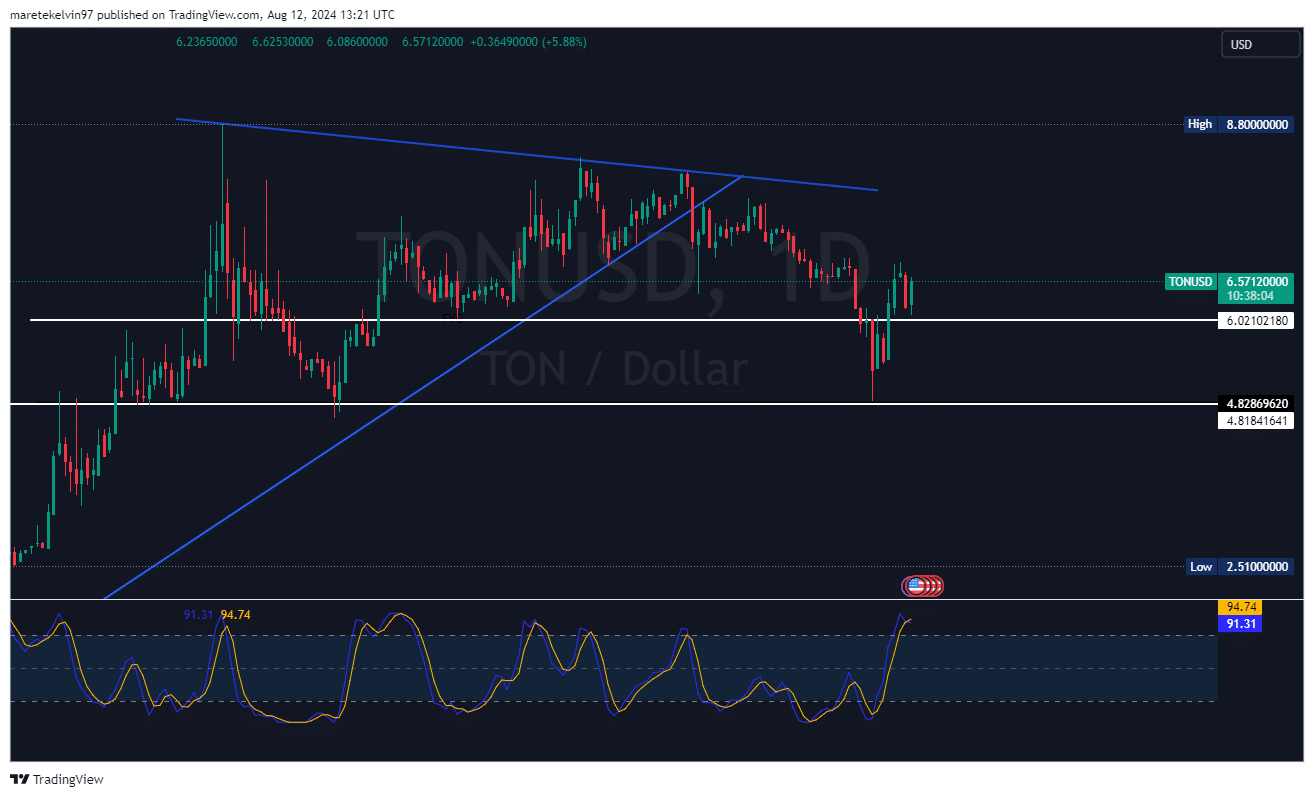

Toncoin [TON] has witnessed a significant price surge in the last 24 hours. The coin’s price has surged by 10% from a key support of $6.02. This follows a short-term 9% price pullback on 11th August, an indication of the coin’s long-term bullish rally.

Source: Tradingview

Source: Tradingview

Liquidation pool at $6.63

Toncoin was facing a significant liquidation pool at press time, with a total of 204k TON positioned at the $6.63 level.

This indicates that many investors have taken positions around this price point, setting it up as a critical zone for potential market moves. If TON’s price hits this level, a wave of liquidations could cascade through the market, amplifying volatility.

Source: Coinglass

Surge in large transactions

In the same period, the number of large transactions has surged by 1.98%. This uptick signals growing interest and activity among whales and large holders.

Typically, such movements suggest confidence in the asset, possibly hinting at future price action. When big money starts moving, it is often a precursor to broader market shifts, making this a bullish indicator for TON in the short to medium term.

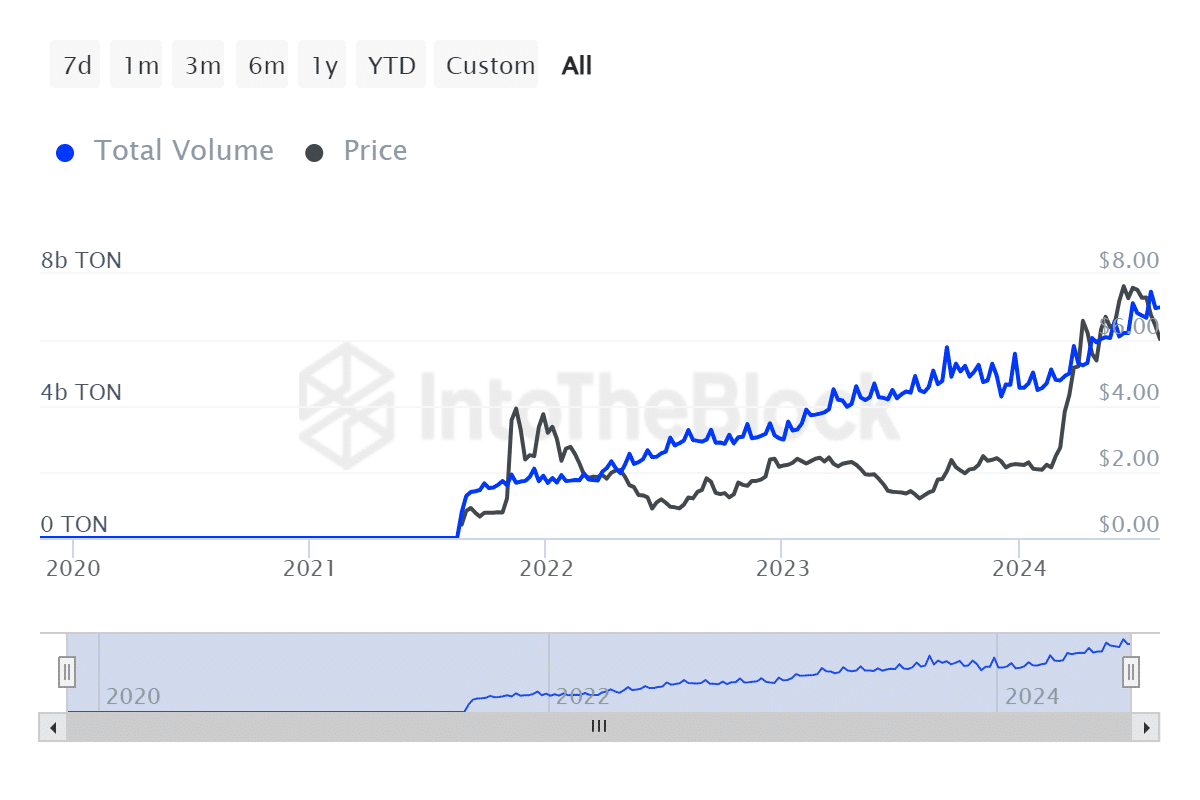

Source: IntoTheBlock

Adoption grows

Adding to the aforementioned, the number of active addresses has risen by 10.69%. This surge is complemented by a 19.49% spike in new addresses.

Both of these metrics point towards growing interest and adoption of TON as more users engage with the network.

An increasing number of active addresses typically correlates with heightened network activity, which can further support price stability and growth.

Source: IntoTheBlock

Is your portfolio green? Check out the TON Profit Calculator

What does this mean for TON?

The data suggests a maturing network with increasing user engagement and confidence. The liquidation pool at $6.63 sets a clear battleground for future price action.

The rise in large transactions and active addresses hints at a significant interest from both large players and new entrants. These metrics offer a promising outlook, with potential for both short-term volatility and long-term growth.